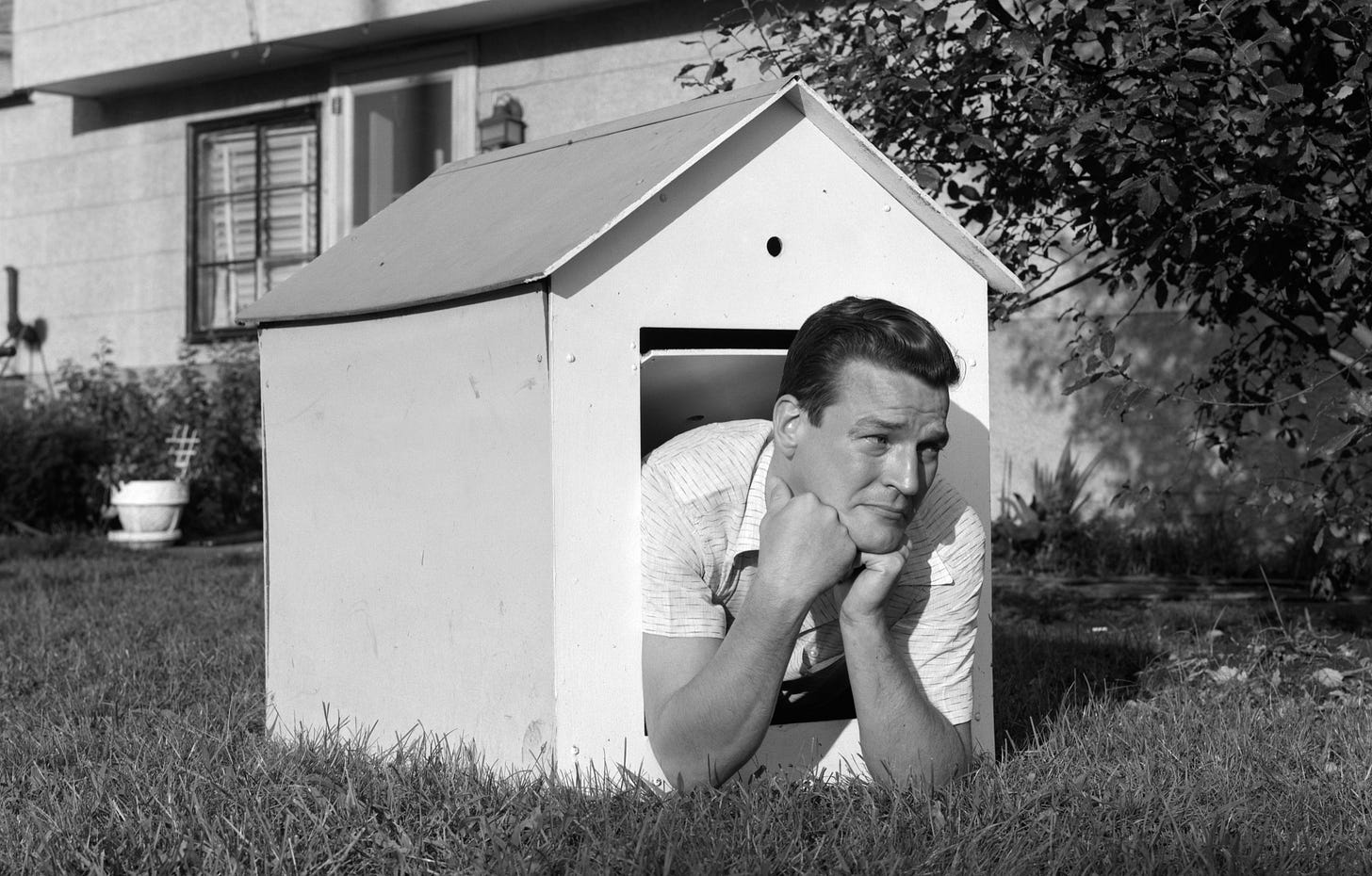

888 in the doghouse – again

888 share price slump, analysts talk up DraftKings, shares watch – GAN +More

Good morning. On the Weekender agenda:

888 suffers a share price slump as investors lose faith.

JP Morgan analysts like what they see at DraftKings.

Shares watch looks at investor reaction to the GAN CEO departure.

BettingJobs’ Jobsboard features head of legal & compliance and creative director roles.

Momma, I got bad news, bad news.

888 share slump

888’s share price fell back over 15% yesterday after its profit warning unnerved investors.

