Wynn’s November bounce

The shares month, World Cup balls, Betclic on the up, Ontario Lottery dressing down, startup focus – Prophet +More

Good morning. To start your week:

Wynn Resorts shares were the standout sector winner in November.

Geolocation data shows World Cup fervor has its limits in the US.

Betclic on the up even as Bet-at-home’s struggles continue.

Ontario Lottery should do better, says Auditor General.

Our startup focus for the month is Prophet Exchange.

The shares month

Wynn Resorts leads November sector bounce with a 28% rise.

November spawned a monster: Investors appear to have taken the positives from the news from Macau, where the award of gaming concessions has been balanced by continued issues with China’s Zero Covid policy. But Wynn has also benefited from the news that Tilmann Ferrtitta has built up a stake in the business.

More widely, evidence of continued strength in Las Vegas continues to buoy the major gaming stocks, as does hints that the rate-raise cycle may have peaked.

The leading gamers were running ahead of the gains on the S&P, itself up nearly 10% in November.

Caesars (up nearly 19.5%) and MGM Resorts (up 18%) both had tailwinds behind their stocks.

🔥 Sector leaders enjoy a good November

Duel purpose: With two separate investor bases joined by a common hope over the prospects for online in the US, Flutter had the better of the month over DraftKings, helped by the news over the arbitration settlement with FOX and its FanDuel investor day.

DraftKings could have been worse; a mid-month revival saw the shares bounce back over 28% at one point, following the poor reception of its Q3 earnings.

See analyst takes below for more on DraftKings.

🥊 The big dipper: DraftKings vs. Flutter

Further reading: The FT on how the relief rally faces severe tests: “November was, in an otherwise terrible year, actually pretty good.”

**Sponsor's message: Spotlight Sports Group is a leading technology, content and media business specialising in sports betting. Working with the largest media companies in the world, including AS.com and Advance Local, Spotlight Sports Group offers fully managed solutions that allow publishers to maximize revenue across their highly valuable sports betting audiences.

For more information visit: spotlightsportsgroup.com

888 debt raise

Peter/Paul: As was pre-announced last week, 888 is to market €200m of debt with the proceeds going entirely towards paying off the same amount of existing sterling-denominated indebtedness. It noted there was no guarantee the new mixture of fixed and floating rate notes would find willing buyers.

World Cup balls

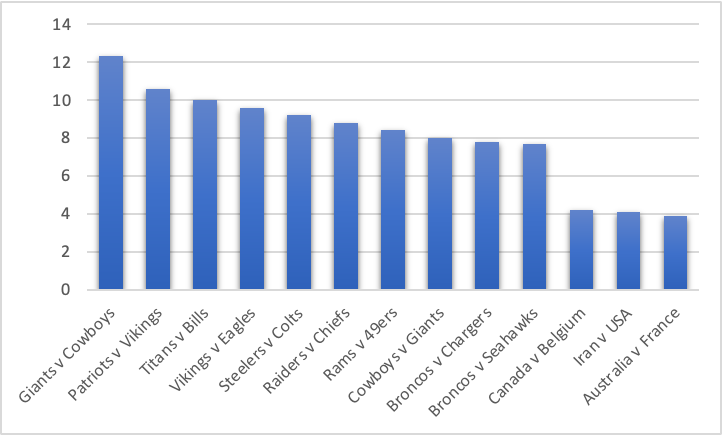

Data from GeoComply shows how some World Cup group stage games compared with a selection of this season’s biggest NFL matchups.

Having a moment: The data from a selection of key matches during the group stages suggests the World Cup is attracting a decent level of betting activity going by the geolocation statistics.

GeoComply recorded 4.4m geolocation checks for USA vs. Iran, compared to 7.8m checks for Broncos vs Chargers, the last Monday night NFL game before the World Series and NBA season started.

It should be noted that USA vs. Iran kicked off at 2pm ET/11am PT while MNF is, obviously, primetime.

🏈 vs⚽ GeoComply checks for key NFL games vs. World Cup

Betclic’s BAH-humbug

Online gaming revenues rose 5.5% to €591m, with adj. EBITDA up 8.4% to €194.4m, despite subsidiary Bet-at-home’s German and Austrian troubles.

Troubles at home: FL Entertainment’s Betclic brand saw revenues rise 15%, helping to offset Bet-at-home’s (BAH) 11% drop caused by the forced exit from Austria in Oct21. Such is the extent of the issues with BAH that in September the company said it may not have the liquidity to meet its obligations.

As a whole, FL Entertainment – which listed in Amsterdam in July – saw revenues rise 15% to €2.7bn, with adj. EBITDA up 17.5% to €446.4m.

CEO François Riahi said Betclic performed strongly despite “several macroeconomic challenges” and was well-placed to capitalize on the World Cup.

The company maintained guidance for its online gambling divisions for revenues of €850m and adj. EBITDA of €200m.

