Ari Emanuel provides $450m to fund MBO of sports-betting supply business.

Aristocrat tidies up its social gaming business with $820m Plarium sale.

DoubleDown says social casino CPAs are on the rise.

Hard Rock Bet is gearing up for 2025 with a focus on amplifying brand and product engagement. With a powerful, custom-built bonusing system and an ambition to redefine traditional CRM, we're seeking leaders who are driven to challenge the status quo:

And other amazing positions here

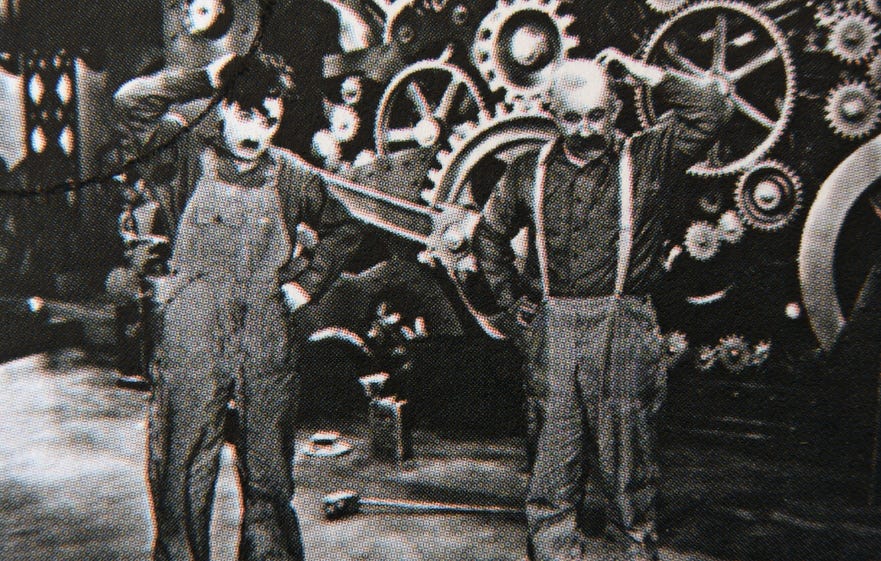

Pre-loved

Value destruction: Endeavor eventually didn’t have to look too far from home for the buyer of its OpenBet and IMG Arena sports-betting backend and data supply business, as its own CEO Ari Emanuel has provided $450m to fund a management buyout.

The sale price represents a 44% discount to the $800m Endeavor bought the company for in 2022. That price itself represented a decrease on the original buyout price of $1.2bn.

OpenBet’s current management team, including CEO Jordan Levin, will also “participate” in the MBO but for an unspecified amount.

Kissing cousins: OpenBet and IMG Arena were put up for sale by Endeavor after itself successfully arranging a buyout by majority shareholder and private equity house Silver Lake. Having clearly failed to find an outside buyer, an MBO was always the most likely solution.

Said one source of the $450m laid out by Emanuel, “it’s pocket change to him.”

The valuation is “utterly artificial,” the source added.

Can’t give it away: Endeavor said that during the “sign-to-close period and after closing” it would continue to market IMG Arena for sale to a third-party purchaser.

It’s for our own good: Endeavor said the sale of OpenBet was a “necessary step” for the closing of the proposed Endeavor take-private by Silver Lake. It said the MBO was likely to close ahead of that final transaction.

Carry on and keep calm: Jordan Levin, said the MBO team was “extremely confident” in OpenBet’s future.

What am I bid? The MBO at least brings to an end one of the gaming sector’s longer running M&A sagas this year.

Despite having a roster of A-list clients, such as Flutter and Entain as well as a host of World Lottery Association members, sources suggested Endeavor had struggled to generate interest in a less-than-cutting-edge proposition.

EveryMatrix delivers iGaming software, solutions, content and services for casino, sports betting, payments, and affiliate/agent management to 300+ global Tier-1 operators and newer brands. The platform is modular, scalable, and compliant, allowing operators to choose the optimal solution depending on their needs.

EveryMatrix empowers clients to unleash bold ideas and deliver outstanding player experiences in regulated markets.

+More

Hands across the desert: In a first-of-its-kind agreement, the Venetian Las Vegas is partnering with the Pechanga Band of Indians’ Pechanga Resort Casino in Southern California, allowing guests to earn rewards across both properties.

Plarium sale

Quit stalling, get back to work: Aristocrat has confirmed the sale of the Plarium social gaming unit to Modern Times Group for $620m in initial payments and a further $200m of performance-contingent add-ons.

