Sep 12: Lottery.com descends into chaos

Lottery.com funding and resignations, Allwyn float, the shares week - AGS, the week ahead, startup focus - Juice Reel +More

Good morning. On today’s agenda:

Lottery.com secures funding but at the price of board resignations.

Allwyn gets the go-ahead for a December listing.

Our startup focus for this week is Juice Reel.

Lottery.com chaos

Board resignation letters cast doubt on the provenance of new investment.

Death throes: According to an SEC filing on Friday, Lottery.com has secured a $2.5m convertible loan from an entity called Woodford Eurasia Assets with the promise of a further $50m. However, the price of the deal is four board resignations and as a result it is “no longer in compliance” with Nasdaq listing rules.

The $2.5m convertible loan is equal to 15% of the issued shares and comes at a 25% discount to the average share price for the past 10 days.

The term sheet “contemplates” up to $50m of “expansion capital”.

Off with their heads: That term sheet required the resignations of four board members including Lisa Borders, Steven Cohen and William Thompson and Lottery.com founder Tony DiMatteo. chief legal officer, and CCO Kathryn Lever also resigned last week. Of the current board, only Richard Kivel remains.

In her letter of resignation published on a Reddit thread, Borders said she had “worked diligently on behalf of the shareholders and uncovered potentially inappropriate activity”, as detailed in previous filings.

This included a $30m misstatement of revenue that led to resignations and sackings among the management team as well as DiMatteo stepping down as CEO. At the start of August, it admitted its future as a going concern was in doubt.

Disdain: Borders added that she had posed questions to the board about the “viability and credibility of potential investors”, which were “met with disdain and were never fully answered”. She added: “Inquiries raised relative to lender suitability and source of funds were dismissed.”

Further, she alleges that a request for additional time to “review and understand research on the ‘red flags’ from the compliance team about a potential investor” was “met with threats to hold an official board meeting without all board members present”.

Her letter concludes: “The need and desire to perform appropriately rigorous due diligence on behalf of the shareholders was thwarted.”

Uncivil war: Meanwhile, in a separate letter Cohen said superficially the Woodford proposal “seemingly provides much-needed financing but also contained a number of provisions that, in my view, required meaningful deliberation and further negotiation”.

After what he termed a “needlessly rancorous” board meeting, Cohen said “certain directors” were “unwilling to deliberate and confer in an open and reasoned manner”.

“Such a breakdown and such an unwillingness to seek consensus in a thoughtful manner does not serve the interests of the shareholders,” he added.

🥷 The only reference E+M could find to Woodford Eurasia Assets is a UK-registered company with a single shareholder, Italian national Alex Smotlak.

Destruction of value: Lottery.com floated via a merger with the Trident Acquisitions SPAC in November 2021. When the de-SPAC was proposed, the enterprise value was $526m; as of Friday. Lottery.com’s market cap was $16m.

💣Lottery.com share price over the past 12 months

For more on the Lottery.com story see tomorrow’s Deal Talk.

* SPONSOR’S MESSAGE **

** SPONSOR’S MESSAGE** GiG is a leading gaming platform and sportsbook provider for online and land-based operators with digital aspirations. We deliver a full end-to-end solution through our award-winning iGaming and sportsbook solutions. Built for regulated markets and a top-class customer experience, GiG is pioneering the multi-platform era. If you are looking to expand your operations into new, profitable markets, our strategy is the solution.

Find out more at sales@gig.com.

Allwyn listing

The merger with the Cohn Robbins SPAC looks set to complete in December.

On the nod: Allwyn, which is now set to take over the UK National Lottery following the withdrawal of Camelot’s legal appeal, got a second dose of good news after the shareholders of the Cohn Robbins SPAC voted overwhelmingly to approve the planned merger.

The new date for the merger to complete is now December 11. The company will have an enterprise value at float of ~$9.5bn

Date for the diary: Allwyn is set to conduct a call with analysts on Tuesday to discuss recent developments and its Q2 earnings released in late August. At the time, it said FY22 adj. EBITDA will come in at between €740-760m.

The week in shares

AGS shares rebound as investors assess the likelihood of further bids.

Bouncebackability: As predicted by the analysts last week when the news broke that Inspired was no longer involved in talks about taking over AGS, the share price retained some of the takeover premium with a near 11% rebound on Friday. Still, it left AGS stock down 9% from its recent highs.

♻️AGS share price in the week to September 9

Recall, when talks came to an end last Thursday, analysts suggested some of the arb froth would dissipate but that some bid premium would remain as it was clear that AGS was now open to offers.

Cirsa Q2

Revenues rose 62% YoY to €400.2m while EBITDA increased 63% to €132.2m.

