Spin cycle

DraftKings needs to improve its slots game, says CEO Robins

DraftKings moves to address its under-indexing on slots-first customers.

Kalshi pre-game pricing is worse than FanDuel or DraftKings, says Citizens.

Earnings in brief: Allwyn benefits from root-and-branch UK lottery overhaul.

The teardown: Macau has staged a summer recovery but will it be sustained?

Hard Rock Bet is growing – we know you know! And we want to bring in some more maestros to make beautiful music in our Sportsbook. You need to be among the very best in the industry to be considered for these roles. Are you up to it?

The reel thing

You spin me right round: DraftKings has enjoyed success in converting sports-led customers to iCasino tables games and a proprietary crash game called Rocket, but has failed to engage the slots-first customer, according to CEO Jason Robins.

Speaking during a fireside chat with analysts at Bank of America late last week, Robins said DraftKings had done a “very good job” on the cross-sell from sports to table games.

But he added that the company “maybe didn’t appreciate” the opportunity of targeting the slots-first customer.

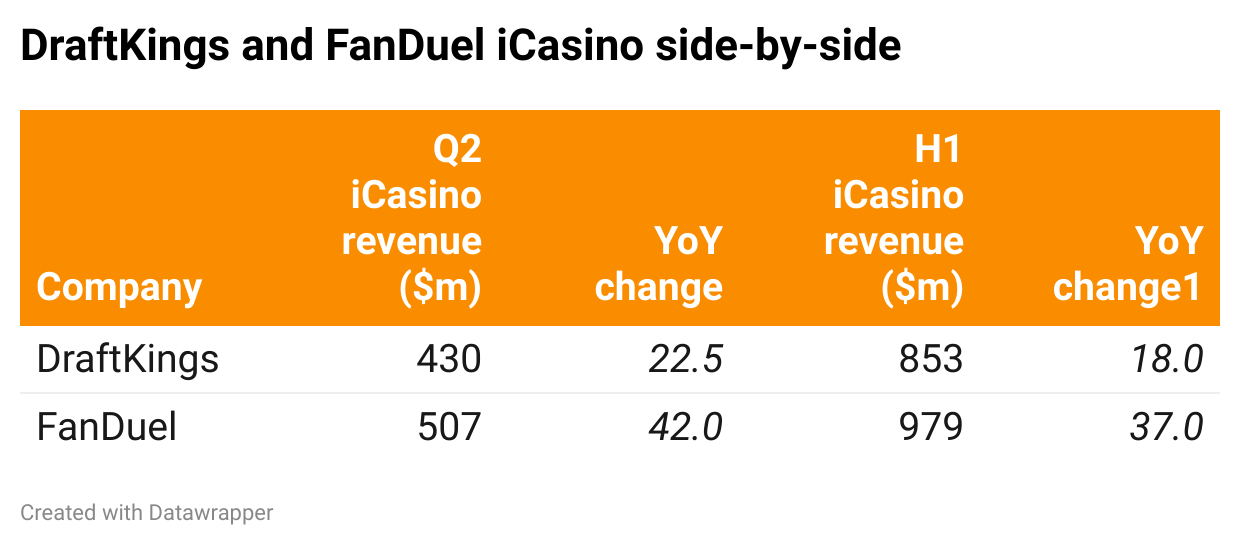

By the numbers: In Q2, DraftKings generated iCasino revenue of $429.7m, a 22.5% increase YoY, while the H1 number of $853.1m was 18% ahead of the prior-year period.

In comparison, FanDuel iCasino revenue hit $507m in Q2, a 42% YoY leap, while the H1 figure stood at $979m, a 37% uplift.

The other half: Analyzing DraftKings iCasino performance, Robins said where DraftKings had gone wrong was not with the product. “We have the product, we have the games, we have the setup,” he said.

Instead, he said the shortfall in revenue was caused by the “marketing and who you’re going after.”

DraftKings had failed to “orient” the sites to focus on the slots-first customer but the company was now “making dramatic improvements” and “focusing on the right thing.”

You make me feel mighty reel: In a note last week, EKG suggested FanDuel had “ridden a multiyear brand and product overhaul,” which was now being seen in its earnings.

The analysts suggested the female demo had been a “major driver,” with ad content, slots GGR mix and app data suggesting rising traction with women players.

The team said that, in comparison, they expected DraftKings to better foreground its slots content and potentially play on a Queen/King creative dynamic.

“That approach could open new resonance with female customers without abandoning its core sports identity,” the team added.

It’s not you, it’s me: Asked by the analysts whether the renewed slots push would come via either the DraftKings or the Golden Nugget brands, Robins said it would be both and noted that Flutter’s recent push on iCasino was “not through a separate brand.”

“I'm not convinced that the brand is the problem,” he added.