The sale is in line with Aristocrat’s strategic review undertaken in May this year.

Aristocrat said it was an “important milestone” as the business continues to focus on its regulated gaming strengths in B&M gaming supply, iCasino supply and social casino.

Teenage kicks: Plarium was acquired in 2017 and Aristocrat said today that it generated an IRR in the mid-teens during the period of its ownership. In the year to September, it generated revenues of ~$615m and $110m in EBITA.

The $820m total including contingent payments compares with the $450m book value of the business.

Analysts at Jefferies said the sale price of 7.5x EBITA was a significant discount to Aristocrat’s group multiple but was a “positive result” nonetheless.

The team added that the sale should also “allay concerns” over Aristocrat’s ability to “rationalize” the portfolio of its Pixiu social gaming business.

Gone fishing: Aristocrat said the strategic review is ongoing with regard to its Big Fish Games unit, excluding its social casino operations such as Big Fish Casino and Jackpot Magic. Aristocrat said it would be taking a $110m impairment charge against these assets in its FY24 earnings.

Jefferies said Aristocrat can now use the scaled down Pixiu platform to focus on social casino games with “more concentrated content investment.”

The sale also gives it “more breadth” to invest into Interactive. The focus on social casino has “raised the concern of cannibalisation risk with Interactive given similarity in content,” the team added.

Join 100s of operators automating their trading with OpticOdds.

Real-time data. Proven trading tools. Built by experts. Increase your GGR in just one month. Join top operators at www.opticodds.com.

Supr, maan

Please allow me to introduce myself: A year on from the acquisition of RMG unit SuprNation, DoubleDown CEO In Keuk Kim said the company was now “increasingly confident” of being able to leverage its own core strengths into what he said remained a “highly addressable” market.

CFO Joseph Sigrist said the company was now “kicking off” the process of bringing games from the social casino arena to the RMG space. The “real work has gone on,” he added.

SuprNation generated revenues of $7.8m in Q3, helping to push total DDI revenues up 14% to $83m. Ex-RMG, the social casino unit saw revenues rise 3%, its fourth consecutive quarter of growth.

Dampener: The analysts at Macquarie pointed out the comps “get tougher from here” and noted management called out rising social casino CPAs.

“That said, the company has several growth drivers,” the team added, pointing to the continued ramp at SuprNation and the ongoing work on internally developed casual games.

+More earnings

Everymatrix: Helped by the acquisitions of FSB Technology and Fantasma Games, EveryMatrix said Q3 revenue rose 66% YoY to €45m while EBITDA was up 71% to €23m.

The company said that adding FSB had pushed GGR volume across the sportsbook business up by 15%. The trading and quants team has doubled during the quarter.

Sportsbook turnover rose 87% YoY to €1.5bn and up to €5.3bn in the LTM. Net revenue for the sportsbook business was up 85% to €11.7m.

Meanwhile, the more recent Fantasma acquisition brings with it a portfolio of well-known titles already live with over 250 customers worldwide. Casino revenue rose 78% to €23.8m while the platform business enjoyed a 30% rise in revenue to €8.1m. The affiliate services unit saw revenue rise 13% to €1.4m.

CEO Ebbe Groes said the past few months had been the busiest in the company’s history.

GAN: Ahead of the completion of its acquisition by Sega Sammy, the backend provider and B2C operator said Q3 revenues rose 24% YoY to $37.1m while adj. EBITDA was up to $5.1m vs. a $2.5m loss this time last year.

SJM: Revenue rose 28% to HK$7.5bn ($964m) with NGR up 29% to HK$6.5bn and adj. EBITDA up 83% to HK$1.04bn.

Our platform empowers operators to scale efficiently in highly-competitive and regulated markets utilising a unique set of capabilities, including:

Total Brand Autonomy: The freedom of having your own in-house sportsbook

True Personalisation: Pricing and product tailored to every customer's expectations and preferences

On-demand User Observability: Access to every single customer interaction, helping you make more informed decisions

Operate Multiple-Jurisdictions Quickly & Easily: Purpose-built tech to effortlessly scale internationally

Grow faster. Reduce costs. Challenge market-leaders with confidence.

Find out more today, book a demo.

Calendar

Nov 12: Flutter Entertainment, Genius, IGT, Light & Wonder

Nov 13: Better Collective

Nov 14: Gambling.com, Gentoo Media. GiG, Raketech, Bragg

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.