Stella David once again moves to steady the ship as Gavin Isaacs departs.

In +More: EveryMatrix, Light & Wonder, New York in January.

Earnings TL;DR: Red Rock, Catena, DoubleDown, NorthStar.

Venture playground: David Briggs discusses the Challenger event.

Hard Rock Bet is gearing up for 2025 with a focus on amplifying brand and product engagement. With a powerful, custom-built bonusing system and an ambition to redefine traditional CRM, we're seeking leaders who are driven to challenge the status quo:

And other amazing positions here

Storm-tossed

Tearing us apart: A sale of the half stake in BetMGM and the break-up or sale of the rest of the company is increasingly likely for Entain following yesterday’s abrupt departure of CEO Gavin Isaacs.

Isaacs’s defenestration came after what multiple sources suggested was a breakdown of relations between him and chair Stella David.

My way or the highway: The unofficial word from the company was that Isaacs’ tenure “just hadn't worked out” and that he had decided to move back to Las Vegas. But sources suggested the real reason was a disagreement between CEO and chair over the direction of the company.

David has once again resumed the role of interim CEO, which she held for nine months while the company sought a replacement for previous permanent CEO Jette Nygaard-Andersen.

Now sources suggest David will necessarily have to take on the role full-time herself.

“They spent so much time trying before settling on Isaacs,” said one well-connected industry consultant. “No one else will take on the role now.”

Hammered: Investment sources indicated the evident boardroom ructions could be the “final nail in the coffin” for the independence of Entain as a listed entity.

Accusing the company of “communication incompetence,” one source at an investment firm went on to suggest that for the board to believe it could “get away with a bland press release” and no further explanation was a “major negative.”

“To leave an information vacuum like they have simply hurts the medium-term multiple that the market is willing to let the company trade on,” they added.

Back where we started: The share price fell 10% yesterday as investors absorbed yet another blow. While Isaacs’ brief tenure had seen the shares stage somewhat of a recovery, his fall leaves them once again languishing just above the level they were at when he officially joined the firm in September.

Bill’s on line 2: A big question is what Isaacs’ departure means for the future of the BetMGM joint venture. As was previously reported by E+M, it was thought Isaacs was “more open-minded” about selling the 50% stake to MGM Resorts.

MGM Resorts’ CEO Bill Hornbuckle previously praised Isaacs as a man who would “do wonders for the business.”

His departure in such murky circumstances will “only strengthen MGM’s hand,” suggested one industry adviser.

Best part of breaking up is when you’re making up: Another well-placed consultant suggested the news would “naturally restart the talk about a break-up” of Entain, with the sale of its BetMGM stake “the first item on the agenda.”

Private equity interests “will be looking at what is going on,” they added.

“Someone surely comes out with a public bid for Entain and states that the business needs to be broken up and sold off,” added the investment source.

Accident prone: The departure of Isaacs is the latest blow to the operator behind the Ladbrokes and Coral brands, Bwin and more recent acquisition STS and Entain CEE.

The company last year settled a case with the HMRC regarding bribery allegations to do with its previous activities in Turkey.

That issue precipitated the departure under a cloud of then CEO Kenny Alexander.

Isaacs was appointed seven months after predecessor Jette Nygaard-Andersen resigned following the HMRC deferred prosecution announcement.

In December it was announced Entain was the subject of a proceeds of crime investigation by the Australian financial watchdog AUSTRAC.

Merry-go-round: The team at Deutsche Bank noted Entain’s CEO “struggles,” pointing out it has been through four CEOs now since Alexander departed.

EveryMatrix delivers iGaming software, solutions, content and services for casino, sports betting, payments, and affiliate/agent management to 300+ global Tier-1 operators and newer brands. The platform is modular, scalable, and compliant, allowing operators to choose the optimal solution depending on their needs.

EveryMatrix empowers clients to unleash bold ideas and deliver outstanding player experiences in regulated markets.

+More

EveryMatrix has announced a “milestone” first-ever games aggregation deal in the US after betPARX signed up to the provider’s own brand games along with third-party content from the likes of Evolution.

Light & Wonder has upped the limit on its revolving credit facility of $1bn from $750m and extended the maturity until February 2030.

Off to the races: Oddschecker and the Jockey Club have announced a sponsorship agreement that will see Fair Play media, the owner of the odds comparison site, become the racing body’s official betting tech partner. As part of the arrangement, Oddschecker will play a significant role in race sponsorships across several Jockey Club venues.

Bowl betting: The Nevada Gaming Control Board said its sportsbooks won a record $22.1m on the Eagles win, with hold hitting 14.6%. The GGR was nearly double last year’s total. Meanwhile, FanDuel said its total number of bets on the event rose 19% to 6.6 million.