E numbers: Having taken a 60% stake in Italy and E-Play24 in July, Cirsa said it would continue to look for M&A opportunities in the online gambling space. E-Play24 is a top 10 operator in Italy and generated revenues of over €100m in 2021. Q2 online revenue came in at €35m while EBITDA more than doubled to €9.1m.

Away from the front: Latin America was the main growth region, up 21% with management saying it was the region least affected by the war in Ukraine.

Spain continued to be worth over 53% of EBITDA.

The week ahead

Coming up: On the schedule for this week, Allwyn releases its Q2 earnings on Tuesday. On Wednesday, Kindred will conduct a Capital Markets Day.

On Tuesday, the latest edition of our regular monthly newsletter Deal Talk will be sent. This month’s issue looks into the ongoing strategic review of Catena Media, takes a look at the failure of Lottery.com and looks at the prospects of the still-to-complete betting and gaming SPACs.

The E+M podcast returns on Thursday to cover the week’s news and look ahead to the SBC Summit Barcelona.

Startup focus – Juice Reel

Who, what, where and when: CEO Ricky Gold founded the New York-based Juice Reel in May 2019 on the premise that sports bettors could benefit from having a platform which recorded their bet histories and that offered a tech-driven route to more responsible gambling habits. Monetization comes through working as an affiliate to operators.

Funding backgrounder: Gold initially bootstrapped the business with a team working for sweat equity. Between Oct21 and Mar22 it has raised $1.3m. A primary backer is a San Diego-based private equity firm called Cypress Ascendent.

The pitch: “Prior to Juice Reel, no suitable and automated tool existed to understand your play,” says Gold. “That is a dangerous fact when you consider the exponentially growing prevalence of legalized gambling.” Gold says the product has been well-received by the public and is now starting to get operator recognition.

The company recently signed a deal with P2P platform Lucra Sports.

Juice Reel has recently passed 22,000 downloads, serves 1,500 DAUs, and syncs in over $300M of handle.

The recently introduced Crowdsourced Insights allows for the tailing of both the best-performing and worst-performing users.

“It is working at a shockingly good rate with our Instagram,” says Gold.

What will success look like? Gold says he hopes Juice Reel will become the “de facto platform” for sports bettors before, during and after games. “It’s the bridge that connects all sports bettors to all sportsbooks,” he adds.

He suggests suitable acquirers could be the major affiliates.

“I could also envision Robinhood or stock/crypto platforms that want a customer base of highly transactional and gamified users.”

Ricky Gold: “Our company has a highly scalable path to long-term profitability that could be suited as a standalone business and/or eventually go public.”

**Sponsor’s message ** Would you like to get your brand seen by more than 2,500 decision-making executives in the iGaming sector? How about positioning your business as a thought-leader in your area of expertise? Well, sponsorship opportunities at iGaming NEXT: Valletta ‘22 are still available. Built on three core pillars of content, networking opportunities and VIP hospitality, iGaming NEXT Valletta is rapidly cementing its reputation as the must-attend business event.

In order to find out more about the available sponsorship opportunities, please contact iGaming NEXT at sales@igamingnext.com.

Datalines

New York: Mobile sports-betting GGR rose 35.9% in August to $99.6m MoM, while net revenue rose to $48.8m. Handle rose 8.9% to $872.2m.

Leaders by GGR: FanDuel led the market with 46.8% followed by DraftKings (26%), Caesars (12.8%) and BetMGM (8.8%).

Also-rans: PointsBet (2.5%), Rush Street (2.2%), WynnBet (0.5%), Resorts World (<0.4%) and Bally Bet (<0.1%).

Illinois: August 2022 casino GGR came in at $147m, up 1.3% YoY. Sports-betting GGR hit $14.4m, up 118% YoY on handle of $122.6m, representing a 13.1% YoY rise.

Iowa: Casino GGR was up 1.3% YoY to $147m, while sports-betting GGR increased 118% YoY to $14.4m on handle that rose 13% YoY to $122.6m..

Leaders by GGR: FanDuel GGR came to $4m, DraftKings to $3.5m and Caesars was third with a GGR of $3.2m.

