Deal for Snai will make Flutter the top online operator in Italy.

Playtech shares already on the up after Caliente settlement.

By the numbers: the August data from New Jersey and Massachusetts.

Maybe today you are singing songs with someone new.

Hard Rock Bet is all about fun and innovation. With a top ranked sportsbook & casino product, unique access to US states, and a globally recognized brand, join our team to help shape the online experiences that millions love. We’re currently seeking:

And other amazing positions here.

Gold medal hunt

Shout to the top: Flutter Entertainment has announced the anticipated acquisition of Playtech’s Italian-facing Snaitech for €2.3bn, vaulting itself to #1 in the Italian market. Playtech had said it was in exclusive negotiations with Flutter over the future of Snaitech in mid-August. The deal is expected to close in Q2 2025.

In FY23, Snai generated revenues of €947m, up 5% YoY, and adj. EBITDA of €256m across its online and retail operations.

Flutter said Snaitech achieved a CAGR of 26% and 32% respectively over the past four years.

Peter Jackson, Flutter CEO, said the deal was “compelling strategically and financially.”

M&A by the numbers: In a trading update released yesterday with the Caliente settlement news (see below), Playtech said Snaitech “continues to see underlying growth in wagers against a tough comparative while being negatively impacted by customer-friendly sporting results in Italy, particularly at the start of the year.”

Playtech said the €2.3bn price tag represented an enterprise value to EBITDA multiple of 9x.

Playtech bought Snai in 2018 for €846m. Since the buyout, adj. EBITDA has improved from €139m to €256m.

Share and share alike: Flutter said the acquisition of Snai would give it ~30% of the Italian online market, just ahead of current market leader Lottomatica, which currently controls ~29%.

It remains to be seen whether the Italian competition authorities will look into the deal.

🥇 Flutter aims for bragging rights in Italy

Cut and shut: Flutter said it expected to benefit from ~€70m of synergies from combining its Italian businesses in the three years subsequent to completion. It added that unquantified revenue synergies were also expected.

Lever: Flutter said its leverage would increase following completion, from its level as of June 30 of ~2.6x on $5.5bn of debt. It said it expected the leverage ratio to “reduce rapidly.”

Nacional ambitions: Just last week, Flutter announced a deal to buy a controlling stake in NSX, the operator behind the Betnacional brand in Brazil, involving the injection of $350m in cash.

Again, that deal was designed to grab a podium position, this time in the soon-to-regulate market.

Diary date: Flutter will be hosting an investor meeting next week, September 25.

Kero is a premier micro-betting provider, powering more than 150 operators across the globe.

Our extensive coverage of fast markets in Football, Basketball, Baseball, and Soccer is a proven method for increasing in-play handle and hold.

Talk to us about how we utilize algorithmic recommendation to power highly contextual micro markets for the ultimate in-play experience.

The Playtech side

Free as a bird: Playtech said, following the sale, it would continue as a focused tech-led B2B provider with an “accelerated” growth plan and a portfolio of strategic ventures.

One such is the reformulated deal struck yesterday with Caliente, which saw the two resolve their legal dispute, with Playtech remaining a 31% JV partner in the Caliplay venture.

Rolling in it: After completion the company said it would return €1.7bn-€1.8bn to shareholders and would also repay an outstanding €350m bond, “significantly strengthening” its balance sheet.

Playtech noted shareholder support representing ~34% of total votes had given their approval to the sale of Snaitech.

Mor Weizer, CEO at Playtech, said the transaction “represents a compelling opportunity to maximize value” for the company’s shareholders.

Premium: Investec analysts said the deal represented a “very attractive price” for Playtech. Indeed, the team at Jefferies noted the €2.3bn represented a 16.5% premium to the “undisturbed” Playtech share price.

However, the team at Peel Hunt had struck a skeptical note yesterday ahead of the news, suggesting a standalone B2B business would have a “good story to tell, but may be small for some investors.”

“Playtech may be acquired if it does not bulk up,” the team added.

Buy the rumor: Playtech’s shares were already up nearly 20% in the past five days, helped by a report from Sky News yesterday of the imminent announcement of a deal for Snaitech and its Caliente update yesterday.

Sell the fact: The shares were down 2% in early trading today, however.

🔥 Playtech on fire, shareholders are satisfied

+More

Wynn Resorts added to its debt with Deutsche Bank, lumping a further $71.8m onto the term loans and extending the maturity date until 2027.

BetMGM and USA Today publisher Gannett have announced a strategic partnership that will see the operator become the preferred OSB and iCasino partner, providing odds and betting information across the network.

