Weekend Edition #78

UK regulation review, Massachusetts licensing, Churchill Downs’ Exacta deal, iCasino pivot, the esports betting year +More

Good morning. On today’s agenda:

UK parliamentary committee to examine gambling regulation.

The Massachusetts Gaming Commission has beef with Barstool.

Churchill Downs vertically integrates with $250m Exacta deal.

The iCasino pivot: DraftKings and Caesars head in opposite directions.

The boys from the NYPD choir were singing Galway Bay.

UK parliamentary maneuvers

The parliamentary committee with oversight of the gambling sector has announced it will examine the government's approach to regulation.

Shot across the bows: The Digital, Culture, Media and Sport Committee has invited interested parties to submit written evidence by February 10 addressing a number of issues following “warnings that more needs to be done to protect people, including children, from gambling-related harm”.

The Committee said it would look at the government’s progress in the wake of other parliamentary committee inquiries around how regulation can “keep up with innovations in online gambling and the links between gambling and broadcasting and sport”.

Among the issues where it is seeking input are the scale of problem gambling in the UK, the key priorities of the White Paper, how broadly the term ‘gambling’ should be drawn and whether the regulator is capable of overseeing the online sector.

The Committee also proposes to answer what problems arise when gambling companies are based offshore.

What they say: DCMS Committee member Julie Elliott MP said regulation was “struggling to keep pace with the rapidly changing” gambling market.

Knight errant: Notably, the date for submissions is after the presumed mid-January publication of the White Paper. The news is also complicated by the Committee chairman Julian Knight MP having had the whip withdrawn by the Conservative party after a complaint about his behavior was made to the police.

**Sponsor’s message** Venture capital firm Yolo Investments manages €550m in capital across 80 of the most exciting companies in fintech, gaming & blockchain. The Gaming Fund, regulated by the Guernsey Financial Services Commission, a dedicated 29-company, €183m AUM portfolio has invested in fast-growth assets including Dabble, Kalamba, SimWin & ThriveFantasy. Yolo Investments has just opened its fund to new investors as it looks to scale new cutting-edge concepts, including its exclusive high-roller land and live casino brand, Bombay Club, global banking network & OTC desk Aims Group.

Get in touch with your pitch or disruptive products to plug into our investment network!

Massachusetts ’Bowl cut

Massachusetts Gaming Commission hearings focus on controversies surrounding Barstool as it suggested retail betting could launch in time for the Super Bowl.

Conditions attached: Retail betting will provisionally launch in late January after a meeting yesterday gave the nod depending on GLUI certification. Boston Encore, MGM Springfield and Penn’s Plainridge Park have all been granted licenses.

The Penn licensing comes despite conditions around the activities of its Barstool Sports brand and its college football activities. It follows critical coverage of Barstool in the New York Times, which focused on its campus promotional activities.

In a letter to the MGC, Penn CEO Jay Snowden criticized the NYT for its “one-sided take”, noting that 85% of Barstool’s audience is over the age of 25.

He added that David Portnoy and other Barstool personalities were not directly employed by Barstool and were effectively a third-party affiliate/marketing company.

Caesars and BetMGM have been approved for preliminary OSB licenses, which are set to launch in March.

Mohegan’s digital progress

Mohegan said it was already profitable online as Q4 group revenues rose 5.6% to $412.9m but adj. EBITDA fell 9.5% to $99.8m.

Sun shine: CEO Ray Pineault said there was “no doubt” online would be a “significant contributor” to the bottom line at Mohegan. He was speaking after Mohegan’s first year of contributions from Connecticut where it said it had achieved ARPU of $450.

“It’s already performing profitability,” he told analysts. “We remain focused on profitability and maintaining a prudent marketing and bonusing strategy.”

The company noted it had also achieved ARPU of $450 in Ontario.

Mohegan launched sports betting at its Niagara Resorts properties in November.

iCasino pivots

Earlier this week, E+M’s Due Diligence looked at the moves made to pivot towards iCasino.

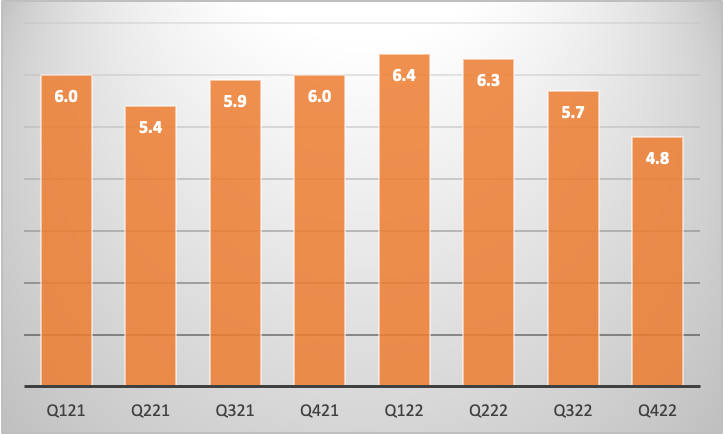

Different drum: The latest monthly online analysis from Deutsche Bank discusses the trends from the last eight quarters for many of the biggest online operators in the US. In light of recent news around brands seeking to pivot towards iCasino, it is worth taking a look at the data for both DraftKings and Caesars.

For DraftKings, it can be seen how adding the Golden Nugget operation to its business has dragged its percentage share of the total iCasino market to 26.7% and 26.6% in the last two quarters.

🎈DraftKings: pivoting towards iCasino via the Golden Nugget acquisition

In comparison, Caesars appears to be heading south, with its total iCasino market share down to a mere 4.8% in Q222 versus a peak of 6.4% in Q121.

