Weekend Edition #75

VICI takes full ownership of two MGM properties, ESPN’s sports-betting uncertainty, illegal betting survey +More

Good morning. On today’s agenda:

VICI buys out Blackstone to take full control of two MGM properties.

ESPN chief suggests a sports-betting partnership deal is “not imminent”.

AGA survey estimates up to $44.2bn being lost to illegal gambling.

EKG suggest Caesars is holding back on iCasino digital ad spend.

It’s alright ma (I’m only bleeding).

Black out

VICI Properties and Blackstone have agreed to a $2.77bn deal that sees VICI take over full ownership of the MGM Grand and Mandalay Bay.

Road movie: The agreement sees VICI buyout Blackstone Real Estate Income Trust’s 49% share of the two Strip properties for $1.27bn and sees it assume Blackstone’s pro rata share of the $3bn of property level debt, worth ~$1.5bn. The properties will generate rent of $310m as of January under the terms of a new lease agreement with MGM Resorts.

The team at Deutsche Bank suggested VICI will contribute ~$1.2bn of cash for the deal with the remainder coming from existing debt facilities.

DB doubted the deal would have been possible if approximately 55% of the total purchase price “wasn’t locked in at an inexpensive cost of debt”

Analysts at Truist said they liked the deal as it “simplifies VICI’s structure and highlights VICI’s multiple paths for growth despite the company’s larger base and a rising interest rate environment”.

Signs of distress: Stories yesterday suggested the $125bn BREIT is something of a distressed seller having limited redemptions after a “clamor” from investors in Asia to get their hands on cash on fears over the long-term health of the commercial property market.

Opportune: Analysts at CBRE suggested the deal represented a “quick and easy trade” for Blackstone to “find liquidity”.

Truist noted that BREIT still owns the Bellagio real estate, worth up to $5bn, and is part of the three-way ownership of the Cosmopolitan, worth ~$4bn.

In the press release, Blackstone COO Jon Gray said Las Vegas “continues to be a high conviction market for Blackstone”.

Encore: Meanwhile, Wynn Resorts announced the completion of its $1.7bn sale and leaseback deal for its Boston Harbor property.

** SPONSOR’S MESSAGE: BettingJobs is the global leading recruitment solutions provider to the iGaming, Sports Betting and Lotteries sectors. Boasting a 19-year track record supporting the iGaming industry, and with a team of experts and world class knowledge, it’s no surprise BettingJobs is experiencing rapid growth with outstanding results. Does your company have plans to expand teams to cope with strong growth and demand?

Contact BettingJobs.com today where their dedicated team members will help you find exactly what you are looking for.

ESPN deal uncertainty

Speaking at a conference this week, ESPN chief Jimmy Pitaro suggested there were “no deals imminent” in sports-betting.

No dice: At the Sports Business Journal conference this week, Pitaro is reported to have suggested that while sports betting had some “importance” for ESPN, there was no hint of progress towards rumored enhanced partnership deals.

Meanwhile, JohnWallStreet at Sportico spoke to former ESPN boss John Skipper this week who suggested returning Disney CEO Bob Iger would seek a “smaller marketing position”.

This might involve a “big minimum guarantee against a bunch of advertising inventory”.

Sense check: “Investing billions of dollars in a low-margin sports-betting venture when the company is looking to cut costs makes little sense,” he added.

Further reading: don’t expect that ESPN sportsbook anytime soon.

Illegal betting survey

Up to $44.2bn in GGR is being lost to illegal gaming in the US according to the AGA.

The new survey undertaken by the Innovation Group on behalf of the AGA suggested up to $3.8bn a year of sports-betting GGR and a further $13.5bn of iCasino GGR is currently being lost to the offshore market. The survey also found that up to $26.9bn in GGR is being lost on unregulated machines.

The survey of over 5,200 respondents found that 49% of sports bettors had placed a bet with an offshore bookmaker within the past 12 months.

The illegal iCasino market is worth nearly 3x the estimated legal market in 2022 of ~$5bn.

According to the AGA there are an estimated 870k unregulated machines with ~25% take rates.