“I think it is the way that we have been marketing and who we have been marketing and targeting.”

Get it right this time: Robins said last week that if the company gets the mix right going forward and is “even able to get to half of the share that we have of the table games side of the market with slots, we're going to have a tremendous amount of growth in the next couple of years.”

Jackpocket boost

Robins also spoke about the benefits DraftKings was seeing from the coincidence of a $1.8bn Powerball/Mega Millions jackpot that was won this past weekend.

It represented the somewhat belated realization of the original thesis behind buying Jackpocket in the first place – that big jackpots would unlock huge sign-up numbers.

The timing of the big jackpot on the eve of the opening weekend of the NFL, “couldn’t be better timing,” said Robins.

For more of what Robins told the BofA analysts, see today’s Earnings Extra edition (PRO subscriber only).

Does your Bet Builder supplier or in-house Same Game Multi solution support 13 sports, including all of the main global betting sports, plus local variants and even eSports? Does your product allow your end-users to place both Pre-Match and In:Play Bet Builders across multiple sports? Can you offer cashout across all Bet Builder transactions? Does your solution use your own odds rather than another opinion of the market? If the answer to any of these is ‘no’ then come and find out why over 170 operators are using the Algosport Bet Builder solution today.

Kalshi odds comparison

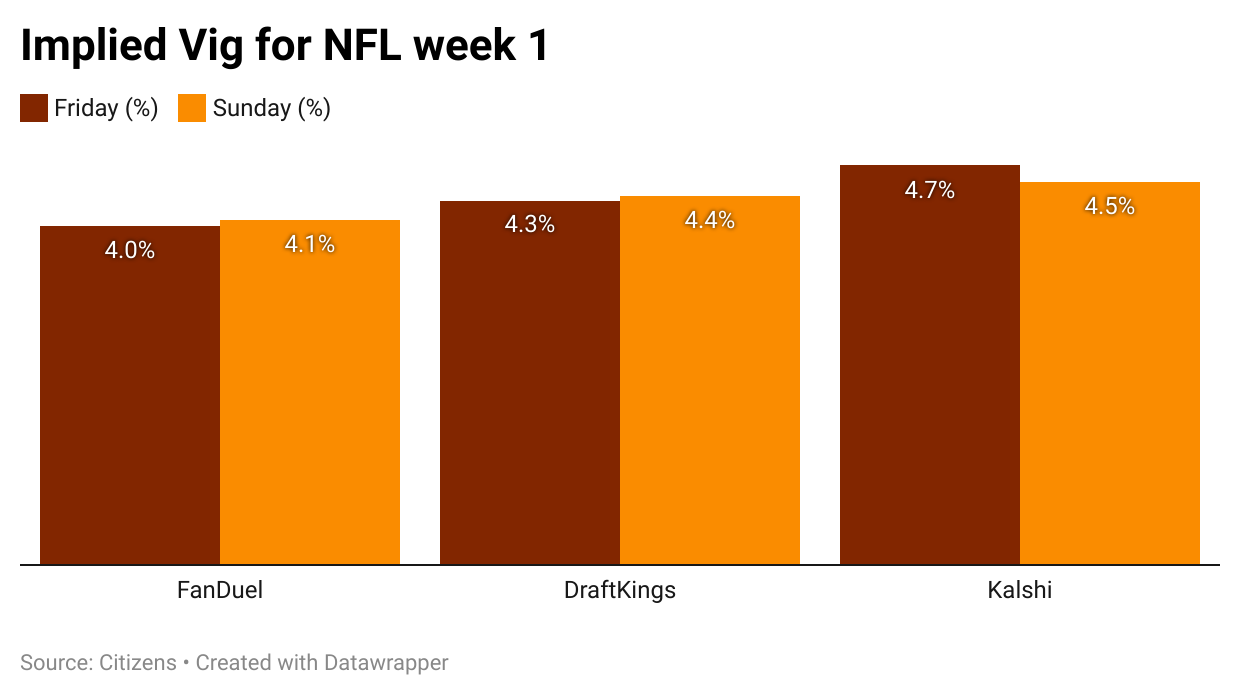

Oddschecker: Kalshi offered worse odds than the OSB market leaders in the first weekend of the NFL, with pricing that was up to 23% more expensive than FanDuel on Friday night’s NFL slate, according to analysis from Citizens.

The analysts found that Kalshi failed to deliver on the expectation of better exchange pricing.

Instead, there were distinct differentials between Kalshi on the one hand and FanDuel and DraftKings on the other.

Citizens found that pricing on Kalshi for the money line and over/under was 10% and 25% more expensive compared to DraftKings for the NFL slate on Friday, and 16% and 23% more expensive compared to FanDuel.

Pricing tightened between the traditional sportsbooks and Kalshi for Sunday’s games, yet the average of the money line was still 7% more expensive compared to FanDuel/DraftKings, with over/under 10% more expensive.