Ontario Lottery’s slap

OLG was criticized for poor casino performance by the Auditor General even as the province’s digital GGR for igaming shot up 65% in Q3 to CA$267m.

Imbalancing act: Ontario Lottery and Gaming’s online GGR was up 7% to CA$108m in Q3, ex-iLottery, while OLG’s digital turnover had grown 270% to CA$511m in 2021-22 vs. 2019-20. However, the AG’s report bemoaned the fact that the province retained more than 45% of OLG’s digital revenues but only 5.7% of commercial operators’.

The report said the province would be better off if OLG’s internet gaming revenues could be maximized and if it made the most of its “unique position” as the exclusive lottery operator.

Everyone’s a critic: The report showed that OLG generated CA$4.5bn in revenues in 2021-22 but net profits for the province were down 3.6% to CA$1.5bn. The report was highly critical of OLG for agreeing to reductions in revenue commitments from Hard Rock International, Gateway Casinos and Great Canadian.

The week ahead

Startup month: The latest edition of the Earnings+More Startup Month will be sent tomorrow, including an interview with Meredith McPherron, CEO at Drive by DraftKings, a look at why investors are so keen on growth companies in the gambling regtech space and an Inside the Raise feature on Dabble.

Analyst takes

DraftKings: After meeting management, the team at JMP noted that CFO Jason Park was keen to emphasize the “compounding nature” of customer cohort profits and noted that DraftKings was pessimistic about any of Florida, Texas or California launching before mid-2025.

This will lead to a “more tempered” state legalization path vs. prior years and a pullback in promotions and sales and marketing.

Management also said sports teams partnerships are “less impactful once individual states surpass a certain penetration rate”.

The team at JMP estimated DraftKings could hit ~$300m positive EBITDA in 2024 vs. the company’s own breakeven estimates.

IGT: In lottery, the team at Credit Suisse suggested IGT has a distinct advantage in being able to provide an end-to-end solution for states via its new Omnia system, an “all-inclusive” platform bringing together retail solutions, cashless, player data and iLottery capability.

Startup focus – Prophet

Who, what, where and when: Founded in 2018 by CEO Dean Sisun and COO Jake Benzaquen, Prophet Exchange claims to be the first sports-betting exchange in the United States having launched in New Jersey at the end of August. It intends to expand its footprint in further states in 2023.

Funding backgrounder: Prophet Exchange has previously completed a Seed funding round led by Sharp Alpha for an undisclosed amount.

The pitch: Sisun says Prophet Exchange is “delivering freedom” to sports bettors, suggesting punters in New Jersey are seeing between 10% and 20% better returns than with traditional sportsbooks. “We are solving common pain points in the sports-betting industry,” he suggests.

“We want to redefine the sports-betting experience by consistently offering the best odds and prices in the market and consistently having bettors win more on our platform without the fear of being banned or limited,” Sisun adds.

What will success look like? Sisun says Prophet Exchange sees interest continuing to grow in both the understanding and anticipation of what betting exchanges will bring to the US market.

He adds that since launch in New Jersey, it has received direct feedback and interest from industry partners, and “large increases in people coming onto the Prophet Exchange platform”.

Regulatory lines

Ireland: The Gambling Regulation Bill released late last week has caused some consternation when it comes to the wording around advertising and marketing. Specifically, catch-all provisions around “not offering inducements” would appear to suggest all forms of promotion and advertising might be prohibited.

The team at Regulus Partners suggested the effective functioning of the entire market “rests on a timely and effective clarification of a badly worded sentence”.

Datalines

Colorado: Sports-betting GGR was down 29% MoM to $36.5m in October, while handle of $526.6m was the second-highest total after January's $573m. Operators spent $15.4m in promotions. Parlays generated $16.8m from stakes of $92m or a 18.3% hold.

New York: Sport-betting GGR dropped 16% to $34.6m while handle increased 25% to $429.2m for the week ending 27 November. FanDuel led with 49.7%, followed by DraftKings (32%), Caesars Sportsbook (8%) and BetMGM (7%).

Virginia: Sports-betting GGR dropped 6% to $45.5m in October, with handle rising 34% YoY to a monthly record of $528m.

Newslines

Tabcorp Holdings is hoping to raise $290m of new debt to pay off debts and fund potential M&A opportunities following the demerger of its lottery and keno divisions in June.

Facebook has confirmed that its written permission will be needed for companies wanting to run gambling ads and provide evidence that the activities promoted are regulated and will not target under-18s.

What we’re reading

Wanted: NYC rat Czar.

Cathie Wood isn’t losing faith.

Open-door policy: the UK living with the consequences of its policies on online gambling.

Calendar

Dec 6: The Startup Month #5

Dec 13: Deal Talk #5

Dec 20: Due Diligence #2

Contact

Scott Longley scott@clearconcisemedia.com

Jake Pollard jake@openmediaservices.com