Chart of the week

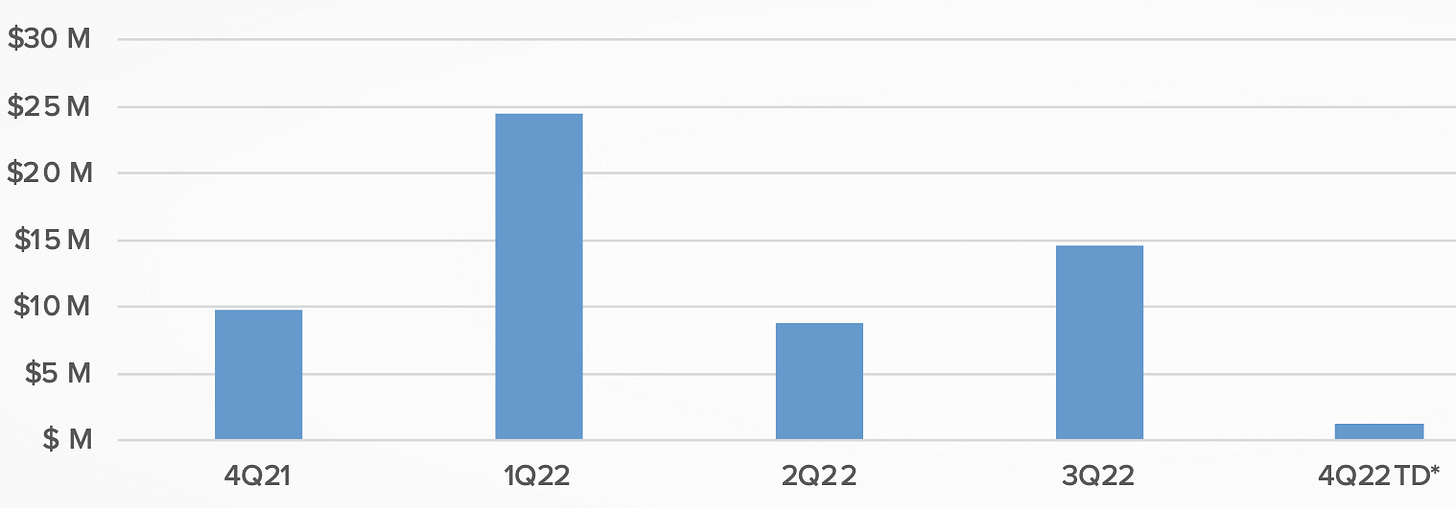

Eilers & Krejcik show that Caesars is yet to open the marketing taps with its online casino offering.

👎 The EKG team noted the lack of digital ad spend to support the Caesars online casino offering in the fourth quarter. They suggest Caesars is holding back until the rollout of what Caesars CEO Tom Reeg said on the Q3 earnings call would be the result of “an “aggressive product improvement road map”.

As EKG said, “it is not yet clear” what that product rollout would entail. “It’s beginning to appear more likely that a ramp up in its online casino ad spend will m ore closely coincide with said product.

🚧 Caesars digital ad spend since Q421

Analyst takes

NeoGames: Deutsche Bank says the iLottery to sports-betting and iGaming provider offers “unique growth story” as it initiates coverage saying its core “favorable niche” in iLottery, where it controls ~68% of supply, allied to its Aspire Global acquisition from earlier this year means it is well-positioned.

The analysts added that the global iLottery market is expected to grow at ~14% CAGR, with North America set to grow at 25% CAGR in the next five years.

Note, Aspire Global was fined £328k this week by the UK Gambling Commission for anti-money laundering failures.

Sector watch – NFTs

The slump in NFTs means gambling regulators might be lucky to lay a glove on an “emerging product” that might disappear as quickly as it emerged.

Rhodes aside: Concerns about NFTs as an emerging product for potential regulatory oversight are growing just as a market downturn afflicts the sector. The UK Gambling Commission is the latest body to suggest the nature of the product raises issues about whether it constitutes gambling.

During a speech last week to gambling sector CEOs, UKGC boss Andrew Rhodes, noted NFTs as being one of a short list of “emerging” products alongside synthetic shares and cryptocurrency which were “evolving all the time”.

He said the Commission would be directing more resources to understanding the relevancy of such products to gambling regulators.

As noted in a previous sector watch, the French regulator in the summer met with fan token provider Sorare as part of an assessment into whether its business model was akin to gambling.

Candy crash: In among the general crypto crisis following the FTX collapse, NFTs have suffered their own collapse in values, particularly the high-profile Bored Apes having fallen over 80% from their peak earlier this year.

Meanwhile, a report earlier this week suggested NFT provider Candy Digital had laid off a third of its staff.

The company is backed by Fanatics and at the time of its last cash raise in October last year was valued at $1.5bn.

The company has a deal with Major League Baseball to build its NFT collection.

Further layoffs in the space came in early November when marketplace Dapper Labs shed 22% of its staff.

Earnings in brief

Intralot: Revenue was flat at €302.8m while EBITDA rose 6.6% to €82.6m in the nine months to September. In Q3, EBITDA rose 16.6% YoY to €115.9m with the company saying it benefitted from a structural and capital reorganization.

Datalines

Macau GGR was down 55.6% YoY and in November to MOP3bn as travel restrictions continued to hamper visitation levels. Macquarie analysts said travel prospects had improved “slightly” as China looked set to loosen its zero-COVID policy following weeks of protests. The SAR renewed casino concessions in the past week, removing any regulatory overhang in the process.

Arizona: September data shows sports-betting GGR rose 52% to $55.5m on handle which was up 49% to $537.4m.

Leaders by GGR: FanDuel (36%), DraftKings (24%) and BetMGM (20%) led the way.

Nine brands achieved less than 1% GGR share including Betfred (0.5%), Unibet (0.05%) and Bally Bet (0.05%).

The nine achieved a total GGR between them of $1.16m.

Rhode Island: Land-based gaming was up 9.7% to $53.4m while sports-betting GGR rose 70.1% to $6.2m on handle that fell 7.7% to $55.5m.

Newslines

Entain has relaunched the Unikrn esports-betting brand that it acquired last year. The new site is live in Brazil and Ontario with launches into further regulated markets planned for next year.

Metric Gaming has announced a strategic partnership with world-leading racing provider Racebook HQ to supply B2B managed trading services for the global industry.

GiG has signed heads of terms for omni-channel platform provision with an unnamed “established” Ontario land-based operator.

Bragg Gaming has launched online casino games with BetRivers in New Jersey.

Chalkline has partnered with the CRM provider Optimove to develop conversion and retention metrics for free-play sports games.

Resorts World Las Vegas has gone live with Sightline Payments’ cashless solution. The resort is the first La Vegas casino to launch remote ID verification, said Sightline.

What we’re reading

Telles like it is: A tale of murder in Las Vegas.

Quiet desperation: Lockdowns are sucking the life out of Macau.

Calendar

Dec 6: The Startup Month #5

Dec 13: Deal Talk #5

Dec 20: Due Diligence #2

Contact

Scott Longley scott@clearconcisemedia.com

Jake Pollard jake@openmediaservices.com