US iCasino supply: the $2bn opportunity

The US iCasino supplier sector examined, AI in gaming, recent analyst takes +More

Good morning. Welcome to the latest Due Diligence, which this month focuses on the iCasino supply side. In a recent note, the team at JMP suggested that the bull case for suppliers in the US could be up to $2bn and gave a handy rundown of the landscape of a sub-sector likely to see huge change in the coming years.

Meanwhile, Jefferies takes a look at where AI might intersect with the gaming sector.

A shareholder has lost faith in Entain’s strategic compass.

Analyst takes on BetMGM, Aristocrat and Genius Sports.

I'm looking for a partner, someone who gets things fixed.

Content is King

‘Good games make money,” suggests the team at JMP.

iDemand: The content creators within the iCasino sub-sector saw revenue gains that outstripped all other sub-sectors within the consumer discretionary space as suppliers continued to benefit from strong revenue growth in the US.

Across the range of listed suppliers growth averaged 27% for 2022, ahead of gaming REITs (18%), gaming (8%) and beverage (8%).

Young at heart: iCasino operations notched up growth of 36% in 2022 to reach over $5bn in revenue but, as the analysts suggest, the market remains in its infancy and the demand for more new content is evident.

“The need for quantity and quality is vitally important, and highly-skilled developers often spend months creating the math, features, and offerings to produce just a single game, which only lasts for several weeks on average,” says the JMP team.

Inferiority complex: Proprietary content has been a focus, but they note that operators remain fearful that in-house games “carry the risk that games could be inferior to speciality studios and generate lower returns”.

Pure-play content providers, then, will be an “essential part of the industry as it matures over time”.

Where are we now: In 2022, US iCasino generated GGR of $5.4bn and has demonstrated a 15% CAGR since 2013. Notably, as consumer awareness has grown, spend per head has almost doubled to $188 in the last two years.

🎰 US iCasino spend per head

Source: JMP

The race to $2bn: Based on a high-single-digit margin, JMP detailed their Bull, Base and Bear estimates for the size of the supply potential.

To get to a $2bn North American iCasino supply market, JMP suggests the market would need to see legislation passed in Indiana, Illinois, New York, Iowa, North Dakota, California, Colorado, Virginia and Alberta in Canada. With 7% of organic growth, this would see the GGR pie rise to $28bn.

The Base case assumes future legalization from IN, IL, NY, IA, ND, and Alberta; 5% organic growth; and comes up with a content revenue opportunity of $1.2bn.

The Bear case assumes no further legislation, 5% organic growth and pitches the supplier opportunity at $750m.

Note, the JMP Bear case has already been exceeded as the note came before the Rhode Island news, which adds 0.3% of the US adult population

** SPONSOR’S MESSAGE ** The Huddle Journal:

During NBA Finals Huddle outperformed competitors with superior reactivation rates, proving their market strength, and validated that Huddle is market leader when it comes to pricing.

Throughout the NBA Finals, the market adjusted to fall in line with the Huddle price on over 72% of occasions where Huddle Pricing deviated from the market by more than 3%.

For 80% of the suspensions Huddle made, Huddle reopened its lines for betting within 15 seconds, compared to the market average of only 59%.

Explore more: https://huddle.tech/unveiling-huddles-remarkable-statistics-a-recap-of-the-thrilling-nba-finals/

Growth thru M&A

Multi-ball: Against the backdrop of the desire for ever more content, it is not surprising that, as the JMP team points out, M&A within the supply space tends to be in the region of 20x EBITDA vs. the 8x EBITDA that companies generally trade at.

They note in the report that supplier M&A historically has occurred at higher multiples to B2C where the average is ~12x EBITDA.

Where the wild things are: The report details many of the larger players in the iCasino space, from large land-based entities that have branched out into the online arena to the online endemic providers that dominate in slots and live-dealer.

It constitutes a cut-out-and-keep guide for potential M&A combinations.

The big suppliers

PlayAGS, IGT, Light & Wonder, Everi, Ainsworth, Aristocrat, Konami and Inspired.

