The sector’s leading lights have a combined value of over $150bn.

In +More: Carruthers resigns, Apollo pays $550m Venetian divi.

Evoke enjoys a “Winner’ bounce.

By the numbers: Caesars sloughs off its sponsorship commitment.

Hard Rock Bet is all about fun and innovation. With a top ranked sportsbook & casino product, unique access to US states, and a globally recognized brand, join our team to help shape the online experiences that millions love. We’re currently seeking:

And other amazing positions here.

Shining lights

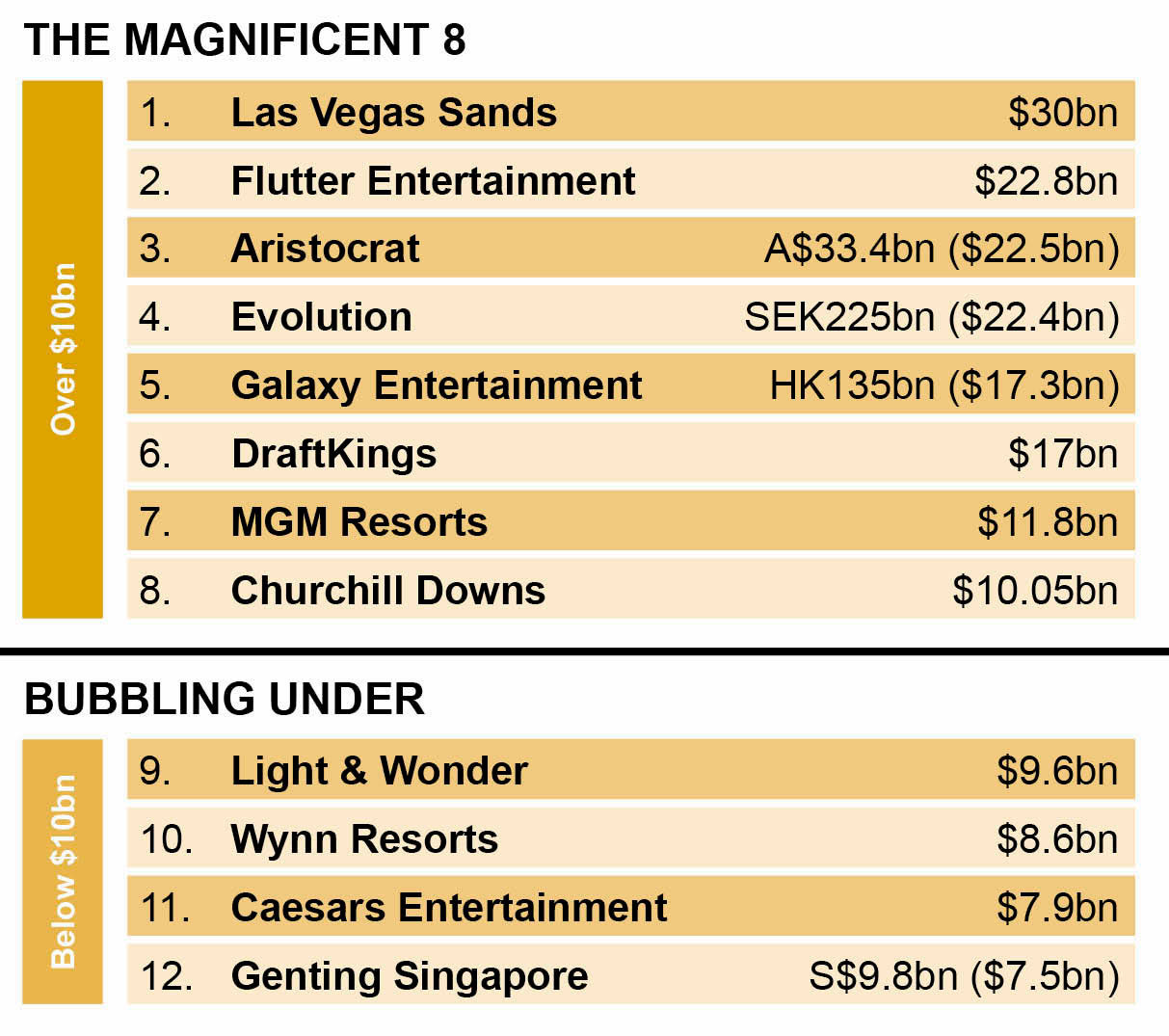

Magnificence: The eight listed companies in global gaming with market caps of at least $10bn currently have a combined value of around $154bn. However, the extent to which they impact the overall direction of travel within the sector is debatable.