🎭 Caesars: pivoting away from iCasino, apparently

Churchill Downs acquires Exacta

Churchill Downs has “surprised” with its acquisition of historical horse-racing tech specialist Exacta for $250m.

Exacting standards: In acquiring Exacta, a tech provider for HRM manufacturers integrated with providers such as AGS, IGT and Light & Wonder, Churchill Downs has made a surprising move, suggested analysts at Jefferies.

They indicated there was “limited precedent’ for an operator vertically integrating with equipment or tech suppliers.

Nevertheless, they suggested the deal will accelerate synergies from the recently completed PPE deal, where Exacta has seven years left of an exclusive 10-year contract.

The transaction will close in 2023 and will be funded by cash on hand and existing credit facilities. Wells Fargo estimated the deal multiple to be between 7-9x.

The esports betting year

Riot Games’ Valorant is the fastest-growing esports title by betting volume, according to Rivalry.

Vale! The first-person shooter game is now the fourth most bet on esports after seeing volume growth of 264% YoY. According to the esports-led betting operator Rivalry, it is “now a serious contender” to the top three of League of Legends, CS:GO and Dota2. Across all esports betting, in-play accounted for 62% of all bets versus 38% being pre-match.

Two sevens clash: Rivalry said it wasn’t too surprising given its likeness to CS:GO and the “well-established betting culture surrounding it”.

A bang on the ear: Mobile Legends: Bang Bang has also leapt into the top 5, surpassing StarCraft 2. It is the first-ever mobile game to reach the top 5.

Rivalry noted the majority of betting from ML:BB took place in Southeast Asia.

CS:GO continued to be popular in Australia and Canada (where Rivalry is licensed) as well as the rest of the world ex-Asia. In LatAM, LoL was top “by a large margin”.

Over 50% of punters who bet esports with Rivalry bet on traditional sports, with the most popular in this regard being basketball.

ParlayBay’s €1m fund raise

Growth fund: The new funding will be used to develop new products and sign more clients in 2023. This year ParlayBay signed supply deals with TipoBet365, TOPsport and Hub88 and 7bet.

Fredrik Elmqvist, the Yggdrasil founder who joined tParlayBay’s board in early December, said raising money against a tough economic backdrop was a “sign of strength”.

Further reading: ParlayBay was the subject of a startup focus in June.

Sector watch – casual games

Down time: After record growth during the pandemic years, global spending on gaming software is predicted to fall 4% this year to $184bn, according to a report from games data company Newzoo.

Crush landing: The primary driver of the decline is mobile gaming, which accounts for 50% of the market and where revenues are expected to fall 6% to $92.2bn.

Newzoo said the “corrective factor” of post-lockdown spending was particularly notable in the key Asian markets of China, South Korea and Japan.

Still, Newzoo remains positive on the long-term outlook, with the market forecast to grow to $211.2bn by 2025.

“This signals our belief that the games market will continue growing healthily in a post-pandemic world, albeit at a slower pace than during the pandemic,” the analysts noted.

Tika-tape: Still, there are other signs of stress within the casual gaming space. Playtika, for instance, announced earlier this month it was laying off 610 staff or 15% of its global workforce. The Israeli-based company floated on Nasdaq in January 2021 but its shares have struggled ever since and are down 73% in the intervening two years.

Datalines

Michigan: Sports-betting GGR was down 24.5% YoY to $40.8m with handle up 1.3% to $480m in November, while online casino GGR rose 35.1% to $145.4m. BetMGM was overall GGR market leader with 33.3%, followed by FanDuel (25.3%) and DraftKings (16%).

Leaders by AGR: FanDuel led by 57%, followed by BetMGM (19%), DraftKings (14%), Caesars (5%) and Barstool (4%).

💪 FanDuel’s AGR dominance in Michigan 2022 YTD

Land-based casino GGR was down 3.8% to $99.9m. Deutsche Bank noted the YoY drop marked another month of underperformance relative to the neighboring states Ohio (+2.7%) and Iowa (+1%).

Pennsylvania: Sports-betting GGR was down 17.5% to $70m on handle that rose 3.6% to $789.2m; online casino GGR rose 37% to $128.6m and land-based casino GGR dropped 1.3% to $264.8m in November. Across all verticals GGR rose 3.4% to $469.4m.

OSB leaders by GGR: FanDuel 52%, DraftKings 20.7%, BetMGM 8.8%.

Newslines

FuboTV will stream Bally Sports’ RSNs as part of a new content agreement despite uncertainty around how much content the RSNs will have access to.

VICI has completed a sale and leaseback acquisition of Foundation Gaming’s Fitz and WaterView casinos in Tunica and Vicksburg, Mississippi, for $293.4m.

MGM Resorts has completed the sale of the Mirage in Las Vegas to Hard Rock.

Allwyn has agreed a deal to buy Camelot Lottery Solutions for an undisclosed sum. The deal follows the buyout of Camelot UK for a rumored £100m.

GiG has signed a five-year agreement to provide online casino games and player account management services to LuckyBet.

Intralot has signed a five-year supply deal to provide the Ohio Lottery Commission with its sports-betting solution.

Kambi has signed an online sportsbook agreement with Brazilian DFS operator Rei do Pitaco.

What we’re reading

Sphere and now: The MSG Sphere surpasses the Allegiant Stadium in costs.

On social

Calendar

Jan 2: E+M is back

Jan 3: The startup month #6

Contact

Scott Longley scott@clearconcisemedia.com

Jake Pollard jake@openmediaservices.com