Weekend Edition #90

Caesars’ digital bridge, F1 could be a Las Vegas fixture, Bally’s headcount, sector watch – crypto trading +More

Good morning and welcome to the latest weekender. On today’s agenda:

Analyzing Caesars’ ‘bridge’ to digital profits.

DraftKings gets the once over from Deutsche Bank.

Formula 1 could be a Las Vegas fixture for years to come.

Coinbase’s SEC troubles are featured in sector watch.

On the Jobsboard this week, head of finance and CMO roles.

Caesars’ digital bridge

The “lofty goal” of $550m of digital EBITDA by 2025 might be optimistic.

I can see clearly now: There is “healthy” and “understandable” skepticism around Caesars’ claims to be able to generate $550m of digital profits by 2025, suggested the analysts at Wells Fargo. But they added that they “do see a path” to $400m of EBITDA from the company’s OSB and iCasino business.

The team said the way forward to profits is “by no means intuitive,” particularly given the $666m EBITDA loss in 2022.

Hinge and bracket: To get there, Wells Fargo suggested success will “hinge” on modest sports-betting GGR market share gains, maintaining rational promo spend levels, executing its iCasino ramp while also curtailing marketing.

The $550m target rests on Caesars being able to grab 11% medium-term sports-betting market share alongside a “structurally high hold” of 7.2% vs. 2022’s 4.5%. iCasino GGR would need to hit $500m or ~8% market share, promotions cut to $265m and marketing costs pegged at $220m.

According to recent analysis from Deutsche Bank, Caesars OSB market share stood at 6.5% in Q4 while iCasino market share in Q4 was 5%.

Analysts at Regulus recently pointed out that Caesars only generated $6m of digital revenue after promotions were taken into account.

Plausibility: Wells Fargo suggested $400m is more plausible, with “more realistic assumptions” for 2025 of 9% sports-betting market share, 7% iCasino share, promos of $230m and marketing at $230m.

How do you get to Carnegie Hall? The analysts suggested “several imperatives” for Caesars including improvements on hold – “a must” – and OSB share in new states of ~10%, while the iCasino “market share capture” must also be successful.

With marketing, while “details are sparse” on 2022 spend, they suggested Caesars likely spent $670m in 2022, caused largely by the money invested in New York in Jan22.

For 2023, they see spending falling to ~$470m before tumbling to $230m in 2025.

** SPONSOR’S MESSAGE ** Founded in 2013, Metric Gaming is based in Las Vegas and London and developed the industry’s first truly multi-tenant sportsbook platform, purpose-built to support operators across multiple territories, regions or States. Metric is proud to be partnered with both Racebook HQ and Lacerta Sports (powered by Starlizard) and will roll out innovative MTS solutions for both racing and sports in 2023, including soccer and four main US sports.

To find out more, please visit www.metricgaming.com

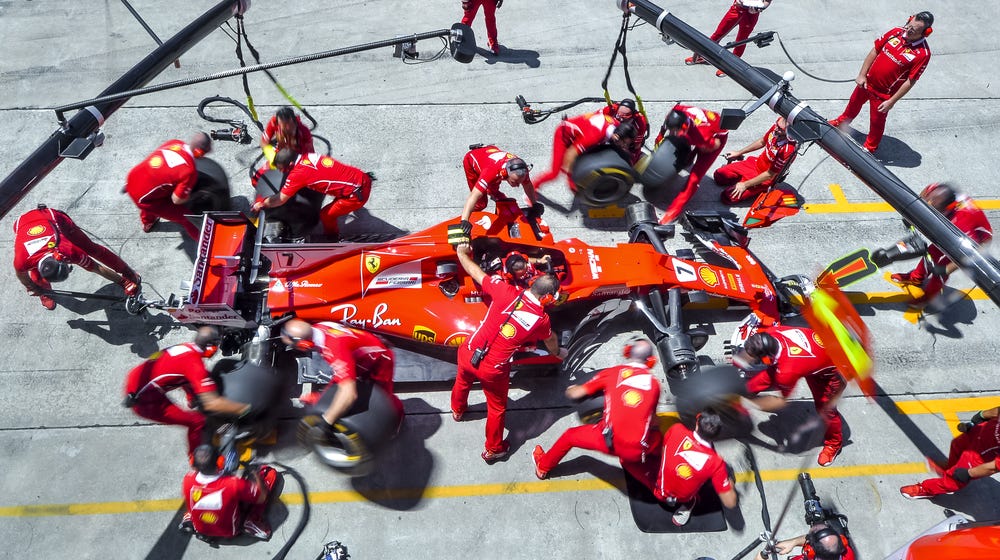

Drive to survive

Checking in on current development sites, the team at CBRE suggests there is every indication that F1 will be more than a three-year gig.

Motor home: Visiting the site of the paddock area currently being built for the Formula 1 Grand Prix in mid-November, the team at CBRE have pointed out the $500m investment in Las Vegas on the part of F1 dwarfs that of other GPs.

The figure compares with $60m that was pumped into the Montreal race and $210m that was invested in the South Korean event.

“The size of the investment could be indicative of the intention to stay in Las Vegas long term,” suggested CBRE.

More than a pitstop: As it stands, F1 is only slated to appear in Las Vegas for three years. However, CBRE noted that the Clark County Commission recently passed a resolution that made it possible to close Las Vegas Blvd the week before Thanksgiving every year until 2032.

Pipeline: CBRE noted that 2023 is a big year for developments and new openings in Las Vegas with 60 projects in the pipeline, including Hard Rock’s rebranding of the Mirage, Red Rock Resorts’ new Durango casino, the opening of the Fontainebleau and the MSG Sphere.