Gannett previously had an exclusive deal with Tipico US, which MGM Resorts recently bought.

It also has an existing relationship with Gambling.com, which will continue to work with BetMGM.

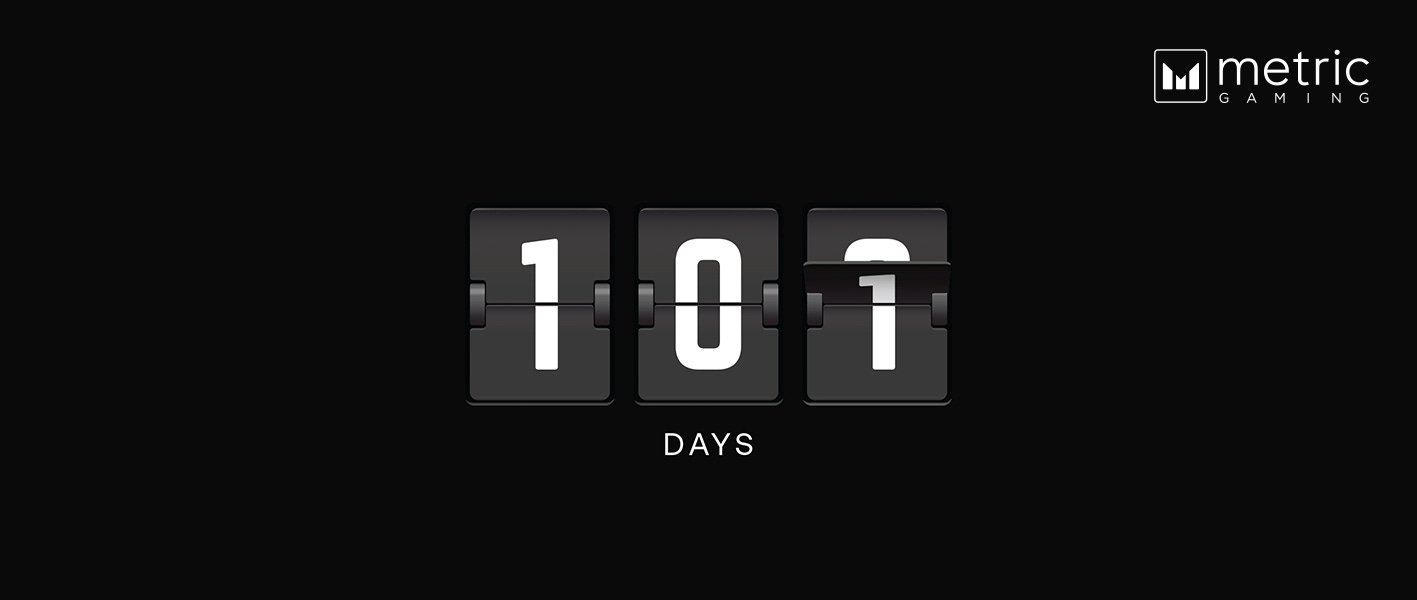

Our new, multi-tenant platform is off to an auspicious start…

Live for over 100 flawless days:

Out of soft launch in <2 weeks across 2 sportsbooks

0% downtime across multiple releases and major events

0 rollbacks across major product releases

Anyone that has endured a maiden platform launch can attest to just how significant that is.

We’ve built a powerful new tool for the industry, and we're looking to collaborate and grow alongside our partners, deploying our cutting-edge tech to launch unique and engaging new products.

Get in touch to find out more.

By the numbers

New Jersey: B&M gaming in August hit $294m, up 4.9% YoY, while iCasino GGR came in up 28% YoY to $198m but sports-betting GGR was down 35% to $62.7m.

In terms of online shares, DraftKings continued in the lead in iCasino with 25%, followed by BetMGM and FanDuel, both on 21%.

MoM moves saw FanDuel gain ground at the expense of DraftKings and BetMGM.

In sports betting, the moves were more dramatic. Although FanDuel remained on top with 40%, down 100bps, DraftKings shipped over 700bps of share to 26% from 33%.

They were followed by BetMGM (9% vs. 7% in the prior month), Caesars (5%), ESPN Bet (4.5%) and Fanatics (5.5%).

Massachusetts: Sports-betting GGR of $34.5m was 47% up YoY on handle that rose 42% to $447m. DraftKings led by GGR with 49%, followed by FanDuel (32%), BetMGM (7%), ESPN Bet (4%) and Caesars (2%).

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

Calendar

Sep 25: Flutter investor day

Sep 30: Playtech

Oct 17: Entain

Oct 24: Betsson, Evolution

Oct 25: Kindred

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.