Weekend Edition #84

DraftKings’ Sell note, FanDuel’s New York dominance, Super Bowl set to break $1bn, Wynn’s new notes +More

Good morning and welcome to your post-ICE weekender. On today’s agenda:

DraftKings gets a ‘tactical downgrade’ from the team at Roth MKM.

New York data shows how FanDuel established market leadership in New York.

Regulated handle for the Super Bowl this weekend will top $1bn for the first time, suggests EKG.

Wynn places $600m of new notes following well-received earnings.

DraftKings sell

The recent share price rally notwithstanding, the team at Roth MKM have “tactically downgraded” DraftKings to a Sell.

Hope over experience: The analysts believe DraftKings’s Q4 results late next week will see EBITDA losses come in worse than expected and will dent wider investor hopes about the company’s “profitability narrative”.

The team suggested new state launches in Ohio and Massachusetts will have required more upfront costs than expected by the Street.

On top of that, they believed Fanatics’ imminent launch will “reinvigorate concerns over an intensifying promotional environment”.

Roth suggested the recent share price action ahead of the Q4s was also helped by the recent redundancy news.

“The news created a narrative that DKNG may reduce 2023E EBITDA loss guidance,” they added.

Pointing to the recent GeoComply data about the Ohio launch, the Roth team indicated that, although it points to newly regulated states ramping up more quickly, it does mean greater EBITDA losses from intense promotional spend.

With Massachusetts also launching in Q1, it magnifies Q1 losses.

“DraftKings will incur losses when giving out promotions but will not have enough time to earn back revenue by quarter end,” suggested the team.

** SPONSOR’S MESSAGE ** Your customers think your payment options suck. And you pay too much for them! Process payments with BTC, ETH & Stablecoins instead - fast, reliable and inexpensive. And never any chargebacks! Get set-up @ ICE by meeting CoinSmart - licenced and regulated in Canada by the Ontario Securities Commission, and in Europe. Your customers (and your CFO) will thank you.

Book a meeting or drop us an email at smartpay@coinsmart.com.

Ad ban bill

A bill has been introduced in Congress that would treat sports betting like tobacco and ban all ads on TV, radio and online.

Ad break: The Betting on our Future Act, as proposed by Paul Tonko (D-NY), would see the Federal Communications Commission take on oversight of sportsbooks. In the fact sheet supporting the bill, Tonko said sports-betting ads are “out of control” and using “predatory tactics”.

It also cited DraftKings specifically as having spent $500m on sales and marketing in 2020.

In fact, as per E+M’s Due Diligence, in the 12 months to September 2022, the company spent $1.12bn on sales and marketing.

The Tonko fact sheet also pointed to a 45% rise in calls to the National Problem Gambling Helpline.

“Congress needs to reel in an industry with the power to inflict real, widespread harm on the American people,” Tonko added.

Super Bowl predictions

The team at Eilers & Krejcik says it expects the Super Bowl to breach the $1bn in regulated handle mark for the first time.

In making a prediction for handle of $1.06bn, the EKG team admitted they didn’t want to get into the realms of predicting GGR due to the inherent volatility involved. But they noted that for operators, the actual result of the game was less important than the numbers that came through the door.

“The Super Bowl is mainly an opportunity to acquire casual customers who can be cross-sold to other sports, online casino, or be reactivated next NFL season,” they added.

EKG also questioned the American Gaming Associations forecast of $16bn handle for all betting activity on the game, which includes office pools and offshore wagers.

They are skeptical that the legal market only captures 6% of overall demand.

The team added that it expects 15-20% of Super Bowl OSB handle to be bet via same-game parlays (SGPs) but that just 10-15% will be bet in-play. The lower metric is due to the fact that “football skews lower” on in-play.

Datalines – New York

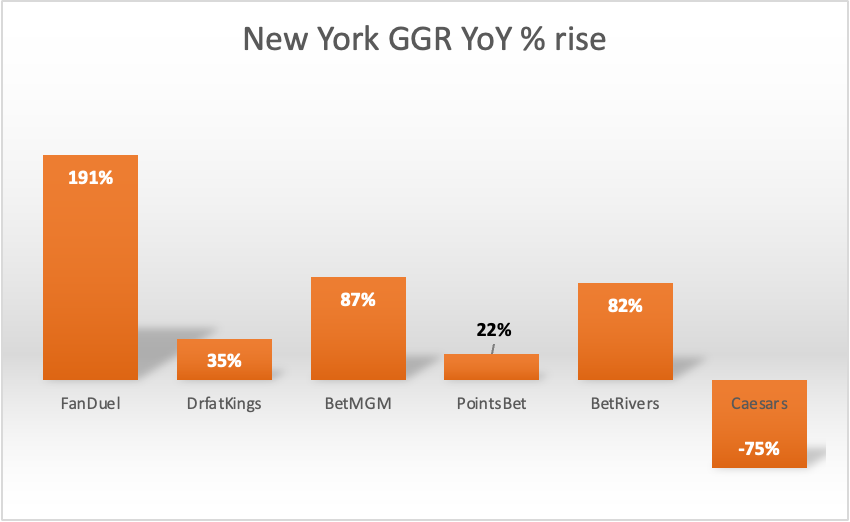

In the first year-on-year full-month comparable, the data shows the extent to which FanDuel has established market dominance.

Top of the rock: In achieving a GGR of $81.9m, FanDuel more than doubled its market share from the first month of operations in New York in January last year to nearly 55% from just under 23%. Its share of handle went from 31% to over 40% or $726.7m.

