DraftKings and MGM Resorts give sector a booster shot.

In +More: Coinbase CEO hints at prediction market entry.

Deutsche Bank says M&A is part of ‘DraftKings’s playbook’ for 2025.

The teardown: a look at where Robinhood is winning.

Hard Rock Bet is gearing up for 2025 with a focus on amplifying brand and product engagement. With a powerful, custom-built bonusing system and an ambition to redefine traditional CRM, we're seeking leaders who are driven to challenge the status quo:

And other amazing positions here

Mood swing

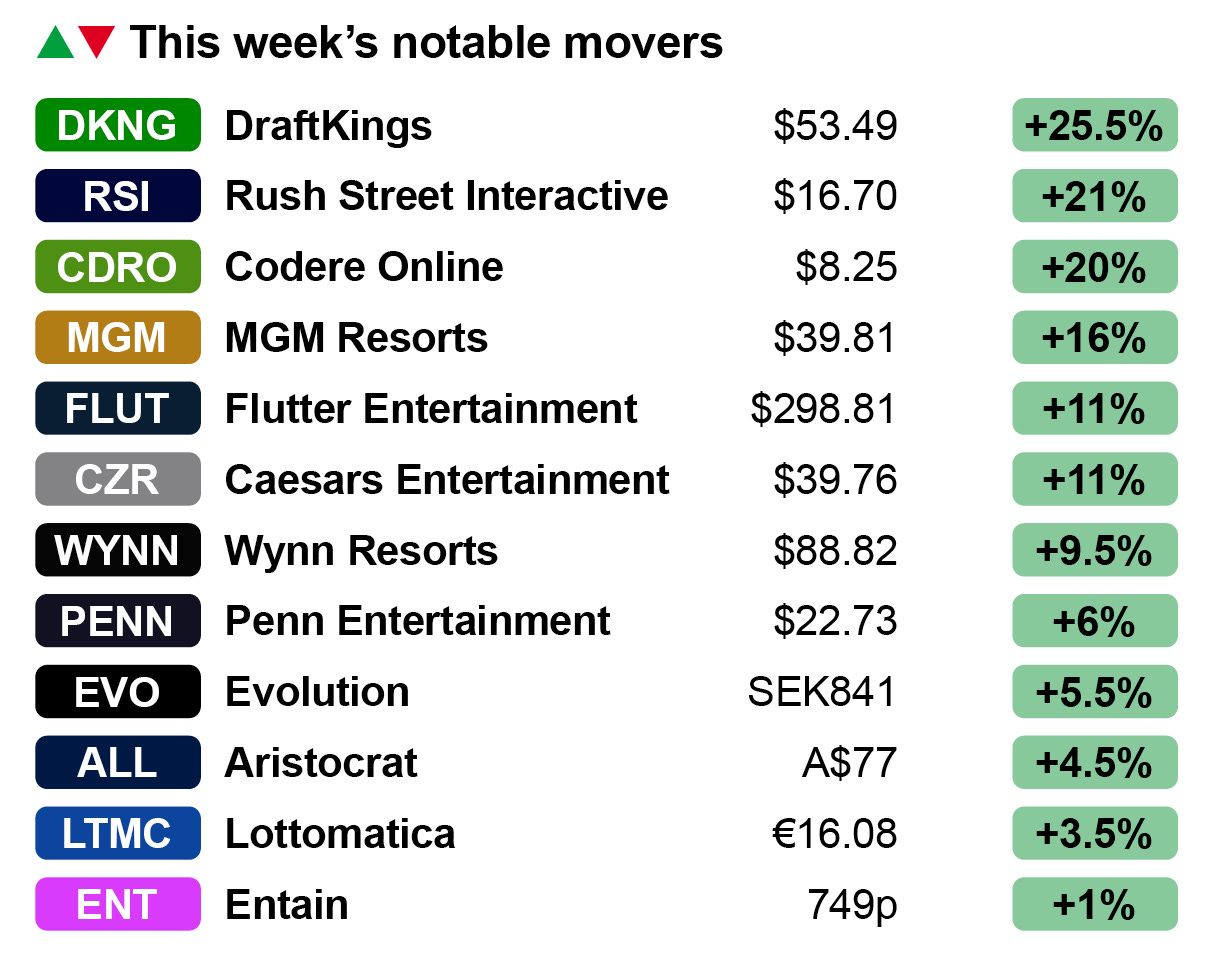

Turbo charged: The leading companies in the sector enjoyed large double-digit gains last week, led by a 25% leap at DraftKings, a 16% uplift for MGM Resorts and an 11% boost for Flutter Entertainment, which saw the company’s value rise to over $50bn for the first time.

