Earrings call exchange on M&A leaves room for interpretation.

In +More: Flutter dominates the earnings calendar this week.

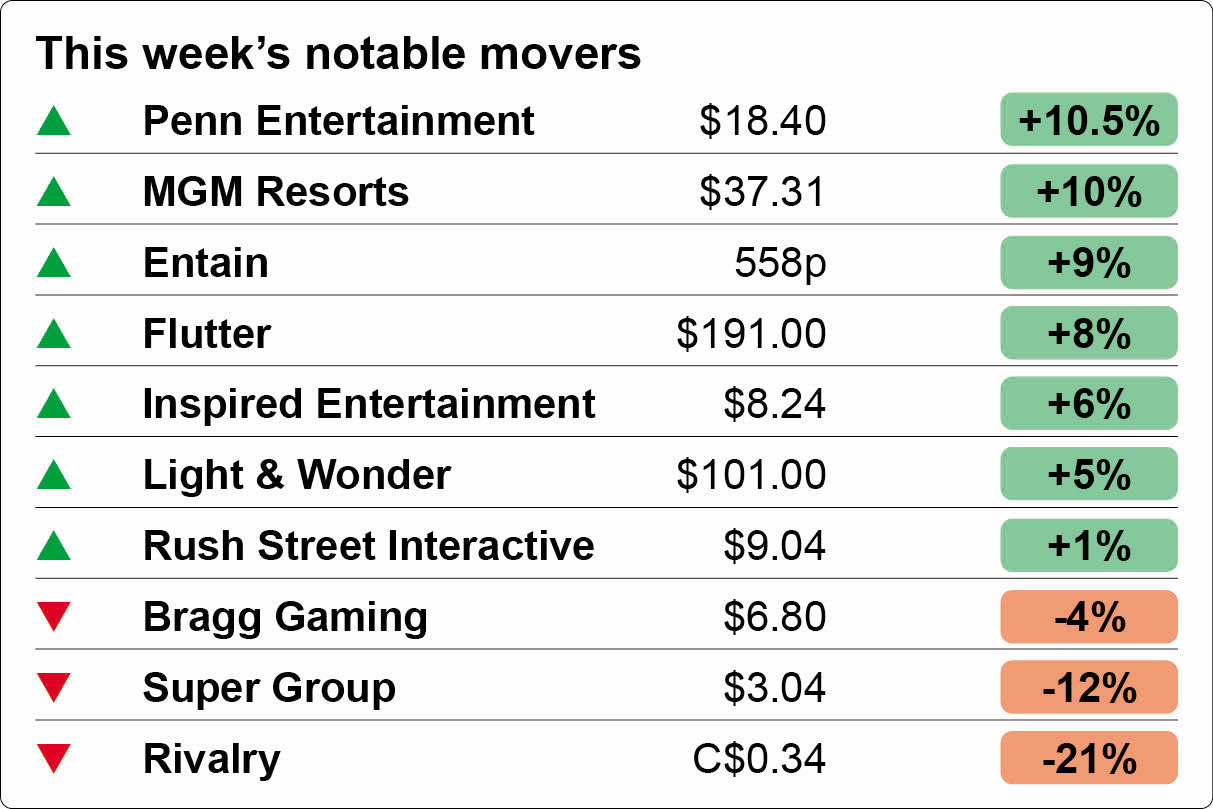

The shares week: gaming recovers from the yen carry-trade crash.

A look at the parlay numbers posted by US OSB operators.

The men from the press said: ‘We wish you success.’

Hard Rock Bet is all about fun and innovation. With a top ranked sportsbook & casino product, unique access to US states, and a globally recognized brand, join our team to help shape the online experiences that millions love. We’re currently seeking:

And other amazing positions here.

Headline news

Q&A: A question about single asset sales was batted away by Penn Entertainment CEO Jay Snowden on last week’s earnings call, but wider questions regarding potential discussions with Boyd about a full-blown takeover attempt aren’t so easily dismissed, sources suggested.

On the call, Snowden was asked a “specific question” on whether Penn was “looking at selling individual assets, properties.”

