DraftKings pockets Jackpocket, misses on earnings

DraftKings M&A and Q4 earnings, Penn earnings reaction, shares watch – DDI, sector watch – Bitcoin +More

DraftKings lays out $750m for lottery reseller, reveals Q4 earnings miss.

In +More: Underdog and PrizePicks pull out of Florida, Massachusetts numbers.

Analysts express disappointment over Penn’s ESPN Bet losses.

Sector watch looks at the soaring Bitcoin price.

BettingJobs’ Jobsboard features payments and commercial director roles.

I'd rather jack than Fleetwood Mac.

DraftKings confirms Jackpocket buyout

Pocket rocket: DraftKings has bought lottery reseller Jackpocket for $750m in cash and shares, as was predicted by Earnings+More on Tuesday. DraftKings said the deal would drive $260m-$340m in incremental revenue and $60m-$100m in adj. EBITDA by 2026.

Those figures rise to $350m-$450m and $100m-$150m by 2028.

DraftKings will pay $412.4m in cash with the remainder coming in shares. It is expected to close in H2.

Payday: The New York-based Jackpocket was founded in 2013 and its last funding round came in Nov. 2021 when it raised $120m in a Series D round led by Left Lane Capital. Also participating were the likes of Kevin Hart, Mark Cuban and previous investors including Greenspring Associates, Raine, Anchor Capital, Gaingels, Conductive Ventures and more.

Lifetime funding for Jackpocket totalled ~$200m, suggesting a 3.5x return for its investors.

JMP said the deal represented a 9.6x multiple on 2023 revenues.

Raine also advised the company on the sale.

Add value, stir: DraftKings CEO Jason Robins said the deal would “create significant value” for his company, giving its customers “another differentiated product” while also improving its marketing efficiency, “similar to how our daily fantasy sports database created an advantage” for DraftKings in OSB and iCasino. Analysts cautiously welcomed the news.

“In a TAM-dominated industry, DraftKings has now unlocked an incremental cross-selling vertical,” said JMP with “huge overlap” between iCasino and iLottery players.

Truist said they expected the deal would “require an investment phase before it's additive.”

But Deutsche Bank suggested DraftKings bears might question the need to spend $750m on a lottery-style business while the “core is in the process of ramping from negative EBITDA into the billions.”

Scary monsters: The markets appeared less sure – or were maybe spooked by the albeit well-telegraphed earnings miss (see below) – with the shares dropping over 3% in after-hours trading.

A miss – and a raise

Miss you: At the same time as the Jackpocket news, DraftKings released its Q4 earnings showing the predicted hold-related revenue shortfall. Revenues were up 44% YoY to $1.23bn but adj. EBITDA of $151m missed forecasts.

This was below the implied guidance of $187m-$207m due to the previously signaled adverse sports results in November.

The company said structural hold stood at 10.4% in Q4. Recall, rival Flutter said in its recent trading statement FanDuel’s structural hold over the same period was 13.5%.

Habit of a lifetime: Despite the Q4 miss, DraftKings once again raised its midpoint estimates for 2024 revenue to $4.78bn (from $4.65bn) while the adj. EBITDA midpoint is now $460m, up from $400m. The upgrades are due to the upcoming launches in North Carolina and Puerto Rico.

The company expects 2024 to be its first full year of adj. EBITDA profit.

Keep the customer satisfied: Ahead of the call later today (see Monday’s Cheat Sheet for reaction), analysts remained upbeat. “Adjusting for Q4 hold from favorable sport outcomes, DraftKings is a business that continues to surprise investors to the upside when it comes to profitability,” said the team at Macquarie.

But Deutsche Bank suggested skeptics would likely note that gross margin guidance for 2024 was revised downwards.

BettingJobs is the global leading recruitment solution provider for the iGaming, Sports Betting, and Lottery sectors. Backed by a 20-year track record of successfully supporting the iGaming industry, it's no surprise BettingJobs is experiencing rapid growth and outstanding results. Does your company plan to expand its teams to cope with strong demand and growth?

Contact BettingJobs today where their dedicated team members will help you find exactly what you are looking for.

+More

Off Keys: Both Underdog Fantasy and PrizePicks have said they will pull out of Florida under pressure from the regulator. See Compliance+More next Tuesday for more.

What we’re reading: An already bad week for fantasy gets worse. Dustin Gouker’s The Closing Line.

Tie-up: M&A advisory firm Tekkorp Capital has announced a new partnership with recently launched consultancy Circle Squared run by betting and gaming veterans Clyde Harris, Graham Cassell, Mick d’Ancona and Peter Sherman.

Global appeal: Entain said betting on the Super Bowl across its UK- and European-facing brands increased 12%.

