Startup funding bounces back in Q1

Quarterly funding roundup, GeoComply’s Challenger event, Inside the Raise – Winible +More

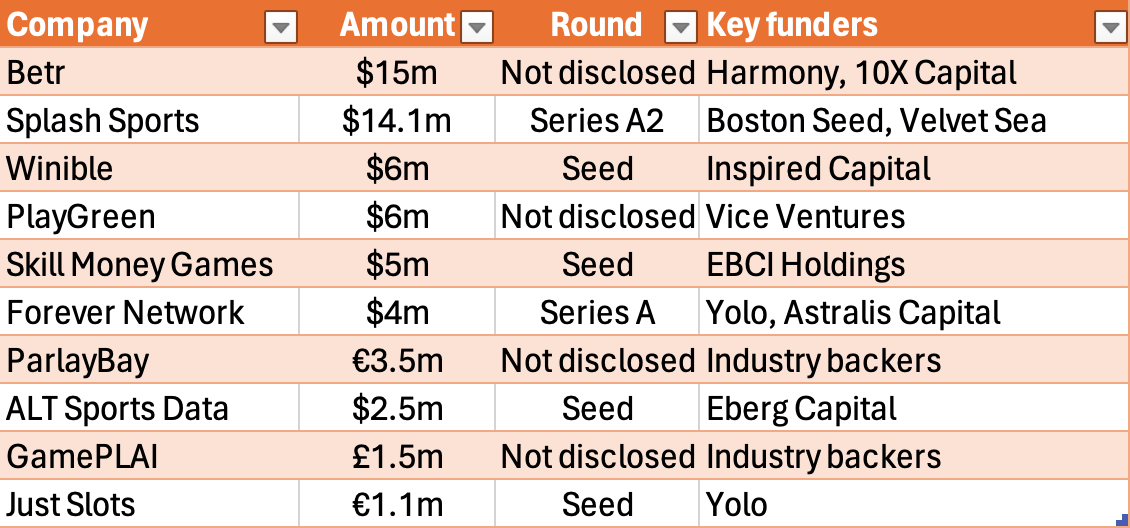

Funding for sector startups brought in over $60m in the first quarter.

In +More startups: the startup focuses from the past month.

GeoComply‘s co-founder on getting the Challenger event off the ground.

Inside the raise looks at Winible’s recent funding round.

The grime on buildings is just a memory.

Sector funding rebound

Bounceback: Funding for betting and gaming startups and scale-up companies rebounded significantly in the first quarter after a relatively poor year for raises in 2023, according to data collected by Earnings+More.

In total, E+M tracked 16 deals in the first three months of the year, raising at least $60.6m.

This is the biggest quarterly total since the $52m raised in Q223 when there were only four deals but which included a $35m raise from Betr (which raised again this quarter) and a $10m deal for Prophet Exchange.

In terms of the amount of deals, Q124 is the biggest total since E+M started tracking funding rounds in 2022. The next biggest was the 15 deals in Q322, which raised between them at least $115m.

Feeling better, again: The biggest raise during the quarter came with Betr, which raised for the fourth time, this time going back to the well for a further $15m and increasing its valuation, yet again, to $375m.

The company has now accumulated $100m, with its previous raise coming in the summer of 2023 when it snagged $35m, valuing the firm at $300m.

The new funding round added the names of Harmony Partners and 10X Capital to an already long list of existing investors including Fuel Venture, Aliya Capital Partners and Eberg Capital.

Making a splash: The next biggest raise in the quarter came from P2P sports strategy games provider Splash Sports, which achieved a series A2 led by Boston Seed, Velvet Sea Ventures, K5, Elysian Park, Acies Investments, Accomplice, Counterview and others.

Next up was the $6m seed funding round achieved by sports-betting influencer platform Winible, led by Inspired Capital. (See Inside the Raise further down in this newsletter.)

Also raising $6m was Brazilian-focused media entity PlayGreen, which intends to launch a sports-betting business. It secured the cash from Vice Ventures.

