CaliPlay legal tussle takes a turn

Caliente’s CaliPlay complaint, Super Bowl thrills, DraftKings is the standout in the week ahead, startup focus – Deep CI, Iowa’s de facto market exits +More

Good morning. In today’s edition:

The legal tussle between Playtech and Caliente takes another turn.

The Super Bowl produces a thriller – and breaks geolocation records.

All eyes will be on what DraftKings says about profitability in the week ahead.

Our startup of the week is affiliate monitoring platform Deep CI.

Datalines looks at de facto market exits evident from the Iowa January data.

’Cause baby, now we got bad blood, you know it used to be mad love.

CaliPlay’s Playtech complaint

A legal battle over a seemingly minor contract issue could have wider ramifications.

Riddle me this: Late on Friday, the Caliente-owned CaliPlay issued a response to Playtech’s somewhat vanilla statement last week about the 49% ownership option in CaliPlay held by Playtech. But the statement appeared to leave open more questions than it answered.

Recall, Playtech said last week it was seeking a declaration in the English courts with regard to a “clarification on a point of disagreement” between the two companies.

That disagreement is over the current status of an option that exists (or existed) which would allow CaliPlay to redeem the additional services fee element payable to Playtech Malta.

CaliPlay says this option remains exercisable within 45 days following board approval of CaliPlay’s audited accounts for FY2021, which it pointed out on Friday is yet to happen.

The statement then added that Playtech omitted this fact in its interim results in September.

In December, CaliPlay subsequently challenged the accuracy of the September interim statement.