Lottery.com has announced it has bought SportLocker in an all-stock transaction. As part of the acquisition, SportLocker will be rebranded as Sports.com and will immediately launch as a premier platform for sports fans worldwide..

By the numbers

Massachesetts: GGR for January came in at $72.7m, up 17% MoM, on handle that was down 1% to $652m. DraftKings maintained its lead both in handle (49%) and GGR (52%), followed in both metrics by FanDuel on, respectively, 30% and 36%.

ESPN Bet came third by handle at 7% and with just 3% of GGR, while BetMGM hit 6% handle and 5.5% GGR share.

Penn earnings reaction

Crumbs of comfort: The team at Macquarie neatly summarized the scale of ESPN Bet’s losses in Q4, pointing out the negative adj. EBITDA of $334m was “similar” to DraftKings’ largest quarterly loss of $314m but less than Caesars Q122 loss of $554m.

Behind the curve: But as they added, both these companies are now expected to produce positive EBITDA this year, “highlighting the degree to which Penn is playing catch-up.”

But the team at Truist noted the accelerated customer acquisition experienced in Q4 meant management felt comfortable in moving the profitability inflection ahead by one year to 2026.

Not buying it: The team at Deutsche Bank were notably pessimistic about the online picture, suggesting that “despite all of the talk” about tech stacks, partnership relationships and UI, “one thing stands out with respect to the leaders in the OSB segment.”

“They have spent, and lost, considerably more, in their formative/ramp years, than those who currently sit in the 3-6 market share positions, and multiples more than the also-rans,” they argued.

They noted that cumulative losses for the current market leaders exceeded $1bn.

Long and winding road: As such, the Deutsche Bank team added, despite the strong brand partnership Penn enjoys, the $700m-750m of cumulative losses it anticipates before breaking even, and with aspirations to garner greater than 10% market share in the OSB segment, “are not supported by historical experience.”

Hence, while ESPN Bet “may well be off to a reasonably solid start relative to expectations,” the team anticipates the road to be “long and bumpy.”

Tie-ins: On the call, CEO Jay Snowden was keen to stress the extent to which ESPN was bought into the project. Truist noted the Bet Mode, and ‘6-pack odds’ integrations are now active, and allow direct engagement through the ESPN app.

They noted management’s comments that the new FOX/Discovery/ESPN streaming service JV will “carry over ESPN Bet integrations”, which could increase customer access.

Side show: Not for the first time, discussions around online obscured Penn’s core regionals business, which the team at Jefferies characterized as being “solid.” Truist noted Penn provided guidance on the call for the B&M business, with adj. EBITDA for 2024 expected to come in at $1.91bn-$2.03bn.

The guidance reflects the poor weather in January and increased competition in key markets as well as moderate wage pressure.

Deutsche Bank liked the regionals numbers, which on their own “would have had shares higher today.”

🤮 Investors weren’t too keen on Penn’s Q4 earnings

The shares week

Double up: Social casino and now iCasino operator DoubleDown Interactive enjoyed a stellar week on the markets with its shares up nearly 40% as of market close in New York on Thursday.

As reported this week, the company saw growth in its social casino business in Q4, the first time it has been in positive territory in terms of revenue for 12 quarters.

Q4 also included a debut contribution from the recently acquired SuprNation iCasino business.

🥳 At the double: DoubleDown Interactive up nearly 40% on the week

Operators, how's your risk management for NFL or March Madness? Utilize the trading screen used by top operators in the US, Europe, and Australia.

