DraftKings soars on January optimism wave

January’s sector bounce, ICE previews, World Cup differential, the week ahead, startup focus – Virtually Sports +More

Good morning. On today’s agenda:

DraftKings leads the way as the sector enjoys a New Year bounce.

Breaking: Better Collective pre-announces record revenues.

ICE week in London is upon us.

Entain and Kindred experience differing World Cups.

The startup focus is Virtually Sports.

Analyst takes looks at US regional gaming.

The month in shares

Sector leaders benefited from the wider market relief rally in January.

Turning a corner: DraftKings enjoyed a 44%-plus bounce in January as it rode the wave of the relief rally affecting the border market, as the prospects for an end to the rate-tightening cycle coming to an end cheered investors. This is against a 14.8% rise in the Nasdaq over the same period.

DraftKings was helped by the news last week of redundancies at its European and Middle Eastern offices.

Rush Street Interactive, the other online pure-play operator, is up over 17% in the same period.

🔥 DraftKings on fire: sector bellwether enjoys a January surge

Juiced: In the wider gaming sector, MGM Resorts rose over 17% in the last month, while rival Caesars was up over 21%. Penn, which reported somewhat disappointing earnings late last week, was up over 10%.

The UK-listed stocks also enjoyed some reflected glory. Flutter was up 11% over the past month and Entain gained 13% over the same period. The troubled 888, however, was down over 20%, caused by its Middle Eastern VIP admission last week.

Deal talk: The team at Citizens noted that, against the optimistic backdrop, there has been a notable tick up in corporate activity. Caesars recently announced a new $3bn bond and credit facility arrangements, while gaming REIT VICI garnered $1bn in an equity raise.

“Large-scale financing activity has seen a very strong start this year, with several gaming and leisure operators executing both debt and equity transactions,” the team wrote in a note to clients.

