To buy or not to buy, that is the question

M&A outlook, Bally’s tumble, analyst takes, startup focus – Lucra Sports +More

The analysts put their M&A crystal balls to work.

In +More: Flutter and 888 get set to release trading statements.

Bally’s shares dive on the back of UKGC fine.

Caesars, GLP go under the analysts’ microscope.

Our startup focus is social-betting company Lucra Sports.

Who will tie it up with a ribbon and put it in a box for me?

M&A outlook

Analysts mull a mixed picture for M&A activity in 2024.

Burning a hole: Expectations remain high that there will be significant M&A activity in the year ahead. “As the market leaders pivot to profitability, history tells us that the resulting excess cash is likely to be deployed to support inorganic growth,” said the Citizens Bank 2024 preview.

To build a home: But the team at JMP cautioned that in OSB the market leaders were well capitalized enough to “build not buy.” More likely, the team suggested, was a move to augment iCasino capabilities.

iCasino-centric companies “will be the focus of M&A, particularly those with rich user bases,” JMP added.

The team noted the most successful M&A example here was DraftKings’ deal to buy Golden Nugget in 2021.

Kings of the wild frontier: Speaking of which, the team at EKG have predicted DraftKings will once again enter the M&A arena this year. “DraftKings has long had designs on leveraging its US sports expertise in nearby markets,” they wrote.

The confluence of the company marching quickly towards profitability and Brazil opening up to legal OSB and iCasino means an acquisition in Latin America “would not surprise.”

Broadened horizons: Similarly, JMP also argued that US companies will be seeking out M&A in international markets, but they put MGM in the frame as being likely to want to acquire an international sportsbook to complement its LeoVegas operation.

“We expect to see consolidation in Brazil as the market transitions from a gray to legal market,” they suggested.

B2B2M&A: Truist noted that a variety of B2B names – including AGS, Everi and Inspired – are currently trading at around 5x EBITDA. “If sustained, this could lead to more consolidation/M&A – especially if capital markets improve,” the team argued.

On AGS, the team said the company’s “sizable Class II installed base and strong R&D portfolio would tack on nicely to larger industry players’ offerings; or form a strong base for a PE roll-up.”

For Everi, the team suggested the underperformance last year – share down 21% – was “partly driven by waning enthusiasm, for now” for cashless gaming plays. Given undemanding leverage, it could be an acquirer or a breakup candidate.

At Inspired – which due to accounting turmoil is yet to release its Q3s – Truist suggested the core products of ETGs and virtual sports could make it attractive once the issues are cleaned up.

Finally, in the affiliate space the Truist team indicated M&A will be the focus at Gambling.com, suggesting it will likely try to “expand its reach in media as the fragmented sector further consolidates.”

Further reading: In tomorrow’s edition of Deal Talk we discuss the situation surrounding Entain.

Bull/bear debate

After hosting an open forum made up of 30 institutional investors in the gaming space, the team at Deutsche Bank reported that, among the key debating issues, many within the group believed bet365 would be the disruptor to watch this year.

However, “few expressed confidence that operators currently making pushes in the OSB vertical are likely to garner and maintain significant incremental share.”

DB also reported there is a view that “obsolescence is more likely than M&A” this year.

Sportsbook operators & providers - Are you looking to up your risk management & trading game in 2024?

Set a meeting with Matchbook at ICE 2024 February 6th-8th to discuss any of the following:

The fastest moving pricing & tightest overrounds in class across all major markets for Football, US Sports, Golf, Racing & Greyhounds

A dedicated high limit brokerage service to offset risk for requests like:

$1m on Trump to win the US election in 2024

$200k on the 49ers to win the Super Bowl

$2m on France to win the Fifa World Cup Final

$100k for it to snow on Christmas day in London… we can take it all!

Direct API connection for low latency pricing with historical pricing available on request.

Matchbook B2B - Because the best price is for everyone.

Visit http://www.matchbook.com/promo/b2b or get in touch at b2b@matchbook.com

+More

The week ahead

Flutter will provide the headlines later this week as it provides a trading statement on Thursday. This will be the last statement before it officially attains dual-listing status on Jan. 29.

Note, in that bull/bear debate hosted by DB, there was a belief that investors were “currently rotating” into Flutter ahead of the move.

Earlier in the week, 888 will release its first trading statement under the stewardship of new-ish CEO Per Widerström. Recall, Peel Hunt analysts said recently they expect him to steady the ship while extracting the ”original potential” from the William Hill buyout.

By the numbers

Indiana: In terms of AGR, FanDuel grabbed 41% share in December followed by DraftKings on 38%, while ESPN Bet headed the rest of the market on 9%, with BetMGM on 7% and Caesars on 6%.

What we’re reading

Homebodies: “I know how much poorer this city would be without bet365.” The FT.

