Report: Flutter may team up with Boyd for Penn interactive bid.

Caesars Entertainment buys trading supplier ZeroFlucs.

In +More: 10 years of crash games, Polymarkets’ threat.

The startup focus is blockchain-based exchange BetDEX.

I could be so good for you, I'm gonna help ya.

Hard Rock Bet is all about fun and innovation. With a top ranked sportsbook & casino product, unique access to US states, and a globally recognized brand, join our team to help shape the online experiences that millions love. We’re currently seeking:

SVP – Performance Marketing

Sr. Director – Sports Promotions

And other amazing positions here.

The go team

Tag team: Penn Entertainment’s shares rose nearly 5% on Friday after a report emerged suggesting Flutter Entertainment was interested in teaming up with Boyd Gaming to form a joint approach to buy the business.

To each, their own: According to The Deal, if a joint bid were agreed, Boyd would take Penn’s 43 bricks & mortar properties while Flutter would be gaining control of the ESPN Bet JV alongside theScore business. Previous reports suggested Boyd has already made an approach.

The article indicated each company was taking steps to ready themselves for potential M&A.

Flutter last week appointed former Disney executive Christine McCarthy to its board while Boyd has recently added former banker Michael Hartmeier to its own top table.

Friends with benefits: Notably, Flutter and Boyd have a long-standing relationship via a 5% stake in FanDuel. The Las Vegas locals and regional gaming operator received the share as part of a market access deal that has seen FanDuel gain licenses in multiple states.

Taking care of business: The Deal said sources told the newswire Flutter would also be interested in buying back the stake as part of any Penn buyout arrangement. The report noted the 5% could be worth up to $1bn while Flutter would also pay $500m-$1bn for the Penn interactive business.

That compares with the $2.1bn Penn paid for theScore in 2021 and the $150m a year it pays Disney for the ESPN Bet JV.

It should be noted that Flutter owns Sky Bet in the UK, perhaps the foremost example of a media/betting tie-up actually succeeding.

Another company mentioned by The Deal as a potential bidder for Penn’s interactive arm is Rush Street Interactive.

Accumulate to speculate: Penn remains the subject of huge speculation, with various high-profile activist investors on the share register including HG Vora and Donerail, both of which have previously gone public with their discontent over the direction of travel at the company.

While analysts have expressed skepticism over the Boyd bid, investment sources have suggested to E+M the activists might be persuaded by a cash plus shares offer.

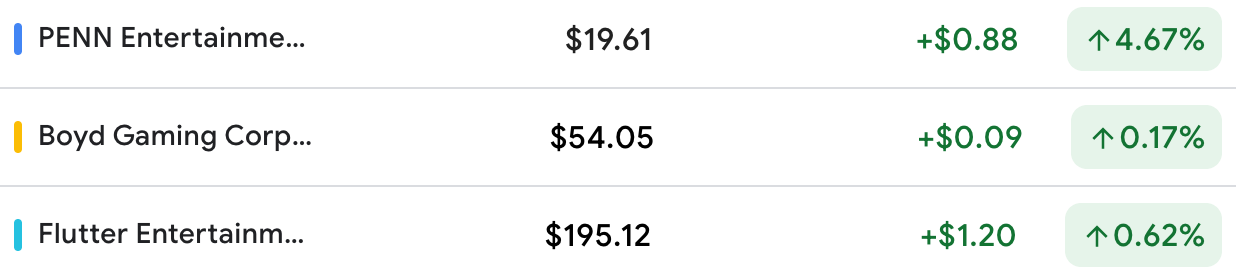

2️⃣➕2️⃣ Penn up nearly 5%, Boyd and Flutter flat

Now live on the OpticOdds screen: player market alternate lines, vig, line history & more…

Built for operators with an emphasis on speed and coverage, OpticOdds offers:

SGP Pricer: query top operators and instantly see how correlations are priced in real-time.

Live Alerts & API Access: get odds updates from sharp sportsbooks on best odds, arbitrage, player markets, reference lines, settlements, injuries, and more.

Market Intelligence: analyze competitor markets to see what you're missing. Drill into hold, alternate lines, uptime, and release time.

Join top operators at opticodds.com/contact

+More

Raketech has sold off its US-facing sports tipster operation ATS Consultants for $2.25m after a strategic review determined the business, bought in December 2021, was non-core. The company didn’t disclose the name of the buyer.

Scout Gaming has broadened its agreement with bet365 for the delivery of fantasy sports products in the US.

Earnings in brief

Buzzin’: UK-facing real and online bingo operator Buzz Bingo said 2023 was a “year of reset,” after it showed adj. EBITDA rising 14% to £34.7m from revenues that rose 6% to £207m with like-for-like up 5%. In 2024 to date, it said adj. EBITDA was up 24% YoY while LFL revenue was up 5%.

On social

Coming for you:

What we’re reading

If you don’t slow down, you’re gonna crash: 10 years of crash gambling.

+More careers

Racecourse Media Group CEO Martin Stevenson has stepped down, although he will remain in place until year-end to help with the transition. The company has started the search for his successor.

Adam Hope has been promoted to CTO at Entain-owned Angstrom. Prior to joining the firm in September last year he was head of technology at William Hill.

Finnish monopoly operator Veikkaus has appointed Andreas Reimblad as vice-president of sports betting. Reimblad was most recently director of sportsbook at Kindred.

