Sep 2: Weekend Edition #62

PointsBet FY, Codere Online Q2, Kansas open, Ontario analyst reaction, sector watch - affiliates +More

Thought bubble

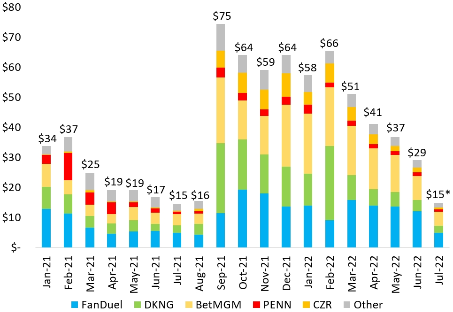

It’s a week until another crunch moment for the US betting and gaming world as the NFL prepares for kick-off. For all the talk of the heat being taken out of the promotional environment over the summer, the chart put together by the analysts at Truist (see below) shows that this is unlikely to stop a September splurge. The line we’re reminded of comes from Godfather III - every time I think I’m out, they pull me back in.

PointsBet FY analyst call

FY22 gross win was up 41% AU$497.8m while Q4 GW rose 24% to AU$122m.

FY US GW rose 66% to A$158.7m while Australia GW was up 32% to A$338.4m.

Less than zero: PointsBet’s Ontario operation generated only A$16m of handle and a mere A$0.7m of gross win and A$0.2m of net win in Q4 with active clients standing at 7,239. Post-launch marketing expense was A$7.7m. Despite the disappointing figures, CEO Sam Swanell remained optimistic, saying the market would have to “go through a football season and see how quickly it can pick up our expectations”.

Sam Swanell: “We're not ready to write-off Ontario just yet.”

Proud as punch: For the US, Illinois aside where it achieved 8.8% market share in Q4, the share metrics in the nine other states where PointsBet operates remained under target. Swanell said he was “really proud of the year that we delivered”.

“We've obviously, as we said, we've scaled our team, we've grown revenue dramatically. We've increased our TAM,” he added.

The group doesn’t expect 2023 US marketing budgets to exceed the $162m it spent in FY22.

Hart to Hart: PointsBet also announced the appointment of Edward Hartman as group chief strategy officer. Hartman joins from the USFL where he was executive VP of business operations. Previous to that he was senior VP for digital partnerships and wagering at FOX Sports.

**Sponsor's message: Spotlight Sports Group is a leading technology, content and media business specialising in sports betting. Each week our experts produce a newsletter covering the biggest stories in the global sports betting industry. Sign up for our newsletter here to have it land in your inbox this Friday.

For more information visit: spotlightsportsgroup.com

The NFL looms

The calm before the storm: Looking ahead to the kick-off next Friday, the analysts at Truist note the distinct drop-off in promo spend across Pennsylvania, Michigan, Arizona, Connecticut and Virginia with the July total representing the fourth straight month of declines. That is until operators “presumably begin spending again” with the new season.

💵OSB promo spend in PA/MI/AV in the months leading up to football season

Source: Truist Securities research

Codere Online

Revenue rose 36% YoY to €27.4m while adj. EBITDA losses worsened to -€9.9m.

FY guidance for net revenue remains at between €110m-€120m.

Call the cops: Codere admitted it had been the victim of cybercrime after €0.7m was paid to a fraudster posing as one of the company’s vendors. The company believes - hopes perhaps - it is a one-time theft.

Pathway: On the earnings call, CFO Oscar Iglesias said the company would update investors on its path to profitability in Q3. As it stands, Spain was adj. EBITDA positive at €3.6m while there was significant growth in revenues in Mexico (+85%) and Colombia (+56%). Codere also recently launched in the City of Buenos Aires and is pursuing another license in Cordoba.

Turn the taps: Iglesias noted that marketing spend was “discretional” and could be “increased or decreased at any time”. Marketing spend declined sequentially in Q2.

Viejo mundo, nuevo mundo: In Spain, CEO Moshe Edree said there had been a lessening of competition given recent marketing restrictions whereas in Mexico he cited a more competitive landscape against rivals Caliente, BetCris and Rush Bet.

Earnings in brief

OPAP: Q2 GGR was up 11.7% to €442.1m with lottery revenues up 9.8% to €165m and VLT revenues shot up 106.4% to €74.5m. EBITDA rose 16.3% to €166.9m. CEO Jan Karas said OPAP delivered a solid set of Q2 results thanks to strong retail activity following the easing of Covid-related restrictions and despite more recent softer consumer spending.