Sneaking into the top five, Skill Money Games saw EBCI Holdings – the investment arm of the Eastern Band of Cherokee Indians – lead a $5m raise.

The Zeal thing: Outside of the top 10, Zeal Ventures made its latest investment, putting €1m into UK-based prize games operator Daymade. There were also five deals where the amount raised was not disclosed.

The companies involved included no-code provider Flows, which saw new investment from Light & Wonder, and AML provider Kinectify, which received funding from gaming giant Aristocrat.

Affiliate F2P games provider 20Shots also raised new investment, as did open banking-based financial risk checks provider ClearStake, which said it secured a “seven-figure” sum.

In a similar vein, Underdog Fantasy’s in-house incubator fund GuardDog made its debut investment in single-customer view provider idPair.

Among the gaming-endemic investment funds, Yolo Investments was one of the busiest, being the lead investor in new games developer Just Slots as well as having involvement in the funding of Forever Network’s new Basketball Forever F2P game.

Also during the quarter, outside of the gaming space, Yolo invested $8m in blockchain-based The Open Network and its new Toncoin initiative as well as TON-based startups.

Above and beyond: Additionally in Q1, BeyondPlay was sold to Flutter for an undisclosed sum that sources suggested would have been “close to” $25m. The jackpot management tech provider founded by Karolina Pelc has been bought to bolster FanDuel’s iCasino offering.

Regulatory compliance is such an important feature of iGaming that it is vital to understand its role. For this reason, we spoke with our Senior Compliance Director Ohad Straschnov to understand the work he and his teams carry out.

From legal standards to contract negotiations and conforming to regulations, read the article to find out how Ohad’s team enables Soft2Bet and its partners to operate in regulated markets worldwide.

https://www.soft2bet.com/news/understanding-the-role-of-compliance-in-igaming

+More Startups

Predictive sports analytics outfit Caerus has announced a multi-season partnership with an Italian club. Caerus was formed by Mike Adams, an analytics and risk management expert who has worked with names such as FanDuel and bet365.

Startup focus – Caerus, from yesterday’s edition.

Cipher Sports Technology has launched a new service for bettors called Dimers Pro, which analyzes real-time data from over 20 leagues and, the company said, provides sophisticated sports bettors with information to inform their betting strategies. View Dimers Pro here.

Invincible: The AI-powered virtual-sports provider said the response to the beta launch of its Owners Club mobile horseracing game has been “overwhelmingly positive”, with an average of 392 NFT owners playing daily.

Sparket: The California-based sports-betting content platform has added Kent Young to its advisory board. Also this month, the company expanded its partnership with the World Jai Alai League.

Daily fantasy sports operator ThriveFantasy has failed to secure additional funding, which could result in a shutdown of the business, according to LegalSportsReport.

Lagos, Nigeria-based iCasino studio Shacks Evolution Studios has announced a strategic partnership with BetStarters.

Content provider Jogo Global has signed a deal with ITV Studios, gaining access to huge entertainment brands including The Voice and Hell’s Kitchen.

Startup focuses

Boston-based season-long fantasy sports provider Bettle Fantasy Sport.

AI-driven sports-betting tools provider SharpStakes.

LA-based gamification operator Locker.

New York-based slots developer Supremeland,

GeoComply NY Challenger event

Support group: Ahead of GeoComply’s Challenger event taking place in New York on May 7, Earnings+More spoke to company co-founder and director David Briggs about the inspiration for providing a forum in the sector for entrepreneurs and their backers to discuss shared issues and difficulties.

The event takes place at Citi’s downtown headquarters and Briggs says its involvement, and particularly the buy-in of its gaming sector investment banking lead Andrew Fabian, was crucial to getting the initial idea off the ground.

“He has gone through the startup process himself,” Briggs notes of Fabian’s time as co-founder of Betcha.

“The idea behind the event is that those starting businesses in this sector face common hurdles and that it would be worth sharing our experiences,” Briggs says.

The Challenger event debut took place last May and Briggs says that having a line-up of top-notch speakers who were willing to share their time and insights proved to be a huge success.

