Less than super: online poker’s travails

Online poker scandal, Jackpocket concerns, Penn’s online losses examined, Macau revival +More

Concern spreads in online poker following GGPoker’s superuser scandal.

In +More analysts takes: Kindred’s slow progress, MGM’s bad reaction.

DraftKings’ Jackpocket buyout raises regulatory fears.

ESPN Bet losses predicted to push up Penn’s debt levels.

The year of the dragon revives Macau’s fortunes.

Know when to walk away and know when to run.

Poker’s latest cheating scandal

Take, take, take: A recent superuser cheating scandal at GGPoker, the market’s biggest operator in terms of traffic, has placed questions over trust in the industry. GGPoker announced in late December it had banned a player called ‘MoneyTaker69’, with the operator confiscating close to $30,000 in winnings.

Add it up: A user on the Two Plus Two forum called ‘GGSuperUser’ posted MoneyTaker69’s stats, which showed the player had won at 90 big blinds per 100 across a sample of 8,900 hands in December alone.

This was on the back of a voluntary put in pot (percentage of hands voluntarily entered) of 53% and a pre-flop raise (percentage of hands where he raised before the flop when having the opportunity to fold or call) of 17%.

In simple terms, MoneyTaker69 was winning far more often than would be deemed possible for a player with those stats.

The player also won the top prize of $47,586.80 in a GGPoker tournament in December.

Thumbnailed: A ‘superuser’ is a term used to describe poker players who use devices or tools that give them an unfair advantage over other players, such as the ability to see other players’ hole cards.

When approached for comment by E+M, GGPoker reverted back to its statement on the matter.

This detailed how MoneyTaker69 had used GGPoker’s ‘Thumbs Up/Down Table Reaction’ feature to intercept network traffic and customize his own game client.

GGPoker also said it has implemented security patches to prevent further client-side data leaks.

InclineBet provides performance-driven digital marketing services to the global regulated iGaming market. Our team bring unrivalled expertise in digital marketing, online casino and sports betting to deliver high-performance UA, CRM and Creative services.

iGaming isn’t merely another market we serve, it’s the only market.

Click to learn more about what we do and how we can help.

Erosion of trust

Inside scoop: Steve Ruddock, iGaming analyst for affiliate Gambling.com, told E+M: “It looks like a typical security breach that the company believed it patched. The failure has definitely eroded the trust of the poker community.”

Scandal sheet: While infamous cheating scandals have occurred before in online poker, this is arguably the most significant proven case since the Absolute Poker scandal of 2007, where Absolute Poker insiders were found to have cheated and the company was fined $500,000.

Ruddock suggested the only way to prevent a similar situation is through legalization and regulation.

“Third-party security audits, as well as game integrity testing, should be mandatory,” he said.

“Operators who continue to be reactive instead of proactive should heed the words of Will Rogers: ‘It takes a lifetime to build a good reputation, but you can lose it in a minute’.”

An unlikely ascent: GGPoker has reached the top of the online poker market table in terms of cash-game traffic in a short space of time, usurping long-time leader PokerStars.

At the time of writing, PokerScout ranked GGPoker’s average cash-game traffic across the past seven days at 11,000 players; the nearest operator in comparison was PokerStars with 3,600 players.

This situation would have seemed very unlikely in Q2 2016, when PokerStars claimed to hold a 71% share of the online poker market and that its poker revenue was 10 times bigger than that of its largest competitor.

Even at the start of 2020, GGPoker only averaged about 1,500 concurrent cash-game players, according to GameIntel. GGPoker first took the lead in this regard in June 2021 when it passed 5,000 average concurrent cash-game seats.

In the shadows: Consensus in the industry is that GGPoker has risen to this position as a result of its gray-market activities, particularly in China. Most forms of gambling are illegal in China, but a ban on online poker has only been strongly enforced by the government since 2018; after GGPoker had made a name for itself in the country.

GGPoker’s B2C business is not licensed in any US market, although its B2B business is licensed in Pennsylvania.

The company refuses to speak publicly on gray-market operations or which territories it is licensed in.

This air of secrecy extends to GGPoker’s parent company, NSUS Group.

The owner of the group is not named in any official capacity, aside from a pictureless LinkedIn profile attributed to Michael K., who titles themselves as founder and director at NSUS.

Stagnant pool: With online poker now some way removed from the boom of the mid-2000s, it is unlikely any other operator will break GGPoker’s current position of strength without also operating in gray markets.

Online poker is also not gaining traction with regulators in the US as it once was.

Since Nevada, New Jersey and Delaware all went live with regulated online poker in 2013, only three more states have joined them in Pennsylvania, Michigan and West Virginia.

