Scoop: Tipico ‘set to sell’ its US platform

Tipico’s US platform sale, Novig shuts in Colorado, GLP on deal flow, startup focus – SBC First Pitch +More

Tipico believed to be looking at the imminent sale of its US platform.

In +More: Bragg funding, a big week ahead in earnings.

Novig shuts up shop in Colorado, at least temporarily.

GLP says it is working behind the scenes on deal flow.

Startup focus looks at the contestants in SBC’s First Pitch.

I need to get me out of this joint.

Tipico platform sale talk

Tip-stop: Tipico is set to sell its standalone proprietary US-facing sports-betting platform with MGM Resorts heavily rumored to be the buyer, according to multiple sources who spoke to Earnings+More on condition of anonymity. The move is thought to be imminent but sources weren’t in a position to divulge a price.

One source suggested the platform was originally developed with an eye on selling B2B access, but that never happened. The company didn’t respond to enquiries.

Size zero: It is not known whether the sale would include the US OSB and iCasino operations. Tipico officially launched OSB operations in New Jersey in October 2020 and subsequently expanded into Iowa, Ohio and Colorado. However, as with many other European operators, such as Kindred and 888, it has failed to achieve anything more than a tiny footprint.

According to the March data from New Jersey, Tipico’s sportsbook generated $292k in gross win in March and $1.1m in Q1.

It fares better in iCasino: in March it generated GGR of $1.3m, leaving it with a Q1 total of $3.5m.

The proprietary US platform is a standalone product from the company’s European operations.

Who’s buying? Sources pointed out a sale to MGM Resorts could make sense given its stated desire to own a sportsbook backend. It would offer the company the chance to move its LeoVegas sports-betting operations to an in-house platform. LeoVegas currently sits on the Kambi platform.

A spokesperson for MGM Resorts said the company did not respond to market rumors.

Another potential buyer would be Fanatics, which, as one source suggested, is currently relying on a somewhat uneasy mix of an outsourced Amelco code base and the in-house odds provision from Banach, which it acquired as part of the acquisition of PointsBet US.

Tip the wink: The future of the Malta-based Tipico itself has also been the subject of speculation. It has been owned by private equity firm CVC – which itself was the subject of a €2bn IPO in Amsterdam last week – since 2016 with ownership having passed through various CVC funds, which explains the longevity of the ownership.

Sources suggested the largely German-facing operator generates EBITDA in the region of €350m a year.

They added that CVC would be seeking a double-digit multiple were it to seek a sale, valuing the business at over €3.5bn.

White Paper worries?

Department of Trust is the industry’s go-to platform for end-to-end frictionless and enhanced financial risk assessments anticipated by the White Paper.

Join Rank Group plc and other leading operators in getting a head start on the coming era of additional checks from the sector experts.

Book your demo today at https://dotrust.co.uk

Offices in London and Gibraltar. FCA, ICO registered. ISO27001 certified.

+More

Keep it in the family: Bragg Gaming has secured $7m in funding from entities controlled by its own group director of content Doug Fallon, the founder of the Bragg-owned games studio Wild Streak Gaming.

CEO Matevž Mazij said the new financing, which bears an interest rate of 14% and matures in 2025, gives Bragg “additional flexibility” in the midst of the ongoing strategic reviews.

Kambi has signed a sportsbook backend provision deal with the Choctaw Nation in Oklahoma for on-property and online operations. The company said that, pending regulatory approvals, the agreement includes the scope to expand into multiple states. It noted the Choctaw’s flagship casino is located near the Texas border and is the official casino partner of MLB’s Texas Rangers.

Playtech has extended its strategic marketing partnership with Canada’s NorthStar Gaming with a further $3m of short-term funding.

The week ahead

A big week: The market should have a clear picture of the state of play by the end of this week after Caesars, MGM Resorts, Penn Entertainment and DraftKings all report.

The analysts at CBRE noted Caesars is likely to report a positive digital EBITDA contribution despite the impact of poor sporting results and a “relatively” limited parlay offer.

In Vegas, Truist believes Caesars would not have enjoyed as good a Super Bowl as MGM Resorts.

In its Q1 sector preview, Truist noted that the position of Penn’s ESPN Bet was “intriguing” given recent survey evidence, which suggested further integrations with ESPN itself could be the key to success.

In comparison, the success of DraftKings in parlays would help soften the blow of poor sports results, said Truist.

Career paths

The big move: Sportradar has named its next CFO with Craig Felenstein joining the company in June. Analysts at Jefferies noted Felenstein will be the third permanent CFO since Sportradar IPO’d in 2021.

