Kindred’s Dutch flier

Kindred happy with Netherlands re-entry, Evolution not so much with RNG, Boyd analyst reaction +More

Good morning. Today’s agenda:

Kindred offers up some Dutch delight but announces Iowa exit.

Evolution still not happy with RNG despite overall growth.

Boyd Gaming gets analyst credit for its Q3 earnings beat.

Market reaction: Kambi slumps after poorly-received Q3 earnings.

In the twist of separation, you excelled at being free.

Kindred’s upbeat Dutch return

Kindred’s return to the Netherlands market provided a boost but revenues were still down 6.9% to £277.8m while pre-tax profits slipped by 16% to £60.3m.

Back in the game: Active customers in the Netherlands since launch hit 137k and the reentry into the market helped push revenues from western Europe up by 27% to €151.8m. But this was still nearly 20% down on the Q321 total of £189.6m.

CEO Henrik Tjärnström said “the ramp up is very much there” in the Netherlands.

Average daily gross win in the Netherlands rose from £258k in the first four weeks of the quarter to £476k in the last six weeks of Q3.

Norwegian wood: Under legal pressure, Kindred has moved towards a passive effort in Norway but Tjärnström noted the company had followed a similar process during the long lead-up to the Netherlands regulation and that had had “little effect” on revenues.

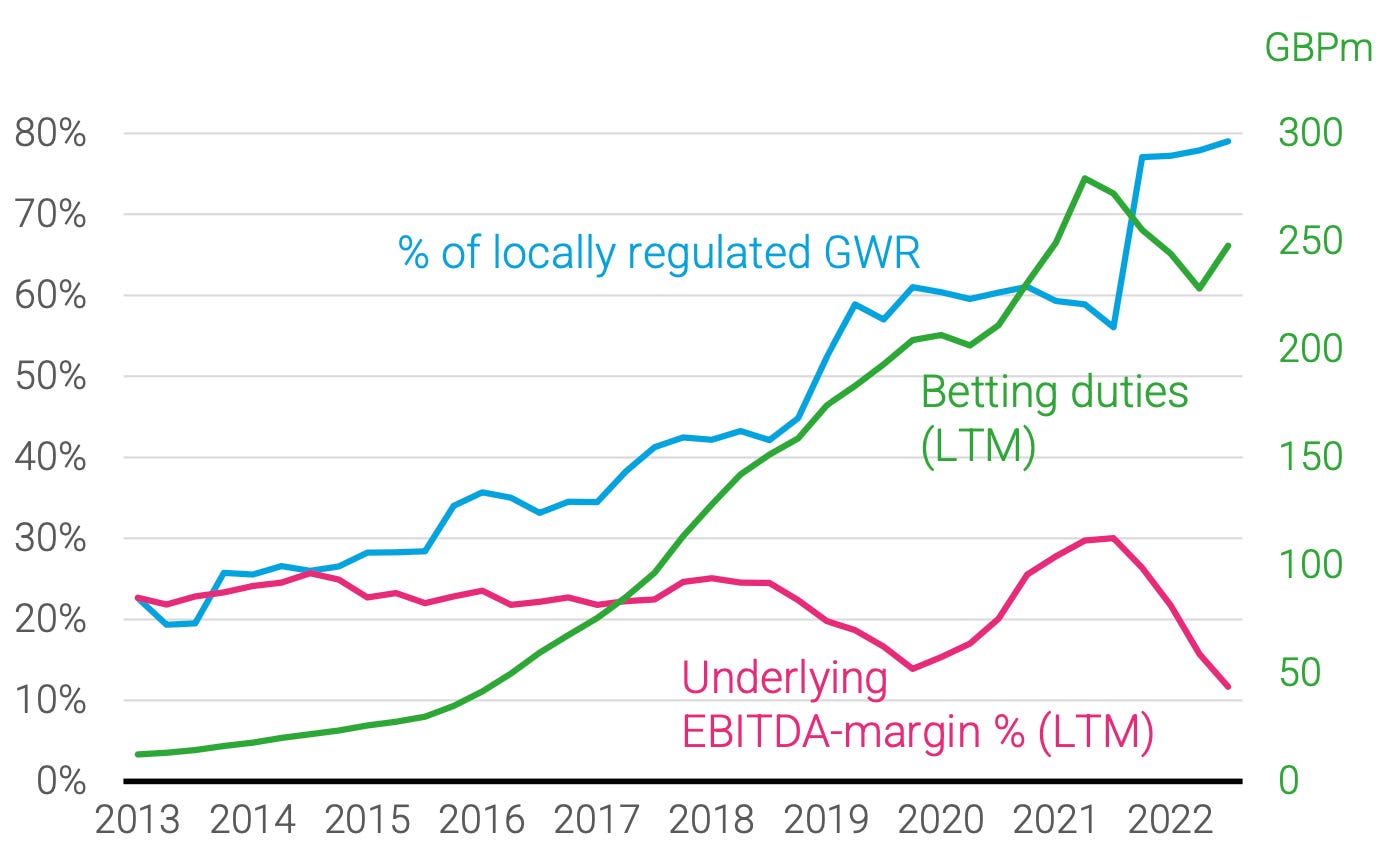

Hardly getting over it: Underlying EBITDA fell by 52% to 340.3m while underlying EBITDA margins stood at 15%, ~700bps lower than the margin target set for 2025 at the recent investor day. Tjärnström said the collapse in margins was “inevitable” given the regulatory picture.

👀Kindred’s margins drop with regulated markets rise

The news from Omaha beach: North American revenues rose £1m to £7.8m but were down 3% in constant currency terms. In order to “optimize” its business, the company announced it would be exiting the Iowa market in Q4, leaving Kindred live in six states and provinces.

