Funding for betting and gaming startups tops $100m in Q1.

In +More: Playstudios blames sweeps for the social casino downturn.

The earnings edit: Wynn Resorts, Genius Sports.

Venture playground: In focus – InsightPlay.AI.

Hard Rock Bet is gearing up for 2025 with a focus on amplifying brand and product engagement. With a powerful, custom-built bonusing system and an ambition to redefine traditional CRM, we’re seeking leaders who are driven to challenge the status quo:

And other amazing positions here

Raise me up

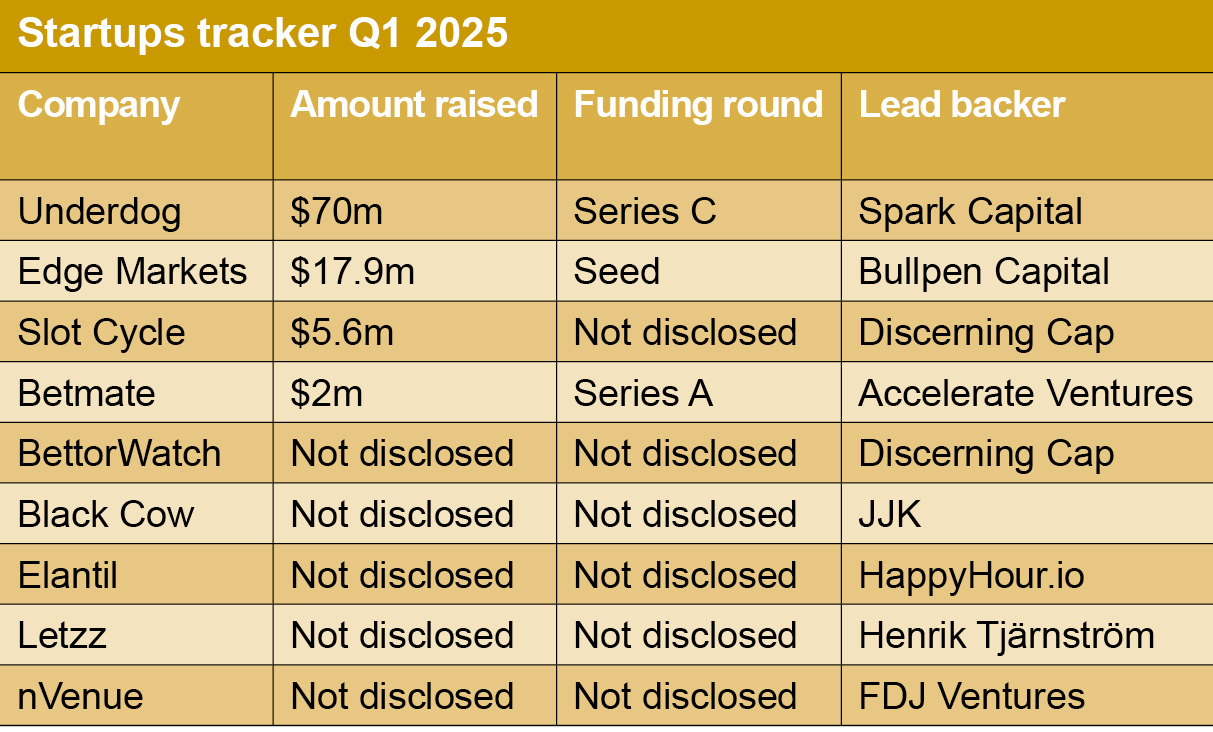

Over the under: Startup investors ploughed over $100m into betting and gaming-related companies in the first quarter of this year, with the bulk of the cash going towards DFS+ and latterly sportsbook operator Underdog.

Downpayment: The $70m raise represents just the first installment in an expected $100m funding round, which values the business at a pre-money valuation of $1.23bn.

Giving off sparks: The funding round was led by Spark Capital whose GP Will Reed said Underdog had proven it can win “where it matters most” with the product.

Fundraises for the first three months of the year as tallied by Earnings+More showed a total of at least $95.5m was raised by nine companies.

Adding in presumed raises by companies that did not disclose actual amounts means the total is almost certain to have topped $100m.

Close to the Edge: The next biggest raise came from sector-adjacent financial services provider Edge Markets, which pulled in $17.9m in seed funding led by Bullpen Capital, with the participation of StepStone Group and Suro Capital.

Among the rest, Slot Cycle raised $5.6m in a round led by sector-endemic investor Discerning Cap. It also backed responsible gambling provider BettorWatch during the quarter.

Meanwhile, Betmate was the other company to announce the quantum of raise, with $2m for a Series A round provided by Accelerate Ventures.

Undisclosed sums were also raised by Elantil, Letzz, Black Cow and nVenue.

