Early data from Kalshi’s March Madness markets.

In +More: XLMedia’s North America earnout disappoints.

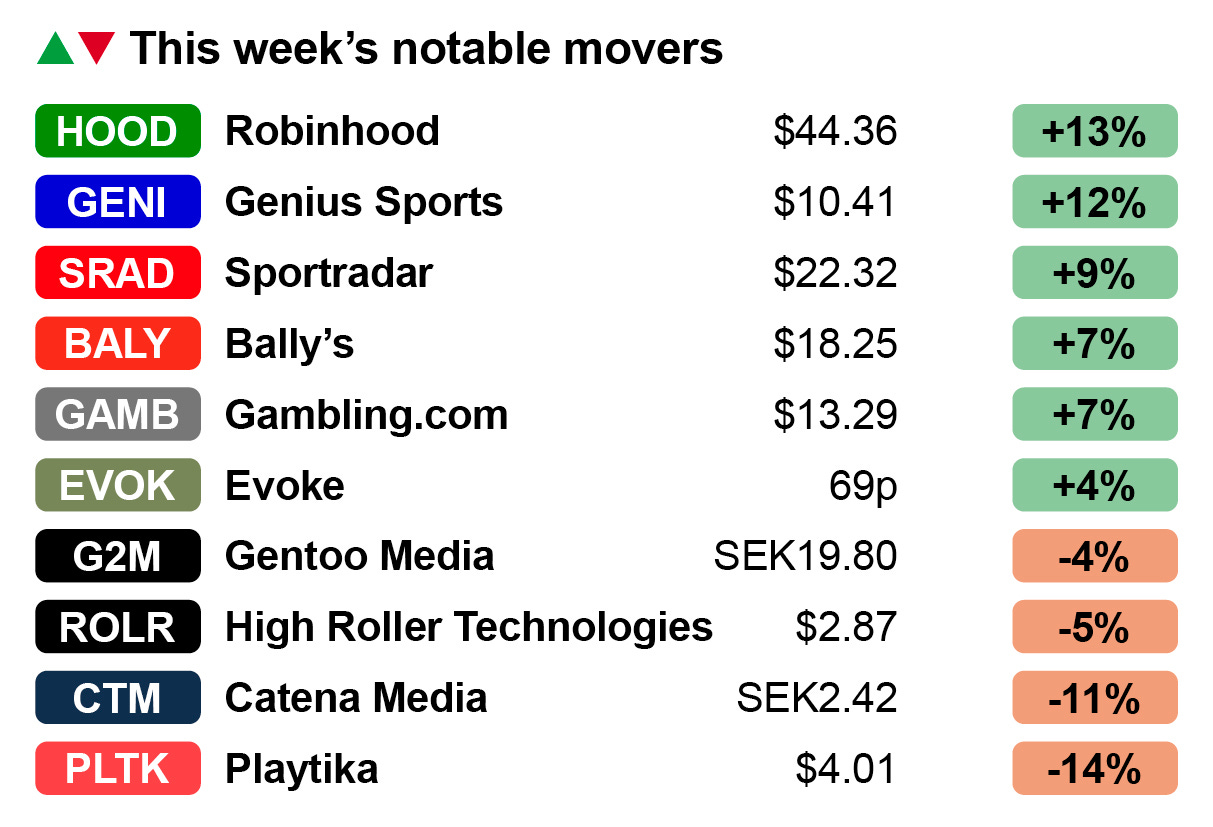

Markets watch: Robinhood’s double-digit gains on predictions launch.

The teardown: iCasino growth rates examined.

Hard Rock Bet is gearing up for 2025 with a focus on amplifying brand and product engagement. With a powerful, custom-built bonusing system and an ambition to redefine traditional CRM, we’re seeking leaders who are driven to challenge the status quo:

And other amazing positions here

Gangbusters

Let the madness begin: The volume of bets recorded by Kalshi on the men’s College Basketball Championships topped $143m by the end of Saturday and rose to $193m overnight on Sunday, in the first weekend of trading on the leading prediction market.

This figure represents just over 7% of the $2.63bn estimate from EKG for total volumes bet on March Madness across regulated states.

Known unknowns: Trading will have been boosted to an unknown extent by the inclusion of volumes from Robinhood, which launched its Robinhood Derivatives operation just last week.

