Jobs go at Jake Paul-fronted OSB and fantasy operator.

In +More: Investors fear for Star Entertainment’s future.

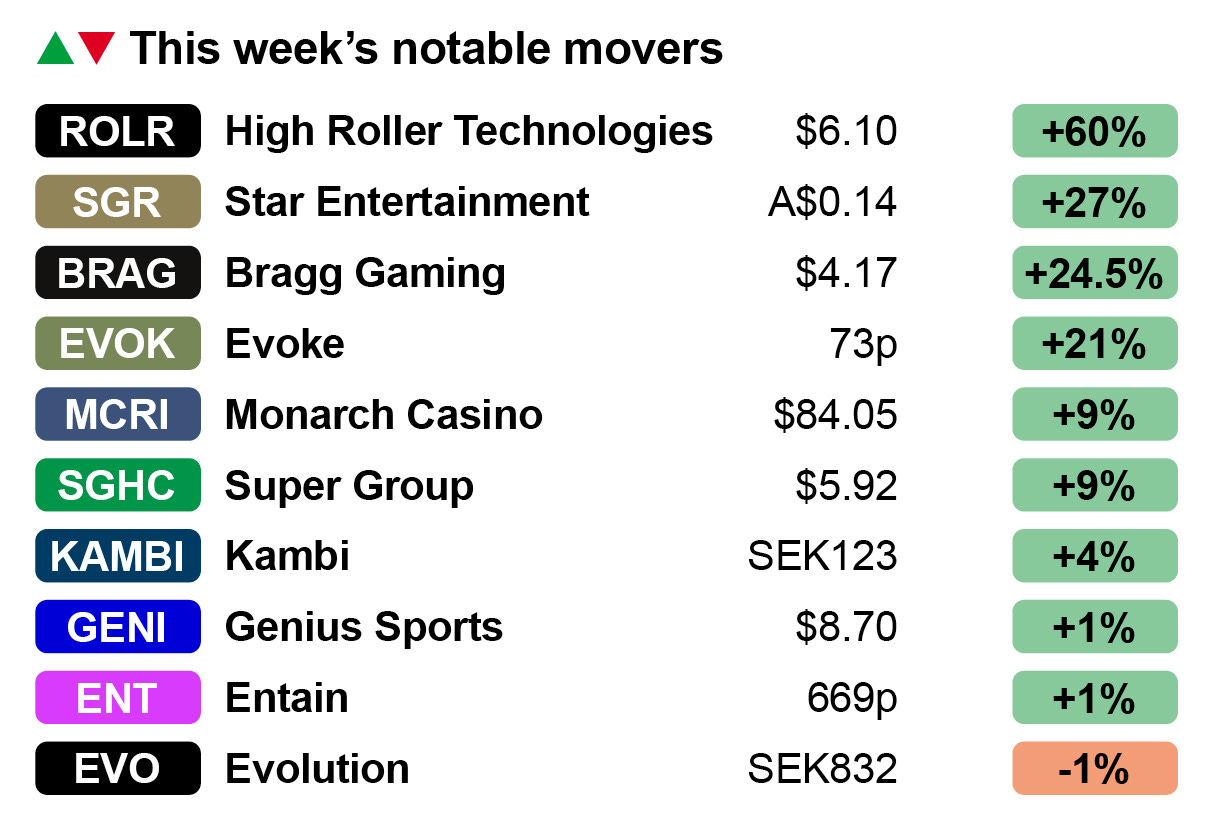

Markets watch: UK’s listed champions enjoy a rare good week.

By the numbers: Why debt remains an issue for big gaming names.

Hard Rock Bet is gearing up for 2025 with a focus on amplifying brand and product engagement. With a powerful, custom-built bonusing system and an ambition to redefine traditional CRM, we're seeking leaders who are driven to challenge the status quo:

And other amazing positions here

Low blow

N-n-n-n-n-nineteen: The OSB and daily fantasy sports startup Betr has confirmed with E+M that it has made 19 layoffs among its engineering staff in a move CEO Joey Levy said reflected the company’s “better sense of the essential personnel needed to accomplish our goals.”