Midnite oil: Subsequent to quarter ending, there have been a number of significant deals announced, including a $10m Series B round for UK-focused B2C challenger brand Midnite.

Alternative sports data and affiliate services provider ALT Sports Data, a fortnight back, raised $5m in seed funding in a round led by Relay Ventures and Eberg Capital.

Betty announced it had secured a $15m credit facility via a new source called CadaCredit, a private funding platform whose founding members include Oakvale’s Sandford Loudon and Justin Park, co-founder of Betty itself.

Impeccable timing: Just yesterday, micro-betting provider Kero Sports announced the closing of a $3m Series A funding round led by SIG Sports Investments and with the participation of existing investors, including Eberg Capital, Avenue H Capital and Yolo Investments.

“Kero Gaming has demonstrated exceptional growth and innovation in the micro-betting space,” said Joe Grubb, VP at SIG Sports.

Comps: The Q1 total represents a 50%+ increase on the $60.6m stated total for the prior-year period when 17 companies announced new raises. It is also double the amount raised in Q4 and represents approximately over half the total for last year of $190.5m in announced fundraising.

Discernible interest: With two deals completed in Q1 – Slot Cycle and BettorWatch – and with a lead investor involvement in Midnite, the team at Discerning Cap, including Davis Catlin and David Williams, is emerging as one of the bigger endemic sources of capital to sector startups.

Gambling.com Group [Nasdaq: GAMB] is fueling the online gambling industry with unmatched performance marketing solutions. Leveraging proprietary technology, a diverse portfolio of premium websites, and the newly acquired consumer-facing OddsJam and B2B service provider, OpticOdds, $GAMB connects operators to high-value players across the globe.

Positioned as a dynamic leader in the sector, Gambling.com Group is an engine of growth and profitability, backed by a proven track record of driving revenue for operators in sports betting, iGaming, and beyond.

Visit our investor page to see why it’s the platform behind the industry’s most successful operators.

+More

Anti-social: Playstudios CEO Andrew Pascal said during his company’s Q1 earnings call that alongside a broader market weakness in social casino, the market was also being impacted by the “rising popularity” of sweepstakes-style offerings. He said sweeps were “capturing increasing mind share and spend from players” and that in response Playstudios was “hard at work on the development of a sweepstakes solution.”

Fanatics has launched a standalone iCasino app in Michigan, New Jersey, Pennsylvania and West Virginia. A web version is also now available in West Virginia, with online access in Michigan, New Jersey and Pennsylvania coming soon.

Genting Malaysia is to acquire the remaining 10% it doesn’t already own of Empire Resorts – the entity behind the Resorts World New York property – from the family trust of executive chair of Genting Lim Kok Thay and family for $41m, as well as taking on a $39.7m loan.

What could possibly go wrong? Tabcorp is to trial in-play betting in pubs and clubs after receiving approval from the regulator in New South Wales. “I believe this is the future of wagering,” CEO Gillon McLachlan told investors at the Macquarie Australia Conference. “There’s a heavy level of interest from all the retail outlets.”

FanDuel Sports Network, the sportsbook-sponsored RSN, has doubled its paid subscriber base to ~650k in the past two months and is on pace for a million subscribers by the end of the year.

The earnings edit

Wynn Resorts

Just tariffic: The Trump administration’s tariff policy has claimed another victim as Wynn Resorts followed Churchill Downs in suspending work on domestic development projects. The halt mainly involves work on the Encore in Las Vegas, due to concerns about the impact of tariffs on its costs.

CEO Craig Billings suggested the “pace of change at the moment is just too significant” with the wider tariff backdrop to commit to revised timings on its CapEx plans.

Uncertain ratio: He also admitted to “uncertainty” over the macro impact on consumers, even if its own “affluent” player base tended to be more resilient, but added that “so far” the businesses in Las Vegas and Macau were “holding up quite well” with forward-booking visibility “just fine.”

This came after the company reported revenues declining 10% YoY to $1.7bn and adj. EBITDA slumping by nearly 18% to $533m.

Macau caused most of the damage with adj. EBITDA down 26%, and again Billings warned on the “uncertainty out there” and the impact that may have on demand.

For more see this morning’s Earnings Extra (PRO subscribers only).

Genius Sports

For your own good: Genius Sports CEO Mark Locke said that a ban on college prop bets might be in the best interest of the sportsbooks, as his company takes on the mantle of the exclusive distributor of betting data.

“The narrative is often that what the NCAA wants to do is counter to what’s best for the sports-betting industry – and I strongly disagree with that sentiment,” he told the analysts.

Locke was speaking after Genius reported Q1 revenues up 20% YoY to $144m while adj. EBITDA soared to $19.8m, nearly triple the figure from the prior-year period.

