New management team faces familiar failures as it issues a profit warning.

In +More: Penn’s online layoffs, Superbet gains Brazil license.

Expanding universe: Evolution buys Galaxy Gaming, Betsson earnings.

Accel Entertainment takes over FanDuel’s Illinois market access deal.

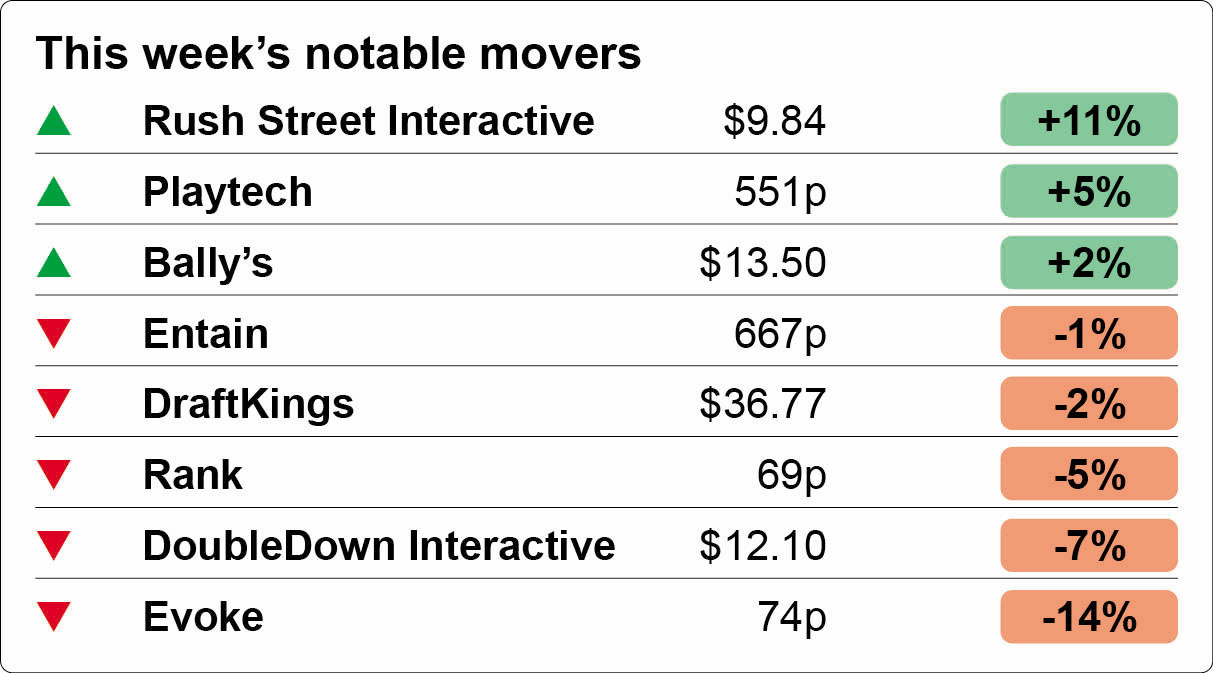

Rush Street leads the week’s share price gainers on more buyout rumors.

You go back, Jack, do it again, wheel turnin' 'round and 'round.

Hard Rock Bet is all about fun and innovation. With a top ranked sportsbook & casino product, unique access to US states, and a globally recognized brand, join our team to help shape the online experiences that millions love. We’re currently seeking:

And other amazing positions here.

New ways to fail

This marketing campaign is now a profit warning: Evoke has issued its first profit warning under the leadership of CEO Per Widerström, reporting what one analyst said was a “spectacular undershoot” after a UK marketing blitz failed to deliver the expected uplift in revenues. The shares tanked, falling over 14% on the day.

Recall, the campaign ended up having to be shelved after the ads caused an outcry.

The ads in question included messages such as “This carriage is now a casino” on trains and “Your casino is now arriving” at bus stops and train stations.

Plan A B C: The team at Regulus Partners said the warning was “neither small nor unlucky,” with the analysts suggesting Widerström’s new strategic plan appeared to bear very close resemblance to previous ideas about generating revenue “simply” by turning on the marketing taps.