Well-received earnings statements from DraftKings and Wynn Resorts on Thursday and MGM Resorts on Tuesday were the catalysts for the change in investor sentiment.

All things go: Shares prices across the sector rode the coattails as some of the biggest names added billions to their market caps. DraftKings saw its value soar by 15% on Friday to $26bn. This despite having seen its 2024 adj. EBITDA whittled away to $181m vs. the already downgraded forecast of $240m-$280m.

With a multiple at 27x, the team at Deutsche Bank said DraftKings’ shares had “seemingly shrugged off every fundamental and thematic risk that has emerged over the last several months.” See ‘The Long Take – DraftKings’ below.

Over at JMP, the team suggested “investor sentiment has materially shifted in recent weeks.”

MGM Resorts was up 16% for the week following its earnings after market close on Tuesday. It is now worth just shy of $12bn.

Analysts at CBRE said in the wake of the earnings that the company has built a “compelling growth story” for the decade ahead.

This includes BetMGM inflecting this year, MGM Digital “poised” to add over $200m in additional EBITDA within five years and developments in Japan and likely New York.

Isle be there for you: Also reporting last week was Wynn Resorts, which enjoyed a near 10% uplift after it made clear its Al Marjan project in the UAE was all systems go. See ‘Quick takes’ below.

Macquarie said last week Wynn was tapping into the “vast wealth creation for higher-end consumers over the last several years.”

Slipstream: A beneficiary of the renewed investor interest in the sector was Flutter, the home of DraftKIngs’ rival FanDuel. It saw its value soar to $53bn as it enjoyed a near 6% leap on Friday in the wake of its major competitors’ earnings.

The upward move extended its lead as the most valuable company in the sector ahead of Las Vegas Sands, which is worth $31.5bn and Aristocrat at A$48.3bn ($30.7bn).

Diary date: Flutter is set to report its Q4 earnings on March 4.

Calendarized: Also enjoying the reflected glory this week were Rush Street, up 21%, set to report on February 26, Caesars Entertainment (+11%), up in symphony with major rival MGM and which reports on February 25, and Penn Entertainment (+6%), which reports on February 27.

Entain managed a 1% rise despite the abrupt departure of CEO Gavin Isaacs at the start of last week. The shares enjoyed a 7% bump up on Friday.

Meanwhile, investors in Codere Online (+20%) were full of confidence after the company confirmed it would be in full Nasdaq compliance when it reports this Thursday.

GeoComply's international solutions are unlocking compliance and security for the global market, so players everywhere can enjoy seamless, worry-free gaming experiences.

Book a meeting with the GeoComply team at SBC Rio (booth #A250) and learn how their advanced geolocation, identity, and fraud solutions safeguard your platform from account takeovers, fraudulent chargebacks, promotion abuse, and more!

GeoComply’s Brazilian solution is designed specifically for the local market, offering seamless geolocation compliance (without requiring a companion app), robust anti-fraud measures, and streamlined licensing support—all while minimizing customer friction.

+More

New Jersey in January saw iCasino far outstrip B&M gaming both on growth terms, rising 21% YoY vs. 2.6% for its land-based counterpart, and in actual terms, standing at $222m vs. $210m. Nothing much changed in market leadership, with DraftKings (24.6%), BetMGM (23%) and FanDuel (22.4%) leading the way. In sports betting, GGR was down 28% YoY to $122m on handle that fell 33% to $1.1bn.

Skin deep: Brian Armstrong, CEO at Coinbase, waded into the debate about prediction markets on his company’s Q4 call late last week. The crypto trading platform had “nothing to announce today,” but he noted the prospect of adding the product was “very exciting.” “The beautiful thing about these prediction markets is that people have real skin in the game,” he said. “I actually think it’s a better source of truth than what we’re seeing in many traditional media publications.” See ‘The teardown – Robinhood’ below.

Gaming affiliate and affiliate service provider Acroud has completed its restructuring, which has seen Gary Gillies’ RIAE Media become the largest shareholder with a 39% stake while holders of the outstanding bond will receive 23% of the company. Bondholders also received a cash payment of SEK65.3m ($6.1m).

Earnings this week

Following former sector leader Catena Media’s Q4 earnings last week, Better Collective (earnings on Wednesday, call on Thursday), Gentoo Media (Tuesday) and Raketech (Wednesday) will fill out the picture of the gaming affiliate sector this week.

