Due Diligence #1

Will DraftKings need to raise more cash from investors? Plus some recent analyst takes

Good morning and welcome to our latest new monthly edition, Due Diligence, where the aim is to delve deeper into topics of importance to the sector.

For our debut issue, we take a look into DraftKings and what the recent results say about its drive toward profitability and the problems it faces in attempting to achieve its goals.

DraftKings and profitability

Redemption song: The initial response of investors to DraftKings’ Q3 earnings will have been dispiriting for management, given the extent to which they have consistently said that profits will follow the high double-digit year-on-year revenue rises seen this year.

In its statement, DraftKings raised its full-year estimates to $2.16bn-$2.19bn.

Its 2023 guidance is $2.8bn-$3.0bn, or 33% up on 2022 at the midpoint.

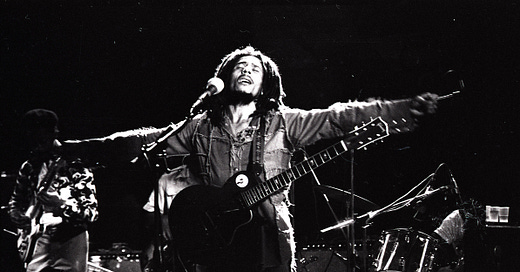

🪜DraftKings quarterly revenues Q420-Q322 ($m)

Action/reaction: The new adj. EBITDA losses guidance for 2022 is now between $780m-$800m, while the new estimate for 2023 adj. EBITDA loss is predicted to be between $475m-$575m.

But while the company insisted it will reach adj. EBITDA profitability in Q4 next year, in the days following the earnings DraftKings saw over 27% wiped off its value as investors took fright at the company’s cash burn.

The shares regained most of that ground within the past week as the markets made a rebound on better inflation data.

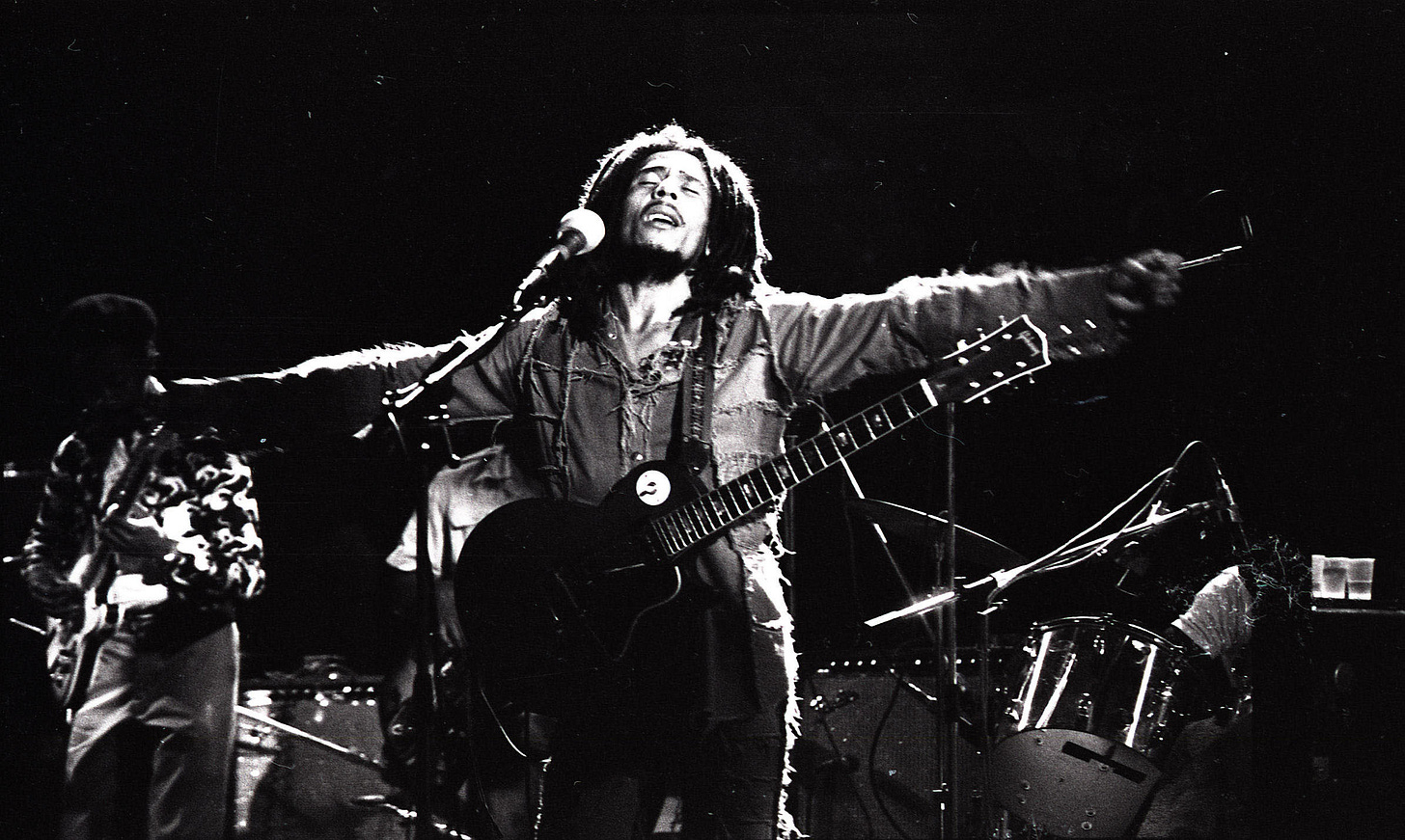

🎢DraftKings’ share price action in the last month

** SPONSOR’S MESSAGE** GiG is a leading gaming platform and sportsbook provider for online and land-based operators with digital aspirations. We deliver a full end-to-end solution through our award-winning iGaming and sportsbook solutions. Built for regulated markets and a top-class customer experience, GiG is pioneering the multi-platform era. If you are looking to expand your operations into new, profitable markets, our strategy is the solution.