Roll call: In order of market cap, the eight biggest players in the space are Las Vegas Sands, Flutter Entertainment, Aristocrat, Evolution, Galaxy Entertainment, DraftKings, MGM Resorts and Churchill Downs.

The movements of the biggest stocks in the betting and gaming space likely have less impact on the fortunes of their own sector than the Magnificent Seven.

The value of gaming’s biggest stocks is naturally dwarfed by the combined market cap of the Magnificent Seven – Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla.

Together they are worth an almost unimaginable $15.4tn and how those seven stocks perform impacts global markets in their entirety.

Still, the size of the sector’s leaders by market cap indicates that it is one that institutional investors cannot ignore.

Reading the runes: Other than the name of the sub-sector in which they sit, no discernible sector-wide trends account for their recent share price movements.

The widespread pessimism around the fortunes of the Macau market account for the poor performance of Las Vegas Sands and Galaxy which are down 21% and 30% respectively.

Flutter’s switch to a primary listing in the US has helped drive a 16% uplift in its share price while despite its recent tactical missteps, rival DraftKings is still up 8%.

Gaming supplier Aristocrat, up 31%, is riding a wave of optimism surrounding its future prospects as it moves to complete its NeoGames acquisition.

Perhaps surprisingly, the leading iCasino supplier Evolution is down 12% with stock-specific issues – striking workers, for instance – causing shareholder unease.

Across the board: If any stock can lay claim to bellwether status given its spread of interests it is MGM Resorts. With a business spanning Las Vegas, an element of US regional gaming, a footprint in Macau and interests in online, it is the nearest the sector gets to a gaming conglomerate.

However, it is fears about ‘peak Vegas’ that are likely behind the 14.5% decline YTD in its share price.

A better showing comes from Churchill Downs which has built solid investor support, in particular, for its efforts at widening the footprint of HRM operations. It is up 3% YTD.

Bubbling under: A handful of companies within space stand a chance of breaking through the $10bn barrier, among them gaming supplier Light & Wonder, Wynn Resorts, Caesars Entertainment and Genting Singapore.

Bubbling away: But likely the most significant moves within the sector in the coming months will affect the lower reaches of the top 10 placings within the US-listed space.

Currently sitting in 10th and 11th place in the US list are, respectively, Boyd Gaming and Penn Entertainment which, if reports are to be believed, are potential merger candidates.

Again, while a simple 2+2 doesn’t work, the significantly enlarged regional gaming footprint of any combined entity might excite more investor interest.

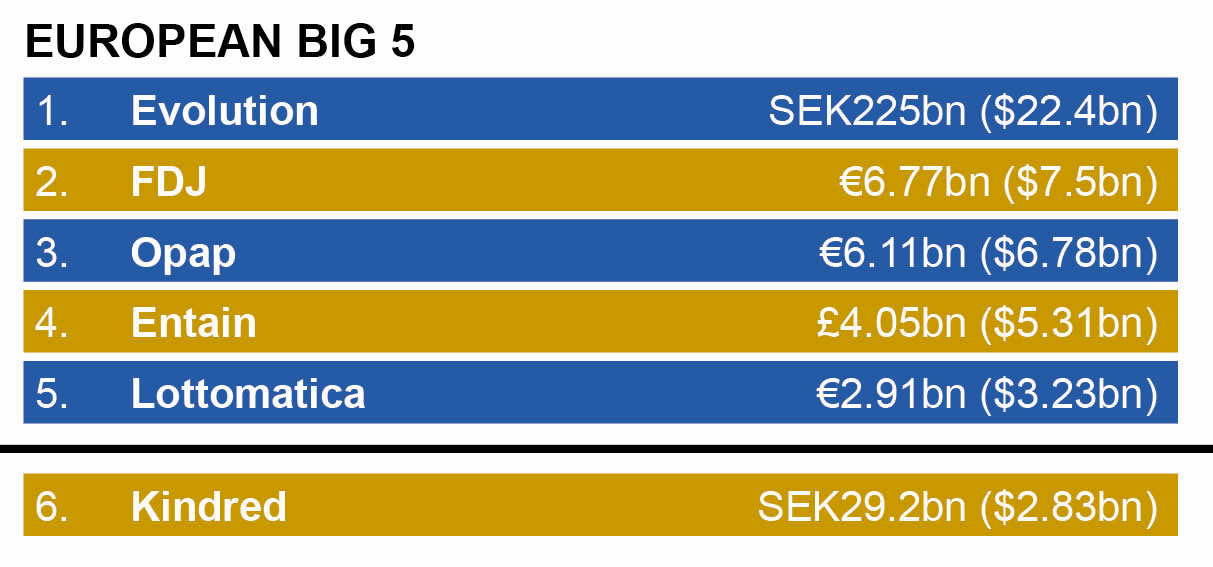

Cordon Bleu: Also potentially eyeing a place in the top bracket is Française des Jeux (FDJ). It is currently worth €6.77bn (or ~$7.5bn) but is in the process of finalizing the acquisition of Kindred.