Intralot: H1 revenue was up 1.1% in H1 to €204.8m and EBITDA was up 1.4% to €55.1m. During the period Intralot completed a share capital increase in July for a total amount of €129.2m. In the US it acquired 100% of Intralot US and redeemed its senior secured PIK loan of $254m by agreeing a three-year SSL of $230m and a $50m revolver.

Sportech: Revenue was static at £12.6m while the company produced an adj. EBITDA profit of £0.3m vs. a loss of £0.8m in the prior-year period. At the start of H1, Sportech sold its LEIDSA lottery business to Inspired, enabling it to return a further £7m to shareholders. Sportech also operates 10 retail sportsbooks in Connecticut.

Sun International: The South African casino operator saw H1 revenue rise 37% to ZAR5.17bn while adj. EBITDA rose 99% to ZAR1.47bn. The results were driven by domestic leisure spend with international and conference business still lagging.

The E+M podcast is back with episode #15

You can listen to it on Podbean. It’s also available for download here.

Just stop

The Flutter RNS multiple email incident.

L&W departure

Analysts are unruffled by the news that Barry Cottle is to leave Light & Wonder.

Leaving the stage: Barry Cottle’s departure from Light & Wonder announced late on Tuesday “won’t meaningfully shift” the company's strategic direction, according to the analysts at Jefferies. The team note that interim CEO Matt Wilson has 20 years of gaming experience and was previously LNW's chief executive of gaming.

There was some surprise at the timing of Cottle’s departure, suggested Truist, who believed he would stay on until his contract expired in May 2024. But “this feels like a natural phase for leadership transition,” they added.

Kansas open

Kansas went live yesterday with DraftKings and FanDuel among the six operators open for business on day one.

No place like home: The state opened up with a soft launch ahead of a full market opening next Thursday. The six books given the go-ahead by the Kansas Lottery included PointsBet, Caesars, BetMGM and Penn Entertainment, which also opened a retail outlet at its Hollywood Casino in Kansas City.

Ontario analyst reaction

Analysts were “underwhelmed” by the data from the first three months.

Add back: Looking at the figures released by iGaming Ontario (iGO) on Tuesday, the team at Roth Capital said the annualized GGR/capita of US$34 suggested by the data is “far below consumption rates” in US states with both OSB and iGaming.

Delay on the gray: They noted that several key gray market launches only happened during the three months and that the market should ramp with the launch of the NFL season.

No benefit: But they still added the evidence to date suggested “limited benefit” for US-based operators such as Penn (with theScoreBet) and DraftKings.

Negatives: Moreover, the underwhelming data also “offers evidence” that Canada’s provinces “may offer less attractive market opportunities than US states”. Notably, they add that the inability to advertise promotional offers will have a “particularly negative” impact on iGaming TAM.

Toehold: The team at JMP were more positive, suggesting that as the market evolves the US operators will “gain more of a foothold”, albeit not with the same market share levels as they enjoy in their home markets.

In combination: In addition to the ~$10m Penn said it achieved from icasino since launch in April, JMP estimated it would have also made ~$5m in sports.

theScore on the board: “We believe this implies low double-digit market share, above our 10% market share expectations.”

Wells Fargo, meanwhile, estimated Penn achieved market share of between 6-8% based on app download data.

Las Vegas analyst reaction

The performance of the Las Vegas Strip in July continued to impress.

Peak viewing: Fears that Las Vegas and the Strip, in particular, might have hit a peak were contradicted by the July data while the forward picture also continues to remain supportive, suggested the team at Macquarie.

Heavy mass: They said the continued strength in mass-market gaming to start Q3 is “encouraging” and we think the seasonal slowdown will be less pronounced given the return of conventions combined with a strong events calendar.

Weathering: The team at JMP pointed out that the headwinds in the economy “have not spilled over into the gaming/consumer segment to this point”.

“Strong demand should drive margin sustainability in 2H22,” they predicted.

“Labor remains a headwind across gaming, but these business models have evolved as a result of COVID-19.”

Datalines - Macau

GGR of MOP$2.19bn (US$271m) was down 50.7% YoY and the second-lowest monthly GGR total in 2022.

Visitation numbers increased to 14.7K for the week of 20-26 Aug and peaked at 18K on 27 Aug.

