Entain seeks UK ‘clarity’

Entain update, Las Vegas December, GiG completes AskGamblers deal +More

Good morning. On today’s agenda:

Entain hammers home its regulated market direction of travel message.

Massachusetts launches retail betting.

The Las Vegas Strip records its best-ever month in December.

Macau sees a significant bounceback in January.

PointsBet suffers a negative share price reaction.

Entain waits on catalysts

Entain’s CEO suggests the UK White Paper will add clarity as she distances the company from 888’s VIP travails.

Jive talking: Entain “doesn’t have VIPs”, claimed CEO Jette Nygaard-Andersen, who was keen to emphasize Entian’s recent push towards generating 100% of revenue from regulated markets. “Our focus is on the recreational base,” she told analysts.

“We are the only major global operator to exclusively operate in regulated or regulating markets; a brand new benchmark for the industry,” she said.

She noted that “approximately” 93% of the business now comes from already regulated markets and with Brazil as the biggest of the ‘soon-to-regulated’ markets.

Recall, this week 888 admitted to AML and KYC failures related to VIP customers from the Middle East. The news cost 888 CEO Itai Pazner his job.

Noting recent pro-gambling and freedom of choice comments from the UK gambling minister, Nygaard-Andersen said “just having the White Paper will provide some clarity about what are the expectations here”.

Take the hit: Rob Wood, CFO, said Entain had already “absorbed the lion’s share” of whatever affordability measures might be introduced, but added there will be an “ongoing impact” in H123. He repeated previous comments about Germany that the company needed to see enforcement action against operators that had remained outside the regulated system.

“We hope that 2023 will be the year when Germany returns to growth,” he added.

The trading update showed full-year NGR up 12% YoY due to the resurgence in retail, up 66%, helping to overcome the headwinds in the UK and Germany, which meant online NGR fell by 1%. Q4 group revenue was up 4%, with online up 12%. FY EBITDA will come in at £985m-£995m, up 12% at midpoint.

SuperSport has been immediately accretive, contributing €8m of EBITDA to FY22 despite only being incorporated from late November.

The BetCity acquisition was completed in January and Nygaard-Andersen said the business was “trading well”. “We’re comfortable with the expectations they have going into 2023, they have a market share of around 20%.”

The CEO said Entain was as “active as ever” when it comes to M&A.

“We have a really strong balance sheet,” she added. “We are clearly not an operator buying distressed assets here.”

World cup willies: Wood noted that despite losing top-tier football during the tournament, Entain’s best estimate is the World Cup still added incremental growth of 2%. Recall, Kindred recently blamed poor trading during the World Cup and the loss of fixtures elsewhere for an earnings miss.

** SPONSOR’S MESSAGE: BettingJobs is the global leading recruitment solutions provider to the iGaming, Sports Betting and Lotteries sectors. Boasting a 20-year track record supporting the iGaming industry, and with a team of experts and world class knowledge, it’s no surprise BettingJobs is experiencing rapid growth with outstanding results. Does your company have plans to expand teams to cope with strong growth and demand?

Contact BettingJobs.com today where their dedicated team members will help you find exactly what you are looking for.

Massachusetts live

Scissor cut: Retail sports betting has launched in Massachusetts with ribbon-cutting ceremonies at the Encore Boston Harbor and MGM Springfield. Online sports betting will follow within a matter of weeks.

Meanwhile, Sportradar announced it had received a license from the Massachusetts Gaming Commission.

Nevada December

The Las Vegas Strip ended the year with a flourish and the best December on record.

Showtime: Strip GGR soared by 25% YoY to $814.2m in what the analysts at JMP suggested was seasonally “the most important” month of the year. Quarterly Strip revenue was up 4% and 2022 as a whole posted a 22% better result than 2021. “The Strip is now firing on all cylinders,” said CBRE.

Wells Fargo noted it was a “step up even from the strength in recent months”.

Slot revenue was up 7.3% to $405m while table revenue leaped over 40% to $263m, helped by a 70% rise in baccarat to $146m.

JMP noted that the VIP drop of $146m was the best month since Feb22.