Career paths

Raketech: Oskar Mühlbach is to step down from his position as CEO, citing differing views on the company’s strategic direction. Co-founder Johan Svensson will act as interim CEO.

UK Betting and Gaming Council: CEO Michael Dugher will assume the role of chair when Brigid Simmonds steps down from the role on April 21. The role of CEO will remain vacant until a replacement is found.

Caroline Ackroyd has resigned as CFO of XL Media, effective March 31. She plans to join another operator in the gaming sector.

Fitzdares has hired Nick Dutton as its new COO.

Bragg Gaming has appointed Simon Dudnjik as chief human resources officer. He joins from Sportradar.

Bally’s bad week

Winds of change: Gamesys’ £6m UK Gambling Commission fine grabbed the headlines last week, but it is perhaps fears over the viability of Bally’s permanent casino in Chicago that is driving the poor share price performance, down over 10% last week.

Truist said last week that “questions remain on financing”, though the team expects some clarification early this year.

Still, leverage of 5.5x est. 2025 EBITDA “remains a key issue for investors here.”

🚽 Bally’s down over 10% in a week

Analyst takes

Caesars: Those who doubt roll-up strategies can work like a charm need only look at Caesars. In its 10 years as a public company – first as Eldorado, then as Caesars when it bought the firm in 2020 – it has increased revenue by 32x.

ROIC and a hard place: More impressive, said the team at JMP, is the returns on invested capital (ROIC) track record.

In an initiation note, the analysts said the expectation is the company will clear another “lofty bar” in achieving $500m in online EBITDA in 2025.

They suggested operational efficiencies should increase market share, while tech improvements – both internal and external – will extract higher ARPU from its 60m database members.

Gaming & Leisure Properties: After meetings with management, the team at Truist were positive on the company’s visible deal pipeline, suggesting the flexible balance sheet was advantageous with potential rate improvements.

Truist noted that GLP expects M&A activity to be more significant this year, while it was also continuing to explore international opportunities.

On the Oakland A’s Tropicana redevelopment, GLP told Truist it was not opposed to selling the property.

ICE London 2024 will be MEGA with Soft2Bet! We look forward to showcasing our Motivational Engineering Gaming Application (MEGA), the best gamification package in the iGaming industry. We also invite partners and delegates to visit our brand new stand, where our senior leaders will be hosting workshops that will highlight our state-of-the-art technology, platform and services and of course MEGA. See you at Stand S6-210!

https://www.soft2bet.com/news/soft2bets-mega-is-coming-to-ice-london

Startup focus – Lucra Sports

Worth a Luc: The company’s two founders Dylan Robbins, CEO, and Michael Madding, COO, met 10 years ago when they both worked at Goldman Sachs. They spent their free time together watching and playing sports, keeping a running note on their phones of their friendly side bets.

But, says Madding, “we wanted instant settlement of our bets, we wanted complete control to customize the odds and spreads, and we wanted a lifelong scoreboard (to see who had ultimate bragging rights on and off the [golf] course).”

So, in 2019, they started Lucra, which now employs 15 people remotely across the US.

“Lucra is a social-gaming product where friends can challenge friends on the professional sports they watch and the recreational games they play,” explains Madding.

They launched the product in 2021 and achieved 50k active customers and ~$15m in handle.

Everything on Lucra is user-generated. “Pick the player or game to compete on and set the terms of the wager.”

As a skill-based game, Lucra can operate in 44 states, covering 95% of the US population.

“Last summer, we evolved the business from B2C to B2B2C, and built a SDK (software development kit) that allows enterprise clients to integrate our technology and offer natively it to their customers inside their existing platform,” Madding adds.

Lucrative: In Mar22, they raised $10m via a Series A, led by Raptor Group, SeventySix Capital and Victress Capital, as well as Milwaukee Bucks owner Marc Lasry, professional tennis player John Isner and NFL Pro Bowl wide receiver Emmanuel Sanders.

Luc out: “There is a unique market opportunity in the B2B software space within the wagering ecosystem,” Madding claims. With the “intense focus” from the market leaders on D2C, it “leaves an open door for Lucra to differentiate itself from the competition.”

There has been “overwhelming positivity and interest in the B2B vertical”, he says. with seven deals signed in three months, including with Major League Pickeball and TennisONE (see below); six-figure to multi-million-dollar upfront fees; massive market demand for what we are building; and a pipeline of 600 names and growing.

“Each deal will generate $1m+ of revenue over their 2-3-year deal length,” he adds.

Luc to the future: The company says revenue last year increased 5x. Over the next 1-2 years Lucra’s goals include becoming “ubiquitous as the white-label software provider for real-money gamification”.

