Sizing Kentucky

Kentucky sports-betting estimates, Datalines – Ohio, Nevada conference visitors, GAN’s adverse investor reaction, startup focus – 2mee +More

Good morning. On today’s agenda:

Analysts are quick to size up the Kentucky opportunity.

The latest data suggests Bet365 is having an impact in Ohio.

Investors reacted badly to GAN’s earnings.

The startup focus is adtech provider 2mee.

Blue field opportunity

The analysts are quick to flesh out the Kentucky opportunity.

Out of the starting gate: With the ink barely dry on Gov. Andy Beshaar’s signature on Kentucky’s sports-betting legislation, JMP’s analysts suggest it will be 15th largest out of the current slate of 28 OSB states with a GGR at maturity of between $250m-$300m.

The language of the legislation appears to allow for a launch in January 2024, thus adding 1.4% of the US population to the potential sports-betting TAM.

Jefferies said the comparatively low tax rates – 9.75% for retail and 14.25% for mobile – should draw “considerable interest from digital operators”.

You don’t say: The existing fantasy sports market in Kentucky means that FanDuel and DraftKings will be in prime position to pick up early market share leadership, JMP suggests to absolutely no one’s surprise.

They also suggest Churchill Downs will likely benefit from the retail betting opportunity as well as the potential of selling the three skins it will receive as part of the legislation.

Note, the passing of the legislation has come too late for Churchill Downs’ own OSB proposition which was shuttered back in early 2022.

As per Ohio (see below for February data), JMP suggests it is likely the new launch will see “deeper initial investment, faster user adoption rates and high initial returns” compared to previous state launches.

“Kentucky launching in 2024 would result in a modest reduction of EBITDA across the board (12 to 18-month paybacks), but not impacting full-year profitability outlooks for the tier one and two online operators,” they add.

** SPONSOR’S MESSAGE ** Huddle is a next-generation technology provider for iGaming operators, dedicated to unlocking the full potential of this rapidly growing industry. Huddle’s cutting-edge automated odds feed solution offers fast, accurate pricing and trading services, helping operators increase turnover and drive margin; whilst reducing costs and managing risks. To find out more, please visit: https://huddle.tech/

Datalines – Ohio

Bet365 emerges as a meaningful competitor in Ohio.

Stoked: FanDuel and DraftKings continued their dominance of the Ohio market in February with a combined 77% of GGR but bet365 was a notable entry into the top four with 5.5% GGR share and 5% of handle.

Analysts at EKG suggested there were indications within the February data that bet365 made a post-Super Bowl marketing push.

“We continue to believe bet365 will treat Ohio as a field trial of sorts for future US markets (i.e. Texas) in which it could conceivably leverage first-mover advantage,” they add.

Notable less-than-one-percenters include Betway, betr and PointsBet while Tipico achieved just over 1%.

Making hay: Meanwhile, the team suggests FanDuel – which they argue is “less encumbered” by profit expectations – was able to use aggressive promo spend in February to maintain its handle and GGR share.

They also note, though, that FanDuel also enjoyed the best conversion of GGR to NGR, grabbing fully 81% market share.

💯 Bet365 muscles its way into the top four in Ohio

Datalines – Las Vegas Visitors

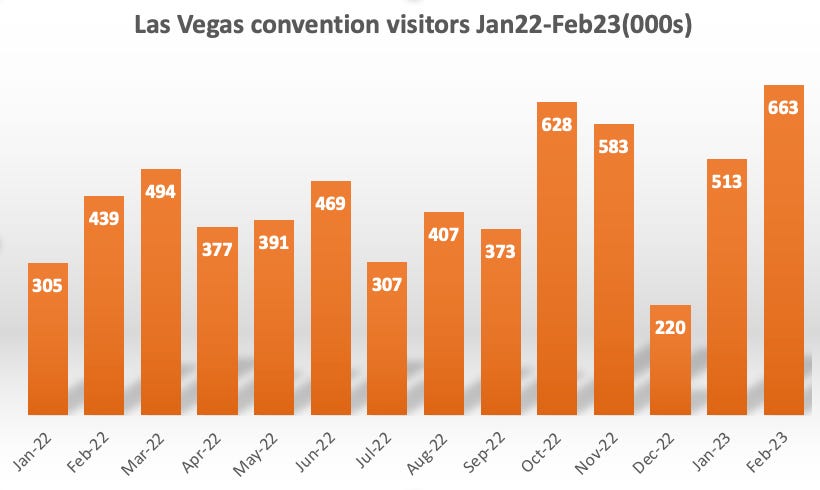

Strip revenues matched January's GGR total despite having three fewer days of activity, helped by the notable revival in conference traffic.

The Las Vegas Strip continued its record-breaking run with Strip revenue at $712m, flat MoM but up 19% YoY while the quarter to date is up 22%. JMP’s analysts noted the continued strong fundamentals including the returning convention custom.

The team at CBRE noted convention visitors were up 51% YoY “but still have room to run” as the Feb23 total is still 13% down on Feb20.

Investors are more cautious, however, about the rest of the year with “growing concerns across the economy and the banking crisis”.