Influenza: With Jake Paul playing a prominent role, Betr burst onto the scene in August 2022 promising to shake up the related worlds of sports betting and sports betting-led sports media via an exclusively micro-betting offering.

Talking up your book: Betr raised an initial $50m, with Levy talking about micro-betting as being destined to be the “predominant way people would bet on US sports.”

Levy was also a co-founder at micro-betting supplier Simplebet, which was bought last August by DraftKings for a potential $195m.

Betr raised a further $35m in June 2023, which valued the company at $300m, and then topped that up with a $15m raise in March last year, which upped the valuation to $375m.

Invisible touch: In a statement to E+M, Levy said Betr grew “significantly” in 2024, adding that the company saw “triple-digit growth across all key metrics.” However, in OSB and iCasino there is very little sign of that growth in the officially available statistics.

The re-tuned sportsbook generated a mere $73k of GGR in Ohio in December, for instance.

The company’s revenues are not visible in the official statistics in Pennsylvania and there is no market share data for Kentucky, Virginia or Colorado.

Recall, Betr exited Massachusetts in late 2023, saying it was "trading a 7 million population state for over 23 million in the net new states for collectively less economics than it would have required to renew in MA alone,"

Betr pivoted into fantasy sports last year with the launch of a DFS+ product, BetrPicks, available in 33 states plus Washington DC.

The latest download data from the analysts at JMP shows the company achieved a share of 7% in the NFL season.

All hat, no cattle; One industry source said Betr had produced “a lot of PR and Instagram posts, but no real momentum.” Another suggested it had “absolutely burnt through capital.”

Coming of age: Levy said Betr was “always evaluating how we can operate as efficiently as possible,” adding that on entering its third year of operation it was “becoming a more mature business” with a “better sense” of both its goals and the personnel needed to accomplish them.

Karma: He added that having recently completed the integration of the Chameleon platform it acquired from FansUnite in May 2023, it has “unfortunately” made certain roles redundant.

He said the people affected left at the start of this year. “This is the worst part of the job, but is necessary to ensure we are running our business as efficiently as possible.”

We simplify game development by doing the heavy lifting, so you can focus on creativity.

Whether you’re an emerging studio or an established one looking to relieve development pressure, we ’ve got you covered.

Flexible Build Support: We bring your math sheets to life and handle rollout across RGS instances.

Rapid Deployment: Get your content live in as little as 2 months.

Wide Distribution: Access key US & European markets via an extensive network of distributors and integration with chosen operators.

Future-Proof Growth: Secure a path to owning your own platform with our source code license option.

+More

We’re praying it’s not too late: Australia’s Star Entertainment has been rebuffed in an attempt to persuade the New South Wales government to give the casino operator tax relief in order for it to avoid running out of cash, as reported in the Australian Financial Review.

Volatile: The shares fell 18% in trading today, Monday. This followed a 27% rise last week.

FanDuel has launched its sportsbook in Puerto Rico and is set to open a new retail sportsbook in partnership with Cage Sports in San Juan.

DraftKings-owned Jackpocket said it has seen the largest-ever win by an individual using a lottery courier service as the winning ticket picked up the $122m Mega Millions jackpot.

Pete Sullivan, SVP for lottery at DraftKings, said it was a “groundbreaking moment.”

Roll up, roll up: Phil Ruffin, the owner of Circus Circus in Las Vegas, is reported to be considering selling up and buying another property on the Strip.

Ruffin bought Circus Circus for $825m in late 2019 and has said he is looking for $5bn.

Come on down: BetMGM has obtained exclusive iCasino rights to The Price is Right and Family Feud games show IP via a partnership with media group Fremantle.