Opportunity knocks: The issue of prediction markets also got an airing, with Locke saying the emergence of sports-based event betting was an “opportunity.”

He also noted that it might even prompt a change of heart over federally recognized sports betting.

For more see yesterday’s Earnings Extra (PRO subscribers only).

Earning in brief

Lottomatica: The Italian market leader said revenues rose 33% YoY in Q1 to €586m while adj. EBITDA was up 47% to €221m. Its total online share now stands at over 30%. E+M PRO will report later today on this morning’s earnings call.

Accel: Revenue of $344m and adj. EBITDA of $50m were both up 7% YoY as CEO Andy Rubenstein hailed the strength of the company’s local distributed gaming model, now operational in 10 states. Meanwhile, the move into racinos took a step forward post-close with the launch of phase 1 of the Fairmount Park Casino in Illinois, which the company said had seen “encouraging” early results.

Raketech: The affiliate announced ahead of its earnings it had reached an agreement to extend the earnout payment period related to the acquisition of Casumba Media. This came ahead of this morning’s announcement that revenues had more than halved YoY to €9.8m while adj. EBITDA also fell by over 50% to €2.4m.

Sky City: Citing deteriorating trading conditions, New Zealand and Australia-focused casino operator Sky City has cut its FY25 adj. EBITDA guidance to 4% below the previous bottom of its range $225m.

Zeal Network: The Germany-focused lottery reseller saw revenues rose 42% to €51.1m while EBITDA soared by 89% to €17.7m. The company said the success in Q1 was “highly indicative of our future direction” with significant growth in both revenue and profitability, while continuing to add new customers.

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

Venture playground

In focus – InsightPlay.ai

Who are you? Launched earlier this year, InsightPlay.ai is an all-in-one AI solutions platform focused specifically on the iGaming industry. Headquartered in Colombia, it is led by founder and CEO Javier Troncoso.

What’s the big idea? iGaming operators and affiliates “struggle” with fragmented systems, multiple tools for marketing, support, compliance and more, says Troncoso, which “leads to inefficiencies and inconsistencies.”

InsightPlay’s offer is a single, unified platform where agentic AI optimizes each department’s operations in real time.

By automating routine tasks, identifying high-value players and simplifying compliance, the platform “fills a niche for intelligent, integrated iGaming solutions,” claims Troncoso.

The result, he adds, is “improved player engagement, tighter compliance controls and a dramatic cut in overhead costs, all under one roof.”

KPIs: These include a 10-20% increase in player retention due to more personalized engagement strategies, plus up to a 30% reduction in support costs.

Real-time compliance checks reduce manual oversight by an average of 40%.

Clients often launch new localized campaigns up to 50% quicker.

Funding backgrounder: Insightplay.ai has largely been bootstrapped by its founding team, bolstered by a network of strategic angel investors.

Growth company news

Mainlining: The ‘Shopify of online betting’ provider Maincard has attracted an option to invest from Waterhouse VC, as it seeks to raise $3m to scale its sales team and launch multiple brands from the waiting list by the end of Q325.

Tom Waterhouse, CIO at the eponymous firm, said the sector is “ripe for innovation that allows new entrants to focus on player acquisition and retention rather than backend development."

Recent E+M in focus company Elantil has appointed Amnon Liebermann as head of distribution channels. Liebermann was most recently North America regional business manager at Relax Gaming, and also previously held positions at the UK Health Lottery and g.games.

The social dumpster

EveryMatrix delivers iGaming software, solutions, content and services for casino, sports betting, payments, and affiliate/agent management to 300+ global Tier-1 operators and newer brands. The platform is modular, scalable, and compliant, allowing operators to choose the optimal solution depending on their needs.

EveryMatrix empowers clients to unleash bold ideas and deliver outstanding player experiences in regulated markets.

Upcoming earnings

May 7: Flutter Entertainment, Light & Wonder, Lottomatica

May 8: Super Group, Penn Entertainment, Inspired Entertainment, DraftKings (earnings), Full House, Golden Entertainment

May 9: DraftKings (call)

Increase Operator Margins with EDGE Boost Today!

EDGE Boost is the first dedicated bank account for bettors.

Increase Cash Access: On/Offline with $250k/day debit limits

No Integration or Costs: Compatible today with all operators via VISA debit rails

Incremental Non-Gaming Revenue: Up to 1% operator rebate on transactions

Lower Costs: Increase debit throughput to reduce costs against ACH/Wallets

Eliminate Chargebacks and Disputes

Eliminate Debit Declines

Built-in Responsible Gaming tools

To learn more, contact Matthew Cullen, chief strategy officer: Matthew@edgemarkets.io

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.