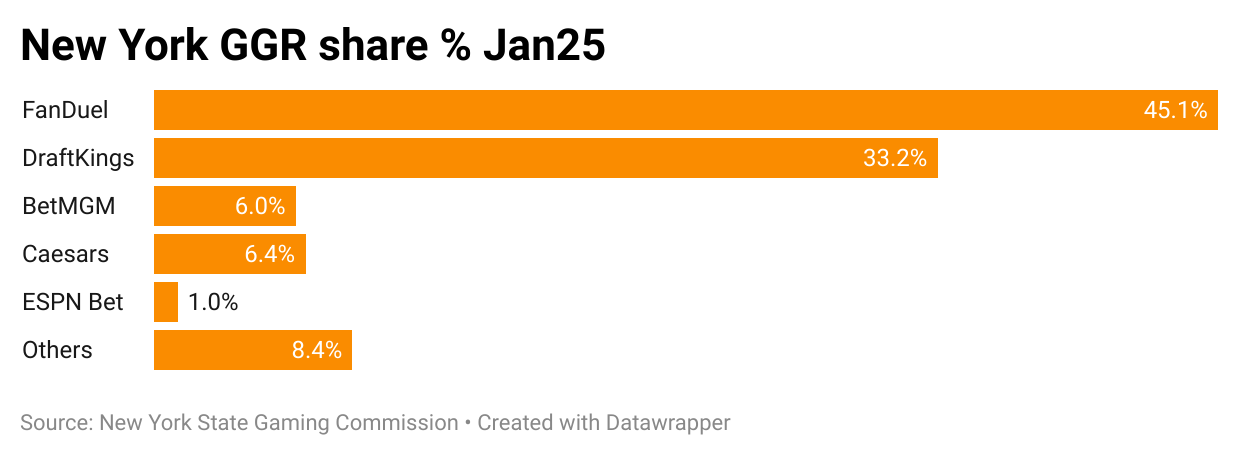

I’m walking here: The data for New York in January showed FanDuel and DraftKings maintaining their lead, as GGR rose 17% YoY to $247m on handle that was up 27% to $2.48bn and hold of 10%, 80 bpts down on Jan24. The analysts at Deutsche Bank suggested the acceleration was in part due to incremental NCAA football games.

Earnings TL;DR

Red Rock Resorts: A booming demographic picture of high-end relocators in the Las Vegas Valley provided the backdrop for the continued success of Red Rock Resorts, as the Durango Casino – now open for just over a year – helped drive record revenues, with minimal cannibalization at its other Locals properties.

Revenues rose 7% for Q4 to $495.7m while adj. EBITDA was up a more slim fitting 0.5% to $202.4m.

The coming quarters will see the company embark upon the expansion of the Durango and renovations at the Green Valley Ranch property, which will affect adj. EBITDA expectations.

Investors warmed to the call, sending the shares up nearly 3% in post-market trading.

For more in-depth analysis, see this morning’s Earnings Extra (paywall).

DoubleDown Interactive: Revenue of $9m from the real-money iCasino business SuprNation narrowly failed to bring total revenues into positive territory. The $82m in Q4 was $1.1m short YoY as social casino revenues fell 7% to $73m.

CEO In Keuk Kim said the 30% growth in the Sweden and UK-facing SupraNation was ahead of expectations.

He said that, a year into owning the business, DDI was “continuing to gain experience and expertise” in iCasino and was hoping to further grow the top line this year.

Kim said further M&A remained on the agenda with the hope of sourcing long-term growth and profit drivers.

He added that companies of greater scale than SuprNation would be considered.

Catena Media: Revenue remains under pressure, particularly in sports, which suffered a 54% cratering, while the earnings generated by iCasino leads was off by 15%, leaving the total down 30% to €10.2m. FY24 revenue from continuing ops was down 35% to €49.6m while adj. EBITDA fell off a cliff, down 79% to €5.4m.

CFO Michael Gerrow was insistent the company was now sufficiently “right-sized” after reducing costs by 33% YoY.

He added that the company hoped to repay its €21.4m of outstanding bond in June and insisted it had no plans to issue any further equity.

Catena also quickly killed off its AI content-generation project. CEO Manual Stan insisted the company still sees value in the vertical but did not view “this particular product to be the right venture for us.”

Gateway drug: Stan also spoke about how sweepstakes gaming could “bullet-proof” the iCasino brands, proving the “gateway” for as and when regulation happens.

Shareholders didn’t warm to the earnings, sending the shares down 14% on the day.