In response, he said “it's not as simple and easy as though you just sell off an asset.”

Credulous: This was “essentially the wrong question to ask,” suggested one investment source, as the stories that have emerged point to a much more encompassing M&A deal involving a potential joint bid from Boyd Gaming and Flutter. Snowden told the analysts “don’t believe everything you read,” but still left the door ajar for speculation.

“What I will say is that, as a company and as a board, we always will evaluate opportunities to enhance value.”

According to one source, this framing leaves the door open on the potential for talks to have taken place.

Analysts at CBRE noted Penn “didn’t provide much color on the speculation” but that larger M&A involving the company “will likely remain a key topic for investors in the background.”

A low bar: The reaction to the earnings was generally positive with the shares rising over 5% on the day, helped by the earnings beat in interactive and a robust B&M gaming performance.

But as one source put it, Penn “set expectations so low they finally had a quarter that was not as bad as feared.”

Wanna play football for the coach: Jefferies said the future for Penn was now “heavily dependent” on the success or not of ESPN Bet as the football season approaches.

The launch in New York also looms large. The indications from the call were that Penn would not spend beyond its means and would take a “more conservative approach” to the market, said JMP’s analysts.

The team at Macquarie, meanwhile, suggested Penn’s margin for error in online execution was “razor-thin.”

Unlock new jurisdictional licensing in weeks, not months with OneComply! Your gateway to effortless licensing and compliance management.

Say goodbye to the complexity of submissions and hello to 95% efficiency from start to finish! Complete your first licensing application 50% faster, get real-time alerts for immediate compliance actions, and slash legal fee costs by up to 90% with no more duplicate tasks.

Click here to connect with us and discover how much more you can accomplish with OneComply.

+More

By golly: Entain has launched a new GenZ-focused brand in New Zealand called betcha in association with the NZ Tab. Recall, Entain formed a 25-year partnership with Tab last year.

Optimove has partnered with Captain Up and Gamanza on gamification solutions that promise higher engagement levels.

We’re off to see the wizard: The Sphere in Las Vegas is nearing a deal with Warner Bros. Discovery to adapt the 1939 classic, The Wizard of Oz, into a “one-of-a-kind immersive experience.” According to the New York Post, the cost of conversion would be ~$80m.

The week ahead

Flutter will dominate the news with its scheduled Q2 earnings call on Tuesday AMC, when it is sure to face questions regarding its response to DraftKings’ announcement of a customer surcharge in high-tax states.

As with Penn on Friday, Jefferies said the likeliest response will be “wait and see.”

For Flutter’s own earnings, the analysts at Jefferies pointed out the Q2 data points to “robust” growth for FanDuel over the period.

The team reported that market share remains a focus with Flutter but that the company is “aware” of growing focus of investors on profitability.

Also reporting this week, Sportradar announces on Tuesday, while gaming affiliates Catena Media and Raketech are both Wednesday and fellow affiliate provider Gambling.com releases its earnings on Thursday.

Also on Thursday, Evoke will follow up its July profit warning with its H1 results.

Meanwhile, Earnings+More will be launching our newest weekly edition, the Midweek Memo, on Wednesday.

Shares week – crash and carry

Back where we started: The sector recovered from the somewhat disordered unwinding of the Japanese carry trade at the start of last week, with more greens than reds visible on Thursday and Friday.

Penn management will be happier this week after an evidently well-received earnings announcement, with its shares up 10.5% following better-than-expected interactive numbers.

Just as happy will be MGM Resorts, which ended the week 10% up as investors dismissed fears of an imminent recession. Caesars (5%) and Wynn (1%) were also positive for the week.

Every now and then I get a little bit nervous: Talking of well-received earnings, Entain will be encouraged to have brought to a halt, at least temporarily, its YTD share price slide with a 9% bump on the week.

Post-results, the team at Jefferies said Entain had “demonstrated progress” with Brazil, in particular, outlining the “turnaround template.”

The team added that investors appeared to be ascribing zero value to BetMGM.