Felenstein joins from Lindblad Expeditions where he was CFO. He previously held finance roles at Shutterstock, Discovery Communications and Viacom.

The Jefferies team suggested Felenstein’s US experience could prove to be positive for the investor base given the complexity of the business and the US OSB market.

The online gaming technology provider Huddle has appointed Tom Daniel as senior VP of trading. Daniel recently was a partner at Propus.

Affinity Interactive has appointed Scott Butera as CEO, effective immediately. Butera most recently led Affinity’s Sports Information Group business.

PrizePicks has appointed Renee White as chief people officer and Phil Sherwood as senior director of responsible gaming.

Coming soon – The Token Word

The Token Word will cover key aspects of the crypto world including the rise of token ETFs, the crypto exchanges, the emerging regulatory structures, fan tokens and crypto-based betting and gaming. The debut edition will be sent on Wednesday.

Novig calls ‘temporary’ halt

On the rockies: The future of the betting exchange appears to be in doubt after the company notified its customers in its only market to date in Colorado that it was “ceasing operations” as of April 30, at least temporarily.

Responding to enquiries from E+M, a spokesperson confirmed the company was “working on some huge game-changing product updates.”

“We will be sharing more in the next couple of months about these updates and timeline for welcoming users back to the app,” the spokesperson added.

Recall, Novig was founded by Harvard grads Jacob Fortinsky, CEO, and Kelechi Ukah, CTO. It raised a $6.4m seed funding round in August last year, led by Lux Capital with participation from Y Combinator, Paul Graham, Joe Montana, Soma Capital and a host of other investors.

Novig operates in Colorado via a market access deal with Full House.

GLP earnings recap

If it quacks like a duck: Talking of the pipeline, CEO Peter Carlino said the gaming REIT had consistently managed to “scrounge something out of the woodwork, year in, year out,” when it came to sourcing new deals and, while Q1 had been relatively quiet, a lot was going on behind the scenes.

“It’s like a duck going across the pond,” he said. “It looks smooth and effortless. But down below the water, he is frantically paddling. We’re always frantically paddling here.”

Asked whether GLP found the market more competitive, Carlino said the company was “not the cheapest.”

“I never wanted to be the winner in an auction because the winner often loses.”

Look no further: Matthew Demchyk, chief investment officer, said GLP was the “ideal choice” for any operator looking for “bespoke financing solutions.” “We've always been a dependable capital partner and in the current backdrop the value of that dependability has gone up.”

Biden their time: Demchyk also noted the likely volatility engendered by the approaching presidential election would play into some calculations, particularly around potential tax changes.

Higher for longer: Steve Ladany, chief development officer, noted that the higher-for-longer rates scenario currently playing out in the US means a lot of operators have seen increased debt costs “last longer than I think they maybe had hoped for or at least anticipated.”

This has an impact in terms of the cap rate – i.e. the cost of the real estate deal – that operators are willing to pay. “It has meant that cap rate expectation has started to move higher,” he added.

Analyst takes – Boyd Gaming

Over & over: After a post-earnings 15% fall on Friday, the team at CBRE suggested the shares were oversold, with the market pricing in potential recession impact. The shares were left trading on a multiple of ~7x but, as the analysts pointed out, when taking into account the presumed $10-a-share value of the 5% stake in FanDuel that falls to ~6x.

Recall, Boyd reported lower-than-forecast earnings on Thursday with issues apparent in part of its regionals business and in the Downtown and Locals segments in Las Vegas.

The team at Jefferies said the question raised by Boyd’s Vegas figures from Downtown and the Locals market is whether the weakness is company-specific or indicative of a broader slowdown.

😰 Boyd Gaming shares ship 15% on Friday

Kambi Group is the leading provider of premium sports betting technology and services, empowering operators with all the tools required to deliver world-class sports betting and entertainment experiences. The Group’s services not only include its award-winning turnkey sportsbook but also an increasingly open platform and a range of standalone sports betting services from frontend specialists Shape Games, esports data and odds provider Abios, and AI-powered trading division Tzeract. Together, we are limitless.

For more info, go to www.kambi.com

Funding rounds

Kutt and thrust: Social-betting startup Kutt has raised $1m+ from an institutional fund raise led by Lightning Capital, with the cash going towards growing the Kutt community and expanding its betting markets.

Kutt was founded by CEO Sim Harmon and was the subject of a startup focus in April last year. The company said it recently passed the 10k user mark.

Jock Percy, general partner at Lightning Capital, said it was Kutt’s differentiated product offering that attracted them to the investment.