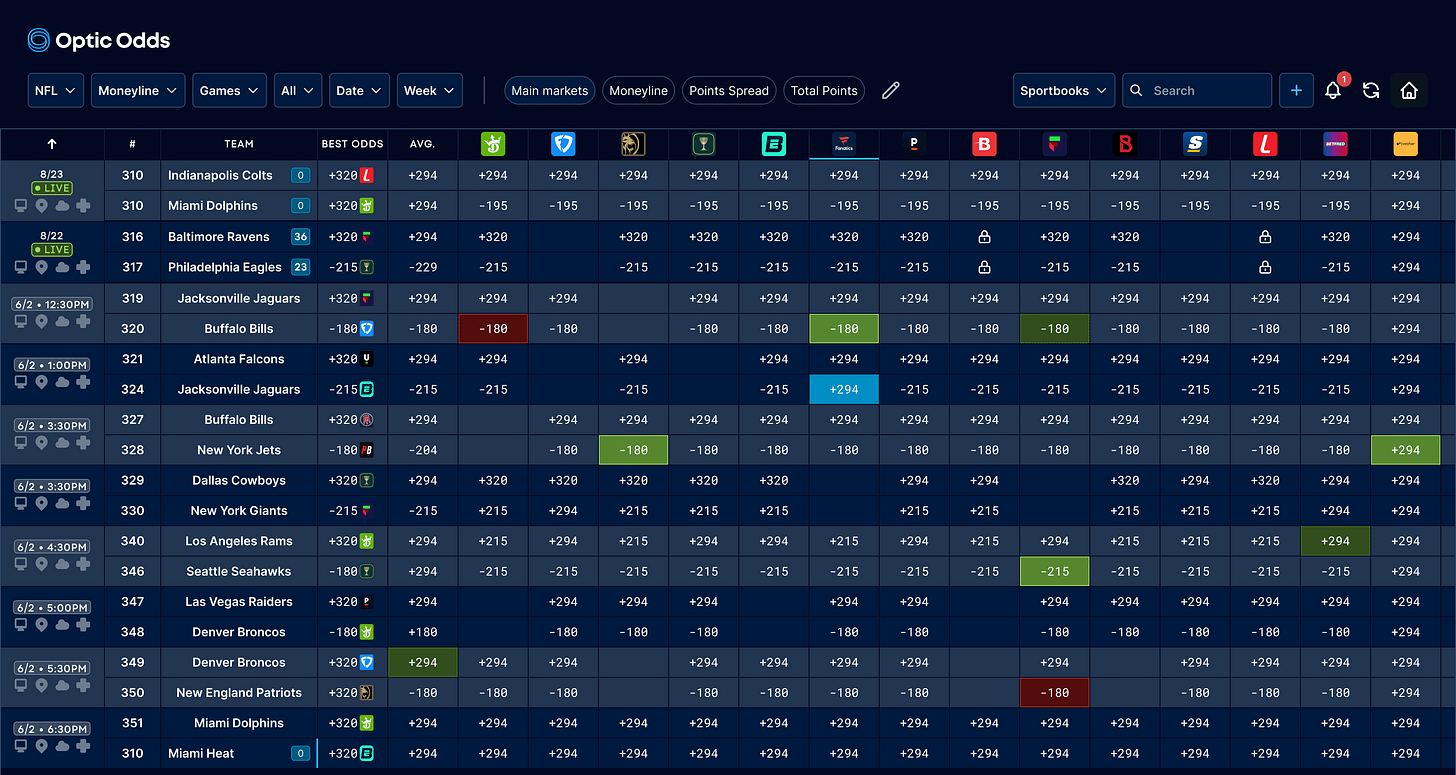

Optic Odds includes:

Main lines, alternative markets, player props for the Big 6, soccer, and more

Ultra-low latency: built with an emphasis on speed

Create bespoke custom weighted lines on the screen and receive live alerts for line movement via Slack or Teams

Also, our push format API offering real-time betting odds from 150+ sportsbooks: player props, alternate markets, injury data, historical odds, schedules, ranking, scores & more, is available upon request.

Get in touch at ryan@opticodds.com.

Sector watch – Bitcoin trading

Bounce: Slightly delayed, perhaps, but the price of Bitcoin has breached the $50k mark in the past week in the wake of the launch of the Bitcoin ETFs. Recall, in late January the news of the approval from the SEC was deemed as disappointing, despite fund flows totaling $1.2bn.

“Following a disappointing launch of several bitcoin ETFs we’re now seeing continued inflows into newly issued funds, and I think we’re seeing much more organic demand for bitcoin as a result,” James Butterfill, head of research at crypto investment group CoinShares told the FT.

The rally in the price of Bitcoin has sent its market capitalization to over $1trn for the first time in more than two years and futures bets are suggesting traders see the price as being likely to exceed its high of $69k.

Further, the banks are now lobbying for changes to the applicable accounting rules that currently make it more expensive for US banks to hold digital assets than their customers. The existing regulatory structure requires the banks to count crypto they custody as liabilities on their corporate balance sheets.

It means they have to set aside assets worth a similar amount to protect against losses to comply with their capital requirements.

But now they are asking to be allowed to exclude certain assets from what counts under the broad crypto umbrella.

This would include any traditional assets recorded or transferred using blockchain networks — for instance, tokenized deposits — as well as any tokens underlying SEC-approved products, such as spot-Bitcoin exchange traded funds.

And to exempt regulated lenders from the current balance sheet requirement while maintaining the requirement that firms disclose their crypto activities in financial statements.

Calendar

Feb 16: DraftKings (call)

Feb 20: Caesars Entertainment

Feb 21: Raketech, Kambi, Churchill Downs (e)

Feb 22: Acroud, Better Collective, Churchill Downs (call), VICI (e)

Feb 23: VICI (call)

Director of Payments and Treasury – Lisbon

Thai Country Manager – Manila

Commercial Director – Asia / Cyprus / Eastern Europe / Malta / Remote

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.