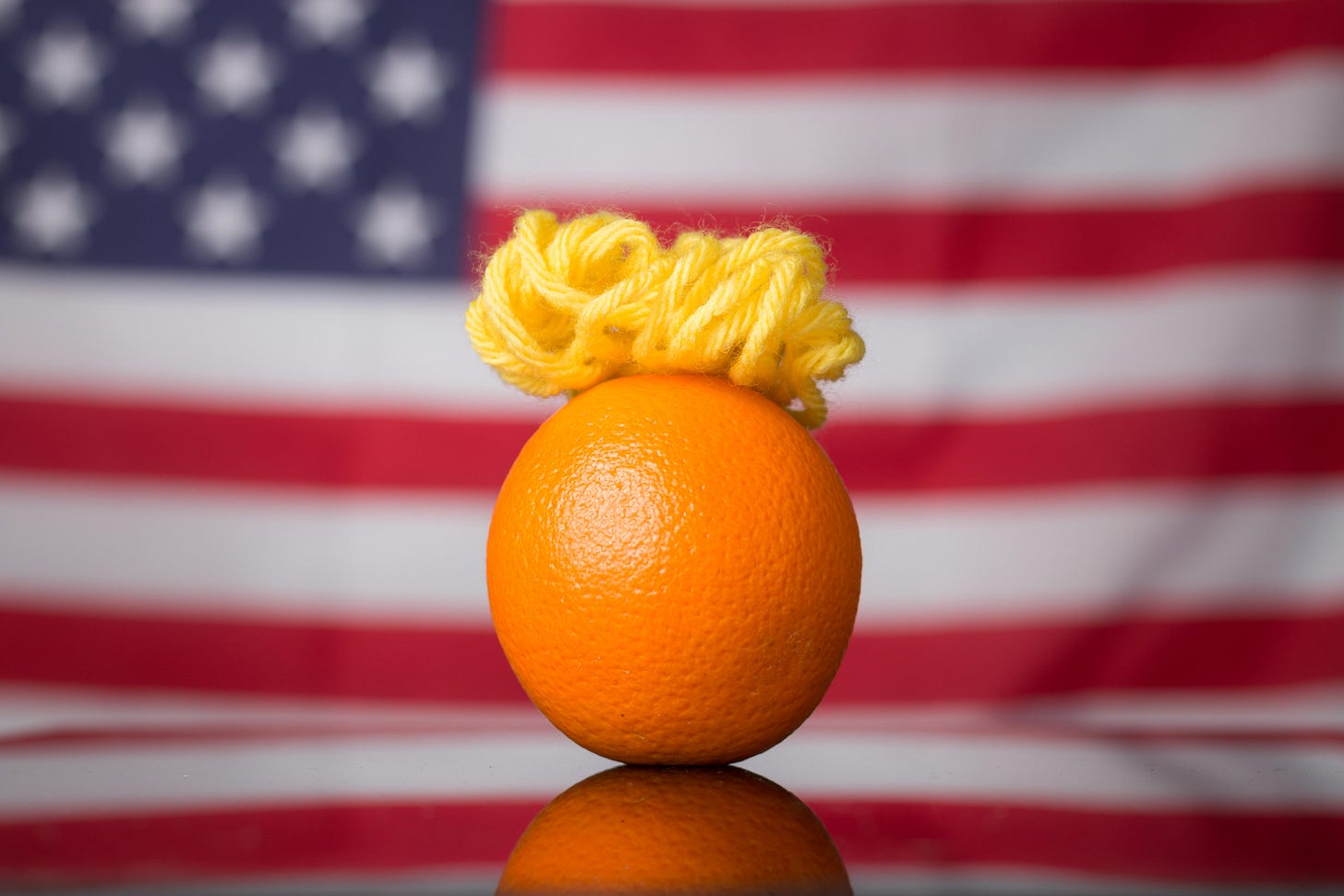

Pro-business presidential victory lifts all boats.

In +More: Entain clarifies on Sports Interaction.

Bally’s plants a B&M flag in the UK with Newcastle casino buy.

Betway owner talks up its African market supremacy.

You always come to the parties,

Hard Rock Bet is gearing up for 2025 with a focus on amplifying brand and product engagement. With a powerful, custom-built bonusing system and an ambition to redefine traditional CRM, we're seeking leaders who are driven to challenge the status quo:

And other amazing positions here

Melt-up

Sea of green: Betting and gaming stocks enjoyed bumper across-the-board share price rises on Wednesday as part of the general market melt-up that greeted the news of President-elect Donald Trump’s victory in Tuesday’s presidential election.