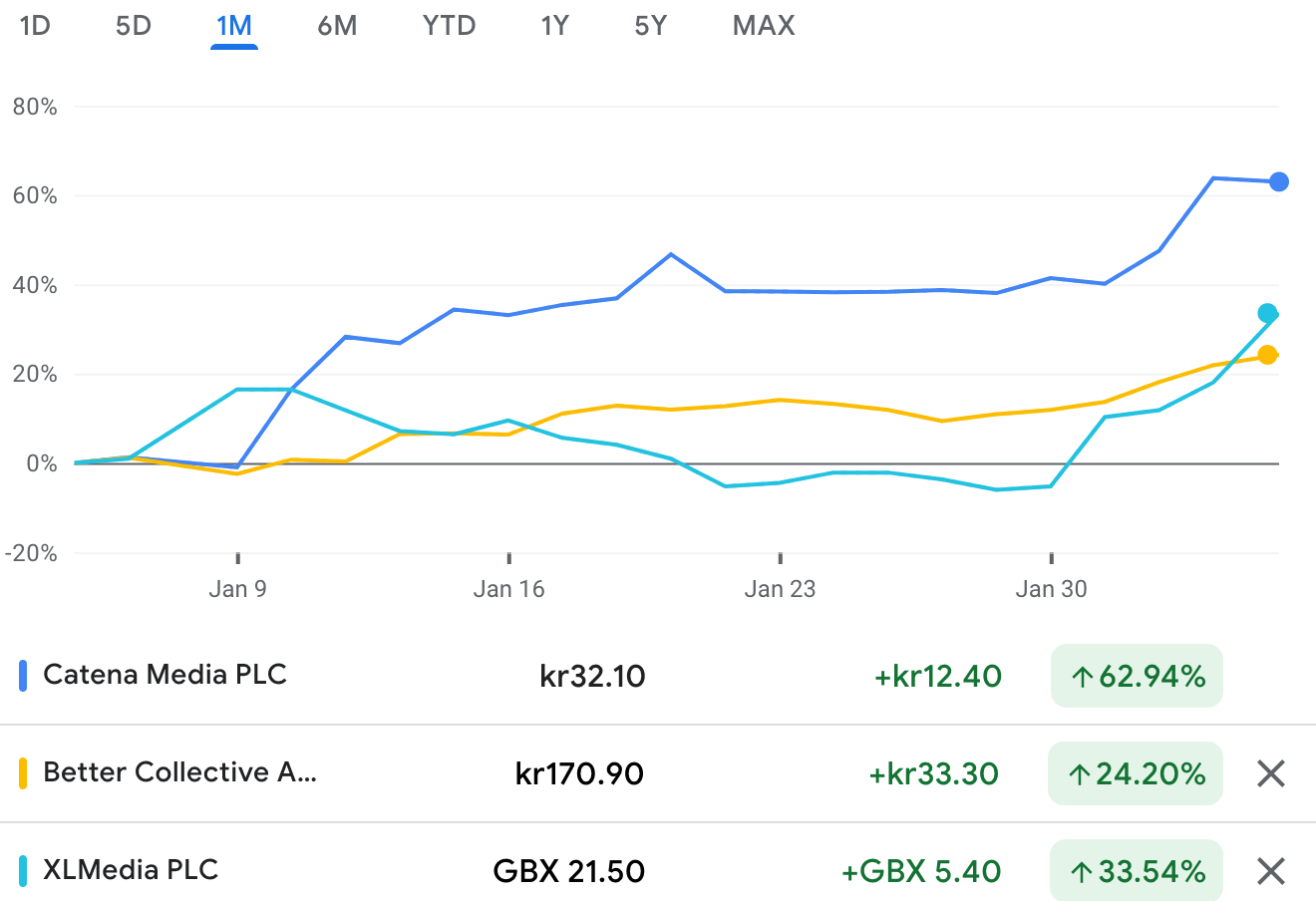

Buy the rumor: The affiliate sector, meanwhile, has also seen some significant share price moves, helped by the news last week that sector behemoth Better Collective had taken a stake in major rival Catena Media. Potential sector consolidation talk also boosted UK-listed XLMedia. Note: See below Better Collective’s Q4 pre-announcement of record revenues.

🎉 Goin’ to a party: affiliates gain ground on consolidation rumors

Further reading: Is it just apocalypse postponed? According to BoA, after the January rally, the market could face brutal declines later in the year.

** SPONSOR’S MESSAGE ** Tried, tested and proven over a decade in the highly-regulated US market, and continuing to expand across Europe, Latin America, Asia and Africa. GeoComply harnesses the power of its market-leading geolocation technology to protect against fraud, including fake account creations, bonus abuse, account takeovers, stolen identities, money laundering, and more. Visit geocomply.com.

Better Collective pre-announcement

The super affiliate has upgraded forecasts after announcing a record-breaking Q4.

Take that to the bank: Better Collective said this morning Q4 revenues would come in up 63% YoY to €86.1m, with US revenue up 71% YoY to €33.9m. Q4 EBITDA will be €35.2m, up 115%. The organic growth rate was 34% in 2022 as a whole and 34% in Q4.

BC’s EBITDA for the quarter comfortably absorbed a €14.7m impact from the move to revenue share over CPAs. This was more than the €10m previously warned.

US revenues broke through the previous guidance of $100m.

Better Collective will announce its audited Q4 numbers on February 21 AMC.

London calling

The coming week will be dominated by ICE 2023 at ExCel London.

By the numbers: Organizer Clarion is trumpeting that this year is the biggest-ever edition of the show, occupying 51,466 square meters of space. Won’t somebody think of the shoe leather?

This could be one of the last times ICE takes place in London, however; Clarion launched a consultation last week suggesting it might move the 2025 edition to either Madrid, Barcelona or Paris.

Day one agenda: The World Regulatory Briefing begins on Monday and features an opening salvo from Sarah Fox, deputy director for gambling and lotteries at the UK Department for Media, Culture and Sport, talking ahead of (someday) the UK White Paper (9:05am).

Next up, Tim Miller, the witchfinder general of the UK Gambling Commission, speaks at 9:20am.

Miller then joins a European gambling regulation panel at 9:30am with Anders Dorph, director of the Danish Gambling Authority, and Isabelle Faique Pierrotin from France’s ANJ.

Entain chair Barry Gibson is in conversation at 10:40am.

Pitch ICE will feature 14 startups, including, according to the schedule, PlayEngine, the Responsible Gambler, SportBuff and Random State.

The week ahead

The ongoing earnings season continues with MGM Resorts and Wynn heading the names reporting this week.

Known knowns: MGM reports AMC on Wednesday. A lot of what the company will say has been prefigured by the recent numbers from the Las Vegas Strip, BetMGM’s trading update and rival Caesars’ Q4 pre-announcement.

Wynn Resorts reports on the same day. Analysts will be looking for further commentary on the improvements being reported in Macau.

On Tuesday, Red Rock Resorts will give a further update on the locals market and its plans for the upcoming Durango property.

In Europe, Kindred will be the focus on Wednesday morning as it gives more detail around its earnings miss. Added to its long list of excuses used in recent years, the company said poor trading over the World Cup period (see below) and issues in Belgium and Norway are to blame for what is set to be a disappointing Q4 EBITDA outcome.

World Cup highs and lows

Recent commentary around betting activity during the World Cup points to contradictory patterns.

Who won the World Cup? The French regulator ANJ reported last week that operators had enjoyed record staking levels, with the total take 56% higher than for the 2018 World Cup and 37% higher than for Euro 2020.

However, in its recent January profit warning, Kindred – whose Unibet brand is one of the market leaders in France – said that “contrary to expectations” the World Cup failed to ignite the customer base.

The company blamed the loss of fixtures elsewhere and responsible gambling measures for its earnings miss.