+More analyst takes

Slow progress: Worries over soon-to-be-acquired Kindred’s progress towards producing its proprietary sportsbook were not allayed by the recent Q4 earnings. The company, subject to a $2.8bn bid from FDJ, said it remained on track to deliver its own sportsbook with the initial rollout now planned for the current quarter.

However, sources told E+M “the reality” was that Kindred was behind schedule with its smaller markets not switching to its own sportsbook until the end of this year.

Meanwhile, larger markets wouldn’t be moving until 2026.

MGM Resorts: The market reacted badly to MGM’s earnings, sending the shares down 6% the day after the call with analysts as investors took fright at the news for slimmer Las Vegas margins.

The team at CBRE estimated that on a more normalized hold, MGM would have seen negative same-store adj. EBITDA in Vegas for the quarter.

“This likely took some enthusiasm out of the quarter,” they added.

Dog eat dog: The report from EKG on cannibalization between B&M gaming and iCasino, as reported on by Compliance+More, was the cause of some debate on LinkedIn as Brian Wyman, partner at Innovation Capital, went toe-to-toe with David Briggs, co-founder at GeoComply, over the report’s conclusions and, well, a lot more. Click here to start the thread. 🍿

BettingJobs is the global leading recruitment solution provider for the iGaming, Sports Betting, and Lottery sectors. Backed by a 20-year track record of successfully supporting the iGaming industry, it's no surprise BettingJobs is experiencing rapid growth and outstanding results. Does your company plan to expand its teams to cope with strong demand and growth?

Contact BettingJobs today where their dedicated team members will help you find exactly what you are looking for.

DraftKings’ Jackpocket regulatory fears

Jack in the box: Looking at the $750m acquisition of Jackpocket, the team at Regulus pointed out it “appears” to tick a lot of DK’s strategic, product and cultural boxes. The team noted that Jackpocket “exists because US adoption of online lottery has been sclerotic, especially for instants,” pointing out that only seven states offer some form of iLottery.

However, a number of states either explicitly allow or don’t prohibit third parties buying a physical lottery product on behalf of another customer. Hence, ’courier’ lottery offerings.

“Naturally, large numbers of even younger Americans would now rather buy tickets online than go to the convenience store,” the team added

Utility futility: But regulatory questions loom with the twin dangers of either the courier model being questioned or states moving directly to iLottery, both of which could “undermine the utility” of the courier workaround.

Jackpocket’s “punchy” valuation, Regulus suggested, implies “very strong continued consumer adoption of the model, untrammeled by regulatory intervention, state competition, an early-adopter maturity curve or competition.”

Number of the beast: This worked for DraftKings in DFS, the team added, but lottery is a “very different beast with nervous friends in much higher places.” Further, they suggested the “clear attempt to use a lottery workaround product” to leverage sports betting and iCasino is also likely to turn up the regulatory heat.

“Whether DraftKings’ bravery in entering the US lottery space with a workaround product is to be admired or feared remains to be seen.”

Penn online dynamics

Tipping the scales: Looking into the dynamics of ESPN Bet’s promo push, the team at Deutsche Bank explained how the better-than-expected registrations and deposits in Q4 could have led to the “considerable miss” of $344m relative to the expected $100m-$150m losses.

Deutsche Bank pointed out that large-scale promo activity will have exacerbated the issues brought about by November’s adverse football results.

“When heavily promoting, poor hold has a more significant impact,” the team wrote.

Meanwhile, it also lengthens the time until players are actually losing money of their own.

Pulling back: They noted that in the subsequent weeks, ESPN Bet’s promotional expenses have started to normalize. Management said on the call that promotions as a percentage of handle had fallen back to 2.8% in January vs. over 32% in November.

“We believe the current promotional strategy, which is more in line with market peers, will provide a much more reasonable view of market share when measured by handle and GGR,” the DB team added

The losses haven’t helped Penn’s leverage situation, with Deutsche Bank noting the ratio of debt to EBITDA has “ticked up meaningfully.” This is set to worsen this year before any online-driven improvements.

As of the end of Q423 net leverage stood at 6.1x, but DB estimates the online losses mean lease-adjusted net leverage will rise to 8.2x in Q324.

When the levee breaks: debt levels are then forecast to improve in 2025 with the predicted improvement in online profitability.

Analyst takes – Macau

Dragon’s breath: Both visitation and hotel occupancy during the recent Chinese New Year period “approached” levels last seen in 2019, according to Jefferies, who noted that total arrivals of 1.36m far exceeded Macau government forecasts for ~1m visitors.

“Despite expecting the traditional post-holiday slowdown, February gaming revenue is on track to reach a post-pandemic high,” the team added.

