Reality bites: US market exits

Signs of distress in US sports betting, Allwyn Camelot bid, the week ahead, Apple policy move, startup focus – Atlas World Sports +More

Good morning. On the agenda for today:

Kindred’s Iowa exit and Illinois licensing withdrawals suggest US sports-betting reappraisal.

Allwyn confirms it is in talks to buy Camelot.

A significant earnings week with Caesars, MGM, Penn Entertainment and DraftKings.

Under pressure Apple changes its policy on gambling ads.

Our startup for this week is Atlas World Sports.

Reality bites in US sports betting

Kindred’s Iowa exit and the withdrawal of all applicants for supplementary licenses in Illinois show how the tide has turned on enthusiasm for US sports betting.

Taking the temperature: Kindred’s somewhat quiet exit from the Iowa market, compounded with the news from the Illinois Gaming Board that all four of the applicants for the next round of sports-betting licenses had withdrawn, suggests a market where the froth is fast disappearing.

Kindred said last week that as part of the “optimizing” of its US market strategy, it would be concentrating on states with multi-verticals as opposed to sports-betting-only.

Hence, it will be exiting Iowa in the fourth quarter, leaving its Unibet brand live in five US states plus Ontario in Canada.

IL behavior: At the same time, the Illinois Gaming Board said late last week it was reopening the application period for more sports-betting licenses after three of the four that had previously lodged an interest withdrew.

Digital Gaming Corp – Betway – withdrew its license request.

Tipico lodged its application late and was hence disqualified.

Fubo Gaming was also disqualified after a staff member was found ineligible. But Fubo has since announced it is exiting betting and gaming altogether.

Tekkorp Digital Acquisition Corp – the SPAC originally seeking a deal with Caliente – also withdrew.

Under the cosh: In the recent Deal Talk edition of the newsletter, sources suggested that brands spending time and money fighting for single-digit percentages of the market was “not sustainable”.

The bottom line: the consensus was that many brands would give it one last NFL season before potentially calling it a day; but, for many, decision time already appears to be now.

Live or let vie: Meanwhile, the Sharpr newsletter reported last week that Esports Entertainment has closed down its esports-focused sportsbook Vie.gg, including in New Jersey where it only launched earlier this year. As Sharpr noted, in New Jersey in July Vie.gg took in a total of $570 in gross wagers.

One out, one in: As also reported in last Friday’s Weekend Edition, Las Vegas-based retail sportsbook Superbook has gone live in Iowa.

**Sponsor's message: Spotlight Sports Group is a leading technology, content and media business specialising in sports betting. Working with the largest media companies in the world, including AS.com and Advance Local, Spotlight Sports Group offers fully managed solutions that allow publishers to maximize revenue across their highly valuable sports betting audiences.

For more information visit: spotlightsportsgroup.com

MGM Macau Covid blow

MGM Cotai is subject to a lockdown after a positive Covid case was identified on site.

Less than Zero: China’s zero-Covid policy has struck once again, as Inside Asia Gaming reported yesterday that MGM Cotai is now in lockdown after a dealer at the resort tested positive. According to the report, no one is allowed to either enter or exit the building.

Allwyn’s Camelot talks

Allwyn has confirmed a report that it is in “advanced discussions” with the owners of Camelot about buying its UK operations.

In a statement released over the weekend, the Czech-based lottery and gaming operator confirmed it was in talks with the Ontario Teachers’ Pension Plan (OTPP) about a potential acquisition of Camelot UK.

Allwyn was finally confirmed as the next UK National Lottery operator after Camelot’s legal challenge failed and will take over the running in 2024.

The group said the “shared objective” with OTPP would “best serve the interests” of all stakeholders, including the good causes and Camelot’s staff.

Tidying up: The Sky News report suggested that, if a deal were to be agreed, it would give Allwyn access to Camelot's UK earnings roughly a year before it surrenders control of the franchise. It also suggested it would bring a halt to Camelot’s outstanding legal challenge against the regulator.

Allwyn recently pulled its US float plans via the merger with the Cohn Robbins SPAC.

The week ahead

Another important set of earnings looks with Caesars on Tuesday and MGM Resorts on Wednesday, while Penn reports on Thursday and DraftKings on Friday.

Primed: With Thursday’s Nevada data proving that the Strip appears to be defying gravity, all eyes will be on what the casino giants say this week about prospects for Q4 and beyond.

Caesars on Tuesday could update on the potential Strip sale. While buyers might balk at the price – and raising the cash is problematic – there is no doubting the appeal of owning a Strip property.