Back where we started: Yesterday’s sell-off came after 888 warned on full-year profits and pinned the blame on tougher regulatory conditions, which it said were hampering its revenue recovery. There has been a paucity of good news coming from 888 in the past year or more. Since finalizing the merger with William Hill in late 2021, the company has:

Issued a profit warning last October.

Admitted during an investor day that dealing with its debt load was a priority.

Lost its previous CEO Itai Pazner after a compliance scandal involving Middle Eastern VIPs, which saw it reach a regulatory settlement with Gibraltar.

Been threatened with losing its UK license by the Gambling Commission after the company received an unsolicited approach from former Entain CEO Kenny Alexander.

New CEO Per Wideström is set to take over next month and he has his work cut out. The company said yesterday that Q3 revenues would be down 10% YoY to ~£400m and though the company expects Q4 to be sequentially higher, it would still be slightly down YoY.

The company posted an H1 loss of £32.5m and said FY EBITDA would be “below expectations”.

Meanwhile, 888 appears to be running low on cash. The net cash figure as of September 28 stood at ~£162m and it had undrawn facilities amounting to another £150m.

As of the end of H1 net debt stood at £1.66bn.

Happy when it rains: Analysts at Peel Hunt remained sanguine about the company's prospects, suggesting that with the “transition year nearly over” attention now turns to what the new management team of Wideström and CFO Sean Wilkins can do.

Peel Hunt noted the value of the company was ”locked up in debt”. “If 888 trades as we forecast, the leverage multiples should fall and a value-creating refinancing becomes possible,” the team added.

Still, Goodbody analysts said the profit warning was “disappointing”, albeit the company shares some of the factors that lay behind rival Entain’s warning earlier in the week.

“FY23 was always likely to be a challenging year for the group; however, the earnings recovery potential remains strong for FY24/FY25 and the valuation remains undemanding,” the team added.

🚑 888 investors in need of some TLC

** SPONSOR’S MESSAGE ** BettingJobs is the global leading recruitment solutions provider to the iGaming, Sports Betting and Lotteries sectors. Boasting a 20-year track record supporting the iGaming industry, and with a team of experts and world class knowledge, it’s no surprise BettingJobs is experiencing rapid growth with outstanding results. Does your company have plans to expand teams to cope with strong growth and demand?

Contact BettingJobs.com today where their dedicated team members will help you find exactly what you are looking for.

ICYMI

Florida was all over the news in Compliance+More this week. First, after the state Gambling Commission sent letters to fantasy providers PrizePicks, Underdog Fantasy and Betr; and, latterly, because it looks like the dispute over the gaming compact and the Seminole’s efforts to get going (once again) with sports betting looks destined to be heading to the Supreme Court.

In The Closing Line, Dustin Gouker analyzed the comments this week from MLB commissioner Rob Manfred, who suggested there could be separate, gambling-focused broadcast streams in the future. “Do we really need this?” Dustin asked.

“I know it will be done, but this is not on the first page in the laundry list of things we can do to grow legal sports betting in the United States,” he wrote.

In Straight To The Point this week, Steve Ruddock took a look at yesterday's launch of OSB operations in Kentucky. As Steve noted, with Gov. Andy Beshear very much using the launch as part of his re-election campaign, the accelerated launch timetable is “leaning heavily” into a regulatory body that, among its members, has zero experience of the gaming industry.

DraftKings analyst booster

The “fundamental drivers” for DraftKings impress the team at JP Morgan.

Overweight getting fatter: DraftKings will benefit from a continued increase in market share that comes from the higher hold rates caused by a higher parlay mix and risk management as well as improved customer loyalty, according to the team at JPM.

Customer acquisition costs are also decreasing due to national scale having been achieved alongside a predicted “precipitous” drop off in sales and market expense.

“These translate to better flow-through and rapid EBITDA margin expansion,” said the analysts.

JPM has upped its DraftKings’ 2024 revenue and adj. EBITDA forecasts by 3% and 5% respectively to $4.36bn and $310m.

2025 adj. EBITDA, meanwhile, rises by 12% to $824m while revenues are now seen as coming in 5% higher at $5.11bn.

Further out, the team sees DraftKings having more than $3bn of cash balances by 2026.

Raise the drawbridge: JPM also suggested DraftKings has a “strong moat” to compete against new entrants such as ESPN Bet, “much like it competed against Caesars”.

Earnings in brief

Holland Casino said its land-based business continued its post-pandemic recovery with revenues rising nearly 15% to €405m. However, online revenues fell by a third to €57.2m due to increased competition and as it voluntarily pulled marketing ahead of the national ban.

