Sep 5: UK big three's 'dollar faucet'

Flutter, Entain and 888 analyst updates, Ontario data analyst review, US regional and online update, Startup Focus - Dabble +More

Good morning. On the agenda today:

UK big three should benefit long-term from their US investments.

Analysts revisit the Q2 Ontario data and suggest they will be more accurate over time.

Startup focus for the week is Australian-based sportsbook Dabble.

UK big three analysis

In an overview of Flutter, Entain and 888, analysts at Peel Hunt expect resilience in H2.

We’ll be right back after the break: The US interests of Flutter and Entain dominate the prospects for each company as they continue to invest in their respective stateside positions, suggest the Peel Hunt team.

Geeing up investors: Noting the relatively lowly valuations for both at present, they argue that investors will be more enthusiastic over the long-term once profitability is reached.

Billy Mountain (of debt): For 888, meanwhile, a more positive evaluation of prospects will come from paying down the debt needed to buy William Hill.

Flutter

Turning on the taps: The “stand out” for Flutter is the potential for the “dollar faucet” to be turned on from 2023 onwards. Peel Hunt forecasts £72m of US EBITDA rising to £629m in FY26. With this in mind, they go on to suggest Entain is reaching a “valuation turning point” and they upgrade their target price to £160 vs. £145 previously.

Entain

Diversified: The analysts are also confident in the likelihood of Entain’s half-owned BetMGM venture hitting profitability in FY23, but they also point to the company’s new central and eastern European JV CEE Entain as a sign of its “increasing diversification”.

888

Binary choice: Peel Hunt’s top pick remains 888, which it says is the “most undervalued” of the trio but the issue for investors is “how much discount should be applied to reflect the high level of debt”. With a less developed US business, either “success of giving up” would be a positive for 888’s shares.

**Sponsor’s message** Venture capital firm Yolo Investments manages €550m in capital across 80 of the most exciting companies in fintech, gaming & blockchain. Their Gaming Fund, regulated by Guernsey Financial Services Commission, a dedicated 29-company, €183m AUM portfolio has invested in fast-growth assets including Dabble, Kalamba, SimWin & ThriveFantasy.

Yolo Investments has just opened its fund to new investors as it looks to scale new cutting-edge concepts, including its exclusive high-roller land and live casino brand, Bombay Club, global banking network & OTC desk Aims Group (aimsgroup.io).

Get in touch with your pitch or disruptive products to plug into our investment network!

Ontario analyst view

Last week’s data was missing contributions from significant elements of the market.

The team at Regulus have looked deeper into the Ontario numbers and suggest the regulatory limbo of market leader Super Group means that ~C$30m of revenue was likely ‘missing’ from the first quarter’s total of C$162m.

They add that Super Group will appear in forward licensing but will “remain distortive” into Q3.

However, they add that iGO and AGCO intend to crack down on gray market operators from November, which will drive both greater licensing visibility and more channeling.

The team also confirms the commentary around OLG’s online operation, which Regulus estimates would have been worth ~C$75m of “comparable TAM is missing”.

Adding in further gray market activity, including ~C$7m Entain’s Sports Interaction, and Regulus put the Q2 GGR at closer to C$334m.