MGM hits the board the following day where the subject of its growth and expansion priorities is sure to be foremost among analyst questions.

On Thursday, Penn Entertainment will face questions about how regional gaming is holding up.

Lastly, on Friday DraftKings might face questions about the likely doomed California ballot effort.

Analyst data point

With 70% of the market having reported the team at Truist suggested market-wide September GGR was up 48% on handle that rose 36%, helped by strong hold margins of ~12%. This is on top of data from August showing same-store GGR up 59% on handle up 11%.

Apple pauses gambling ads

The move follows complaints from developers about the appearance of gambling app advertisements in unrelated categories.

New inventory: According to MacRumors, the complaints were caused by Apple's announcement that it had made new inventory available on the App Store that would provide more advertising opportunities for developers, including advertising their apps in categories different to their own.

The new advertising features also allowed developers to promote age-restricted apps across all sections of the App Store and on non-relevant product listings.

But the level of discontent became quickly apparent, with developers taking to social media to complain about the appearance of adverts for gambling apps in their App Store feeds, despite their apps having no link to gambling.

Critics have accused Apple of greed; the company earns revenue from the advertising and takes a 15%-30% cut from in-app purchases.

REIT review

Analysts remain optimistic about the prospects for the largest gaming REITs despite the obvious pressure around interest rates.

Jefferies said GLP’s “better than expected results” showed its model was able to generate “high-quality stable cash flows”, while Deutsche Bank said VICI currently “offers investors stability in an otherwise uncertain environment”. DB added that M&A discussions including REIT parties “remain somewhat active within the regional gaming environment”.

The team at CBRE noted that since gaming REITs were first introduced, this is the first time it has faced rising interest rates.

“The cost of REIT financing is looking more compelling than conventional HY debt,” they added.

While the REITs are looking at diversification, CBRE remains convinced that gaming real estate “is the best opportunity”.