Rising tide: Churchill Downs led the way with an 7.5% improvement, followed by big names in the US-listed sector, including Penn Entertainment – which reports later today – up 5%.

Rush Street Interactive was up 6.5%, while Caesars Entertainment enjoyed a 4%+ uplift.

Show me the way: DraftKings (+5%) and Flutter (+4%) were also lifted by the news that the sports-betting ballot measure in Missouri had narrowly passed. See ‘Show offs’ below.

Stonk: The perceived business-friendly agenda for Trump Mk II pushed stocks up, with the S&P 500 rising nearly 2.5% on the day and the Nasdaq rising nearly 3%. As Bloomberg headlined the price movement, it was a case of ‘America first’ sweeps Wall Street.

Meanwhile, Bitcoin rose to record highs on the prospects of both a pre-crypto President and what Coinbase CEO Brian Amstrong said on X was destined to be the “most pro-crypto Congress ever.” Coinbase soared 31% on Wednesday.

Victory lap: Sometimes a chart really does say it all. In The Token Word.

Vindication: Another winner from the night were the prediction markets with onchain, offshore provider Polymarket reportedly processing $355m of bets or five times its 2023 turnover in just the last five days.

For the last three weeks or more of the campaign, the prediction markets provided by Polymarket and new entrant Kalshi had been pointing to a Trump victory. Such was the clamor that Kalshi and its rival were ranked #1 and #2 on the App Store on November 5.

On X, Polymarket said it had “proved the wisdom of markets over the polls, the media and the pundits.”

“Polymarket consistently and accurately forecasted outcomes well ahead of all three, demonstrating the power of high volume, deeply liquid prediction markets.”

A new entrant into the prediction market space was Interactive Brokers, and its founder Thomas Peterffy proclaimed “these markets will run the world.”

A band of merry men: Another notable new entrant into the prediction space was Robinhood, which launched election markets one week before election day. Its share price rose 20% on Wednesday.

Pop the cork: One person certain to be celebrating is the ‘French Whale’, the pseudonymous Polymarket trader known best as Fredi999, who it is believed won ~$48m betting on a Trump victory.

Algosport are regarded as one of the ‘best-kept secrets’ in the gambling industry, currently supporting hundreds of Tier 1 and challenger operators with our proprietary Algosport Blackbox – a powerful engine capable of supercharging your sportsbook.

We are best known for our next generation Bet Builder/Same Game Multiples product that offers the widest range of sports with unrivalled coverage, markets and features, both pre-match and in-play.

To understand how we could help create more revenue get in touch at www.algosport.co.uk

+More

Entain clarifies: Further to yesterday’s news of the Mohawk Council of Kahnawà:ke canceling its exclusive partnership for its Sports Interaction brand, Entain issued a statement to point out the two organizations “mutually” agreed to nix the deal.

A spokesperson added that the license previously used to operate the Sports Interaction brand is now held by Entain directly rather than through Mohawk Online Limited.

Entain has now taken full ownership of the SI brand and customer database.

“As such, there is no change to Entain’s offering in Canada and no write-down is necessary following the ending of the partnership,” the spokesperson added.

The Czech-based Flashscore, which runs the live scores app Livesport, has completed the acquisition of Spanish-facing soccer live scores, stats and news provider BeSoccer for an undisclosed amount.

BetMGM has started combining player pools between its New Jersey and Michigan poker markets, which the company said marks a “significant milestone” in the evolution of its offering. See today’s Compliance+More.

EveryMatrix has sealed what it says is its largest turnkey platform partnership in Africa to date to migrate MBet from its existing provider. MBet operates in Tanzania and the Democratic Republic of Congo.

Kambi has signed a multi-year partnership with a company called ZenSports for operations into Tennessee via Zen’s VIP Play operation.

Show offs

Slim fit: Missouri’s voters just about gave sports betting the nod on Tuesday with the measure passing by a mere 7,486 votes out of 2.9 million votes. It becomes the 29th state to regulate some form of sports betting.

Market size estimates from the analysts suggested Missouri could be worth between $370m in GGR, according to Deutsche Bank, and up to $580m, as per the sums from JMP.

The DB team admitted their estimate “could prove conservative” if promotions are higher than expectations.

Shape of things to come: The share price rises noted earlier for the leading operators could well be justified by the likely shape of a market, which adds 1.8% to the US OSB TAM and offers an attractive tax rate of 10%.

According to the team at JMP, with Missouri bordering existing OSB states Kansas and Illinois, it means the industry leaders will carry an existing advantage when the market opens, likely in time for next year’s NFL regular season.

JMP noted that DraftKings and FanDuel share 76% market share in Illinois and 81% in Kansas.

Read across: Compliance+More on the Missouri breakthrough.