Wells Fargo said that visitor volume rose 10.1% YoY, with convention attendance up 74%. But this was still 38% below Dec19, suggesting more to come.

Telegraphed ahead: Analysts noted the data had been prefigured by Caesars recent strong Q4 pre-announcement, when it said it expected Las Vegas revenue to be 11% ahead on the prior-year period at $1.15bn. CBRE said they remained bullish for 2023 and Q1 in particular as the comps “remain easy”.

But Macquarie warned that comps get “significantly harder” starting in Q2.

🎉 Las Vegas Strip YoY change percentage

Macau bounce

BREAKING: Macau saw January GGR climb to $1.43bn, its highest total since the onset of the pandemic. According to the Gaming Inspection and Coordination Bureau (DICJ), January’s GGR total was 82.5% higher YoY and 233% higher MoM.

GIG completes AskGamblers buyout

GiG says it is “eagerly anticipating” the opportunities to be derived from the assets bought from Catena Media.

Career opportunities: GiG said it had a “clear strategy” to implement its own SEO and affiliate marketing technology and was “focused on elevating the performance” of AskGamblers and its related assets. The buyout was announced in mid-December and involves €20m upfront with the remaining €25m paid in two tranches over the next two years.

Clearing the decks: In its own statement, Catena Media said the company was in the process of divesting itself of its non-US assets.

The sale “marks another step” in shifting away from gray-market focused assets, it added.

BetMakers warning

The Australian-based sportsbook tech provider warns that its FY23 revenues will be in negative territory.