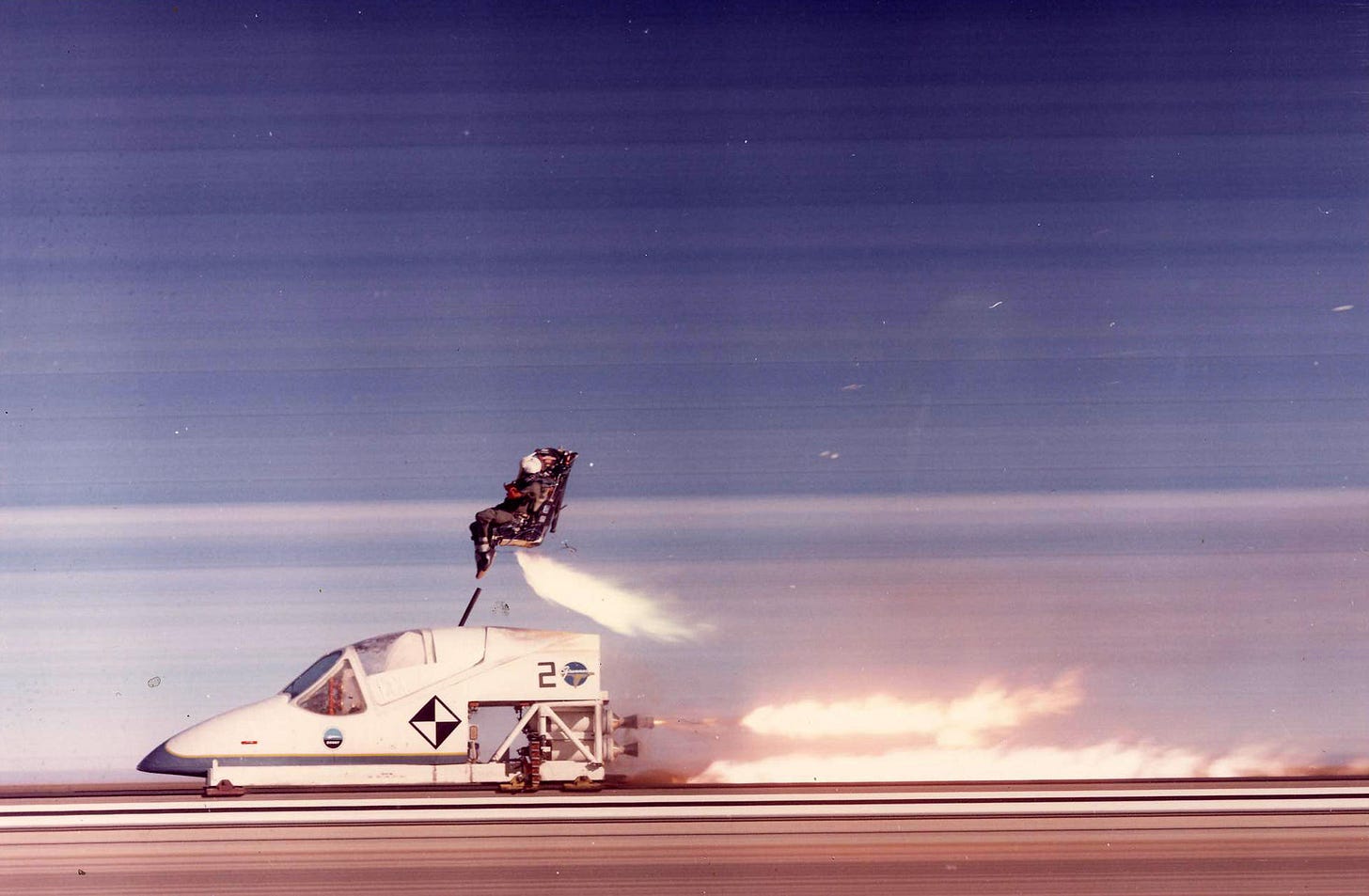

Ejector seat: A note from the analysts at Peel Hunt late last week, before CaliPlay’s statement was released, speculated that CaliPlay may have found, or had plans to find, a buyer for the whole business and would “prefer to eject Playtech from its interest” before selling it.

A big deal: Caliente is one of Playtech’s key structured agreements and the deal between the two, Peel Hunt estimated, was worth ~11% of total B2B revenue last year.

Peel Hunt pointed out that at the time of the attempted SPAC deal with Tekkorp, Playtech let the market know it valued the Caliente option at $720m.

That level was never tested and while Peel Hunt suggested the value of the option, should Playtech exit, would be “material”, nothing has been said by either party about what that value would be and how it would be calculated.

However, there is an expiration date on the CaliPlay deal and it also remains an open question when that comes into play.

The last unanswered question is whether the CaliPlay deal includes the US.

The bottom line: Playtech is no stranger to contract disputes, but this one has the potential to be more disruptive than most and hinges on some big unanswered questions around valuation and business continuation.

** SPONSOR’S MESSAGE ** The Fastest Sports Betting Data In The World: OddsJam offers real-time odds from over 150 sportsbooks in the United States, Canada, Europe, Australia, and more. See why tier 1 operators, affiliates, and DFS companies turn to the power of OddsJam sports betting data & screen to work smarter, not harder.

Book a demo or drop us an email at enterprise@oddsjam.com.

Bowl cuts

GeoComply records over 100m bets over the weekend as analysts at Macquarie suggested, ahead of last night’s thriller, that high volatility could have a material impact.

Triumph: Geolocation supplier GeoComply said it recorded over 100m geolocation checks across 23 regulated US states and the District of Columbia during Super Bowl LVII weekend. It registered 7.4 million accounts over the weekend, a 32% increase from last year.

It also recorded over 100k checks in and around State Farm Stadium in Glendale, AZ, from over 8,000 fan sportsbook accounts.

Hail to the Chiefs: Ahead of the game, Macquarie noted most operators were more concerned with “taking advantage of customer acquisition and engagement opportunities” leading up to the Super Bowl.

But still, the potential for high volatility from just one match will have had operators nervously watching last night for any outcome that might disrupt the monthly and quarterly GGR numbers.

The best outcome for sportsbooks would have been a KC victory (which the ’books got) but with under 51 combined points (which they didn’t).

Bettors favored SGP bets with high-scoring outcomes.

ICE shards

The feedback from last week’s show at the Excel was that operators were heads down concentrating on the year ahead.

Over excited, over optimistic and over here: The team at JMP noted operators were hopeful of “ignoring the macro” and concentrating on the opportunities ahead. But they noted that industry insiders believed there were more redundancies to come.

“The (US) online gaming sector was formed with the anticipation of large initial TAMs and profitability, but actual expectations fell well short, leaving companies overpaying for M&A, deals related to advertising/marketing and over hiring,” the team said.

Companies are “starting to see excess fat as they assess the business model”, they added.

“We see workforce reductions as a lever these operators will pull to right-size the cost structure and better align with profitability.”

Building blocks: The team at Jefferies noted that Light & Wonder was keen to talk about its iCasino plans, including Lightning Box, which is generating one game a month in the US; ELK Studios in Europe; Playzido’s RGS, another new studio belong launched in Las Vegas; and advanced plans for Authentic Gaming’s live dealer product.

The week ahead

DraftKings will be the center of attention when it releases its Q4 earnings later this week.

Fragile: The consensus on DraftKings is that it is making headway in its attempts to hit profitability by its self-imposed Q323 deadline, and such would be the conclusion from the recent share price moves.

But a note late last week from Roth MKM, which “tactically downgraded” DraftKings to a Sell, predicted that worse-than-expected EBITDA losses in this week’s Q4 earnings might “dent” belief in the company’s “profitability narrative”.