Bally’s why aye

Talk of the toon: Bally’s CEO Robeson Reeves revealed the company bought the Aspers B&M casino property in Newcastle, UK during Q3, which he said the company saw as an opportunity to further establish the Bally’s name in the UK and leverage its existing online player base.

The revelation came after the company’s Q3 earnings showed the UK interactive business as the bright spot, with revenues climbing 13% even as total interactive revenues declined 5% to $231m.

The company launched the Bally’s OSB and iCasino brand in the UK over the quarter.

Setting sun: Just last week, Bally’s announced it was selling the Asian-facing elements of the interactive business via an MBO, with the company maintaining a licensing relationship.

Reeves said the deal allows the Vera & John business to “operate entirely independently from Bally’s with more agility and nimbleness.”

He said it would enable the management team there to “be more successful” in unregulated markets while allowing Bally’s to monetize high-margin license revenue streams.

In North America online, revenues rose 54% to $45.7m while adj. EBITDA losses narrowed to $11m.

Deep dish: Overall revenues were “a little soft,” in the words of the analysts at Jefferies, down 0.4% to $630m, while adj. EBITDA was off by 3% to $138m. Casino and resorts revenue fell 2% to $353m.

George Papanier, president, said the Bally’s temporary casino in Chicago had “settled into a largely stable cadence” as it continues to ramp one-year in. Construction continues on the permanent facility.

We simplify game development by doing the heavy lifting, so you can focus on creativity.

Whether you’re an emerging studio or an established one looking to relieve development pressure, we ’ve got you covered.

Flexible Build Support: We bring your math sheets to life and handle rollout across RGS instances.

Rapid Deployment: Get your content live in as little as 2 months.

Wide Distribution: Access key US & European markets via an extensive network of distributors and integration with chosen operators.

Future-Proof Growth: Secure a path to owning your own platform with our source code license option.

The African kings

Moat building: Now present in seven markets across Africa and with podium positions in five of them, Super Group CEO Neal Menashe said the platform that the owner of the Betway and Spin brands has been building across the continent had been years in the making.

“We have operated in Africa for more than a decade and have built a super strong competitive moat,” he told analysts on the call. “We picked our battle.”

He said Africa was now the biggest region, worth 37% of total revenues, which rose 13% to €403m, while adj. EBITDA soared 60% to €83.9m.

Investors warmed to the earnings, sending the shares up over 15% on the day.

Second to Africa for Super Group is Canada where Menashe said the company had enjoyed “strong” YoY growth, although it was still not where the company “wants it to be.”

He also admitted the US has proven to be “trickier” and the OSB business was now shut down.

But the company is maintaining its presence in iCasino in Pennsylvania and New Jersey.

Menashe noted the “decades of expertise” Super Group has generally in iCasino operations, which now account for 83% of total revenues.

+More earnings

Catena Media: The gaming affiliate said a “new operating model” has been put in place and cost-cutting measures implemented, but revenues continued their downward trajectory with a YoY decline of 33% to €10.7m. Adj. EBITDA more than halved to €1.3m.

In late October, Catena announced a €40m writedown, which it said today was related to its Lineups site.

The company said today the lower revenues were due to issues with its media partnerships and changes to “other partners agreements.”

It added that it had made “further progress incorporating social sweepstakes casinos into most of our casino offerings.”

Er, is that meant to reassure us? CEO Manuel Stan noted that adj. EBITDA margins had fallen at one point in July to 1% but were back to 18% in September.

Full House Resorts: Revenues rose 6% to $75.7m but adj. EBITDA dived 43% to $11.7m due to what the company said were elevated costs at the recently completed Chamonix casino in Black Hawk, Colorado.

The company noted that the Q323 number was also flattered by the accelerated recognition of deferred revenues from two OSB market access agreements.

The temporary facility at American Place in Waukegan, Illinois continued to ramp with revenues up 17% YoY and adj. EBITDA rising over 13%.

EveryMatrix delivers iGaming software, solutions, content and services for casino, sports betting, payments, and affiliate/agent management to 300+ global Tier-1 operators and newer brands. The platform is modular, scalable, and compliant, allowing operators to choose the optimal solution depending on their needs.

EveryMatrix empowers clients to unleash bold ideas and deliver outstanding player experiences in regulated markets.

Earnings calendar

Nov 7: Penn Entertainment, Red Rock, DraftKings, Golden

Nov 12: Flutter Entertainment, Genius, IGT, Light & Wonder

Nov 13: Better Collective

Nov 14: Gambling.com

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.

Introducing The Paycheck to Paycheck Voter https://shorturl.at/6AIkb

Remember Remember the 5th of November https://shorturl.at/PFtAJ