DraftKings has a lot to lose if it has the surcharge wrong, say analysts.

In +More: bet365 demerges soccer club.

Penn, Entain and Wynn Resorts among those reporting this week.

Startup focus is behavioral addiction treatment provider Birches Health.

You think you're smart? Stupid, stupid.

Hard Rock Bet is all about fun and innovation. With a top ranked sportsbook & casino product, unique access to US states, and a globally recognized brand, join our team to help shape the online experiences that millions love. We’re currently seeking:

SVP – Performance Marketing

Sr. Director – Sports Promotions

And other amazing positions here.

Over and above

CraftyKings: “Every company has to do what's best for their own business,” said DraftKings CEO Jason Robins, when starting off the Q&A section of the company’s Q2 earnings call on Friday, after it had announced the previous evening a new customer surcharge in high-tax states.

Robins Hood: Under the plan, as of January 1, customers in high-tax states New York, Pennsylvania, Illinois and Vermont will pay what the company insists will be a “nominal fee” on their winning bets to cover tax rates that are above what DraftKings reckons as a reasonable rate of 20%. The company believes the move will drive additional adj. EBITDA.

Analysts speculated that FanDuel owner Flutter and others in the market might opt to follow DraftKings’ lead.

DraftKings could “set a trend,” said Macquarie, while JP Morgan suggested it was an “interesting” way to mitigate higher taxes that they assume others will follow – “why wouldn’t they?” the team questioned.

Robins himself suggested that “if that's our calculus, then others would come to the same conclusion.”

Knowing my fate is to be with you: Truist added that FanDuel’s reaction – Flutter is slated to release its own earnings on August 13 – “will likely determine how successful this initiative will be.” But sources suggested Flutter will, publicly, be non-committal on its rival’s move.

“It’s Napoleon’s dictum: never interrupt your enemy while he's making a mistake,” said one source.

Certainly, there is yet to be any comment from any US OSB or iCasino competitor.

Likely to be the first to be publicly questioned is Penn Entertainment, the owner of ESPN Bet, which is slated for its Q2 earnings call on Thursday BMO.

Non-stick: In an interview on Friday with Sportico, Robins doubled down on the suggestion from the call that the “vast majority” of customers would “not be very sensitive” to a charge on their winnings.

Citing the example of New York, where the tax rate is 51%, he said any deterioration in handle would have to be “substantial” to make up for the EBITDA gain.

Expanding further to Sportico, he said a notional $1bn in handle would pay $510m in taxes.

The new surcharge would then offset $310m of that. “You would need to lose enough revenue to offset $310m in EBITDA,” Robins told the website.

“So it’s unlikely, I would think, that we would see that,” he concluded.

DaftKings: But the analysts at Regulus Partners were skeptical. With “no structural reason” for competitors to copy DraftKings “it means they won’t, leaving DraftKings exposed as palpably offering worse value to customers with winning bets,” the team argued.

“We cannot think of a better way to destroy a brand proposition based on product, value and customer service – and DraftKings has nothing else to offer,” said Regulus.

“The fact that DraftKings’ justification is economically illiterate simply adds fuel to the fire.”

The upside: Yet, across at Macquarie the analysts put forward a scenario where DraftKings could lose 30% market share in its high-tax markets, invest more in marketing and still maintain EBITDA margins “similar” to that of a 20% tax state.

Among the benefits identified by Macquarie is the “strong message” sent to current and future OSB/iCasino states on high taxes.

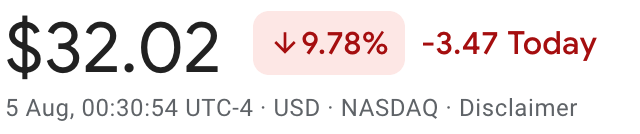

Yes, but: However, regardless of the EBITDA upside, the social media stir caused by the move was enough to precipitate a near-10% fall in the share price on Friday, albeit on a bad day for the market across the board.