“What we were able to achieve was a genuine sense that this community of founders is one that actually works well together when you put them in a room,” Briggs says.

“That’s what drove the success of the first one last year and [convinced] us to try it out in Vegas last October and now again back in New York.”

Drawing in the talent: Briggs says that when it came to this year’s edition, it was the triumph of the previous two events that made it that much easier attracting speakers. “Even though we started with a group of people that I felt that I knew, it's already morphed into its own thing,” he says.

Among the line-up for New York are Karolina Pelc, who recently sold BeyondPlay to Flutter for an undisclosed sum, Tom Rundle, CEO at Dabble, and Matt Restivo, CEO at OddsJam.

“We feel that participants instinctively understand what we are trying to achieve – which is an honest interaction between founders to get the kind of insight and content and connections that frankly you are just not going to get anywhere else.”

For Briggs, that is about bringing together the “community of founders from all stages of their journey” and allowing them to “honestly share about the mistakes they made.” “Then the next generation has a better chance of skipping over a landmine or two and increasing their chances of success.”

“Plus I love the company of these folks, they are genuinely inspiring,” he adds.

Briggs says his plans for the event are to expand into other verticals, for example, the OTT streaming space where GeoComply has also established itself as a core enabling technology, and run it again with Citi.

Maximize Your ROI from Meta. Tired of underperforming Meta campaigns? InclineBet's data-driven approach unlocks exceptional results. Leverage our proven track record in Meta media buying for the iGaming industry. Drive high-value customers and unbeatable cost efficiency.

See our case studies. Visit our website. incline.bet

Inside the raise – Winible

A win win: The gaming affiliate influencer platform has raised $6m in seed funding from investors, including Inspired Capital. Earnings+More spoke to Noah Traisman, Winible’s founder and CEO, and Mark Batsiyan, co-founder and general partner at Inspired, about how they hope the money will enable the subscription-based service to leverage OSB growth.

Where’s the money going? Traisman says Winible is investing in the product and the engineering teams to provide for the “nuanced needs” of the sports-influencer community. With a new HQ in Miami set to open, the company hopes to use it as a venue for events and masterclasses for its 100-plus handicappers and what it likes to call its “betrepreneuers.”

Funding backgrounder: Winible previously raised $500k through a friends and family round, including unicorn founders and successful entrepreneurs in adjacent industries.

“The idea with all of our fundraising is that anyone who invests adds 10x in ancillary value as they do in capital contribution,” Traisman adds.

“I feel that is reflected on our cap table, which is intended to convey credibility due to who is on it more so than how much is in it.”

The company started the process for the latest funding round in December last year and Traisman says that, in Inspired, Winible found an investor that shared its long-term vision.

An Inspired choice: Batsiyan adds that what excited Inspired was Winible’s ability to generate a large audience in a capital-efficient manner. “As the sports-betting market sees exponential growth, there has been an intense amount of marketing dollars spent by the various sports books as they compete over betting customers and work to increase awareness of sports betting,” he adds.

“Winible’s approach stands out in the market; as the overall sports-betting market grows, they are positioned as the go-to platform for sports-betting experts and influencers to educate their followers on betting,” says Batsiyan.

“We anticipate sports betting to grow across sports, types of bets and beyond – meaning they can cover an ever-growing surface area of experts and consumers.

Next up: Batsiyan says Inspired is looking at further potential investments in the sports-betting space. “We continue to look at the betting and gaming space and continue to look for companies that are either innovating on exciting new business models or new technology that can benefit from the overall market growth,” he adds.

Calendar

Apr 17: Entain

Apr 18: Rank

Apr 24: Evolution, Kambi

Apr 26: Betsson

May 1: MGM Resorts

White Paper worries?

Department of Trust is the industry’s go-to platform for end-to-end frictionless and enhanced financial risk assessments anticipated by the White Paper.

Join Rank Group plc and other leading operators in getting a head start on the coming era of additional checks from the sector experts.

Book your demo today at https://dotrust.co.uk

Offices in London and Gibraltar. FCA, ICO registered. ISO27001 certified.

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.