🗽 FanDuel gains the most ground year-on-year in GGR

Illinois

Sports-betting GGR shot up 144.6% to $82.4m in December, while handle increased 30.2% to $1.02bn. FanDuel was the GGR leader with 45.5% share and DraftKings second at 27.2%.

Wynn notes placement

A day after its earnings announcement, Wynn Resorts took advantage of the optimism surrounding Las Vegas and Macau with a $600m placement.

Cashing in: The new notes priced at 7.125% will go towards paying off Wynn’s outstanding 2025 bonds. The placement came after well-received earnings, which analysts at CBRE suggested were “even more impressive” given $11m of hold headwind in the quarter. Jefferies said the improving credit market would provide Wynn with more momentum.

The team added that management commentary on Macau in January and Chinese New Year “likely surprised” investors, with evidence that Wynn will be a “real player in the mass market”.

They still believed the “Wynn premium will prevail”, enabling it to capture “greater than its fair share, even in the mass market”.

Earnings in brief

Mohegan: Revenue rose 1.2% to $406.6m while adj. EBITDA was up 3.8% to $101.1m, with the company saying its diversification strategy and focus on profitability had enabled it to withstand the macro pressure.

Online helped drive the company’s ‘other’ adj. EBITDA to $8.4m, primarily driven by the success of the Connecticut operation.

** SPONSOR’S MESSAGE ** The Fastest Sports Betting Data In The World: OddsJam offers real-time odds from over 150 sportsbooks in the United States, Canada, Europe, Australia, and more. See why tier 1 operators, affiliates, and DFS companies turn to the power of OddsJam sports betting data & screen to work smarter, not harder.

Book a demo or drop us an email at enterprise@oddsjam.com.

Sector watch – affiliates

The news that Better Collective had acquired a 5% stake in Catena Media at the start of the month was preceded three weeks earlier by Catena’s announcement that it had mandated Carnegie Investment Bank to engage with third parties interested.

Since news of the Better Collective stake acquisition came out on February 1, Catena’s share price has climbed 20%. At current valuations, Better Collective’s 5% stake is worth around SEK125m ($12m).

Catena completed the sale of AskGamblers to Gaming Innovation Group for €45m the day before the Better Collective news came out.

Elevation: GiG said it had a “clear strategy” of implementing its own SEO and affiliate marketing technology and “elevating the performance” of AskGamblers.

Catena also announced this week that CFO Peter Messner would be leaving the company.

North America focus: Messner is based in Sweden and Catena CEO Michael Daly said: “Given our closer focus on the North American market, we have agreed that this is the right time to make a transition in our financial leadership.”

Acroud also made changes to its management team by replacing CFO Roderick Attard, who left the business in December, with Tricia Vella as interim CFO.

In October E+M revealed that the group was the ‘mystery buyer’ of Catena Media’s paid media division.

Sports gannet: Gambling.com announced a major new partnership this week with the US media giant Gannett. The affiliate group will supply Gannett with sports-betting content to drive traffic and monetize its vast online inventory.

Gannett owns household media brands such as USA Today and more than 200 local media outlets, with a reach of more than 47 million readers across the US.

Gannett CEO Michael Reed said: “Our highly engaged audience of more than 47 million sports fans crave analysis and betting insights to find the best sportsbooks and online casino sites.”

ICYMI

Sharpr this week led with the scoop that OpTic Gaming is part of a group searching for investors to fund a sportsbook and suite of betting products. It is pitching a new company called ‘NextGen Wagering’ and looking to raise $7.5m through a seed convertible preferred stock A offering.

Earnings+More this week:

DraftKings soars in wave of January optimism.

Lloyd Danzig from Sharp Alpha was the investor interview in the latest Startup Month.

Kindred admitted to a £7.1m upcoming UK regulatory settlement.

Compliance+More this week:

The UK government reshuffle sows further White Paper confusion.

Sky Bet and Paddy Power will face no further action over TV ads with football personalities.

New York needs a legislative triple play for iCasino lobbying to succeed.

**SPONSOR’S MESSAGE** Random Colour Animal specialise in motion-first design and production. We create advertising graphics, video trailers, and brand assets for B2C operators and B2B providers in iGaming. This spans animated campaigns, banners, social promo series, hero and explainer films – we also bring movement into brand identity design.

Read how to go motion-first with your marketing:

https://randomcolouranimal.com/nothing-happens-until-something-moves/

Newslines

Playtech is entering the US retail sports-betting market thanks to a supply deal for its sports-betting terminals and management systems with the gaming machine operator Gold Rush Gaming in Ohio.

Bally’s Corporation has been granted a license by the Illinois Gaming Board for its temporary casino in the Medina Temple neighborhood of Chicago.

Betfred has received a mobile sports-betting license in Maryland.

Fantasy sports operator SimWin has signed a contract to broadcast its 24/7 virtual sports on streaming service SimulTV.

Tekkorp Capital president Robin Chhabra has been promoted to the role of CEO of the company, taking over from Matt Davey who is now chairman. Former William Hill US CFO Mark McMillan also joined the group as partner.

Better Collective will provide sports-betting content and data to one of Poland’s leading online news websites Wirtualna Polska.

NeoGames is now a “semi-premium partner” of the European Lotteries Association and will be able to take part in EL events for the next two years.

Novomatic’s online gaming division Greentube has received its online slots license in Germany to operate its StarGames consumer brand.

The Dublin-based gaming investment firm Stram Entertainment, which owns betting affiliate website BestOdds, has acquired FansUnite’s affiliate brand BetPrep for an undisclosed sum.

Calendar

Feb 14: Betsson, Deal Talk

Feb 15: GiG

Feb 16: DraftKings earnings

Feb 17: DraftKings analyst call

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.