Read across

Trump the meme coin: The crypto market hype went into overdrive at the weekend after President-elect Donald Trump announced the launch of the $TRUMP meme coin on the Solana blockchain.

“It’s time to celebrate everything we stand for: WINNING!” Trump posted on X.

The banana zone: The $TRUMP token soon soared to a market cap of $13bn. The price of Solana also hit a record high of $295 on Sunday.

The new President’s son Eric Trump declared $TRUMP as “currently the hottest digital meme on earth” on X as it soared to a value of $70bn today, Monday, ahead of the inauguration.

See The Token Word this week.

The week ahead

The tired feet of the industry will be traipsing around the Fira in Barcelona from Monday through to Wednesday for ICE.

Markets watch

Send them victorious: The two major, remaining, UK-listed gambling operators Evoke and Entain achieved a rare win on Friday when they topped the chart of winners, each up over 6% on the day.

The catalyst was Evoke’s very brief trading statement saying it enjoyed a ~12-13% revenue uplift in Q4, meaning H2 revenues will be ~8% ahead YoY.

Friday’s rise confirmed the feel-good ahead of the update, leaving the stock up 21% on the week.

Entain was up only 1% on the week despite its own positive statement on Monday.

Despite a 3% dip on Friday, High Roller ended the week as by far the biggest winner, up 60%, after the operator of the eponymous premium iCasino brand said it had agreed a strategic partnership with player acquisition and retention experts iConvert.

It leaves the shares still 21% down on the float price after they suffered a somewhat calamitous 50% decline since November.

Bragging rights: Bragg Gaming enjoyed a 24.5% boost after its Tuesday announcement of an exclusive development and technology contract with Caesars Entertainment for the US and Canada.

B&M casino operator Monarch Casino was given a 9% boost this week after the analysts at Truist reversed direction on the company.

In 2023 the analysts downgraded their rating due to fears the Black Hawk expansion was “entering later innings on growth” and Reno remained pressured.

Two years on, however, the team said both properties were “best-in-class with high-quality amenities appealing to relatively higher-end customers within their respective markets.”

The analysts also saw M&A potential, suggesting these assets and its under-levered balance sheet “could be appealing to some.”

License to spill: Among the fallers, Evolution saw a 1% decline for the week after it suffered a near 5% fall on Friday. The latest cause of instability was the news from the UK where the Gambling Commission’s CEO Andrew Rhodes made mention of Evolution’s ongoing license review.

As reported by Compliance+More, the Commission has evidence of Evolution’s games being available on black market sites targeting UK customers.

Rhodes said he didn’t understand “why anyone in the licensed industry would want to do business with a company that is supporting illegal competition.”

See C+M tomorrow for more on Rhodes’ comment.

RSI’s Delaware success

Forget your priors: Delaware has been “incredible” for Rush Street Interactive since it took over from 888 the OSB and iCasino operation on behalf of the state’s lottery, CEO Richard Schwartz told an investor conference hosted by Needham last week.

He said RSI was on track to generate ~$100m in GGR annually vs. the ~$14m achieved by the previous incumbent.

It was an “amazing result” attributable to the quality of the product and service that RSI offers, he added.

Smoothing out: Asked about the consumer-friendly NFL results in the past quarter, Schwartz said RSI was inherently less volatile than others, due, in part, to its iCasino focus but also from its exposure to LatAm and the diversification that brings within sports.

“The reality is, while December outcomes for NFL have been pretty rough, December outcomes for soccer were actually fairly book friendly,” he told the Needham analysts.

On taxes in Maryland: Talking about the news last week of a proposal to double the rate of OSB tax in Maryland, Schwartz said states would “generate far more taxes from regulating iGaming than from raising sportsbook tax rates.”

“It’s become increasingly clear that iGaming is the best route to generate revenues, increase profits for the state and protect consumers,” he added.