At Entain, however, CFO Rob Wood said (in a recent trading update) that despite the loss of regular league football during the tournament the company estimated the event had added incremental growth of 2%.

Wood said there had been “more recreational activity”, which pushed margins up to 18% for the tournament, but the lower stakes per head meant that FY22 online NGR was down 1% despite OSB NGR being up 15%.

Lost ground: Sources told E+M that Unibet has “lost a lot of ground to Betclic and Winamax” in France. “Two or three years ago Unibet was definitely part of the leading trio,” the source added. “But in general it is struggling with acquisition in France”.

Entain’s bwin (ex-France) and UK brands were the brands that drove the group’s growth during the World Cup.

** SPONSOR’S MESSAGE ** Founded in 2013, Metric Gaming is based in Las Vegas and London and developed the industry’s first truly multi-tenant sportsbook platform, purpose-built to support operators across multiple territories, regions or States. Metric is proud to be partnered with both Racebook HQ and Lacerta Sports (powered by Starlizard) and will roll out innovative MTS solutions for both racing and sports in 2023, including soccer and four main US sports. To find out more, or book a meeting at ICE, please visit www.metricgaming.com

Analyst takes

Regional gaming GGR grew 1% YoY, “one of the lower growth rates” in the past year, said the team at Macquarie. But despite “a slight deceleration from the consumer”, this was not meaningful with regard to current financials or valuations, they added.

As confirmed by Penn Entertainment, Macquarie said it expects operators “to issue flat revenue guidance, particularly if weakness isn’t seen in January”.

The analysts said regional gaming had been resilient and noted that in 2008 GGR fell to mid-single digits, but this compared with “other discretionary sectors down closer to 20%”.

Boyd Gaming: The team at Roth MKM suggested the regional operator is “finding ways to grow EBITDA independently of macro factors”. The analysts at CBRE noted that even if there was some economic impact later this year, Boyd should be able to offset it with the “accelerating recovery” of group business in Las Vegas and increasing contributions from the Sky River management contract and online gaming.

Startup focus – Virtually Sports

Who, what, where and when: The London-based Virtually Sports was founded in 2021 by Mark Israney, who has put together a team of developers, game designers, artists and animators to develop “virtual sports with a difference”. Israney says 2023 is when the company will “become more visible”.

Funding backgrounder: He says VS received seed funding last year but, with a “fairly low cost base”, there are no plans for further external investment.

The pitch: “We are all about innovation,” says Israney, who suggests that with the sector not short of virtual games suppliers VS wouldn’t get very far with a copycat product. “If we worked on the same sports and delivered games in the same way as everyone else, we would struggle to survive,” he says.

VS currently has three product lines: in-play games, VR games and the development of new sports, and is doing R&D on a fourth innovative product line; the details of which Israney is “keeping under my hat for now”.

He says the market response to the product suite has been “very exciting over the last few weeks”.

VS hopes to be launching games with operators in a range of markets soon, including a VR cricket game that the company will be showcasing at ICE.

What will success look like? “Our very short-term goal is simply to break even,” Israney says. “Success will be getting our games onto multiple clients’ sites and having our in-play games listed within in-play sections, not behind a Virtuals tab.”

**Sponsor’s message** Venture capital firm Yolo Investments manages €550m in capital across 80 of the most exciting companies in fintech, gaming & blockchain. The Gaming Fund, regulated by the Guernsey Financial Services Commission, a dedicated 29-company, €183m AUM portfolio has invested in fast-growth assets including Dabble, Kalamba, SimWin & ThriveFantasy. Yolo Investments has just opened its fund to new investors as it looks to scale new cutting-edge concepts, including its exclusive high-roller land and live casino brand, Bombay Club, global banking network & OTC desk Aims Group.

Datalines

Arizona: Sports-betting GGR rose 8.7% to $54.7m on handle up 32% to $616m.

Leaders by GGR: FanDuel (54%), DraftKings (21%), BetMGM (19%).

Newslines

Playtech said this morning it is seeking legal clarification in relation to the terms of its CaliPlay option.

Aristocrat has completed its acquisition of Roxor Gaming.

Allwyn has completed the acquisition of Camelot UK Lotteries, previously owned by the Ontario Teachers’ Pension Plan Board.

Boyd Gaming is set to become the “official and exclusive” local casino partners of the Las Vegas Raiders, according to the Las Vegas Review-Journal.

Playtech will remain as the exclusive SSBT supplier of Flutter’s Paddy Power in the UK and Ireland.

LeoVegas has entered a sponsorship partnership with Inter Milan.

What we’re reading

👀Regulus on the billion-dollar babies: “We believe that 1xBet is now the largest organic online gambling company by revenue globally, and therefore the biggest global online gambling brand, although we recognise that this requires more estimation than most of the other businesses.”

Calendar

Feb 6-9: ICE London

Feb 7: The startup month, Red Rock Resorts

Feb 8: Kindred, MGM Resorts, Wynn Resorts

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.