“Marketing a me-too product without effective customer segmentation has become a sure-fire way to go backwards in absolute and not just relative terms,” the team added.

“What is slightly alarming is that such poor tactics were allowed to unfold while a new strategy was being unveiled.”

Warning by the numbers: Evoke said on Thursday that adj. EBITDA for H1 would be £35m-£40m below expectations, with the cost of H1 weighted marketing largely blamed for the falling margins. Q2 revenue of ~£431m was “broadly stable.”

For the half-year, UK online revenue was up 3% for Q2, international rose by 2%, but UK retail was down 8% YoY.

Regulus noted in the last instance that Evoke “at least recognises the offer has fallen behind the competition.”

“Closing lots of shops quickly bought time but, unsurprisingly, not resilience without a growth plan,” the team added.

This isn’t helping: Analysts at Investec were also disappointed. “We believe such a substantial profit warning in the first months of tenure of the new CEO and revamped management team is very unhelpful,” they noted.

Investec remained buyers, however, suggesting they appreciated the management team’s “swift decision-making and the fact this is a long-term, complex turnaround job.”

But Regulus said the company has little room for margin and that if the strategic plan doesn’t deliver “there is unlikely to be a drawing board to go back to.”

🤦 A remembrance of warnings past: Evoke’s YTD share price

Unlock new jurisdictional licensing in weeks, not months with OneComply! Your gateway to effortless licensing and compliance management.

Say goodbye to the complexity of submissions and hello to 95% efficiency from start to finish! Complete your first licensing application 50% faster, get real-time alerts for immediate compliance actions, and slash legal fee costs by up to 90% with no more duplicate tasks.

Click here to connect with us and discover how much more you can accomplish with OneComply.

+More

Cutting remarks: Penn Entertainment's OSB and iCasino business is laying off employees within its ESPN Bet operation, according to LegalSportsReport, which cites a letter from CEO Jay Snowden saying there have been a “limited” number of job cuts. CNBC has reported the figure at ~100.

In the letter, Snowden said the company “hit the ground running” after buying theScore, which “led us to temporarily set aside any potential organizational changes that would typically follow a major acquisition.”

Superbet has applied for and is now guaranteed a license in Brazil when the market opens on January 1. It joins Kaizen Gaming as the only operators to officially apply for licenses so far.

A temporary delay in the opening of the Washington DC market has been lifted, with Caesars and BetMGM now operating in the district alongside incumbent FanDuel.

The Mirage in Las Vegas has officially closed, with new owner Hard Rock already moving in the bulldozers as it prepares to demolish the storied Strip property.

Gaming affiliate provider SharpLink has initiated a formal review process after receiving a number of proposals, which could include either an outright sale or merger. Recall, SharpLink sold RSports Interactive for $22.5m in January.

Read across

The Token Word this week reports on how the Republican Party program for November’s presidential election is decidedly pro-crypto. In Compliance+More, it’s a no in Oklahoma.

What we’re reading

Chicago is chasing its losses with Bally’s deal, suggests a City alderman. In the Chicago Sun-Times.

B2B Key Account Manager – Remote in USA

Head of Operations – Malta / Johannesburg

Global Head of IT (French-Speaking) – Singapore

Evolution’s Galactic deal

New frontier: Evolution has announced a deal to buy table game provider Galaxy Gaming for $85m in cash, with the company saying the acquisition solidifies its positioning in the US market. Evolution said management would be retained and it would continue to operate as a separate business unit.

Financially, Galaxy has previously provided guidance for revenues of $29m-$30m for FY24 and adj. EBITDA of $12m-$13m.

The deal also sees Evolution assume nearly $39m of debt, bringing the total value to $124m.

The $3.20-a-share offer comes at a 124% premium to the prevailing Galaxy share price.

Plugging a gap: Recall, at the time of the Q1 earnings, CEO Martin Carlesund admitted US growth had been sluggish and RNG market share was “not anywhere near where we want to be.”

The deets: The deal has been approved by 14% of Galaxy shareholders and will now be put before the rest while various regulatory approvals will also be sought. It isn’t likely to complete before mid-2025.