** SPONSOR’S MESSAGE ** During the Panthers vs Seahawks game that lasted 3 hours and 6 minutes, Huddle had, altogether, 27 minutes and 58 seconds of suspensions, while the market, on average, had 1 hour and 10 minutes of suspension time.

Maintaining top-tier uptime not only enhances the user experience for our clients but also directly contributes to increased customer satisfaction, higher revenue generation, and reducing churn.

Explore more: https://huddle.tech/by-the-numbers-huddles-uptime-performance/

The shares week

GAN shares rose 15% after the announcement of the resignation of CEO Dermot Smurfit.

Harsh verdict: The departure of a CEO normally spells bad news for the share price of the company in question, but that wasn't the case with sports-betting backend supplier and B2C operator GAN this week.

Instead, the day after it was announced Smurfit was leaving the company to be replaced by chairman Seamus McGill on an interim basis, the shares leapt.

The good news for Smurfit is that he remains a significant shareholder in the company and so will have benefitted from the upward bump.

The bad news is that he is a substantial holder of shares that are down over 90% on their float price and off by 96% from the price of $30.45 reached in the heady days of early 2021.

🤮 Going, going, GAN

Sector watch – fan tokens

The ink has barely dried on Tottenham Hotspur’s deal with Socios and the fans are revolting.

You take the High Road: The deal announced this week with Socios will see all Spurs supporters aged over 18 offered the opportunity to buy a token for $2. Once received, it gives them access to the Socios app and “club-related polls, predictors, quizzes and competitions”.

But the Tottenham Hotspur Supporters’ Trust (THST) has already balked.

They say the deal for a supporter engagement token “exposes fans to potential losses”.

Being Spursy: Socios has previously done deals with a host of top clubs across Europe, including Inter Milan where it was the front-of-shirt sponsor for a season in 2021. The Athletic noted that previous fan tokens arranged with other clubs had seen the price initially surge on release before subsequently slumping.

It has deals with five other English Premier League clubs including Arsenal and Manchester City as well as with European giants Barcelona and Juventus.

Data from CoinMarketCap shows that all EPL-related coins are worth a fraction of their initial buy-in price.

The Levy system: The THST complained that the deal with Socios will see fans “end up in a system they do not understand that is designed to monetise their support and love for the club”.

“It is important there should be no financial or technological barriers to fan engagement yet this relationship potentially creates both,” the trust statement added.

What we’re reading

Lighting the blue touch paper: Caesars is nearing the launch of its micro-betting offering for NFL called Fire Bets, according to Sportshandle.com. The offering is modeled on the NFL RedZone and will leverage micro markets provided by Simplebet to offer suitable bets to users at key moments in each game.

Datalines

Arizona: The July data follows a familiar pattern with FanDuel and DraftKings largely sharing the spoils between them and BetMGM and Caesars being the only other operators to manage a seven-digit return after free bets.

Handle hit $320m while gross win after free bets came in at $26.6m.

The top two controlled 72% of the market (FD 41%, DK 31%), BetMGM was on 16% with Caesars on 7%.

The remaining 12 operational books shared 6% between them.

Portugal: Online revenue rose 41% YoY to €206m in Q2, a sequential rise of 4.9%, led by a 51% surge in iCasino to €122m. Sports betting was up nearly 30% to €84m.

Spain: A similar picture emerged in Spain where Q2 GGR rose 55% to €313m, with iCasino up 28% to €150m and sports betting more than doubling to €133m.

Newslines

MGM Resorts and JV partner Orix have signed an implementation agreement for the Osaka IR project with the Osaka Prefecture and the city. The move clears the way for the JV to begin developing the $10bn project, which is scheduled to open in 2030.

NeoGames has expanded its reach in Canada through the launch, via its NeoPollard JV, of premium eInstant games from NeoGames Studio with Atlantic Lottery.

Inspired Entertainment has extended its deal to provide virtual sports content to the Playtech-owned Snaitech.

Kambi has extended its sportsbook supply deal with former Swedish horseracing monopoly operator AB Trav och Galopp.

The UK Tote and France’s horseracing betting operator PMU have agreed a deal to give UK and Irish punters access to French pools.

** SPONSOR’S MESSAGE ** Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

Calendar

Oct 8: GeoComply Challenger event, Las Vegas

Oct 9-12: G2E, Las Vegas

Head of Legal & Compliance – Malta

Creative Director – Caribbean

Head of Affiliates – Remote

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.