They added that losses in new state openings in Ohio and Massachusetts would not be recouped by quarter end.

E+M will cover the earnings statement from DraftKings, which comes out AMC on Thursday, and the call with analysts the following day with an Earnings Extra on Friday afternoon.

Betsson will publish its Q4 earnings on Tuesday. Recall, it reported a 19% rise in Q3 EBITDA thanks to Latam and central and eastern European (i.e. Turkey) growth. On Wednesday, GiG takes to the stage with its first earnings since the completion of its €45m acquisition of AskGamblers.

The American Gaming Association will hold its State of the Industry address on Wednesday afternoon (CET/GMT).

Deal Talk #7: The latest edition will be sent on Tuesday. In this issue, we take a look at whether the sector bounce in January signals that the capital markets will once again be accessible?

We question whether now-disappointed Entain investors made the mistake of paying attention to what MGM said rather than what it did when it comes to its LeoVegas acquisition.

And DoubleDown Interactive’s acquisition of SuprNation is the headline deal of the month.

Startup focus – DeepCI

Who, what, where and when: Deep Competitive Intelligence (DeepCI) is a SaaS platform that detects and monitors commercial brands on affiliate websites. It was founded in 2021 by Riaan de Jager, a 20-year iGaming industry veteran, and Lewis Civin, whose background is in building analytics tools for the retail industry.

Funding backgrounder: The company is entirely bootstrapped currently and de Jager says it is seeking a strategic partner. “But we are in no hurry, it is a matter of finding the right partner,” he adds.

The pitch: De Jager says DeepCI.com “is completely unique” as the first platform that is custom-built for affiliate managers. It combines traffic and keyword data and creates a brand profile for every affiliate page in 25 countries.

“The opportunity is for every affiliate operation to use our tools to manage their affiliate exposure efficiently and without the need for the cumbersome traffic tools they use today,” he says.

Forex is likely to be the next vertical. “We monitor all the English-speaking markets and our clients have access to Germany, France, Italy and all of Scandinavia.”

DeepCI is upgrading its product suite to monitor more US states and its PPC monitoring module went live to coincide with the IGB Affiliate Conference.

What will success look like? The aim currently is to “consolidate our foothold” in iGaming and expand the product suite in 2023 and, De Jager says, “thinking about an exit at this time is a distraction”.

** SPONSOR’S MESSAGE ** Tried, tested and proven over a decade in the highly-regulated US market, and continuing to expand across Europe, Latin America, Asia and Africa. GeoComply harnesses the power of its market-leading geolocation technology to protect against fraud, including fake account creations, bonus abuse, account takeovers, stolen identities, money laundering, and more.

Visit geocomply.com.

Datalines

Iowa: In sports betting, handle fell 25% YoY but as can be seen from the YoY comparison, there was varied dispersal across operators and also some de facto market exits. Notably, it can be seen that both WynnBet and BallyBet saw their handle fall to near-enough zero.

🔭 Iowa YoY variation in handle

Maryland: Sports-betting GGR was down nearly 30% to $59.5m, with handle also down 11.2% to $441.3m in January, while OSB generated $58m of the total GGR figure.

FanDuel led by GGR at 56.8%, followed by DraftKings (26.2%).

Notably, since launch at Fedex Field at the end of January, Fanatics’ retail book has taken $45k in revenue.

Indiana’s gaming AGR was up 8.2% to $195m, sports-betting AGR was up 3.2% YoY to $36.7m, while handle dropped 14.4% to $427.9m in January.

FanDuel led in share of AGR at 48.4%, followed by DraftKings (25.2%) and BetMGM (9.5%).

Missouri casino GGR rose 5.8% to $153.5m in January, while in Iowa casino GGR rose 4.2% YoY to $136.1m with visitation levels up 5.7%. Sports-betting GGR rose 16% to $16.5m, but handle was down 23% to $233.6m.

Newslines

Sportico is reporting that Diamond Sports Group, which owns the 19 regional sports networks (RSNs) operating as Bally Sports, is set to file for bankruptcy next week.

888’s subsidiary VHL Michigan has been approved by the Michigan Gaming Control Board to operate the OSB and iCasino website of the Hannahville Indian Community.

Global Payments is selling its gaming division to Parthenon Capital Partners for $415m.

What we’re reading

Yass man: Susquehanna’s Jeff Yass, the professional oddsmaker.

The real super league: the English Premier League’s rise and rise.

Calendar

Feb 14: Betsson, Deal Talk

Feb 15: GiG

Feb 16: DraftKings earnings

Feb 17: DraftKings analyst call

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.