Earnings Extra editions this week will cover Better Collective (to be sent on Thursday), Churchill Downs (Thursday) and the gaming REITs (Friday).

Diary dates: Genius Sports will release its Q4 earnings on March 4. Evoke has announced it will present its FY24 earnings on March 26.

The long take – DraftKings

Part of the playbook: Pitching that 2025 will be a “make or break year” for DraftKings, the Deutsche Bank team admitted that had also been their 2024 prognosis but “the concept of structural hold emerged, and the market mistook sports betting for table games and slots.”

The DB team pointed out that DraftKings’ own forecasts imply net revenue growth of 35% to get to the midpoint of its guidance of $6.3bn-$6.6bn.

They further suggested this implies it needs growth in OSB net revenue of 40%, which in turn needs 17% handle growth – a figure they said is reasonable but “isn’t a layup."

Hinge and bracket: Where this is important, the DB team argued, is that the DraftKings story “hinges almost entirely on its ability to meet its guidance benchmarks” and any missteps are “unlikely to be well received and confidence would wane.”

In such circumstances, “when a story unfolds with an uncertain ending, there is always a Plan B” and the team contended that, for DraftKings, this Plan B is M&A.

Cash is Kings: This is the backdrop, the analysts suggested, against which the company’s plans to raise more debt should be viewed. As of the end of Q4, DraftKings has cash in hand of $790m and it will be generating ~$850m of free cash in 2025.

In this context, the analysts noted CEO Jason Robins’ answer to the question about international expansion on last Friday’s call, saying expansion ex-US and Canada was a “longer-term opportunity.”

“It is hard not to acknowledge some of the signs that we believe represent a Plan B,” they added.

Quick takes

Italian tender: The tender for new online concessions was recently extended to September this year and the team at Jefferies suggested the structure of the new regime could be the catalyst for further market consolidation.

The Jefferies team pointed out that under the new framework operators pay a one-off €7m fee plus an ongoing tariff of 3% of GGR. This is vs. the previous system of a €50k one-off fee plus a 2.5% GGR tariff.

Jefferies suggested that, as a result, the number of operators is expected to fall from the current 81 to just 30-50 as the leading operators potentially sweep up a long tail of ~30 operators with less than 1% market share.

Discount tents: Even as the shares put on over 11% last week, the analysts at CBRE suggested that shares in Wynn Resorts are not getting enough credit for the current operations, let alone for the Al Marjan project.

The analysts noted this is despite key milestones having been achieved, including the granting of a license, the “significant progress” on construction and the recent $2.4bn project financing agreement.

“The thesis is simple,” they added. Vegas has more runway, Macau is resilient, Al Marjan is speeding ahead, share repurchases are ramping up and valuation remains deeply discounted.

Does your Bet Builder supplier or in-house Same Game Multi solution support 13 sports, including all of the main global betting sports, plus local variants and even eSports? Does your product allow your end-users to place both Pre-Match and In:Play Bet Builders across multiple sports? Can you offer cashout across all Bet Builder transactions? Does your solution use your own odds rather than another opinion of the market? If the answer to any of these is ‘no’ then come and find out why over 170 operators are using the Algosport Bet Builder solution today.