🍹 Las Vegas convention visitors rebound to just below pre-pandemic levels

The shares week

Investors reacted badly to GAN’s earnings.

Cooling off period: The news AMC on Thursday that GAN has initiated a strategic review was enough to bring a 25% fall in GAN’s share price, reversing all of the gains from earlier in the week.

CEO Dermot Smufit said on the earnings call GAN would be focusing on Coolbet’s opportunities in LatAm and its B2B sports offering.

Analysts at Macquarie said last week that a potential transaction is “likely the firmest path to maximizing shareholder value at this point”.

🤮 GAN’s shares slumped 25% on Friday

** SPONSOR’S MESSAGE ** Tried, tested and proven over a decade in the highly-regulated US market, and continuing to expand across Europe, Latin America, Asia and Africa. GeoComply harnesses the power of its market-leading geolocation technology to protect against fraud, including fake account creations, bonus abuse, account takeovers, stolen identities, money laundering, and more. Visit geocomply.com.

The week ahead

The latest E+M Startup Month asks whether the evidence from the dearth of funding rounds in Q1 is evidence of the sources of funding drying up.

Further, the collapse at Silicon Valley Bank has placed the spotlight as never before on where companies stash the money given to them by investors and raises questions about the sector’s exposure in the banking realm.

In Compliance+More today, the first Career Path has been issued, the new monthly edition trends in the compliance space and how they affect the working lives of those employed in the betting and gaming sector.

Analyst takes

Bragg Gaming: Roth MKM says Bragg is one of the fastest-growing companies within their coverage noting that EBITDA growth for 2023 is predicted to be 33%. The team suggests Bragg is hoping to ramp up proprietary content and will be able to maintain distribution for all major operators in the three major iGaming states.

Earnings in brief

Gaming Realms: FY22 revenue rose 22% to £18.7m helped by a 35% surge in licensing revenues. Adj. EBITDA rose 34% to £7.8m. Over the year, Gaming Realms signed up 53 partners to its Slingo Originals content.

In the first two month of the year, revenues were up 53% YoY to £3.7m.

FansUnite: Betting Hero drove most of the group’s FY22 revenues, but on the analyst call CEO Scott Burton said in Ontario regulations are nixing any affiliate activity. He added that the Canadian Gaming Association was working with the Alcohol and Gaming Commission of Ontario and was confident activation services will go live this year.

Galaxy: The land-based and online tables games provider said revenue rose 5% to $6m while adj. EBITDA rose 30% to $3m.

Startup focus – 2mee

Who, what, where and when: Founded by James Riley in 2014, the York-based adtech provider drives engagement via sending messages through the medium of holograms for use by operators, affiliates and publishers

Funding backgrounder: 2mee’s last funding round was closed in March 2022 with £500,000 raised from unnamed tech investors.

The pitch: 2mee’s platform and efficient workflows allow operators to send influencers as advertising short-form video clips to their own sites and apps, as well as those of affiliates and content publishers.

“It's an entirely new way to engage customers, driving acquisition and retention to unprecedented levels,” says 2mee’s Brian Smillie.

He says paid media has lagged the changes in the digital landscape.

“We are still heavily bombarded with banner ads that are simply not as effective as they once were.

Customers to date include SkyBet, BetVictor, Heart Bingo, Sportsbet.io and RacingTV.

What’s new: The big news coming out of 2mee is the full launch of HoloAd in Q2. “We have beta-launched the product with a handful of partners and the early results are off the charts,” Riley says.

What will success look like? 2me is on target to triple revenues in the next 12 months, meaning breakeven will be reached just two years after commercialization.

He says the HoloAd proposition has seen “significant interest from both publishers looking to really differentiate their advertising offering, and by advertisers wanting to stand out on the page”.

** SPONSOR’S MESSAGE ** Founded in 2013, Metric Gaming is based in Las Vegas and London and developed the industry’s first truly multi-tenant sportsbook platform, purpose-built to support operators across multiple territories, regions or States. Metric is proud to be partnered with both Racebook HQ and Lacerta Sports (powered by Starlizard) and will roll out innovative MTS solutions for both racing and sports in 2023, including soccer and four main US sports. To find out more, please visit www.metricgaming.com

Datalines

Macau recorded a 247% YoY (+23% MoM) rise in GGR in March to $1.5bn, with the Deutsche Bank team noting that Q1 concluded with the jurisdiction enjoying a 95% YoY rise in GGR, even if it was down 54.5% vs. Q119.

DB forecast Q2 revenues to rise 374% YoY to $5bn and FY23 GGR to increase 293% to $21bn.

Newslines

Minor leagues: Bally's is the new media rights holder of the Minor League Baseball organization and will act as its exclusive fantasy, OSB and gaming partner.

Herr Grun: 888 has launched its MrGreen online casino brand in Germany in the past week, the first time the brand is available on 888’s proprietary technology platform.

Codere hopes to raise €100m through new debt issuance as co-CEOs Alberto González del Solar and Alejandro Rodino have stepped down after completing a strategic review. Codere will also postpone €700m in bond maturities.

On social

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.