The task of incoming CEO Gavin Isaccs will be to give investors a reason to believe after a 43% decline in the YTD. He starts on September 1.

🎢 Entain’s share price still faces a 43% deficit for the year

Not so pleased with the response to earnings will be Bragg Gaming, which ended the week down 4%. Super Group similarly received scant appreciation for its earnings last week, with its shares down 12%.

Propping up the table this week, however, is the esports-adjacent, GenZ-friendly and Toronto-listed Rivalry, which lost 10% of its value on Friday, leaving it 21% down.

Earnings in brief

AGS: The provider, which saw shareholders approve the $1.1bn acquisition by PE house Brightstar, released a 10Q results statement late last week showing revenues up 8% to $96.7m while adj. EBITDA rose 6% to $42.1m

Another provider that has agreed to be acquired is GAN, which has also recently confirmed approval of the takeover by Sega Sammy. The company said in its Q2s that total revenue rose 5% to $35.6m, helped by a 31% leap in B2B revenues to $13.3m. The B2C Coolbet business saw revenues fall 5% to $22.6m.

Everi: Again subject to a takeover, this time as part of Apollo’s buyout of the gaming and online elements of IGT, the gaming-to-fintech supplier said revenues fell 8% YoY to $191m while adj. EBITDA fell by 17% to $77.3m.

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

By the numbers – parlays

Raking it in: The recent monthly summary of OSB and iCasino trends from the analysts at Deutsche Bank showed the extent to which operators have improved both the total of parlays as defined by a percentage of handle and the hold factor on those parlays.

As a percentage of handle, parlays now account for nearly 26% of the total, in the YTD 2024 vs. just over 19% in 2019. In June, DB said the total hit almost 30%.

At the same time, the hold percentage for those bets has risen from just over 13% to 19%.

💰 Making dollars: parlay betting on the rise

That there is a correlation between parlay and higher hold is obviously well known. But it is also notable that across-the-board hold percentages for parlays are also on the increase.

Recent analysis from HoldCrunch made the point that a superior parlay product lay behind FanDuel’s overall hold leadership.

As HoldCrunch showed in their analysis of hold numbers from March-May, FanDuel was in the lead with nearly 11.5% vs. just above 8.5% for DraftKings and over 8% for Fanatics.

US iCasino: With all the states now having reported for the entirety of Q2, the Jefferies team pointed out GGR growth hit 25% marketwide, in line with the 26% growth seen in Q1. Growth in the big three of New Jersey, Pennsylvania and Michigan was at least 21% in each.

Iowa: Sports-betting GGR rose 31% YoY to $13.9m on handle up 26% to $138m. DraftKings led GGR share on 37%, followed by FanDuel (31%), Caesars (11%) and BetMGM (8%).

Denmark: Total gaming spend in June was up 37% to DKK703m or $103m. Within that, sports betting, both retail and online, rose 77% to DKK271m, online slots was up 27% to DKK303m, B&M casino rose 7% to DKK32m and gaming machines also increased 7% to DKK97m.

Lithuania: GGR rose 13% YoY in H1 to €116m, helped by a 12.5% climb in online revenues to €72.2m. Within that, iCasino generated €53.5m of GGR and OSB came in at €19m. B&M gaming was down 4% to €35m.

Sportsbook platforms don’t go live every day, and certainly not ones as sophisticated as this…

Purpose-built technology, without compromise

Our new technology is built to replicate the autonomy and control of owning your own platform through a smart and convenient outsourced solution.

A competitive advantage

This freedom allows our customers to exploit growth opportunities previously reserved only for those with in-house tech and deep expertise.

All without the compliance or operational overheads of ownership, nor the inflexibility and service limitations of alternative providers.

Sounds interesting? Find out more here: www.metricgaming.com

Metric Gaming – Your in-house sportsbook, outsourced.

Calendar

Aug 12: DoubleDown Interactive

Aug 13: Flutter, Sportradar

Aug 14: Raketech, Catena Media

Aug 15: Evoke, Rank, Gambling.com

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.