If the gap fits: Citizens said it will be monitoring pricing during the season to see if the gap between Kalshi and the major sportsbooks closes. “If we see the spread starting to tighten, it implies the model is working (higher liquidity) and/or Kalshi is offering fewer incentives to market makers,” the team added.

“In our view, the spread should narrow as user adoption (and liquidity) improves throughout the football season.”

Whale meet again: Citizens made the point that Kalshi provides more favorable terms to VIPs and institutions, who are not subject to its normal fees in order to encourage more liquidity with the ultimate goal of increasing betting liquidity and causing a snowball effect.

The hope from this is that it will create tighter pricing overall, “helping out the average consumer by providing more competitive odds.”

Even if pricing improves, Citizens remain skeptical, noting that, even as Kalshi attempts to roll out parlays, they expect pricing to be “even more inferior” compared to the major sportsbooks given the collateral that will be needed by the market makers to trade the product.

Recall, last week DraftKings’ CEO Jason Robins said prediction markets would find it difficult to “ever have as full featured an offering in a prediction market setup as you could in an online sports book,

+More

Knowing yourself is the beginning of all wisdom: One of the oldest political prediction market providers, PredictIt, is the latest site to gain approval as a designated contract maker from the one-woman band at the CFTC. PredictIt first launched political markets in 2014. Co-founder John Aristotle Phillips said: “Prediction markets help people understand the future and this approval allows us to deliver the most robust and transparent version of that vision yet.” The expanded offering is expected to launch next month.

Earnings in brief

Root and branch: Allwyn delivered a complete overhaul of the infrastructure behind the UK National Lottery delivering 30-plus new systems during H1, helping to deliver an "excellent performance, according to CEO Robert Chvátal.

UK revenues rose 14% YoY driven by EuroMillions jackpots and instant win games.

However, EBITDA remained flat at €6m, as the group invested heavily in transforming the National Lottery’s technology backbone.

The UK helped push group revenue up 6% YoY to €2.27bn, or 9% when adjusting for a one-off UK benefit in the prior year. Adj. EBITDA increased 6% to €362m while free cash flow was robust at €300m, keeping leverage at 2.3x.

Digital was once again the standout channel, with online GGR up 16% YoY and now accounting for 42% of total revenues.

Across its geographic segments, Austria was up 4%, the Czech Republic saw 9% growth, and the recent wholly incorporated Greek and Cyprus business Stoiximan saw iCasino growth hit 25%.

By the book: Strategically, the group secured a nine-year renewal of the Italian Lotto licence through 2034, acquired 25.1% of Germany’s Next Lotto reseller and completed the buyout of Stoiximan in Greece.

At the same time, it exited land-based casinos in Germany and agreed the sale of its Australian stake, continuing its shift towards asset-light growth.

Chvátal said the company was well-placed for the “next chapters of our growth story.”

E+M reported that Allwyn is thought to be leading the race to acquire PrizePicks for ~$2bn.

Powering Tier 1 operators, sweepstakes, market makers and apps worldwide.

Global coverage, sub-second latency, and comprehensive trading tools to keep you ahead of the competition.