Caesars buys ZeroFlucs

Tooling up: Caesars Entertainment has moved to strengthen its OSB proposition by acquiring Australian-based sports-pricing provider ZeroFlucs for an undisclosed fee, in the latest stage of the trading capability arms race.

The acquisition follows on from DraftKings’ purchase of Sports IQ in May, Entain’s Angstrom buyout and PointsBet’s deal to buy Banach Technologies before it was sold to Fanatics.

We liked it so much, we bought the company: Caesars said the buyout followed the successful integration of the ZeroFlucs offering into the Caesars Sportsbook proposition. It added it had already enabled the launch of new “vastly improved” same-game parlay products.

What can I say? ZeroFlucs was founded by Steve Gray in 2021. On the news of the deal, he posted on LinkedIn: “I'm normally a man of many words – but they escape me in the here and now.” He becomes Caesars Digital’s senior VP of pricing initiatives.

DraftKings/VSiN rumors

Get shot: DraftKings is closing in on the divestment of its Vegas Sports Information Network, or VSiN, back to previous owner Brent Musburger for a dollar, according to the team at EKG.

DraftKings bought the multi-platform sports-betting broadcast and content network in March 2021 for $70m, saying it would play a part in the ongoing convergence of sports, sports-betting, media and content production. It followed up in April of that year with a $50m three-year deal with Meadowlark Media to buy the rights to distribute the Dan Le Batard podcast.

EKG suggested the VSiN business was currently running at a loss of ~$10m a year.

Copy that: Any handing back to the previous owners resembles the move made by Penn Entertainment when it gave up on Barstool Sports and sold a business it had bought for ~$550m back to founder Dave Portnoy, again for $1.

El Güero Vega, Sea Ice and a Ferrari

The story of how we built and launched the world's most sophisticated sportsbook platform in just 31 months, as told by Metric Gaming CEO, Keith Hayes.

Read in full here (<6min read)

Analyst takes – Las Vegas Strip

No vacancies: The closure of the Mirage and the Tropicana will see a near 5% contraction in room supply on the Strip, which the team at CBRE suggested “sets the stage for a favorable rebalancing of supply and demand and a potential earnings catalyst for Strip operators.”

The analysts estimated the then MGM-owned Mirage had ~1m occupied room nights and generated $596m of revenue and $169m of EBITDAR in FY23.

Johnny guitar: With new owner Hard Rock taking it out of circulation until 2027 as it refits the property, it leaves “significant underlying demand” that will need to find a home.

“The significance and longevity of the supply contraction remains underappreciated, if appreciated at all,” the CBRE team argued.

Venture playground

Startup focus – BetDEX

Who are you? BetDEX was founded in late 2021 by former FanDuel colleagues Varun Sudhakar (CEO), Nigel Eccles (chair) and Stuart Tonner (CTO).

What’s the big idea? The company seeks “to create a sports-betting ecosystem where customers can simply get their bet on,” says Sudhakar.

The resultant BetDex Exchange is an international sports-betting exchange with low fees and no restrictions against its users.

The back end has been “spun out” into a permissionless protocol on the blockchain, called the Monaco Protocol.

This enables anyone to put liquidity on, build skins or apps on top, trade into and create their own markets.

What they say: “Sports betting is a massive industry, yet characterized by a poor user experience with high fees, difficulty withdrawing your money, discriminatory restrictions against winners and more. We want to fix that,” says Sudhakar.

“We believe sports betting should be similar to the financial industry. Buy a stock of Apple on eToro, Revolut or Robinhood and the price is the same. Back Spain tomorrow in the Euros and the price is different across bet365, Pinnacle and Betfair. Furthermore, you will have difficulty getting a large bet on.”

Funding backgrounder: The company completed a $21m seed round in Nov21, led by Paradigm.

Growth company news

Hog heaven: Speaking of Eccles, he posted on X on Friday that his new startup BetHog has just launched in private alpha.

Zoot alors! A next-generation sweepstakes offering called Zoot has announced itself via social media. Founder Sean Ryan said he and co-founder John Cahill saw a “great opportunity to bring back the fun, simple gameplay of early Flash games, but to integrate a better revenue model with sweepstakes options for those who participate.”

He noted the company had been “running fast and lean” for the past six months with initial investment from tech entrepreneur Kevin Ryan, Chris Grove and Vicenç Marti from Barcelona-based Wizard Partners.

WagerWire has launched a feature that allows players to buy and sell daily fantasy pick’em entries on its platform. Players can sell lineups to friends or in the open market and make a profit before the ultimate result settles, the company said.

Kelly Kehn, who last week confirmed she was leaving her company relations role at HappyHour.io, has joined the board of investee company FUNNZ.

Calendar

Jul 19: Evolution, Betsson

Jui 24: Kambi, Churchill Downs (e)

Jul 25: Churchill Downs (call), GLP (e), Boyd Gaming

Jul 26: GLP (call)

Jul 30: IGT, Red Rock, Caesars Entertainment

Jul 31: MGM Resorts

Kambi Group is the leading provider of premium sports betting technology and services, empowering operators with all the tools required to deliver world-class sports betting and entertainment experiences. The Group’s services not only include its award-winning turnkey sportsbook but also an increasingly open platform and a range of standalone sports betting services from frontend specialists Shape Games, esports data and odds provider Abios, and AI-powered trading division Tzeract. Together, we are limitless.

For more info, go to www.kambi.com

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.