The content suppliers

Evolution, Games Global, Digital Gaming Corp., Bragg, Playgon, White Hat, High 5 Games, Play’n GO, Boom Entertainment, Design Works Gaming, Yggdrasil, Pixiu, Gaming Realms, Greentube, ReelPlay

Multiplication tables: The potential for multiple combinations of any of the above appear very high, given recent news around Aristocrat’s $1.2bn bid for NeoGames – which includes the iCasino supplier PariPlay – and IGT’s announcement that it was undertaking a strategic review, which includes the possibility of a sale of its digital division.

Live and let live

Lust for live: Live dealer is set to be a key battleground. JMP notes that as it stands Evolution almost has the market as a lock. “But it is evident that resources are being allocated to develop the technology for this product from other operators in the market.”

JMP suggests the “industry view” is that live dealer could be worth 10-25% of total market GGR at maturity, implying a value of between $1.5bn and $1.8bn.

But the team goes on to note the regulatory picture is clouded by the need to have live dealer studios based in each state due to the Wire Act restriction on games being offered across state lines.

“A complete repeal of the Wire Act would serve as a catalyst for capital investment into the live dealer space, among other verticals, and long-term growth for the content companies in the space,” JMP suggests.

Clear intent: It's worth noting recent comments from MGM Resorts CEO Bill Hornbuckle on the subject of live dealer. Talking about areas for potential M&A during the Q1 earnings call, he signaled the company’s interest in the area.

“There is nothing that suggests that, given the nature of our business, we should not be in that business.”

Mind the generation gap: As part of its report, JMP conducted a survey of industry executives and among its takeaways is that the sector is worried about the younger generation not being interested in slots.

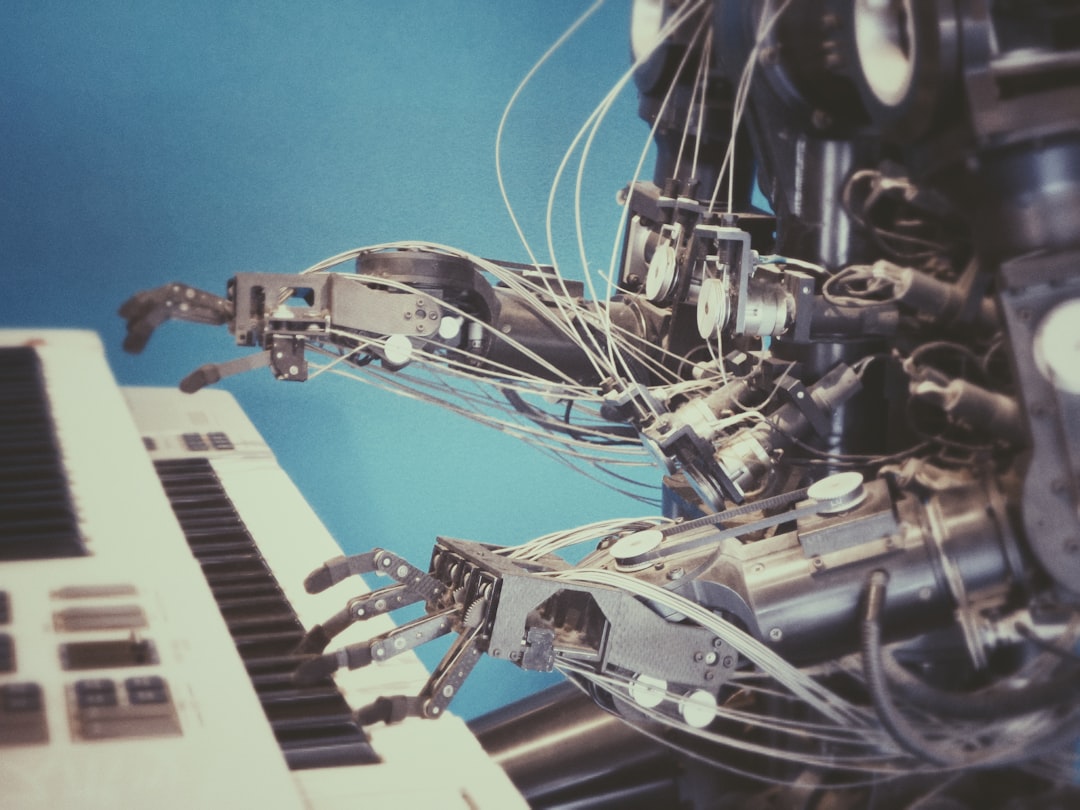

AI comes to gaming

There are multiple touchpoints for how advances in AI will intersect with the gaming sector.