Easy does it: The improved figures came about thanks to the easing of Covid restrictions and the dropping of mandatory hotel quarantine for those entering the neighboring Chinese city of Zhuhai from Macau. Following the release of the numbers Deutsche Bank updated its Macau Q3 GGR forecasts to $870m and FY22E GGR forecasts to $7.2bn. For 2023, DB forecast FY GGR of $24.3bn and FY GGR of $25.8bn for 2024.

Recall, on Aug 23 the team at Jefferies said a spate of Covid infections in 26 Chinese provinces had weakened the prospects for a Macau recovery and the SAR had likely reached a “near-term ceiling” as a result.

Shut-up shop: This followed the closure of all commercial properties including casinos for one week in July as part of the Chinese government’s zero-covid policy.

It’s my party: But the team at Macquarie warn it is unlikely the policy will be lifted ahead of the 20th Party Congress scheduled for October 16.

Colorado: Sports-betting GGR for July came in at $20.8m, up 34.7% YoY of handle which rose42.5% to $258.4m. NGR came in at $14.2m

**Sponsor’s message ** Would you like to get your brand seen by more than 2,500 decision-making executives in the iGaming sector? How about positioning your business as a thought-leader in your area of expertise? Well, sponsorship opportunities at iGaming NEXT: Valletta ‘22 are still available. Built on three core pillars of content, networking opportunities and VIP hospitality, iGaming NEXT Valletta is rapidly cementing its reputation as the must-attend business event.

In order to find out more about the available sponsorship opportunities, please contact iGaming NEXT at sales@igamingnext.com.

Sector watch - affiliates

What a performance: Speaking of performance marketing, Gambling.com CEO Charles Gillespie reiterated his belief that the model provided the best ROI for operators. Gillespie stated that affiliates that can drive quality traffic at scale were best placed to benefit from a maturing US market where marketing rationalization has long been mooted.

Pushy: During the Q2 analyst call he also made the point that his company was being more aggressive in negotiations with operators, rather than being pressured by them.

“Now that we’ve got a thriving business in the US with real momentum, we can have pushier conversations with our clients about what we want to charge them per NDC.”

Resting up: Gillespie’s views are echoed by Allan Petrilli, head of sales at Intellitics. “Many brands have spoken about lower marketing (budgets), and we have indeed seen this in the offseason, it will be interesting to see if this continues into the NFL season,” he told E+M.

Bullseye: “But I think there will be a shift to performance marketing. It enables operators to be a lot more targeted, drives down CPAs and gives more control.”

No alternative: “US operators are under pressure to become profitable, to my mind it is difficult to see how that is going to happen if they don’t focus more on performance marketing,” says Petrilli.

Cafe del martech: The US market is also so much younger than its European counterparts that reporting tech platforms are not as developed or integrated into operators’ systems. Petrilli pointed out that up to now the focus on acquisition might have meant “operators did not feel the need to have proper martech stacks”.

Show me love: “But with the focus on profitability and access to new sources of traffic, real-time platforms that perform are more important than ever. Even if it isn’t simple to get the bandwidth with operators,” he added.

Television, the drug of the nation: Meanwhile, sources suggest that from day one of being regulated, the US industry has been able to access above-the-line advertising and “that mindset is deeply ingrained in marketing departments, where brand affinity and reach are key”.

Born like this: “It’s a different DNA when compared to a European affiliate and marketing sector that launched with PPC and SEO,” one source suggested.

Funding round

ALT Sports Data, a San Diego-based pioneer of trading and consumer data for action and alternative sports, announced the closing of a Seed Round funding led by Trinity West Ventures. It also announced Benjie Cherniak is joining the company as a strategic advisor.

Newslines

Audit agreement: The pressure on Melco Resorts to move listing due to a dispute between China and the US over accounting standards appears to have eased after the two countries came to an agreement with regard to audit work carried out on Chinese companies listed in New York.

Further reading: Landmark US-China audit deal spurs hunt for devils in the details.

A study by Betting Hero has found that 51% of Ontario bettors wagered with a gray market mobile sportsbook that operated in the province prior to online sports-betting and casino regulation in April.

MGM Resorts’ has completed the $604m acquisition of LeoVegas after 96% of LeoVegas shareholders accepted the cash price of SEK61 per share.

Bet365 has gone live in Colorado, the second state in which it has launched after New Jersey.

What we’re listening to

All in: Gov. Newsom is running a protection racket.

On social

Calendar

Sept 5: Start the week with E+M

Sept 8: E+M podcast

Sept 9: Weekend Edition

Contact us

Scott Longley scott@clearconcisemedia.com

Jake Pollard jake@openmediaservices.com