But they added they are “starting to see signs” of development activity slowing.

On a similar note, Tilman Fertitta told analysts at Truist this week that no firm start date has been set for his seven-acre plot on the Las Vegas Strip as he waits on ”clarity” around economic conditions.

DraftKings deep dive

Remaining neutral, Deutsche Bank seeks an “intelligent debate” in future profitability.

Point: For the bulls, DB suggested there is evidence of increasing promo intensity, incremental market share gains, better hold percentages and a decent capital position, with net cash providing a “differentiating aspect” among peers.

Counterpoint: “Taking a more critical look,” however, DB suggested that promo easing is having a “direct impact” on handle, “taking the steam out” of future TAM projections. Meanwhile, DraftKings is “overly exposed” to lower margin OSB relative to iCasino.

This will likely result in lower margins than those achieved by peers should the mix between OSB and iCasino remain static.

The legislative calendar points towards this stasis, meanwhile, with no progress on iCasino forecasted.

Bally’s diminishing headcount

To do: The application of data-driven marketing into retail casinos and a greater focus on cost management are top of new CEO Robeson Reeves to-do list, according to Wells Fargo.

The team noted the sharply reduced headcount in the North American online business, with sports-betting reduced to just 25 people from 250 previously.

Total North American online headcount has fallen to ~360 from 520, with ~200 tech contractor roles also eliminated.

Analyst takes

Playtech: The team at Peel Hunt admitted their previous FY27 estimate on adj. EBITDA of €518m was a “little miserly” given Playtrech spoke this week about a new medium-term target of between €500m and €600m.

For future growth prospects, the team wanted to understand “how much blue sky” is represented by the Hard Rock Digital deal.

Gambling.com is “off to a hot start” in Q1 due to the launches of the Ohio and Massachusetts sports-betting markets, said the analysts at Truist. Noting that Q4 and Q1 were traditionally the company’s strongest quarters, they suggested the guidance for 2023 of revenues at between $93m and $97m was in line with analyst expectations.

E+M correction: Yesterday, we mistakenly said Gambling.com owned Casino.com not the actual site casinos.com. Apologies for any confusion.

Entain: Despite MGM Resorts’ commentary in early February that it isn’t interested in pursuing a buyout of its BetMGM JV partner, the team at Jefferies refused to let go of the possibility. “Many observers noted the supplementary ‘for now’ comment,” they suggested, potentially grasping for straws.

BC’s delayed gratification

Non-instant karma: Better Collective would not divulge “sensitive data” on player values, but CEO Jesper Søgaard said the “delayed gratification” of the revenue share model the group favors varies according to geography.

Søgaard noted that BC’s strategic approach had enabled it to move from success “determined by NDC numbers” and develop new revenue streams such as media and subscription services.

While North and South American growth made the headlines, BC noted that European markets had generated 16.5% in CAGR since 2016 and in the past two years had enjoyed a 75% rise in UK NDCs.

Earnings in brief

Zeal: Looking ahead to 2023, the Germany-based lottery product provider said it has an application pending with the German regulator to provide online games. It added that it expected revenues for the year to be between €110m and €120m, with EBITDA expected to come in at €30m-€50m.

ICYMI

Same-game changer: This month’s edition of Due Diligence delved into what is being said by the operators about same-game parlays and in particular about the in-house vs third-party debate.

Also this week in Earnings+More, Playtech handed over the stage to Hard Rock Digital during its B2B investor day after announcing rising revenues.

In Compliance+More yesterday the news was led by the latest multi-million-pound fine handed out by the UK Gambling Commission to Kindred for RG and AML failings.

On Tuesday, we wrote about the legislative progress made in Kentucky against illegal gaming machines.

Sharpr this week reported on comments from New Jersey Division of Gaming Enforcement Deputy Attorney General Anthony Strangia, who said that about half of the state’s licensed sportsbooks accept esports wagers.

On the Gambling Files podcast this week, affiliates marketing was in the spotlight as Fintan chatted to Kim Lund.

Sector watch – crypto trading

Stake on me: Coinbase saw its shares drop over 14% on Thursday after the company told the market it had received a warning from the SEC about an impending action on various trading activities.

The Wells notice said the SEC is looking into Coinbase’s crypto staking business as well as investment and custody services and the spot trading unit.

The notice said the SEC has reached a preliminary determination that action should be taken.

“We are prepared for this disappointing outcome and confident in the legality of our assets and services,” said Paul Grewal, chief legal officer of Coinbase, in a statement.

Well done: Staking means exchange users lock up their tokens in other crypto projects in return for a high yield.

Awaken the Kraken: Coinbase maintains the tokens listed on its exchange are not securities. However, rival Kraken discontinued its own staking business under similar pressure from the US authorities, albeit without admitting or denying the SEC allegations.

Lending the rules: Coinbase itself has previously received a Wells notice form the SEC over a very similar product called Lend, which, again, would have allowed users to earn interest by lending out their crypto holdings.

The exchange subsequently canceled that launch.

Further reading: Matt Levine on what the SEC really wants.

😱 Coinbase’s five-day share price chart

** SPONSOR’S MESSAGE ** Venture capital firm Yolo Investments manages in excess of €600m in capital across 80 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

Newslines

Century Casinos has received licensing approval from the Nevada Gaming Commission in relation to its acquisition of the Nugget Casino in Sparks.

EveryMatrix has been awarded a license to distribute its content, platform and services in Connecticut.

On social

Calendar

Mar 28: 888 investor day

Mar 30: XLMedia, FansUnite

Head of Finance – Remote/Middle East

Marketing Manager – Asia

Chief Marketing Officer – Remote

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.