The shares week

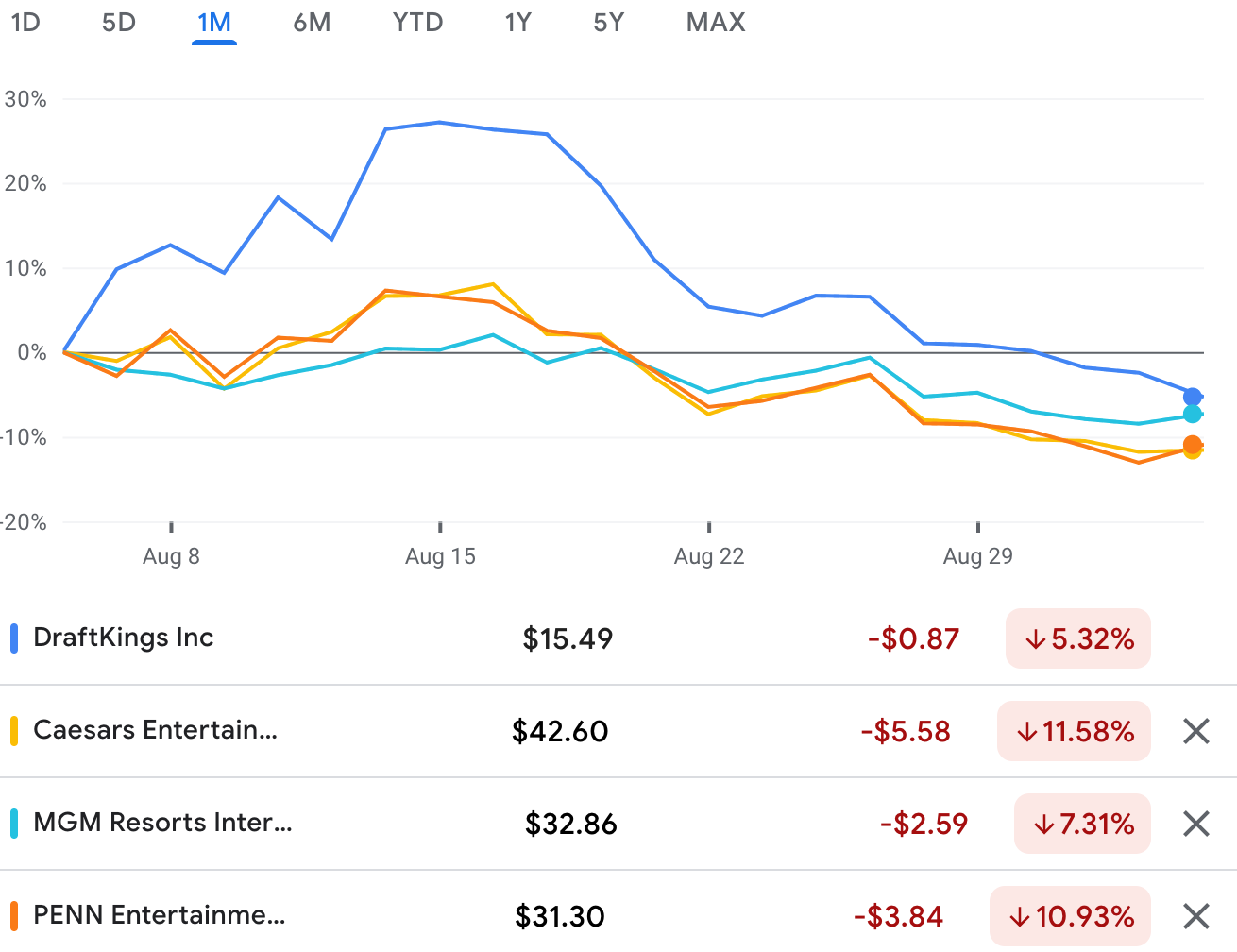

Heading into Labor Day weekend, the US sector leaders suffered a down week.

Dog days of summer: The revival in gaming stocks in the first two weeks of August turned into a late slump in the last four days as the sector was dragged down once again by wider negative sentiment around the prospects for the macro picture.

DraftKings ended the month down nearly 14% after being up nearly 16% on August 15. Caesars was down over 10% on the month and Penn was off by over 8%. Over the same period the S&P was down 5.3% and the Nasdaq over 8%

Regional and online update

Regional casino GGR was down 1% YoY in July to $3.6bn, in line with consensus, Macquarie reports.

Growth of 8% YoY came from New Jersey while Delaware was up 34% but Nevada (-4%), Mississippi (-10%) and Louisiana (-8%) - outperformers in 2021 - were “growth laggards”. Macquarie expects August to be down 7% MoM due to seasonality with Q3 forecasts unchanged at $10.2bn (-1% YoY) and estimates for Q4 coming in at $9.7bn (-2% YoY).

Top trumps: The Macquarie team said the “healthy underlying trends” made it most positive on names with strong underlying FCF, an online gaming growth strategy and preferably lower leverage.

Online growth: Macquarie added that US igaming GGR was up 1% to $392.8m for July and forecast OSB revenues of +26% MoM to $424m and Aug22 OSB revenues of $488m (+15% MoM).

September song: Kansas went live with OSB on Sep1 and despite Ontario Q2 GGR of CA$162m “slightly below expectations”, the Macquarie team said it expects recent states to see “massive acceleration” come the start of the NFL.

The week ahead

What we’re writing: Coming up tomorrow, the Startup Month for September will be looking at the new Joey Levy and Jake Paul-based micro-betting offering from Betr. Also in the same edition, there is an Inside the Raise feature on Kinectify talking to CEO Joseph Martin as well as investor Seth Young and with Ontario in the news, we have a startup (re)focus on Gaming News Canada. Check your inboxes tomorrow morning.

E+M the pod: Later in the week, the podcast returns on Thursday as Scott and Jake discuss the biggest stories from the week.