👉 Book a Demo | Meet us at SBC Summit

Markets

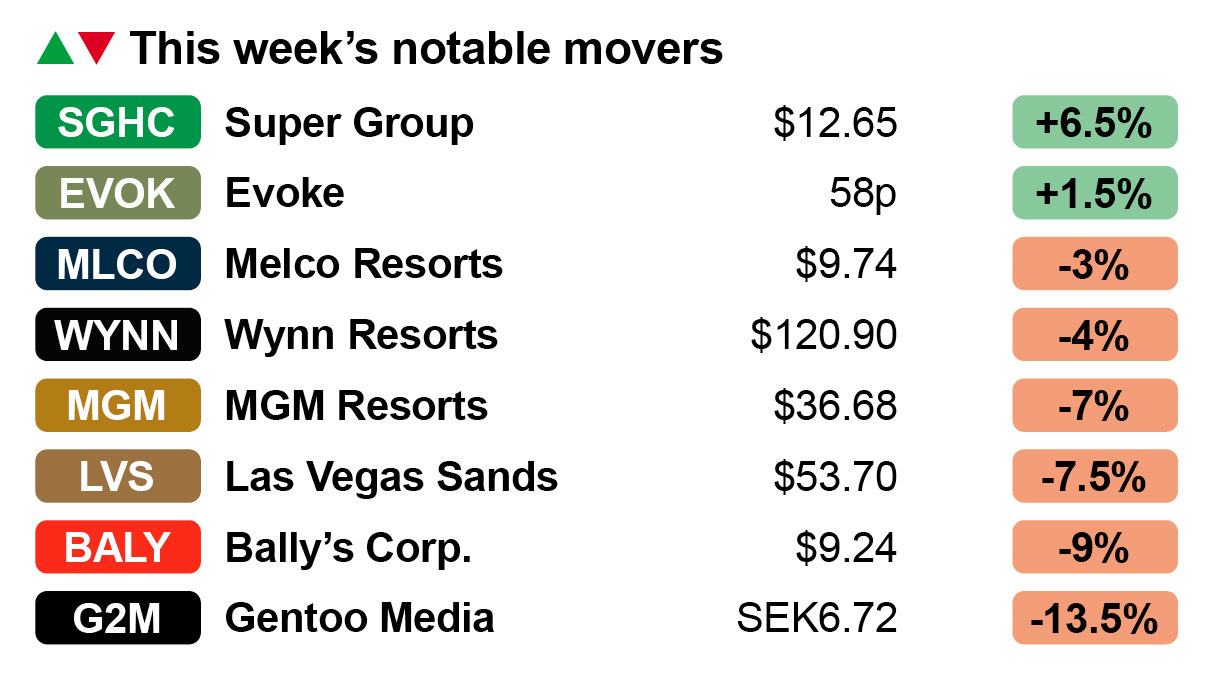

Diplomacy in action: Super Group won the week, helped by a note from Citizens that dispelled investor fears about the company’s exposure to political instability in key markets across Africa.

CFO Alinda Van Wyck told the analysts there was “no historical evidence suggesting risk around corruption or political instability impacting its operations or gaming in totality.”

Evoke enjoyed a curious day on Friday, rising nearly 5% after a late surge on Friday afternoon. This against the backdrop of continued fears over what the UK government might be contemplating when it comes to gambling taxes.

Profit-taking accounts for the share price falls among a number of operators with a footprint in Macau. See below for more on how the leading operators have enjoyed decent returns YTD.

More pain for Gentoo Media this week, down 13.5% as investors continued to absorb the news from the company’s recent earnings.

The teardown – Macau

Do two swallows make a summer? One of the longer-lasting aftereffects from the Covid era might finally be coming to an end, if the revenue data from Macau showing successive post-pandemic highs in July and August proves to be the start of the final stage of recovery.

The pandemic and the subsequent draconian actions on the part of the Chinese authorities chilled the Macau gambling market like no other.

From peak GGR of $37.9bn in 2018 the market dropped to as little as $5.28bn in 2022 as Covid restrictions continued to hamper the immediate recovery.

The market did bounce back somewhat in 2023 to $22.9bn and then again in 2024 to $28.4bn, but this was still some 23% below the 2019 figure of $36.6bn. But the data from the past two months suggests the pace of recovery is now picking up.

Total GGR for August came in at $2.77bn, a post-pandemic high, up 12% YoY and crucially a mere 8.7% behind the same month in 2019.

This follows on from July’s total of $2.77bn, which itself was 9.5% behind July 2019’s total, while June was 11.5% off and May was 18% behind.

Sounds good: While there are multitude of factors playing into the share price performances for Macau-related stocks, they have reacted positively YTD to the mood music coming from the Chinese gambling enclave.

Melco Resorts leads the way, up 68%, with Wynn Resorts also gaining 40% YTD and Galaxy up by 28%. Each of their Macau properties are thought to be gaining market share among the mass segment.

Less impressive are the 12% gain for SJM and the +4.5% for Las Vegas Sands, whose properties are thought to be losing market share.

No alarms and no surprises: Now the question turns to whether this summer surge can be maintained through the remainder of the year. The analysts, at least, are hopeful.

Seaport estimates that September will be 13% up YoY, although with a 12% sequential drop due to seasonality.

Deutsche Bank pitched their forecast slightly higher at 13.6% against the consensus of 10%.

Typhoon, Mary: This time last year Macau was affected by two typhoons, which impacted GGR in September, and Seaport warned that similar weather-related disruption could be a factor this year.

This comes ahead of what Jefferies said would be the next catalyst with October’s Golden Week.

Seaport said the improving consumer confidence – barring any worsening tariff picture – would bode well for Macau.

Still swerving around the same platform potholes?

Are you one bump away from a blowout?

Legacy drag, fragile integrations, and internal delivery gaps don’t fix themselves.

Fincore brings three generations of iGaming platform expertise, a library of proven modules, and serious tech muscle to smooth the journey and accelerate what matters.

We don’t just patch. We rebuild momentum.

Upcoming earnings

Sep 8: Intralot Capital Markets Day

Sep 11: Playtech FY

Sep 18: Super Group Investor Day

Microbetting is exploding with over 20% share of in-play handle in the

U.S. Kero leads the category with unmatched coverage across all major

sports and college, trusted by the world’s biggest operators to power

the future of live betting.

Find out more at www.kerosports.com

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.