NorthStar Gaming: The Ontario-focused operator saw revenue for Q4 rise 48% to C$9.8m ($6.9m), helping push 2024 revenue up 53% to C$29.7m.

Recall, NorthStar recently secured a C$43.5m line of credit via investment from Beach Point Capital, with major shareholder Playtech agreeing to provide “credit support for certain obligations” under the terms of the deal.

CEO Michael Moskowitz said the company now had the platform to reach profitability.

GeoComply's international solutions are unlocking compliance and security for the global market, so players everywhere can enjoy seamless, worry-free gaming experiences.

Book a meeting with the GeoComply team at SBC Rio (booth #A250) and learn how their advanced geolocation, identity, and fraud solutions safeguard your platform from account takeovers, fraudulent chargebacks, promotion abuse, and more!

GeoComply’s Brazilian solution is designed specifically for the local market, offering seamless geolocation compliance (without requiring a companion app), robust anti-fraud measures, and streamlined licensing support—all while minimizing customer friction.

Learn more

Learn first-hand from Daniel Burns, the mastermind behind $20B+ in iGaming M&A deals, and gain exclusive insights into industry-leading strategies.

Click here to register for The Challenger Series!

Venture playground

Challenger event Q&A

E+M speaks to David Briggs, chair at GeoComply and the founder of the Challenger event taking place in New York on March 11. Click here for details of how to get hold of a ticket.

Funding is the lifeblood for startups and scaleups: to what extent do you see the environment having eased since the Challenger event was last in New York in May?

It is an interesting question to consider. On the one hand everyone at Challenger is downstream of macro economic pressures. However, it is also true that Challenger really reflects pockets of very, very high growth and exuberant valuations and market expansions too. As the founders talk among themselves I can see and hear lightbulbs going on and horizons opening.

How have M&A deals changed the gaming landscape in the past decade? What will be the key takeaways from Daniel Burn’s session?

Whether B2B or B2C, there is no shortage of deals happening and Daniel Burns and Oakvale seem to be involved in a staggering amount of them. I think the key takeaway I am looking for from the session is how he manages the egos in the room through these deals and how he manages to de-escalate all the turbulence and flare-ups that inevitably occur in these transactions.

What changes over the five Challenger events to date have you seen in the nature of the debates being brought up?

Early events may have focused on market entry and basic regulatory issues, while more recent events likely delve into complex topics like determining risk vs reward with regulation and compliance as well as the nitty gritty of how you hire and motivate a group of external hires and blend them into a start-up, founder-led culture. Some trends always seem to re-occur though: when and how to trust (and most importantly when not to trust) bankers, lawyers, investors and how to think about your role in the organization as a founder through the company’s evolution.

Now the Challenger event itself is established in the calendar, how do you envisage it to evolve in the years to come?

To be honest – my greatest goal with Challenger is to get [bet365’s] Denise Coates to come and share her story. I think she is arguably the founder par excellence of our sector and her telling her story would really give an audience of new and emerging founders an incredible insight into what has been a rollercoaster ride to where they are today.

Growth company news

The listed premium-only casino High Roller Technologies has announced a strategic partnership with iCasino provider Yggdrasil.

Rimble in the jingle: Esports betting technology provider Rimble has just launched its next-generation BetBuilder, now available for CS2, League of Legends, Valorant, Dota 2 and more. This follows the Same Game Parlays launch last year.

Most operators can't afford to invest endless resources into fraud prevention while remaining competitive.

Luckily, sophisticated fraud protection is accessible with the right payments partner through a single integration.

Extended fraud protection: Vast coverage of fraud signals with device intelligence, user behavior analytics and more

Community data: Compare payment data against a rich network of iGaming, airline and e-commerce transactions

Risk scoring: Leverage machine learning to evaluate the likelihood a transaction will result in fraud

Start fighting fraud a smarter way while reducing the cost of accepting payments with PayNearMe’s all-in-one payments platform built for the iGaming industry.

Earnings calendar

Feb 12: MGM Resorts

Feb13: DraftKings (earnings), Wynn Resorts, Mohegan

Feb 14: DraftKings (call)

Feb 18: Gentoo, GiG Software

EDGE Boost is a dedicated bank account for bettors with a daily debit limit of $250,000 and 100% approval for all gaming activity. Money movement in gaming has never been a payments problem, it's been a banking problem. With no integration (Runs on VISA rails) and no costs, EDGE can impact Operator margin by lowering processings costs and reducing chargebacks while growing revenue through increased cash access and a 1% rebate on all transactions.

To find out more, go to www.edgeboost.bet

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.