The shares week

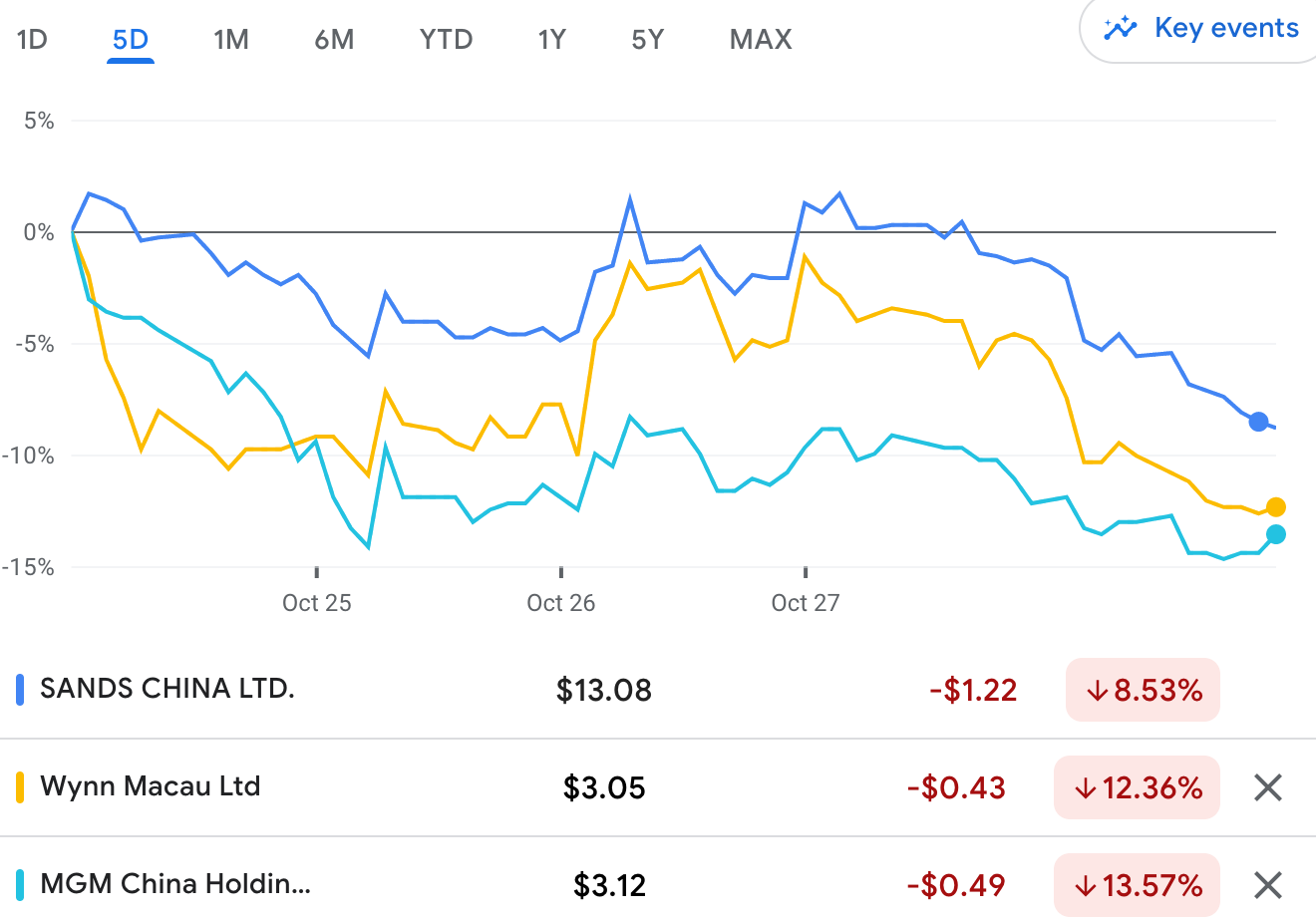

The Hong Kong listings of the leading US operators in Macau suffered a punishing week as the sector from the wider Xi third-term market sell-off.

There Xi Goes: The major Hong Kong-listed offshoots of US gaming’s leading players suffered along with the rest of the Chinese-facing markets as investors reacted badly to President Xi’s consolidation of power at the recent Communist Party conference.

Sands China was down 8.5% on the week, while Wynn Macau was down over 12% and MGM China was down over 13.5%.

Startup Focus – Atlas World Sports

Who, what, where and when: Chicago-based Atlas World Sports was launched in January 2021 by founder and CEO Robert Kraft. Along with Kraft, the group’s co-founders are CFO Kevin Seiberlich, CSO Robert Bardunias and CTO Sasa Maljkovic.

Funding backgrounder: The company is currently finalizing its seed round. To date it has raised $1m from angels with another $500k committed in December, and Kraft says a fund has committed $4m for a Series A in 2023.

The pitch: Kraft says the concept “of course” came about in May 2018 after PASPA was repealed, with the idea being “very similar to Expedia or Priceline” with a central hub for sports bettors to make informed bets with a single, efficient, user-friendly experience.

“We see our mission as organizing all the disparate data in the industry to enable easier access to sportsbooks and create a better experience for users,” Kraft adds.

The reaction from the industry has been “excellent,” he says. “The market is ready for innovation to help sportsbooks market more efficiently and for the users to have a more streamlined experience.”

“We are just launching in the US, but have our eyes on working in Central and South America from late 2023 and beyond.”

Kraft says the “most exciting milestone” so far will be the launch of its AI-backed ‘Predictions Tab’ on the App Store by the end of Q4.

What will success look like? An ideal exit “will probably make sense in three to five years”, Kraft says. “It will most likely be based upon a strategic buyer, whether it is a media company, a European affiliate or an American tech company seem to be the likeliest potential routes.”

Earnings in brief

BetMakers Q123 revenues rose 13% YoY to AU$23.8m thanks to the launches of six new partners during the period. The group is the tech partner of Matthew Tripp’s OSB startup Betr and also activated its agreement to distribute Penn Entertainment horse-racing content outside the US and Canada.

Datalines

New York: GGR was down 10% to $33.5m in the week ending Oct 23, despite handle rising 13% to $365.7m – its highest level since March Madness.

Leaders by GGR: FanDuel (45.3%), DraftKings (32.2%), Caesars (11.3%), BetMGM (5.3%).

Newlines

Australia-listed betting operator BlueBet has made a $500k strategic investment in free-to-play gamification specialist Low6. The agreement is for a five-year period and enables BlueBet to launch products on the Low6 platform.

The Macau Government Tourism Office told GGRAsia that the SAR was preparing to welcome package tours from mainland China next month, although the measures will be implemented gradually.

Spain’s Senate passed a bill that increases ad restrictions including not linking gaming to social success and the depictions of money.

What we’re reading

Betting on politics: US regulators ponder whether to allow election betting.

On social

Calendar

Nov 1: Caesars

Nov 2: MGM Resorts, Rush Street Interactive

Nov 3: Penn Entertainment, Golden Entertainment, Bally’s Corporation

Nov 4: DraftKings

Contact

Scott Longley scott@clearconcisemedia.com

Jake Pollard jake@openmediaservices.com