Artificial energy: The gaming and betting sector is not immune from the fervor surrounding the latest advances in AI and it has prompted the team at Jefferies to put forward a number of predictions for where the technology will impact future operations.

Unsurprisingly, mobile content and virtual dealers are among the areas where the team believes the experiential aspects of the products could be enhanced.

The team indicates that mobile gaming and live dealing content that is already technologically juiced towards personalization will become “more specific”.

In reel time: The team suggests a further application on the slot floor where they say the machines will be designed to make decisions about individual customers in real time.

The future slot floor will be able to deliver content and engaging math models “based on the customers’ tastes and capabilities” but simultaneously “maximizing the revenue capture for the entire gaming floor on a daily basis”.

Appliance of science: What Jefferies fails to mention in the report is the abundant AI applications being discussed in terms of sports betting. Data supplier Sportradar, for instance, has been busy deploying AI across various aspects of their businesses from its Managed Trading Services division through to sports-data collection and sports integrity.

** SPONSOR’S MESSAGE ** Tried, tested and proven over a decade in the highly-regulated US market, and continuing to expand across Europe, Latin America, Asia and Africa. GeoComply harnesses the power of its market-leading geolocation technology to protect against fraud, including fake account creations, bonus abuse, account takeovers, stolen identities, money laundering, and more.

Visit geocomply.com.

Entain revolt

Eminence Capital’s complaints on strategy hit a nerve.

Strategic misdirection: The complaint from the 2% shareholder over the STS acquisition announced last week is “likely to catalyze closer scrutiny of Entain’s strategy and capital allocation,” said the team at Jefferies.

To date, the company has largely been praised for following the ‘local hero’ M&A plan, buying leading operators in (mostly) European markets.

As detailed in the May edition of E+M’s Deal Talk, this includes deals for BetCity in the Netherlands, Enlabs in the Baltics and the one that set up the Entain CEE JV with EMMA Capital, the buyout of Croatia’s SuperSport.

Straw in the wind: Eminence said in its letter that until now it had been supportive of the company’s M&A strategy, but with the crucial caveat that deals should be financed with the lowest possible sources of investment.

But, the letter continued, this doesn’t appear to be the case with the STS deal, which has seen Entain raise £600m through a rights issue that was equivalent to ~8% of the market cap.

Eminence accused Entian of “empire building” using shareholder funds. This was a ”value-destroying strategy”, the letter added.

Annual income twenty pounds, annual expenditure twenty pounds ought and six, result misery: The specific charge relates to the multiple of the STS acquisition, which was completed at ~12x EBITDA. This compares with Entain’s own current EBITDA multiple of 7%.

In the wake of the news of the deal, the share price fell around 7% and though it has steadied since remains underwater compared to the price before the STS deal was announced.

Eminence was blunt. “The market reaction to this equity offering should be a wake-up call to Entain's tone deaf board and management team,” the letter stated.

Analyst takes

BetMGM: Following a meeting with management, Deutsche Bank analysts said while the JV has been very successful, notably in “healthily profitable” iCasino, the structure with Entain “needs to be reconciled”, which is “something both sides continue to contemplate”.

The likeliest solution, they suggested, was that MGM buys out its 50% JV partner – and licenses the tech – rather than the other way around.

Genius Sports: With two years remaining on its NFL agreement, JMP said Genius is “confident” that, with its Second Spectrum offering bringing “value-enhancing” elements, it will be “increasingly difficult” for the league to look to another data provider.

Aristocrat: Macquarie said in late May that the move for NeoGames will be a knockout bid and will easily achieve the needed 67% approval from shareholders.

** SPONSOR’S MESSAGE ** BettingJobs is the global leading recruitment solutions provider to the iGaming, Sports Betting and Lotteries sectors. Boasting a 20-year track record supporting the iGaming industry, and with a team of experts and world class knowledge, it’s no surprise BettingJobs is experiencing rapid growth with outstanding results. Does your company have plans to expand teams to cope with strong growth and demand?

Contact BettingJobs.com today where their dedicated team members will help you find exactly what you are looking for.

Calendar

Jun 30: PointsBet EGM

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.