The teardown – Robinhood

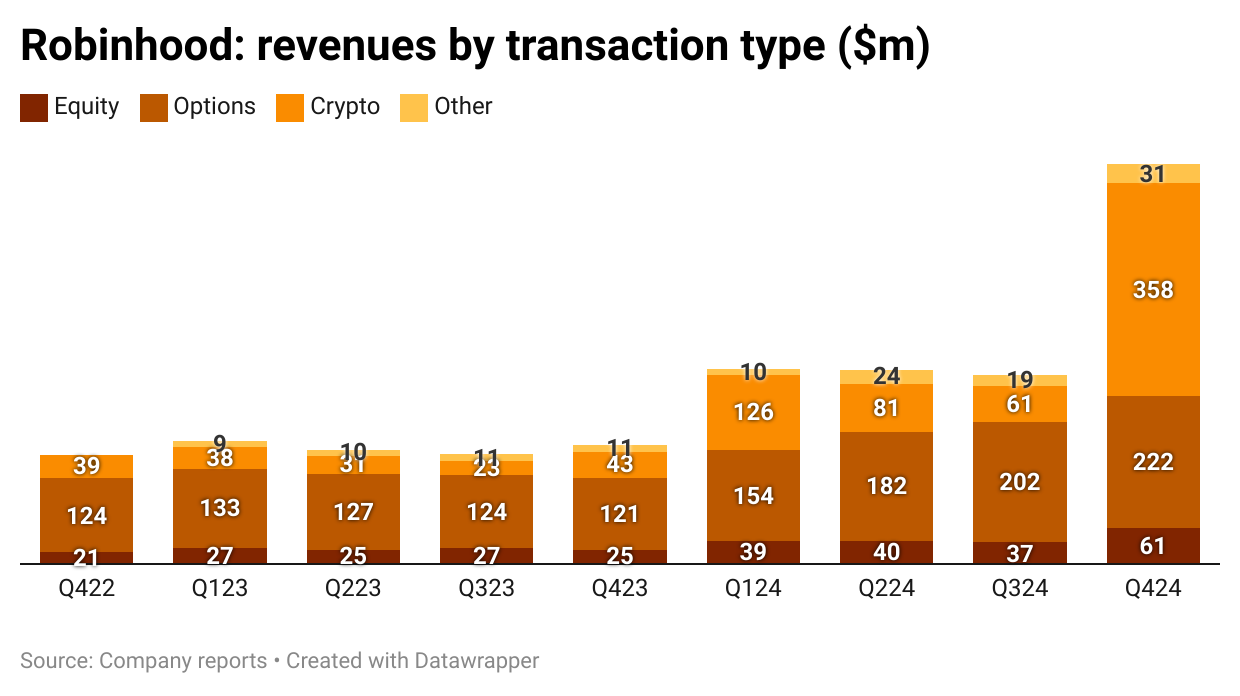

Everything on it: Vlad Tenev, CEO at Robinhood, made the pitch for his company to be the ‘everything trading’ app during the company’s Q4 call last week. with prediction markets potentially being the next leg to that story.

But it was crypto trading that was the standout performer in the three months to December. Revenue generated from crypto transactions rose from $43m in the prior-year period to $358m, or a 733% increase.

To an extent, crypto trading has come out of nowhere: in Q3 it was worth $61m while the previous highpoint was in Q1 when it generated $126m. In 2023 it hovered in a tight range between $38m and $43m.

Token gesture: On the call, it was clear that management sees a clear runway for further growth in crypto trading. Robinhood currently lists ~20 tokens vs. the 250 listed by Coinbase.

Coinbase itself released Q4 numbers last week showing its transaction revenues from customer trading crypto tokens was $1.5bn out of total revenues of $2.9bn.

Pedal to the metal: Echoing his comment on prediction markets, Tenev said that, pending "regulatory clarity,” Robinhood would be accelerating its crypto offering. The company has readied a separate app, Robinhood Wallet, a non-custodial crypto wallet that Tenev said was the “gateway to thousands of additional coins for our customers.”

“What I’m perhaps most excited about is tokenization,” Tenev told the analysts. “Robinhood is uniquely positioned at the intersection of traditional finance and DeFi.”

He added that Robinhood was “one of the few players that has scale, both in traditional financial assets and crypto currencies.”

“What that means for us is bringing real assets onto crypto technology and giving people access to real-world productive assets using crypto rails.”

Where is this heading? Crypto is part of Robinhood’s “everything trading” ambitions. What its customers “really love,” Tenev added, was the capability to trade any asset class in one place, whether that is equities, options, crypto and “soon a comprehensive suite of event contracts.”

EDGE Boost is a dedicated bank account for bettors with a daily debit limit of $250,000 and 100% approval for all gaming activity. Money movement in gaming has never been a payments problem, it's been a banking problem. With no integration (Runs on VISA rails) and no costs, EDGE can impact Operator margin by lowering processings costs and reducing chargebacks while growing revenue through increased cash access and a 1% rebate on all transactions.

To find out more, go to www.edgeboost.bet

Upcoming earnings

Feb 18: Gentoo Media, GiG Software

Feb 19: Raketech, Tabcorp

Feb 20: Better Collective (call), Churchill Downs (call), Codere Online

Feb 21: VICI Properties, GLP (call)

EveryMatrix delivers iGaming software, solutions, content and services for casino, sports betting, payments, and affiliate/agent management to 300+ global Tier-1 operators and newer brands. The platform is modular, scalable, and compliant, allowing operators to choose the optimal solution depending on their needs.

EveryMatrix empowers clients to unleash bold ideas and deliver outstanding player experiences in regulated markets.

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.