During questions, Tjärnström refused to quantify the US losses to date. “We are very confident this is a good investment for the long term,” he added.

**Sponsor’s message** Venture capital firm Yolo Investments manages €550m in capital across 80 of the most exciting companies in fintech, gaming & blockchain. The Gaming Fund, regulated by the Guernsey Financial Services Commission, a dedicated 29-company, €183m AUM portfolio has invested in fast-growth assets including Dabble, Kalamba, SimWin & ThriveFantasy. Yolo Investments has just opened its fund to new investors as it looks to scale new cutting-edge concepts, including its exclusive high-roller land and live casino brand, Bombay Club, global banking network & OTC desk Aims Group.

Get in touch with your pitch or disruptive products to plug into our investment network!

Evolution’s RNG desire

Revenues increased 37% to €378.5m while EBITDA rose 35.3% to €261m, but management remains unhappy with RNG contribution.

Can’t get no satisfaction: Evolution completed the acquisition of No Limit City during the quarter, but CEO Martin Carlesund said the 11% increase in RNG revenues to €68m was “not satisfactory” and the group needed “to accelerate rollout to get more games out”.

Asia major: The region was up 66.6% and was the largest revenue contributor at €127.8m.

North America was up 56% to €50m, but Carlesund said this was “fairly normal” organic growth. “There are no specifics,” he added.

Non-exclusive: With competing providers launching exclusive live dealer products for some of their clients, Carlesund said he was “not in favor of exclusive deals in general”, even if they sometimes needed to be done.

“They require longer lead times and to limit us in the market is not advantageous,” he added.

Key challenge: Recruitment and integrating personnel “to expand capacity” at new and existing studios was the “key challenge” for the group, CFO Jacob Kaplan said.

Higher staffing costs were the main reason behind operating expenses rising 36.5% to €142.1m.

Churchill Downs beats consensus

Revenue was down 2.5% to $383.1m but adj. EBITDA rose 4.5% to $163.2m, the latter ahead of consensus expectations.

At the track: Live racing was the standout with revenues boosted by the hosting of more race days in the quarter compared with last year. Twin Spires revenues fell slightly YoY while gaming was steady.

Note: Churchill Downs will be hosting its earnings call later today.

Earnings in brief

Tabcorp: Revenues for the first three months of FY23 rose 18.7% (amount unquantified) with wagering and media up 14.2% with a claimed digital market share of 24.7%. The company suggested this demonstrates a stabilization of market share after it dipped below 24$ in FY22. Gaming services revenue soared 91.7% vs. pandemic-affected comps.

BlueBet: The Australian-focused operator saw net win fell 8.8% to A$13.5m for the first quarter. Over the period, the company launched its ClutchBet proposition in Iowa. Cash balances as of the end of September was A$42.3m including A$3.6m of customer deposits. The US business cost $2.5m in Q1.

Svenska Spel: Q3 NGR was down 1% to SEK1.9bn while operating profit was down 2% to SEK681m. The sports-betting and casino vertical was down 7% to SEK490m as a result of strengthened gambling responsibility measures. Land-based casino revenues were down 3% to SEK279m.

CIRSA: Estimated Q3 EBITDA will come in at €147m vs. previous guidance of €132m-€135m. FY22E EBITDA was also raised to €538m-€548m vs. €520m-€530m previously. The company also launched a €350m offering in senior secured notes.

Analyst takes

Boyd Gaming: Two words summed up Boyd Gaming’s Q3 earnings yesterday, according to Wells Fargo: “stable and consistent”. The team at CBRE suggested Boyd’s Las Vegas Locals division “continued to chug along at pace” while the Midwest and South business benefited from the ~$7m in OSB fees from FanDuel.

Market reaction

🚨After falling over 15% at one point yesterday, Kambi recovered some ground to end yesterday down over 7% after disappointing Q3 numbers yesterday.

Macau news

A new case of Covid has been found in an area of Macau and although the Tourist Office said it does not expect the news to affect group travel, the analysts at Jefferies said it “could stall Mainland China's overseas destination of choice given Macau's strict zero-COVID policy”.

Datalines

West Virginia: Casino GGR in September was up 10.6% to $85.2m and up 3% on a same-store basis to $73m. Sports-betting GGR was up 13.4% to $8.1m while handle was down 3.8% to $57.7m.

Newslines

The latest gambling participation survey from the UK Gambling Commission showed levels were stable YoY at 44 percent in September but in-person gambling participation significantly increased to 27 percent.

Sportradar and FanDuel have signed a new partnership for official NBA data through the end of the 2030-31 season and have also extended their main data agreement that sees Sportradar designated as the preferred data and odds supplier through to September 2031.

Parleh Media has partnered with Canadian network Game+, a subsidiary of Anthem Sports & Entertainment, for a new soccer-centric program called Room 4-4-2.

U.S. Integrity’s latest partnership deal is with microbetting startup betr in the state of Ohio.

Shouldn’t be news but: Lottery.com has announced the appointment of new auditors, Yusufali Associates.

What we’re listening to

Billion dollar brain: HuddleUp talks to Kevin Durant’s manager Rich Kleiman.

What we (won’t) be watching

Is it just us, or does this look, er, not that enticing?

What we’re reading

Cover-to-cover: The only crypto story you’ll ever need to read, by Matt Levine.

On social

Calendar

Oct 27: Churchill Downs call, VICI, Red Rock, GLP

Nov 1: Caesars

Nov 2: MGM Resorts, Rish Street Interactive

Nov 3: Penn Entertainment, Golden Entertainment

Nov 4: DraftKings

Contact

Scott Longley scott@clearconcisemedia.com

Jake Pollard jake@openmediaservices.com