💥 DraftKings takes a hit on Friday

Taxi for Robins: On the call, Robins suggested such customer surcharges are “typically done in other industries,” citing the case of Uber. “It’s typically line itemed out separately and usually 100% passed along to the consumer,” he told the analysts.

Bookmark this: “People may gripe about it, but I don't really see behavior changing because of it,” he said.

But on X, Alun Bowden from EKG noted gambling is “not like other industries.”

“The money won is the thing you’re buying,” he added. “It’s different.”

To change the mood a little: The surcharge questions dominated the call, but Robins was asked about a range of other matters including M&A prospects. Asked specifically about any plans to buy its way into LatAm, he said DraftKings was “really focused on winning the US online gaming opportunity.”

“Just in the last couple of months, we divested VSiN, we shuttered Reignmakers,” he added. “A mantra and a theme throughout the company is focus, focus, focus.”

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

+More

New Coates of paint: Bet365 has demerged from the EFL soccer club Stoke City, with John Coates, co-CEO of bet365 and chair of Stoke, taking over full ownership of the club and stadium. In a press release, Stoke said the move was made for “licensing reasons.”

It added that a demerger was “identified as the best, most sustainable way for bet365 to continue its global expansion and for the club to continue to enjoy the long-term support of the Coates family.”

“My family and I remain steadfast in our commitment to Stoke City, so it’s very much business as usual,” Coates said.

The week ahead

All eyes will be on Penn Entertainment, which reports on Thursday BMO, as rumors persist of a potential joint bid for the company from Boyd Gaming and Flutter.

On the same day, Entain interim CEO Stella David will get one last crack at the earnings whip before she hands over to incoming permanent CEO Gavin Isaacs at the start of September.

Also this week, Wynn Resorts reports on Tuesday and is sure to face questions about its positioning in the UAE after the country announced the first details of its regulatory body.

Alongside Wynn, Tuesday also sees Genius Sports and Full House reporting, while Wednesday sees Light & Wonder and Super Group under the spotlight.

Career paths

Ciaran O’Brien has joined Entain as its new head of UK & Ireland public affairs.

MGM Resorts subsidiary LeoVegas has appointed Carl Brincat as director of policy and regulatory affairs. Brincat previously served as CEO of the Malta Gaming Authority.

Sector PR specialists Square in the Air has appointed Ben Cleminson as CEO to replace founder Bill Esdaile, who becomes chair. At the same time, Ollie Drew is the new COO and Robin Hutchinson becomes CCO.

Just a Clic away

Gaining ground: After the “conquest” of new customer acquisition during the recent Euro 2024 soccer tournament, Banijay CEO François Riahi said the company’s betting and gaming business was gaining market share in its main market of France.

The Paris-listed betting-to-media conglomerate said Betclic saw revenues rise 42% YoY in H1 to €698m, ahead of the rate of growth across the market.

He noted that player growth of 37% was also ahead of its competitors. “It’s positive for the rest of the year, and it’s positive for the years to come,” Riahi added.

Profits weren’t broken out but group adj. EBITDA rose 11% to €368m. Asked on the call with analysts whether “all the growth” was coming from betting and gaming, Riahi said it was coming from across the business but refused to break it down any further.

Sports-betting revenues rose 41% to €551m, iCasino was up 61% to €98.9m, poker rose 31% to €37.6m and horserace betting was up 60% to €9.7m.

Earnings in brief

Bet–at-home: The wholly owned Betclic subsidiary said H1 revenues were up 5% to €25.4m but adj. EBITDA fell almost three-quarters to €1.2m. The company also warned that a decision in a Swiss court regarding a potential obligation to pay VAT could affect its FY24 adj. EBITDA outlook of a negative €1m to a positive €2.5m.

Unlock new jurisdictional licensing in weeks, not months with OneComply! Your gateway to effortless licensing and compliance management.

