FanDuel shrugs off football hit

Flutter trading statement, 888 reaction, analyst 2024 outlooks +More

Flutter rides with the punches as revenues rise by double-digits.

In +More: Rush Street share rise, Ontario data.

888 gets a mixed reception after “kitchen-sink” drama.

Macau is the top pick regionally for Macquarie.

I keep on rollin' with the flow.

FanDuel’s football hit

Adverse sports results in November cost $343m but revenues continue on an upward path.

Win some, lose some: Flutter’s US revenues in Q4 came in at £1.14bn, which was £147m below previous guidance as the company was hit by two consecutive bad weeks of football results in November. But revenue still grew 19%, helped by better-than-expected gross win margins across the quarter, which CEO Peter Jackson attributed to FanDuel’s success with its parlay product.

“It’s worth remembering our business has a degree of seasonality,” said CFO Paul Edgecliffe-Johnson

“I think Q4 was a good reminder for us that sports margins can be both very positive and negative,” Jackson added.

Mentioning no names: Jackson added that Q4 was also a quarter where there was ”lots of competitive intensity.” “Every year it’s competitive,” he said. “This year was very intense, but the quality of the product stands us in very good stead.”

Edgecliffe-Johnson said the company was encouraged by the promotional environment.

“There has been no meaningful increase in promotional spend,” he said.

Talking about market share growth, Jackson said “a lot of that” has come from customers that were solus iCasino customers.

“We’ve been taking share from the pure-play casino players.”

“Taking significant market share is going to be very valuable for us,” added Edgecliffe-Johnson.

Dial the numbers: Total Q4 revenues rose 15% YoY to £2.67bn, with UK and Ireland online up 21% to £572m (retail up 6% to £75m), Australia down 9% to £304m and international flat at £582m. Due to regulations related to the upcoming New York listing, no EBITDA figures were given.

For the full year, total revenue rose 24% to £9.51bn. The US was up 38% to £3.6bn, UK and Ireland up 15% to £2.45bn and international up 36% to £2.29bn.

Making Britain great again: Jackson extolled Flutter’s progress in the UK where he said the brands Sky Bet and Paddy Power were “taking significant market share.” Edgecliffe-Johnson said Flutter had “stepped early” on positioning the company for the new regulatory landscape.

Grow it alone: Jackson appeared to hint at possible deal activity around the recently opened up Brazilian opportunity. “Our approach to markets around the world is we have always been focused on organic growth,” he said.

“But we’ve also used M&A as a means of cementing positions on the podium and trying to achieve that gold medal position.”

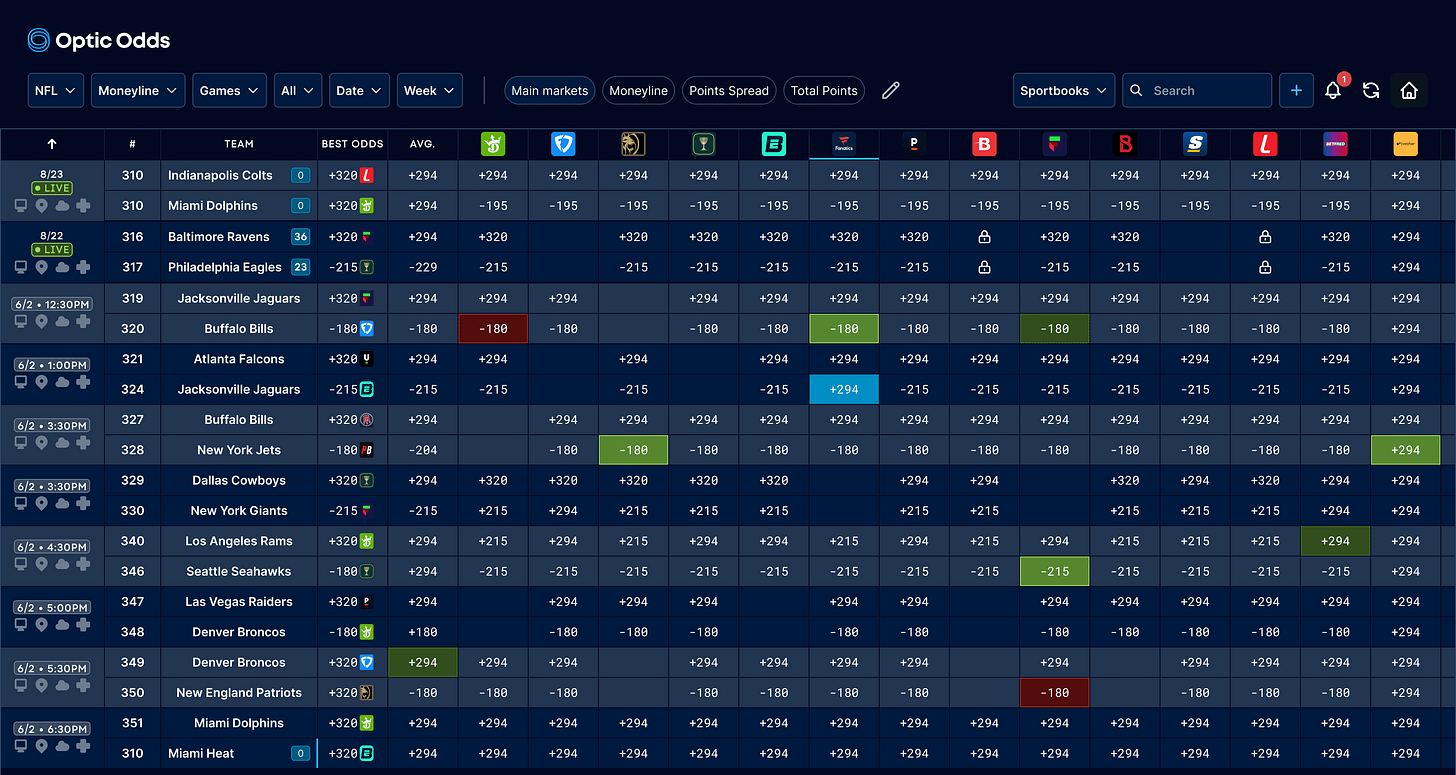

Operators, how's your risk management for NFL or March Madness? Utilize the trading screen used by top operators in the US, Europe, and Australia.