Startup focus - Dabble

Who, what, where and when: The Twitter-meets-Sportsbet Australian-based sportsbook was formed in May 2020 and has been taking bets for a year. The company was founded by Jon and Dave Robin, who previously worked in social affiliates, CTO Scott Hutchens was previously CTO at bookmaker.com.au, CEO Tom Rundle most recently was COO at PointsBet.

Funding backgrounder: $1m of pre-seed funding come from the Robins while a seed funding round was led by Yolo Group, who now own ~12.5% along with family and friends. The business is currently undertaking a $12m growth round.

What's new? In the first 12 months of trading Dabble achieved 90k actives, $200m in handle and $16m NGR. The company is pleased with the early success of its Copy Bet function where players can “copy their mates”, says Jon Robin. “This is particularly popular for 15-leg parlays,” he adds. It also recently launched its first in-app live stream video watchalong.

The longer pitch: Robin says the vision is to build a “global social media platform with local sportsbooks overlaid”. “Why shouldn't an MLB fan in Sydney be able to Copy Bet directly from someone in New York at the Yankees game? Global social liquidity is the end game,” he suggests.

Robin adds that wagering has been a one-to-one transactional experience for “far too long” and “hasn’t migrated to the shared economy”.

“Taking a screenshot and sending it to your group chat via WhatsApp is clunky,” he adds.

“Dabble is an ecosystem where it all happens in the same place. And if our Video MVP goes well, I might be changing my pitch to TikTok x FanDuel or Twitch x Sportsbet soon.

He adds that early feedback has been “extremely positive”. “We still have a very full roadmap and are only part way through the journey, but this is definitely a product that customers want.”

California regulatory update

DOA: After talking to Brendan Bussmann of B Global, Truist note that both Democrats and Republicans have now come out and said “no-go” on mobile sports-betting, suggesting the measure backed by FanDuel and the like is unlikely to pass in November.

“While there still is less than ten weeks until the election, most polling shows that 427 is dead on arrival,” the team note.

Turf protection: Truist reported B Global as suggesting the tribal entities have done a good job of protecting their home turf, but at the same point in time may have also killed their own Initiative 426.

“It is very difficult to have both ballot measures that are similar in structure to pass on the ballot,” they suggest.

Good for the ad men: “The race is already the most expensive in California history and it is far from over,” Truist conclude.

SBC/Oliver’s Wish Charity Boxing

Seven bells: Those interested in watching well-known sector figures attempt to bash seven kinds of ordure out of each other get their chance with the SBC/Oliver’s Wish charity boxing event taking place on 11 November at the Hilton on Park Lane in London.

When we were kings: Among the (mis-)matches are Daniel Beard, a partner at Partis v Vasilije Lekovic, VP gaming at Trustly and Leon Thomas, managing director and group strategy at Entain v Nick Wright, SVP business development, interactive at Bally’s Corporation.

Those wishing to donate visit http://www.oliverswish.org.uk/donate.htm.

**Sponsor’s message ** Would you like to get your brand seen by more than 2,500 decision-making executives in the iGaming sector? How about positioning your business as a thought-leader in your area of expertise? Well, sponsorship opportunities at iGaming NEXT: Valletta ‘22 are still available. Built on three core pillars of content, networking opportunities and VIP hospitality, iGaming NEXT Valletta is rapidly cementing its reputation as the must-attend business event.

In order to find out more about the available sponsorship opportunities, please contact iGaming NEXT at sales@igamingnext.com.

Newslines

Betr has launched a F2P app available nationwide on the Apple and Google Play stores. As noted above, see tomorrow’s E+M startup month for more on Betr and its micro-betting proposition.

IGT is redeeming $500m of the outstanding $1.1bn of senior secured notes due 2025 and the €500m of senior secured notes due 2024.

Wild no more: Red Rock Resorts has announced a fourth casino closure, the Wild Wild West, six weeks after it said it would be demolishing three casinos which never reopened after the pandemic. According to the Nevada Independent, the company confirmed by email the casino would shut this coming Wednesday.

Caesars has opened two new retail sportsbooks in Louisiana at its Harrah's New Orleans and Horseshoe Bossier City Hotel & Casino properties.

What we’re reading

Snap falls behind the times. “Spiegel understood that social media wasn’t about managing bloated profiles of ourselves, but about experimentation and play.

On social

BrentFORD Dave, BrentFORD…

Calendar

Sept 6: E+M Startup Month

Sept 8: E+M podcast

Sept 9: Weekend Edition

Contact us

Scott Longley scott@clearconcisemedia.com

Jake Pollard jake@openmediaservices.com