Find out more at sales@gig.com.

Profit and loss

A look at the last 12 months shows how revenues have risen 62% over the period to $1.86bn, while operating expenses have risen at a lesser pace, up 35% to $3.51bn, leaving the loss from operations up 13% at $1.65bn. On the face of it, it is heading in the right direction.

As can be seen, part of the improved loss outlook comes from a paring back of sales and marketing expenses, at least as a percentage of total revenues.

The absolute sales and marketing spend rose to $1.12bn, up 13% YoY, but as a percentage of revenue, it fell back from 86% to 60%.

Spending on tech and product also fell back as a percentage of revenue to 16% of revenues from 22% and general admin spend was reined back to 45% of revenue from 66%.

The heart of the problem: It is the cost of revenue line, however, which proves to be the standout metric from these figures and it is the one that is clearly the most troubling if you are a bull on US sports betting.

As a percentage of revenue, cost of revenues outpaced the revenue growth, up 79% YoY to $1.25bn. But it also rose as a percentage of revenue, up to 67% from 61%.

Why cost of revenues is rising and why it matters

Death and taxes: Contained within the cost of revenues are various aspects of operations that are impervious to the benefits of scale. E+M spoke to Paul Leyland at Regulus Partners and he suggested that this bucket would include, among other costs, the following:

Cost of content and platform ~15%.

Cost of payments ~15%

Market access fees ~15%

Taxes (substantial but a big unknown)

Lockstep: For each of these elements of the cost base, the percentages are somewhat fixed. Taxes, as the saying goes, are always with us, while the content, payments and market access fees will include large elements of revenue share. Hence, as revenues rise the cost of these revenues goes up in lockstep.

The liquidity question

Analysts have previously questioned whether DraftKings has enough cash at hand to get it to profitability. On the Q3 call, CFO Jason Park was keen to stress the company believed it was “well-capitalized to become free cash flow positive with existing resources”.

As of the end of September, DraftKings has $1.4bn of cash.

Park said it would exit the year with between $1.1bn-$1.2bn.

Based on the 2023 adj. EBITDA guidance, Park said DraftKings will exit 2023 with $500m of cash.

Making assumptions: There are, though, a number of assumptions here. First, as the analysts at JMP indicated, this assumes no more state launches than are already baked into this year’s and next year’s guidance, namely Ohio, Massachusetts and Maryland.

It also assumes no further sales and marketing splurge; at 60%, the percentage spent on marketing is high by European standards.

The marketing spend in the last 12 months might turn out to be a peak figure; but, if this is the case, it is highly unlikely that spend will reverse.

As Leyland suggested, the ~$1.15bn is what is needed to “maintain the share of voice”.

At the 2023 guidance midpoint of $2.9bn, the percentage of sales and marketing would fall ~40%.

If the cost of revenues maintains at 60% of total revenues (i.e. less than the LTM figure) that equates to ~$1.7bn; with tech at 10% (or ~$290m) and G&A falling to 30% (or ~$870), it leaves yearly losses at ~$873m.

This is somewhat back-of-a-napkin calculations, but such a scenario would eat into that year-end $1.1bn-$1.2bn cash in hand and would leave DraftKings at around $300m. That doesn't leave a lot of margin for error.

What the analysts think

Bird on a wire: The team at Roth noted management’s continued insistence that it will not need to raise additional capital before reaching free cash flow break-even but pointed out that “investors are increasingly skeptical”. CBRE added there was “nervousness”.

Jefferies said the company’s cash balance “should support the cash burn until inflection in Q423”, but added that the stock “requires patience”.

The team at Macquarie said they remained “positive on the space” given the strong growth and the long-term TAM opportunity, but recognized that “spending issues still remain”.

🚨More ominously, Roth said DraftKings “continued to ignore the market’s pleas for more capital discipline”. They suggested that achieving positive FCF “without requiring an equity raise” is still possible.

“But it might require a ‘cost realignment’ like so many tech peers.”

Key takeaway: The share price swings affecting DraftKings are perhaps appropriate given the uncertainties surrounding the company, not least when it comes to the cost of revenues. It will need to convincingly provide some answers on profitability, both of the EBITDA and actual kind, before worries about its cash burn recede.

Recent analyst takes

Flutter: Following a decent amount of newsflow around the parent of DraftKings’ major rival FanDuel, it was no surprise that analysts at Wells Fargo suggested Flutter will find its future in the eyes of investors increasingly defined by the US.

Wynn Resorts: Looking at last week’s Q3s, CBRE pointed out that the solid beat in Las Vegas was in line with commentary from Caesars and MGM. “Encouragingly, Wynn reported positive trends across all segments, including casino, hotel and F&B,” they added.

Mack pain: Regulus made the point in the aftermath of Jim ‘Mattress Mack’ McIngvale’s $75m wager win that there were lessons to be learned, particularly around Texan McIngvale’s VIP status. They noted out-of-state bettors in legal states could be worth over 20% of the market-wide figure.

Caesars Entertainment: Macquarie noted the Caesars “investment story” was now pivoting to free cash flow, while Deutsche Bank indicated the majority of the digital improvement had come from stronger cost disciplines.

Calendar

Nov 16: Sportradar, Codere, Flutter Investor Day

Nov 17: Catena Media, Better Collective, Gambling.com

Contact

Scott Longley scott@clearconcisemedia.com

Jake Pollard jake@openmediaservices.com