Fearsome: Jefferies said channel checks showed daily revenue for the holiday period for both Mass and VIP were up MoM 8-10% in the first instance and 10-14% for the latter. The analysts said this appeared to point to the second-highest post-pandemic ADR, only bettered by October’s Golden Week.

Calendar

Feb 20: Caesars Entertainment

Feb 21: Raketech, Kambi, Churchill Downs (e)

Feb 22: Acroud, Better Collective, Churchill Downs (call), VICI (e)

Feb 23: VICI (call)

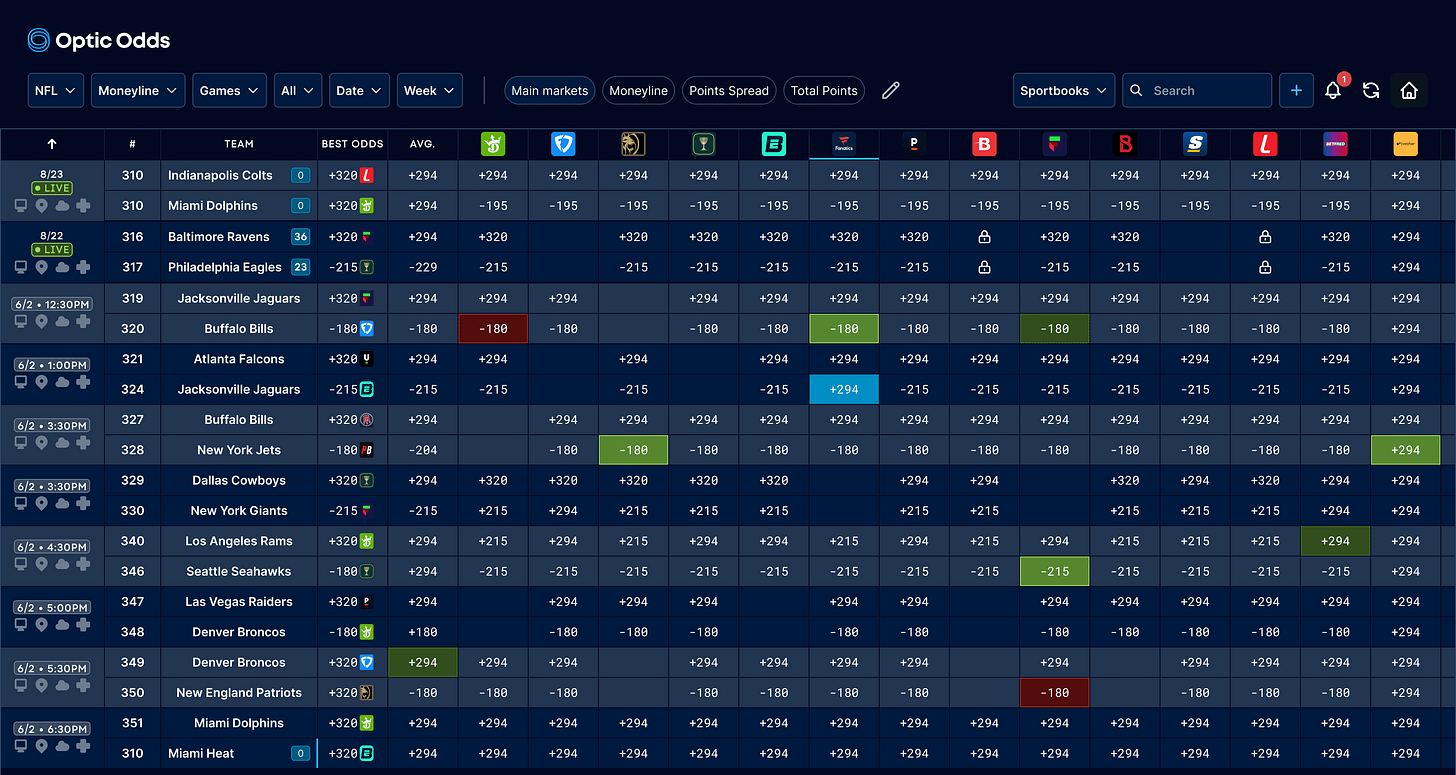

Operators, how's your risk management for NFL or March Madness? Utilize the trading screen used by top operators in the US, Europe, and Australia.

Optic Odds includes:

Main lines, alternative markets, player props for the Big 6, soccer, and more

Ultra-low latency: built with an emphasis on speed

Create bespoke custom weighted lines on the screen and receive live alerts for line movement via Slack or Teams

Also, our push format API offering real-time betting odds from 150+ sportsbooks: player props, alternate markets, injury data, historical odds, schedules, ranking, scores & more, is available upon request.

Get in touch at ryan@opticodds.com.

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.