You’re in whether you like it or not: Notably, Christopher Gerlacher, industry analyst at Prediction News, told E+M that Robinhood “forced an app update for users wanting to access their March Madness markets.”

“This blurs the line between marketing and ops as well,” he added.

Blurred lines: The other area that is far from clear is whether or not the volume figure represents the equivalent of handle. “Trading volumes tend to include both the back and the lay side of a transaction, which is a logical expression of activity because at least in theory there is a third party on either side,” said Paul Leyland at Regulus Partners.

In contrast, betting handle represents just the backers, with the sports book being the in-house layer, he added. “If the layer trading volume comprises genuine customers, then trading volumes can be compared to betting handle directly.”

“If on the other hand a lot of the layer volume is professional or in-house ‘market making’, then the comparable B2C market size figure is only half the trading volume.”

50/50: The extent to which the volumes being bet comes from unregulated OSB markets, particularly California and Texas, vs. the regulated states is also very much unclear. Kalshi was making much of the point in its social media over the weekend that this was sports betting in 50 states.

Robinhood boasts 25 millions users of its various trading services.

Analysts at Morgan Stanley recently suggested Robinhood could emerge as a major player in the biggest shakeup to the US sports-betting market since the repeal of PASPA in 2018.

The team also suggested prediction markets might be worth upwards of $1.7bn in annual TAM across both regulated and unregulated states.

Get involved: Last week, the analysts at Citizens reported back from a meeting with Jason Robins and the team at DraftKings that the company was “rooting for” a positive ruling from the Commodity Futures Trading Exchange on allowing sports-based prediction markets.

A CFTC roundtable to discuss prediction markets will be held in the coming weeks, with many presuming the format is now a done deal following the appointment of Brian Quintenz, a Kalshi board member, as chair.

According to Sportico, a CFTC official said via a statement that the regulator “has no legal justification to prevent Robinhood from offering access to these contracts.”

Disruption ahead: Notably, Kalshi is offering interest of 3.7% APY on all deposits, similar to Robinhood, which currently offers 4% on any uninvested funds in a player’s account.

The Kalshi interest rate also applies to any monies in open positions.

Perplexing: The prediction markets aren’t just shaking up the market in terms of breadth of potential markets. Also last week, Kalshi signed a deal with Perplexity AI to provide real-time pricing and odds news via the app.

Tarek Mansour, CEO of Kalshi, said via an X post that “for too long, price discovery and odds-making have been a black hole – that changes with prediction markets.”

Are payments getting in the way of your progress? A poor payments experience can lead to many operational problems, including higher fraud, increased player churn, low conversion rates and more.

PayNearMe is a payments experience management platform that enables you to streamline deposits and withdrawals, increase acceptance rates and radically drive down your total cost of acceptance—all with a single, modern platform.

Take the first step toward progress: www.paynearme.com

+More

XSmall: Sportradar will pay XLMedia only $1m of the potential $10m earnout consideration following the sale of its North America-facing gaming affiliate business last year. Sportradar paid an initial $20m for Sports Betting Dime and other assets. XLMedia is also due a further earnout of up to $5m from Gambling.com in relation to its European-facing assets. It said the aggregate earnout amount across both the US and European disposals would be $3m-$5m.

Star Entertainment’s largest shareholder has come out in support of Bally’s proposed offer to acquire a majority stake, according to the Australian Financial Review. Billionaire publican Bruce Mathieson, who holds a 10% stake in the Sydney and Brisbane casino operator, will reportedly chip in $50m on top of Bally’s $250m in return for a doubling of his stake and board representation.

In brief

High Roller Technologies: Q4 revenue rose 12% YoY to $8.1m while net losses doubled to $5.9m. CEO Ben Clemes said the business, which IPO’d in October last year, was “taking steps to implement a strategic realignment plan” that has strengthened its balance sheet. It recently launched Fruta.com in various markets and is in the process of applying for an Ontario license.

Quick takes

Gaming affiliate Gambling.com is the “best house in a bad neighborhood,” according to the analysts at Truist. The team noted the company’s Q4 earnings last week showed it “continues to thrive with a runway for continued growth” as it strives towards its medium-term goal of $100m of EBITDA.