The announcement came ahead of Evolution’s Q2 earnings, which saw revenue rise 15% to €508m while EBITDA rose 11% to €346m. EBITDA margins stood at 68%. Live casino revenue rose 18% to €438m while RNG was essentially flat at €70.3m.

Carlesund said the outcome for the quarter was “solid” but did not reflect the operational performance.

E+M will report on Evolution’s call with analysts on Monday.

Earnings in brief

Call the Copa: Betsson said revenue rose 15% to €272m while EBITDA was up the same percentage to €77.6m, helped by high levels of customer activity during the recent Euros and Copa America tournaments.

Notably, in the Euros, Turkey – which remains one of Betsson’s key markets via a partnership deal – reached the quarter-finals.

Betsson was recently unveiled as the new front-of-shirt sponsor for Italian Serie A champions Inter Milan.

Inka trail: Separately, it was announced this week that Betsson is to outsource the backend of its Peruvian business Inkabet to GiG.

Accel’s Illinois move

I’ve got a new partner riding with me: FanDuel has a new market access partner in Illinois after distributed gaming specialist Accel Entertainment acquired Fairmount Holdings – the owner of FanDuel Sportsbook and Horse Racing – for ~$35m in an all-shares deal.

Switching horses in midstream: On the call with analysts post-close Monday, president of US gaming at Accel Mark Phelan said the company would be assuming a 10-year contract with FanDuel. FanDuel originally launched with Fairmount in November 2020, having previously partnered with the Par-A-Dice casino in the state.

“It's an attractive relationship and it's definitely one of the reasons why we were attracted to the asset in the first place,” Phelan added.

A day at the races: As part of the deal, Accel will also takes over racetrack operations at Fairmount Park and will exploit the existing permissions to build, first, a temporary casino followed by a permanent facility at the track, investing $85m-$95m.

** SPONSOR’S MESSAGE ** M&A Opportunity: Integrate Betting into PlayStation, Xbox, and PC Gaming

Explore an exceptional M&A opportunity to acquire a technology that transforms hobby gaming into a sports betting experience. This system lets gamers place bets on their performance on PlayStation, Xbox, and PC. For example, Fortnite enthusiasts can bet on achieving at least 5 kills in their upcoming game. The platform supports probabilities for over 100 different betting scenarios, generating personalized odds with a 20-30% house edge. It doesn't require a gambling license and is compatible with any platform.

Tap into a large millennial demographic with lower customer acquisition costs than traditional gambling. Visit www.betonskills.com to sign up and access a detailed 3-pager!

The shares week

Rush Street Interactive was up nearly 11% for the week after a report emerged suggesting a sale of the business might be completed in September, albeit without identifying a buyer. RSI has been linked previously with DraftKings, which was down 2% this week.

Playtech’s shares were up 5% on the week, helped by a note from Investec that suggested they were “significantly undervalued” given the cash-generative nature of the business.

Bally’s was also in the positive column, managing a 2% rise despite falling over 3% on Friday. The company received a boost this week when it secured the financing for its permanent Chicago casino.

For the negatives this week, Evoke led the UK sector downwards with its 14% tank, while Rank fell 5% on Thursday. Entain was down 1% on the week but managed a half-point rise on Friday.

By the numbers

A slew: It was big-state reporting week this week, with New Jersey, Pennsylvania and Michigan all releasing their numbers.

In NJ, B&M gaming was up 1% YoY to $244m while iCasino rose 25% to $187m. Sports betting was down 9.5% to $60.1m.

In Pennsylvania, gaming rose 7.5% YoY to $485m, with B&M GGR flat at $277m, iCasino up nearly 19% to $161m and sports betting rising 27% to $43m.

In Michigan, OSB was up 69% to $30.9m while iCasino rose 20% to $165m. FanDuel maintained its total market share lead with 28%.

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

Calendar

Jui 24: Kambi, Churchill Downs (e)

Jul 25: Churchill Downs (call), GLP (e), Boyd Gaming

Jul 26: GLP (call)

Jul 30: IGT, Red Rock, Caesars Entertainment

Jul 31: MGM Resorts, Rush Street

Aug 1: DraftKings (earnings)

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.