Book a meeting with Optic Odds at ICE and receive complimentary access to our trading screen for one month - no strings attached.

Includes:

Main lines, alternative markets, player props for the Big 6, soccer, and more

Ultra-low latency: built with an emphasis on speed

Create bespoke custom weighted lines on the screen and receive live alerts for line movement via Slack or Teams

Also, our push format API offering real-time betting odds from 150+ sportsbooks: player props, alternate markets, injury data, historical odds, schedules, ranking, scores & more, is available upon request.

Book a meeting here or get in touch at ryan@opticodds.com.

+More

Friends forever: IGT has announced it has received a contract extension to continue to supply the UK National Lottery’s core system ahead of the switchover to a new platform, as part of Allwyn's transformation program for the National Lottery.

Recall, only last week IGT ended its claim for damages from the awarding of the National Lottery license to Allwyn last March.

Bleakhuis: Entain is suing the previous owners of BetCity, which it acquired for up to €450m in June 2022 over a contract dispute. The case has been brought in the commercial court in London.

Earnings in brief

Golden Matrix – which hopes to complete its reverse takeover with Meridianbet in the coming months – saw FY23 revenue rise 23% to $44m while adj. EBITDA fell 32% to $2.4m. The company attributed the loss to increases in expenses, including operational costs for B2C operation MexPlay.

By the numbers

Kansas sports-betting GGR nearly doubled YoY in December to $20.1m, with DraftKings leading on 43% followed by FanDuel on 36%.

Ontario: GGR rose 22% QoQ to C$658m ($487m) in Q3, representing a 44% YoY leap, with active accounts up to 1.2m. Of total wagers, iCasino accounted for 79% with OSB contributing 18%.

Shares watch

Rush Street Interactive enjoyed a red-letter day on Wednesday, with its share price rising over 14% on the day.

🔥 In a Rush: RSI shares up over 15% in the week

888 reaction

Sinking feeling: 888’s share price dropped over 10% at one point yesterday before stabilizing later to end the day less than 2% down, as investors digested a mixed trading update, which the team at Peel Hunt characterized as a ”kitchen-sinking” of mildly bad news.

Yesterday’s statement partly confirmed the bad news from September’s profit warning as Q423 YoY revenues fell 7% YoY to £424m.

No pain, no gain: 888 has been through a “painful transition”, noted the Peel Hunt team, who added the £30m of additional costs savings that have been identified from the William Hill merger will now be plowed back into product and marketing.

The team at Regulus noted the business is now moving into a period of easy comps compared to the UK compliance and Middle East VIPs issues this time last year. They added there are some “quick wins” available for the new management team led by CEO Per Widerström.

These include cost-cutting – the company confirmed a further round of redundancies yesterday – and marketing efficiency.

But nevertheless, as the Regulus team pointed out, the company is guiding to the lower end of EBITDA expectations.

Drive to survive: “Over the last decade both 888 and William Hill have taken brief respites from endemic underperformance and claimed the beginning of a turnaround,” they added.

“With £1.6bn of debt, rising underlying costs, a less forgiving macro-environment, and continued regulatory uncertainty, the combined group now needs a real turnaround to survive, in our view.”

BettingJobs is the global leading recruitment solution provider for the iGaming, Sports Betting, and Lottery sectors. Backed by a 20-year track record of successfully supporting the iGaming industry, it's no surprise BettingJobs is experiencing rapid growth and outstanding results. Does your company plan to expand its teams to cope with strong demand and growth?

Contact BettingJobs today where their dedicated team members will help you find exactly what you are looking for.

Outlooks for 2024

Eastern eye: Looking at the gaming universe by region, the team at Macquarie said Macau is the market with the most potential upside and, within that, highlighted Wynn Resorts as the company with the most potential upside.

The team said they are “confident” in the floor in Macau having been reached and have faith that the recent GGR and market momentum is sustainable.

Glide path: For online in the US, the team said they expected market growth to slow from 68% in 2022 to ~40% in 2023 and they forecasted a further slowing to 10% this year. They noted the lack of new market openings this year would likely benefit the bottom lines at market leaders FanDuel and DraftKings.

Strip mining: The team at JMP gave credence to fears that Las Vegas is “over-earning”, saying the hesitancy from investors around key stocks Caesars Entertainment and MGM Resorts was understandable.

But they suggested hotel pricing and gaming revenue were still at all-time high levels, and their recent trip to Las Vegas “highlighted the expectation of stability in the coming year.”

The team added the “shift to experiential spending” gave them comfort that visitor growth would continue off an already elevated base.

Analyst takes

Gambling.com: After meeting with management, the team at Jefferies noted Gambling.com has effectively sworn itself off significant M&A “irrespective of the improvement in the opportunity set.”

“Our impression is that equity raises for acquisitions are unlikely near term,” the team added.

Calendar

Jan 24 Las Vegas Sands

Jan 30: PointsBet

Feb 1: Rank

Feb 6-8: ICE, London

Feb 7: Disney

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.