What we’re reading

DraftKings’ adventures in sports content look to be drawing to a close. The company recently cut ties with sports media broadcasters Mike Golic Sr. and Jr. as well as ex-ESPN star Trey Wingo, while a report from Puck said Marie Donoghue, chief business and growth officer, previously at ESPN and Amazon Prime, who spearheaded the push into content is to leave in April. “In retrospect, the gaming industry’s dalliance with media may have always been misguided,” said the report.

The week ahead

Playtech will report its FY numbers on Thursday. This will be the first set of results since last December’s investor revolt last year over the scale of the management incentives derived from the sale of Snaitech to Flutter. The latest news from Playtech came on Friday when the company announced that Mexican antitrust approval has now been received for the revised arrangements related to its strategic agreement with Caliplay.

Evoke: The day before, Evoke comes to the plate and likely with a positive story to tell about its key markets of the UK and Italy. In its January trading update, the company Q4 revenue grew ~12-13%, driven by online, and leaving H224 revenue up ~8%. Adj. EBITDA is likely to be at the high end of previously communicated guidance of £300m-£310m.

Markets watch

Tip off: The launch of its prediction market offering with a full slate of March Madness games helped push investor interest in Robinhood, which enjoyed a double-digit gain over the week, up 13%. It leaves the stock up nearly 20% in the year to date but still down 32% from its mid-February highs.

Also gaining this week are the data suppliers Genius Group (+12%) and Sportradar, up 9% on the week after it announced it was to be paid to take on the IMG Arena betting and gaining data rights deals.

Analysts welcomed the news of the deal, which points to further consolidation in the data and betting rights supply space and will, the analysts noted, be immediately accretive.

Also reporting last week was Gambling.com, with the analysts at Macquarie noting it “continues to be a standout performer in the affiliate space.” The company reported Q4 revenue and EBITDA YoY growth of 9% and 39% respectively, and the shares received a 7% uplift in response.

Less positive was the performance of rivals Catena Media, down 11% on the week on no specific news and now down 40% YTD.

Also in the doghouse, albeit to a lesser extent, was another gaming affiliate provider Gentoo Media, which was down 4%.

This came despite further buying activity from STS founder Mateusz Juroszek’s investment vehicle, who added 28k of shares to his 25.2m holding.

EveryMatrix delivers iGaming software, solutions, content and services for casino, sports betting, payments, and affiliate/agent management to 300+ global Tier-1 operators and newer brands. The platform is modular, scalable, and compliant, allowing operators to choose the optimal solution depending on their needs.

EveryMatrix empowers clients to unleash bold ideas and deliver outstanding player experiences in regulated markets.

The teardown – iCasino

A glitch in the matrix: The iCasino growth rate across the six states – Michigan, Pennsylvania, New Jersey, Connecticut, West Virginia and Rhode Island – was consistently strong throughout 2024, with GGR YoY growth rates of 27% for the 12 months.

That strength continued into 2025 with January coming in at over 33%.

No leap: But February was less impressive with a rate of growth that came in at just over 16%. Noting the deceleration, the analysts at Deutsche Bank identified a number of factors that might help explain the slowing pace.

First, February had one last day this year due to February 2024 being a leap year.

Second, DraftKings saw a customer hit a $9.3m jackpot during the month. As noted last week, this saw DraftKings drop 450bpts of market share over the month.

Michigan’s February growth rate came in at 18%, Connecticut was 19%, New Jersey was 14% and Pennsylvania was 12%, while the standout was West Virginia, which was nearly 54% ahead of the prior-year number.

“Anecdotally,” the DB team noted slot promotions in Pennsylvania – which remains the only state that provides this disclosure – showed promos as a percentage of slot GGR was up 340bps or over 26% YTD25 vs. just below 23% for the same period in 2024.

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

Upcoming earnings

Mar 26: Evoke

Mar 27: Playtech

Apr 23: Churchill Downs (earnings)

Apr 24: Churchill Downs (call)

Apr 30: Evolution

Join 100s of operators automating their trading with OpticOdds.

Backed by the resources of $GAMB, OpticOdds has the industry's most advanced, comprehensive odds data and is poised to drive innovation and growth like never before.

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.