He shoots: Gaming affiliate Skores has completed a debt-funded MBO, with VCs Stags and MI3 coming on board as investors. The company said the new money will help fund international expansion.

Startup focus – SBC First Pitch

Five go to Meadowlands: Five startups have won through to face the judges as part of the SBC North America First Pitch competition. Ahead of the event, representatives from the five spoke to Jesse Learmouth for the Betting Startups podcast.

916 Gaming: Co-founder Steven Astrachan said the company was founded on the idea of creating content for the younger demographic. “Think about crash games,” he said. “The goal is to provide content for those cross-sell players and something different that’s not just your typical slot content.”

Astrachan hoped to be able to persuade the judges that the concept already has market buy-in. “That has been a huge part of getting the business to where it is.”

He noted this was the third time the company has applied for this particular competition.

EdgeSports: Only six months old, co-founder John Pereira noted the bootstrapped B2C-facing sports data startup set about the task very quickly to build a platform that was “super easy to onboard, very inexpensive and you had fast, quick data at your fingertips.”

“We want people to know that we are ready to spend more money on marketing,” he added. “What we have achieved to date is simply via word of mouth.”

He noted the company had now embarked on a seed funding round.

Linemate: The “lifestyle brand” app wants to be the Expedia for sports betting. “We’re the one app to help sports fans to analyze, research, source and place their sports bets in one simplified, fun and engaging way,” said founder Calvin Konya. He noted the company had already achieved 175k downloads.

StatX Sports: “At a basic level, we supply odds to odds and data feeds, to sports books, sports league, sports teams, media companies, podcasts, anybody who will have us,” said founder Shawn Tucker. The launch product is cricket where, he pointed out, betting has “just exploded,” particularly around the Indian Premier League.

“The key takeaway is we have found this huge gap in sports data and we have a novel way of using technology to fill this gap,” he added.

THNDR: The peer-to-peer non-custodial wagering API provider will, says founder Desiree Dickerson, allow players to place bets and wagers with instant settlement for a “very incredibly low fee,” specifically using a Bitcoin wallet.

“This is a payment rail that is just much better for businesses and much better for end-users,” she added.

Growth company news

Kero Gaming: The in-game microbetting provider will supply its sports-betting options to NeoGames Pariplay on its Fusion aggregation platform.

Calendar

Apr 30: Caesars Entertainment, Lottomatica, Melco Resorts

May 1: MGM Resorts, Bally’s, Rush Street

May 2: Penn Entertainment, VICI, DraftKings (earnings)

May 3: DraftKings (call)

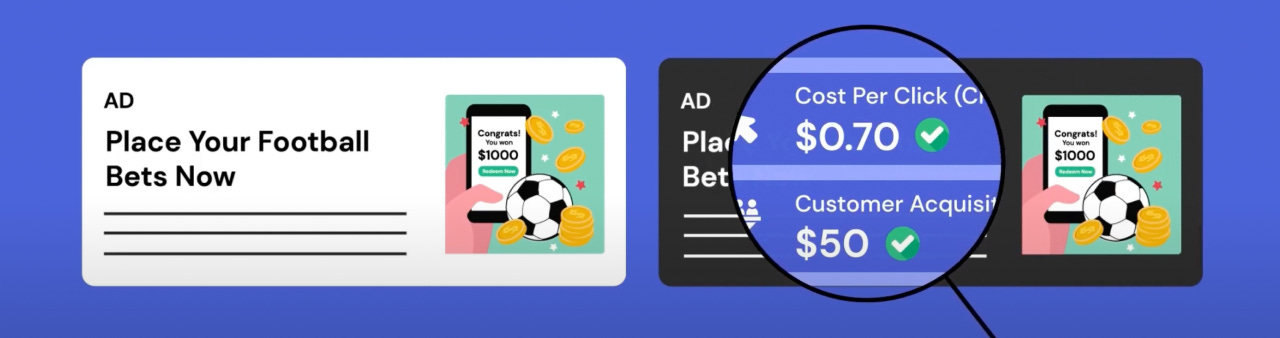

Navigational traffic from customers driving up your CAC?

Our exclusive Shadow Campaigns feature caters to hyper-engaged users who repeatedly click on your ads without driving meaningful conversions. This feature creates an exact duplicate - or ‘shadow’ - version of your existing Google Ads campaign, but at a lower CPC.

You’re in control: Set the rules for the number of clicks allowed on your legitimate campaign. Any user who exceeds this number is directed to the shadow version, which lowers the cost of the click and reduces the overall acquisition cost.

The result? Your budget goes further, and your ads reach their intended audience without risking them being redirected to organic or being targeted by competitors through the auction process. Win-win.

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.