Say goodbye to the complexity of submissions and hello to 95% efficiency from start to finish! Complete your first licensing application 50% faster, get real-time alerts for immediate compliance actions, and slash legal fee costs by up to 90% with no more duplicate tasks.

Click here to connect with us and discover how much more you can accomplish with OneComply.

The REIT direction

Straight and narrow: VICI will not deviate from its belief in the rightness of investment in experiential real estate despite the stock price being buffeted by cyclical factors outside its control, said CEO Ed Pitoniak on the call with analysts last week.

A key criteria in each investment, though, is that they be accretive against a multitude of factors.

And it is because two of Caesars’ properties in Indianapolis don’t fit these criteria that VICI has decided not to exercise the call option.

Hunger games: Still, VICI remains convinced about Las Vegas, where it collects ~45% of its rents, with COO John Payne quoting an airline executive as suggesting there was an “insatiable appetite” for people wanting to visit.

“Our Las Vegas tenants continue to benefit from this momentum,” Payne said.

“The magnitude and consistency of gaming cash flows and the creativity of our gaming tenants continue to drive our conviction in this sector.”

Pitoniak noted VICI would be willing to deploy more in Las Vegas, as it has done recently with the announcement of the $700m investment in the Venetian.

Venture playground

Learn first-hand experiences from gaming founders on high-growth tips and network with the most influential investors, founders and leaders. Click here to register.

Funding news

DuelNow, a decentralized betting exchange, has secured $10m of backing from Bahamas-based digital asset investment firm called GEM Digital as well as a further $1m from various angels including Charlie Lee, creator of Litecoin; Richard Ma, founder of Quantstamp; and Billy Markus, the creator of Dogecoin.

Growth company news

ProphetX; The sweepstakes betting-based sports exchange said via social media last week it is “very close” to launching in 40+ states. ProphetX has been born out of the ashes of Prophet Exchange, the New Jersey-licensed betting exchange, which closed in May.

Sports Betting Exchange or SBX told SportsHandle it is moving towards a launch in Colorado, while Arizona has announced that Sporttrade has won one of two newly available licenses. It and Plannetech – which runs the Prime Sports brand – are taking the berths vacated by Unibet and WynnBet.

Event

The Challenger Series: GeoComply has announced the initial details for its next Challenger event taking place during G2E in Las Vegas. The half-day series of panels and discussions will take place on the afternoon of Monday October 7 at the Fontainebleau. Click here for more info.

Startup focus – Birches Health

Who are you? New York-based Birches Health was founded 18 months ago by Elliott Rapaport after he spent two-and-a-half years scaling a virtual behavioral healthcare business nationally.

What's the big idea? Birches is a behavioral addiction treatment provider, specializing in treating gambling and gaming disorder through telehealth care.

Licensed, specialized counselors offer clinical treatment, covered by insurance and state government funding, across 40 states.

To widen its reach, Birches partners with gaming operators, professional sports leagues, universities and state governments.

What they say: “Problem gambling treatment in the US is rooted in incumbent models, such as in-person peer support groups,” says Rapaport. “While incredibly powerful for many, these methods are not a perfect fit for every American struggling with gambling disorder.”

Birches’ goal is to “ensure ease of access – with no financial or geographical blockers – to top-quality clinical treatment.”

Funding backgrounder: The company last year raised a seed round, led by institutional investors focused on healthcare, gaming and wellness.

Kambi Group is the leading provider of premium sports betting technology and services, empowering operators with all the tools required to deliver world-class sports betting and entertainment experiences. The Group’s services not only include its award-winning turnkey sportsbook but also an increasingly open platform and a range of standalone sports betting services from frontend specialists Shape Games, esports data and odds provider Abios, and AI-powered trading division Tzeract. Together, we are limitless.

For more info, go to www.kambi.com

Calendar

Aug 5: Playstudios

Aug 6: Wynn Resorts, Genius Sports, Full House

Aug 7: Super Group, Light & Wonder

Aug 8: Entain, Bragg, Penn, Golden, Inspired

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.