Genius move

Please take our money: Also speaking at the Needham conference last week, Genius Sports CFO Nick Taylor provided some color around last week’s announcement of a ~$144m cash raise.

“It was a reverse enquiry really,” he told investors.

“It was an opportunistic investment led by Wellington Caledonia and a very small number of our top existing shareholders… who are looking to put growth capital to work.”

Cold water: The cash raise prompted speculation about potential M&A, but Taylor was keen to play down the likelihood of an imminent deal.

“We maintain our high bar for M&A,” he said. “Nothing changes there.”

Pressed on what areas Genius would be looking at if it were to hit the acquisition trail, Taylor mentioned sports and media tech as being the prime candidates.

“We’re a natural consolidator of that sports technology,” he added.

Does your Bet Builder supplier or in-house Same Game Multi solution support 13 sports, including all of the main global betting sports, plus local variants and even eSports? Does your product allow your end-users to place both Pre-Match and In:Play Bet Builders across multiple sports? Can you offer cashout across all Bet Builder transactions? Does your solution use your own odds rather than another opinion of the market? If the answer to any of these is ‘no’ then come and find out why over 170 operators are using the Algosport Bet Builder solution today.

Algosport will be at ICE in Barcelona in this week, so to book a no-nonsense conversation about improving your product or increasing your revenue, please drop us a line at ICE2025@algosport.co.uk or visit www.algosport.co.uk

By the numbers

Pennsylvania: The December numbers made sobering reading for the sportsbooks with OSB GGR down 49% YoY to $47.3m. Compensation comes from iCasino where GGR rose a further 36% to $224m, the second-biggest MoM rise for the year after the 41% enjoyed in Feb24.

Across the year, the lowest percentage YoY rise was the 11% growth in September while the average YoY growth rate was 25%.

Debt tables

Weighed down: In their sector note issued last week, the analysts at Truist noted that while the interest rate environment is better at the start of this year vs. last, “uncertainty remains” and rates could stay higher for longer in 2025.

Ouch: Sensitivity to higher rates across the sector is felt particularly by those with more than 50% of their long-term debt priced with floating rates.

We’re looking in your direction, Penn Entertainment: Notably, the company most exposed by the marker is Penn, which the Truist team noted has 53% of its debt priced in floating rates.

It’s not alone in this. Red Rock Resorts, with 52.5%, and Caesars, at 50%, are similarly exposed, “leaving room for vulnerability” to any rate increases, said Truist.

The team suggested a 1% rise in base rates would cause a 5% hit to Penn’s free cash flow.

Notably, Penn also has among the worst net debt/EBITDA ratios in the sector.

GeoComply's international solutions are unlocking compliance and security for the global market, so players everywhere can enjoy seamless, worry-free gaming experiences.

GeoComply’s Brazilian solution is designed specifically for the local market, offering seamless geolocation compliance (without requiring a companion app), robust anti-fraud measures, and streamlined licensing support—all while minimizing customer friction.

Visit GeoComply at ICE Barcelona (booth #5L16, Jan 20-22) and learn how our advanced geolocation, identity, and fraud solutions safeguard your platform from account takeovers, fraudulent chargebacks, promotion abuse, and more!

Earnings calendar

Jan 23: PointsBet

Jan 29: BlueBet

Jan 30: Evolution, Rank

Jan 31: Red Rock Resorts

Most operators can't afford to invest endless resources into fraud prevention while remaining competitive.

Luckily, sophisticated fraud protection is accessible with the right payments partner through a single integration.

Extended fraud protection: Vast coverage of fraud signals with device intelligence, user behavior analytics and more

Community data: Compare payment data against a rich network of iGaming, airline and e-commerce transactions

Risk scoring: Leverage machine learning to evaluate the likelihood a transaction will result in fraud

Start fighting fraud a smarter way while reducing the cost of accepting payments with PayNearMe’s all-in-one payments platform built for the iGaming industry.

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.