Again, the simple addition of market cap doesn’t necessarily occur. But the French lottery operator hopes the additional business heft will encourage its investors to value the business more highly.

London’s burning: The extent to which Flutter’s move was necessary for the company is on display in the European table where London listings have a sole representative in Entain, currently worth £4.05bn (or ~$5.31bn).

Metric’s new multi-tenant sportsbook technology provides a shortcut to crafting a bespoke, premium sportsbook from the ground up, complete with operator-owned IP and built on highly performant technology, free of technical debt.

Our philosophy is to deeply understand our partner’s business and treat it with similar care to our own. We aim to collaborate with ambitious brands to help them realise their long-term growth potential in regulated markets, globally.

For sports betting businesses looking to finally take control of their sportsbook, there is no faster route to competing on product and price.

To find out more, visit www.metricgaming.com

+More

Crown Resorts has announced the departure of CEO Ciarán Carruthers at year-end with current president and COO David Tsai to become acting CEO from 1 September.

Apollo has received permission from the Nevada Gaming Commission to distribute $550m to its investors following what the company terms a “remarkable” performance in the past two years from the Venetian Las Vegas.

The remaining free cash will be reinvested in the $1.5bn remodel of the property. Recall, the effort will be partly financed with a $700m contribution from the gaming REIT Vici Properties.

Walk on part: Entain’s Ladbrokes brand has signed a multi-year partnership to become Liverpool FC’s official betting partner in the UK and Ireland.

The week ahead

GiG and Rivalry represent the tailenders of the Q2 earnings season with the GiG reporting on Wednesday, likely its last earnings before the company officially splits, and the latter esports betting-focused Rivalry coming the day after.

Ahead of its earnings, GiG this morning announced the completion of the previously announced €3.2m deal to buy Titan to add to its affiliate services business.

The shares week

Better things: Gaming affiliate giant Better Collective’s earnings last week pulled the rug out from under the share price as investors digested the message around the altered picture for media partnerships. The shares were down 3% on the week and are off by 15% YTD.

As the analysts at Jefferies said, the uncertainty over Google's treatment of third-party content has “weighed” on the shares since Q1.

But the team noted they do not expect any material change to 2024 EBITDA with guidance from the company unchanged at between €130m-€140m.

Evoke enjoyed a 9% increase on the week which ended on Friday with news of the acquisition of a majority stake in Romanian bookie Winner.ru though most of the uplift came earlier in the week.

DraftKings enjoyed a 7% bump boosted in part by a recent sector note from JP Morgan which restated the analysts’ belief in the company heading into the football season.

Analyst takes

Penn Entertainment: The upcoming football season is hotly anticipated by investors in Penn Entertainment, say the team at Jefferies who add that the fortunes of ESPN Bet is the most discussed issue.

The team suggests that upcoming noise around early-season positive data points could see short-term upside for the shares.

“We expect Penn shares to be among the most dynamic in the group over the next several weeks,” says the analysts.

Entain: For the team at CBRE, there is “more upside than downside” attached to Entain with the headwinds “well understood” and the potential for further progress under incoming CEO Gavin Isaacs.

The analysts suggest there are further free cash flow catalysts coming from continued deleveraging driven, the team argues, by further non-core dispositions.

“We are confident in Isaacs’ track record, but the first leg of the recovery is already in motion from work implemented over the past several quarters,” the team added.

Join 100s of operators automating their trading with OpticOdds.

Real-time data. Proven trading tools. Built by experts. Meet us at SBC Lisbon & G2E Vegas. Join top operators at www.opticodds.com.

By the numbers – Caesars’ sponsorship spend

Saw them coming: After meeting with management, the analyst at JMP suggested that the company’s online division is set to enjoy a “sharp inflection” in cash flow as what amounted to $1bn worth of team and league sponsorship obligations in 2021 has now declined to $537m as of Q2.

That will lead to a “sharp inflection” of cash flow, the team suggested, with deals either rolling off or being renegotiated.

The reduction in outgoings is a contributory factor to the turnaround in adj. EBITDA prospects which now stands at a positive $76m in the TTM vs. a negative $666m in 2023.

While it isn’t likely to return to pre-2020 levels, the JMP analysts do believe there is room to shave off a further $100m-$200m by 2026.

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

Earnings calendar

Aug 28: Gaming Innovation Group

Aug 29: Rivalry

Sep 6: Allwyn

Sep 25: Flutter investor day

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.