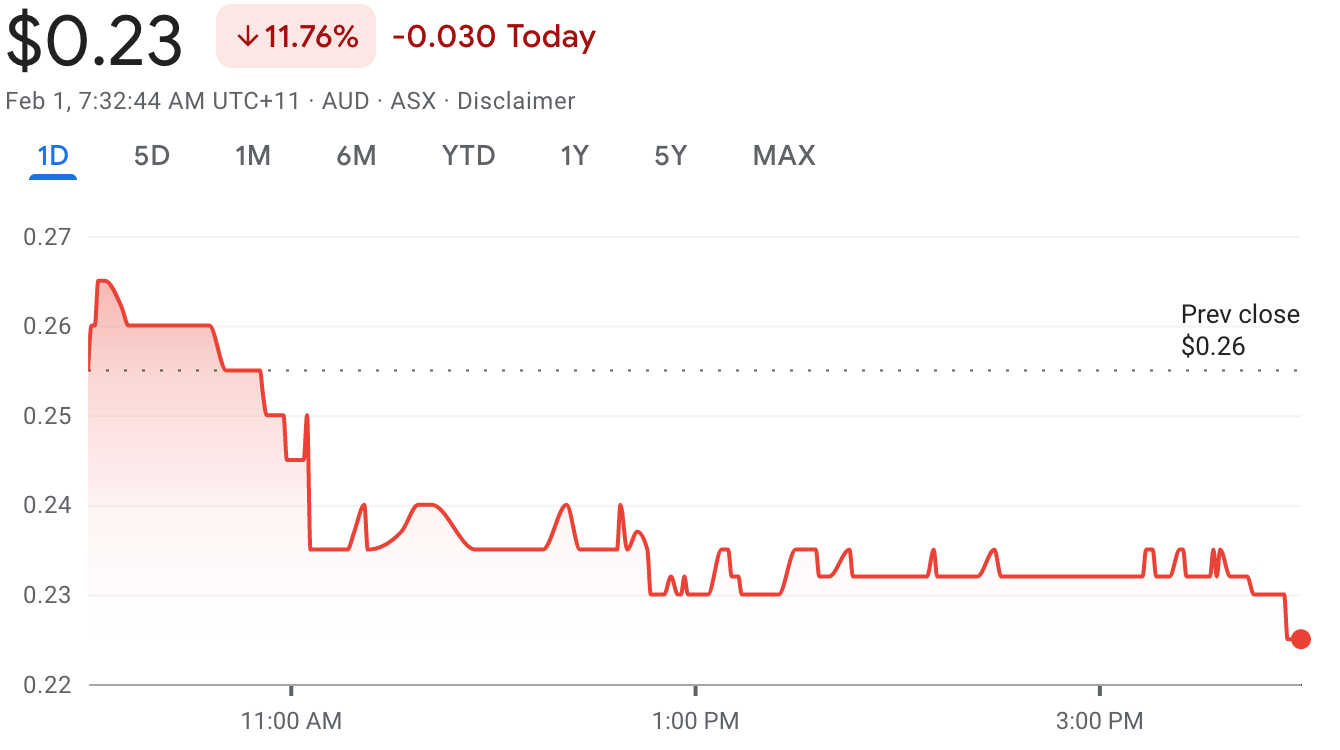

Whatever doesn’t kill you: Investors reacted badly as the provider to the Australian-facing Betr said investments in the first half of its financial year would result in a loss over the full year. Shares fell nearly 12% earlier in the week. BetMakers said the spending would put it in a stronger long-term position.

The company said in H2 it would “focus on reducing and normalizing the cost base” with the aim of delivering positive cash flows.

Musical chairs: At the same time, the provider announced a boardroom reshuffle. Matt Davey is now president and executive chairman, with Todd Buckingham moving from CEO to chief growth officer and former COO Jake Henson taking his place.

🚧 BetMakers Technology shares fell nearly 12% on Tuesday

PointsBet share price reaction

Plunge: Investors in Australia were unimpressed with PointsBet’s FY23 Q2 earnings statement, sending its shares plummeting over 17%. The company said it had “realigned” its partnership with NBC, but added nothing about the recent bid from Australian bookmaking rival Betr.

👎 PointsBet’s shares lose ground following its earnings report

** SPONSOR’S MESSAGE** GiG is a leading gaming platform and sportsbook provider for online and land-based operators with digital aspirations. We deliver a full end-to-end solution through our award-winning iGaming and sportsbook solutions. Built for regulated markets and a top-class customer experience, GiG is pioneering the multi-platform era. If you are looking to expand your operations into new, profitable markets, our strategy is the solution.

Find out more at sales@gig.com.

Earnings in brief

Gaming Realms: In a pre-close trading update, the supplier behind the Slingo brand of games said full-year revenue would come in at ~£18.7m, up 27% YoY, with adj. EBITDA at ~£7.7m, a 36% rise. The company noted that in 2022 it launched in Connecticut and Ontario and with 58 new partners internationally.

Changes at the top: Mark Segal has been appointed as CEO and Geoff Green as CFO with immediate effect.

More, more, more: Analysts at Peel Hunt said Gaming Realms is now benefitting from the “durability and global appeal” of Slingo.

In Compliance+More

Cut of their Gib: In yesterday’s edition of Compliance+More we revealed the jurisdiction at the center of the 888 VIP shambles was Gibraltar. Plus, a look at the legislative do-overs in the US, nearly half of Canadians think gambling ads are becoming excessive and comments from the UK gambling minister spark rare regulatory optimism.

Datalines

Casino GGR was up 4% to $86.2m in Colorado in December, flat in Florida at -0.5% to $56.6m and rose 26% to $45.3m in Kansas. In Kentucky HHR was up 25.2% to $49.9m and +4.1% to $41m on a same-store basis. Oregon sports-betting GGR was up 157% to $6.6m, while VLT GGR was down 3% to $97m.

Newslines

The Soloviev Group and partner Mohegan have put forward a proposal for a casino in downtown New York that would include a ferris wheel, according to the New York Times.

Fanatics Betting and Gaming has joined the sports-integrity body the International Betting Integrity Association (IBIA). Fanatics has also announced a partnership with U.S. Integrity.

NFT-backed fantasy football league operator Sorare has confirmed its sponsorship agreement with the English Premier League.

Bet365 said it has launched in Virginia.

ESports-focused Rivalry has added eight new games, including roulette and baccarat, to its Casino.exe portal.

What we’re reading

Close call: The story of the Pinto, the Yamaha and Mt. St. Helens.

On social

Calendar

Feb 2: Evolution, Penn Entertainment, Boyd Gaming

Feb 6-9: ICE London

Feb 7: The startup month, Red Rock Resorts

Feb 8: Kindred, MGM Resorts

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.