Growth company news

Acing it: The TennisONE app has added real-money contests to its offering in time for the 2024 Australian Open, which got underway yesterday. Thanks to a new partnership with Lucra (see above), fans will be able to bet against each other without the need for a bookie.

“It will be a game changer for tennis fans,” said Lucra investor and former tennis pro John Isner.

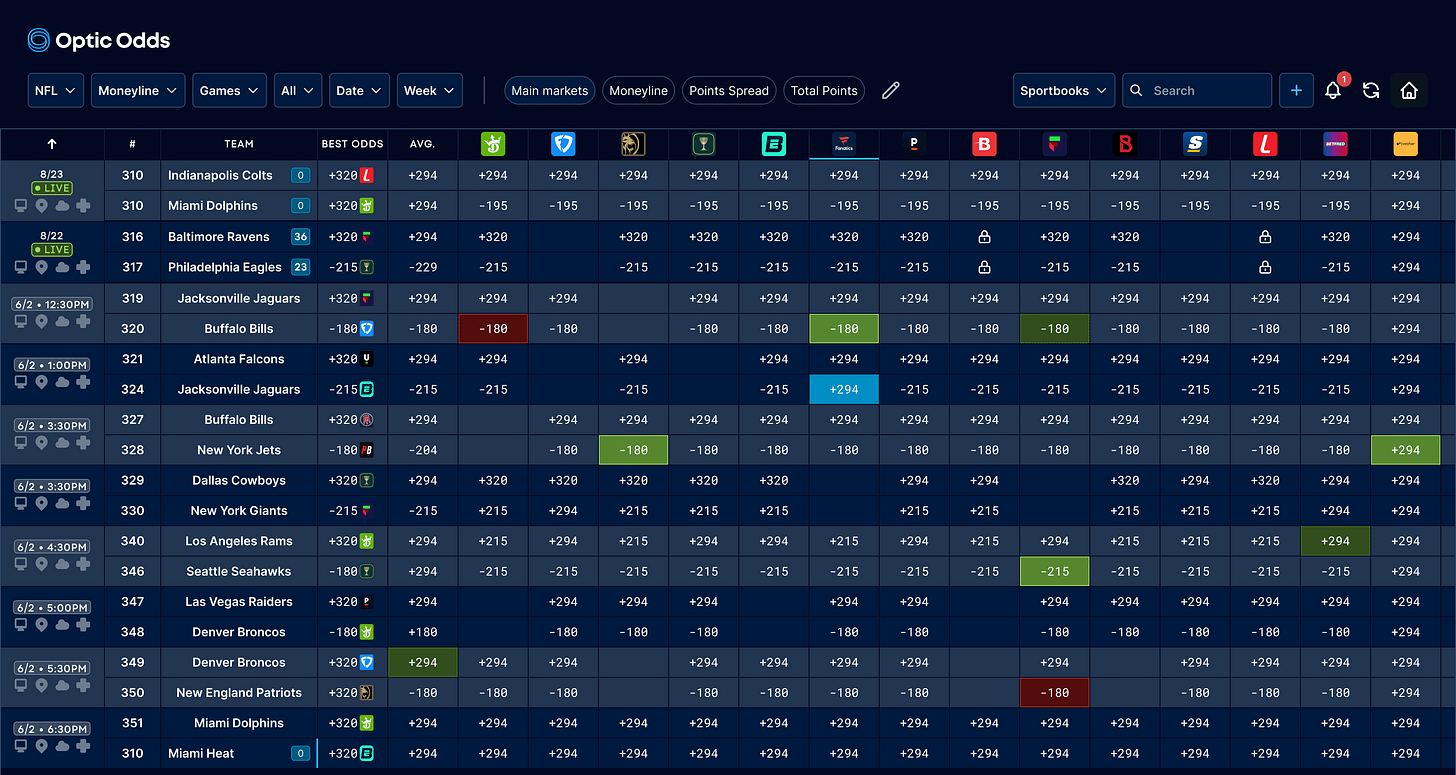

Operators, how's your risk management for NFL or March Madness? Utilize the trading screen used by top operators in the US, Europe, and Australia.

Book a meeting with Optic Odds at ICE and receive complimentary access to our trading screen for one month - no strings attached.

Includes:

Main lines, alternative markets, player props for the Big 6, soccer, and more

Ultra-low latency: built with an emphasis on speed

Create bespoke custom weighted lines on the screen and receive live alerts for line movement via Slack or Teams

Also, our push format API offering real-time betting odds from 150+ sportsbooks: player props, alternate markets, injury data, historical odds, schedules, ranking, scores & more, is available upon request.

Book a meeting here or get in touch at ryan@opticodds.com.

Calendar

Jan 17: 888

Jan 18: Flutter

Feb 1: Rank

Feb 6-8: ICE

Feb 7: Disney

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.