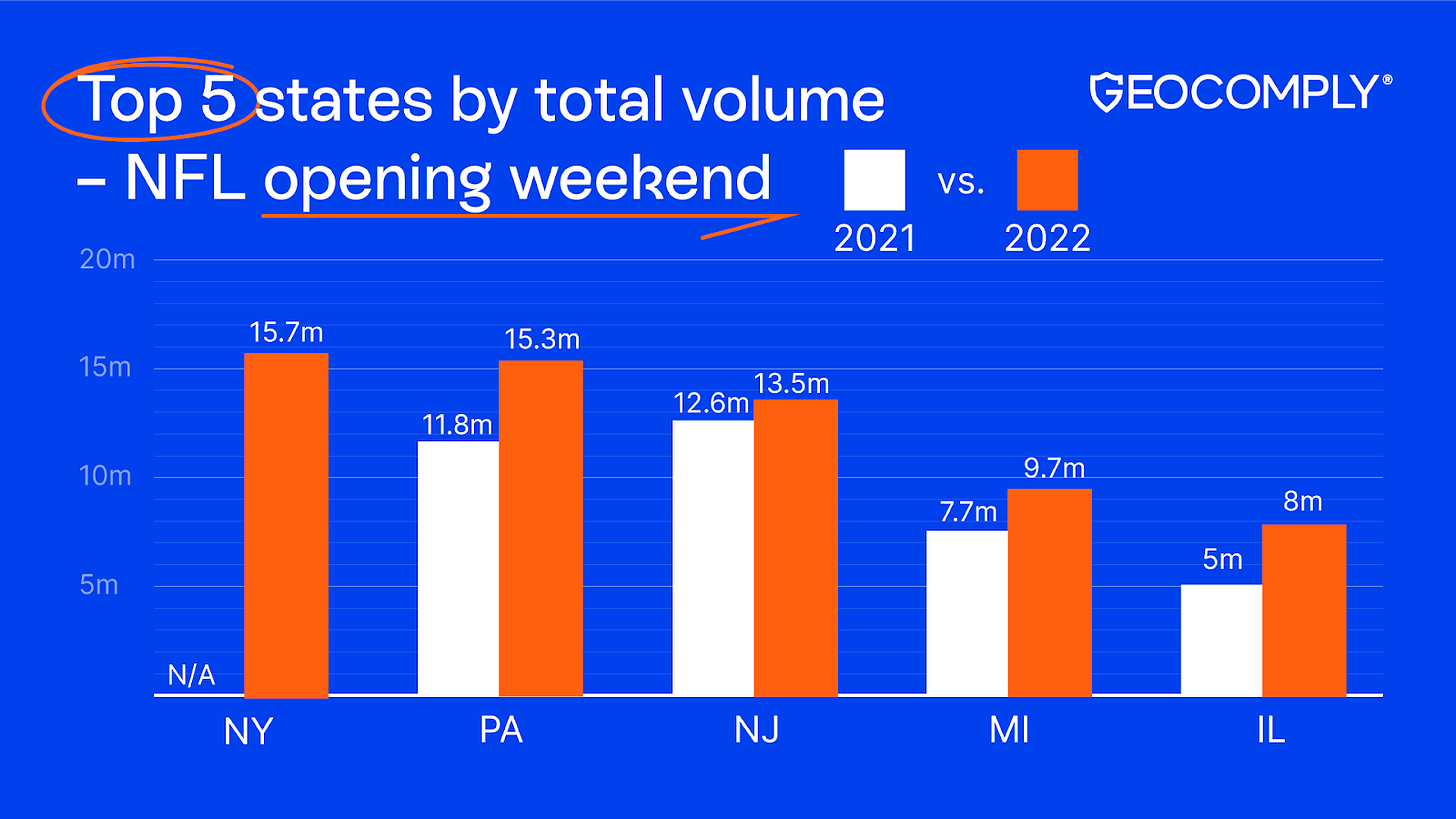

Geolocation data: During the first full NFL weekend, geolocation volumes shot up 71.5% from 60.1m in 2021 to a record 103.1m for opening weekend 2022, according to GeoComply’s statistics.

Newslines

Open all hours: BetMGM opened its first retail sportsbook at an NFL stadium this weekend at the State Farm Stadium, home of the Arizona Cardinals. Betfred also opened a retail sportsbook in Arizona, going live at the We-Ko-Pa Casino Resort in Fort McDowell. PointsBet took its first retail sports bet in Maryland after launching with a wagering facility Riverboat on the Potomac. And DraftKings has opened its retail sportsbook at the Ceda Creek and Tulalip resorts in Washington state.

Dan’s not going to be happy: The opening of Full House’s The Temporary at Waukegan casino has been delayed until December instead of late October, according to the Chicago Tribune.

Swap shop: Trading platform specialist Betswap is supplying its services to New Jersey and Colorado-licensed sportsbook PlayUp.

Genius Sports will provide its pre-match and live sports data and in-play trading technology to MaximBet.

Pinnacle has been approved by the Alcohol and Gaming Commission of Ontario (AGCO).

What we’re reading

As betting ad spend flatlines, the mixed message is still the message.

The mania for buying old songs is coming to an end.

Goodbye to all that: Inside Asia Gaming’s Andrew Scott leaves Macau. “Over the past six months there has been a veritable cavalcade of goodbye drinks, parties, farewells and messages announcing departures from Macau.”

Calendar

Sep 13: Allwyn, Q2, E+M Deal Talk

Sep 14: Kindred capital markets day

Contact us

Scott Longley scott@clearconcisemedia.com

Jake Pollard jake@openmediaservices.com