Sports results have turned in favor of the books in June.

In +More: More bad news in Vegas.

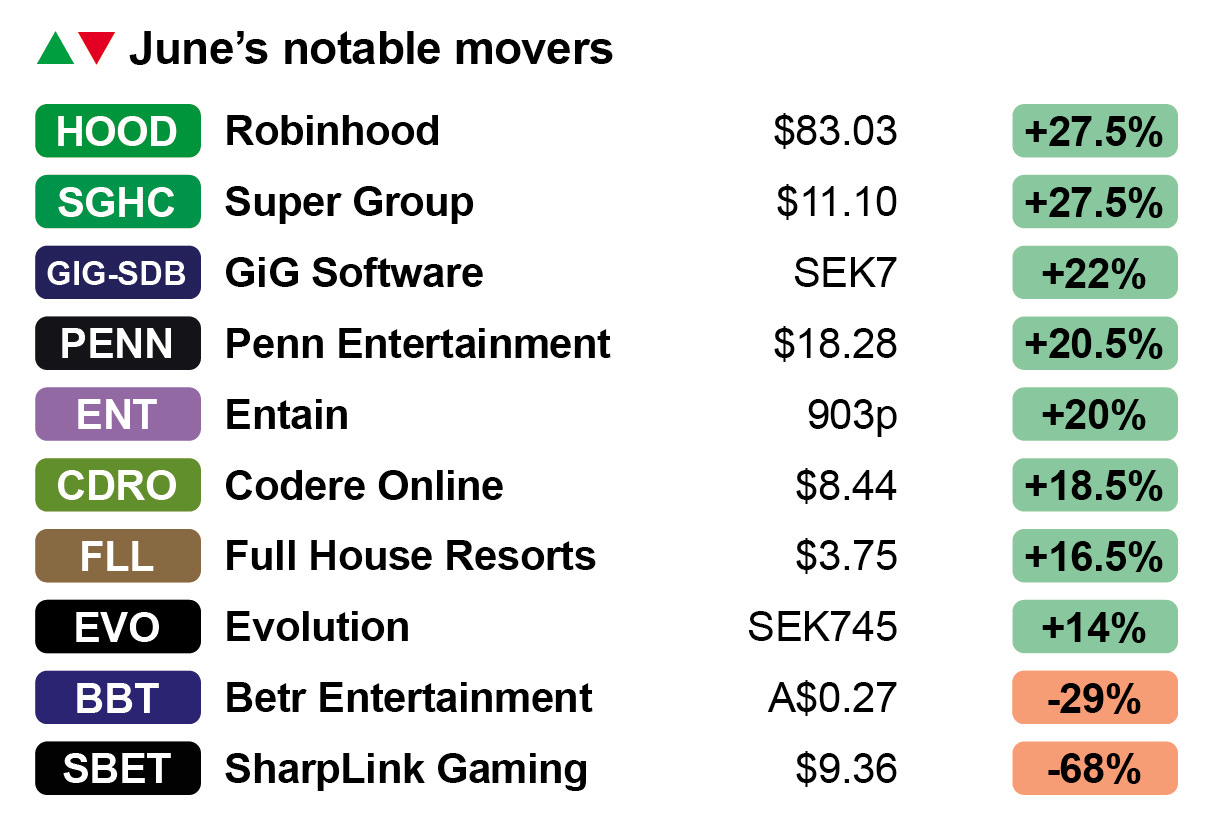

Markets: June bows out with some hefty double-digit sector gains.

The teardown: BoyleSports bucks the trend of UK high-street bookies decline.

Hard Rock Bet is growing – we know you know! And we want to bring in some more maestros to make beautiful music in our Sportsbook. You need to be among the very best in the industry to be considered for these roles. Are you up to it?

You win some

A different ball game: The leading online operators are predicted to report record hold in Q2, marking something of a bounceback after the past two quarters were blighted by spates of customer-friendly results.

Macquarie estimates that hold rates for the past three months will be above 11%, while in the last two weeks of June they hit 13%.

The analysts said they see potential record hold rates for both DraftKings and FanDuel.

Looking at the week-by-week data from New York, FanDuel averaged a hold of 15.5% in June while DraftKings averaged 13.4%. The top two’s nearest competitor was Caesars with 12.4%, followed by Fanatics on 12.2% and then a drop to BetMGM with 10.4%.

Macquarie noted that betting handle growth also appears to have accelerated into the second quarter, up 15% YoY vs. the 11% YoY increase in Q1.

Recall, in Q424 the sportsbooks were hit by historically bad customer-friendly weeks during the NFL season while, to a lesser extent, Q1 was hurt by adverse results during March Madness.

Hold on: The team suggested the good news on hold was likely behind the buoyant month for leading online focused shares. Flutter rose 13% for the month, leaving it with a market cap of $49.2bn at New York close on Friday.

Rival DraftKings rose 22.5% in June while Rush Street Interactive was up 18%.

Sports data and related service provider Sportradar was up 17% while rival Genius Sports rose 3%.

Back of the net: Macquarie noted that as far as investors were concerned, the trading performance in Q2 has overshadowed the news of recent tax rises, including the new 50% top rate in Illinois and now the prospects of New Jersey betting taxes rising to 20%.

It led the team to argue that “net-net” the momentum in the sector would “partly offset” any cuts to 2025 EBITDA guidance driven by uncertainties over tax impacts.

It’s getting better all the time: Yet, despite the tax headwinds, Macquarie contended the outlook for 2025 GGR has “gotten better in recent months,” citing alongside the improved OSB metrics the better-than-expected iCasino growth rates.

Across the sector, the team now forecasts online GGR to grow at 25% this year vs. their prior forecast of 20%.

EveryMatrix delivers iGaming software, solutions, content and services for casino, sports betting, payments, and affiliate/agent management to 300+ global Tier-1 operators and newer brands. The platform is modular, scalable, and compliant, allowing operators to choose the optimal solution depending on their needs.

EveryMatrix empowers clients to unleash bold ideas and deliver outstanding player experiences in regulated markets.

+More

Less Vegas

Feeling the heat: Revenue on the Las Vegas Strip fell 4% YoY in May to $714m while Locals revenue was all but flat at $278m. Visitation was down 7% YoY and RevPAR was off by 5%. The bright spot continued to be convention attendance, up 11% YoY.

“We think the summer softness is well understood with the question being if improvement will be seen in Q4,” said the team at Truist

Recall, on Friday E+M reported on worries among the analysts that this might be more than a seasonal slowdown.

Woe Canada: Notable among the May data was the fall in the number of international travellers going through Harry Reid Airport, with a startling drop in the numbers coming from Canada.

International visitation was down 9% for the month while total air visitation was down 4% YoY.

Within that, Air Canada passenger numbers fell 22% and discount airline WestJet, which also majorly caters for Canadian visitors, fell 35%.

Go for landing: Private equity giant Apollo’s $6.3bn deal to combine IGT and Everi is to complete tomorrow, Tuesday, after it received clearance from the Nevada Gaming Board late last week. At the same meeting, PR group Brightstar was given permission to go-ahead with its $1.1bn deal to acquire AGS.

In the midst of the ongoing takeover battle, PointsBet has admitted that current trading is faltering. Revenue and EBITDA for FY25 are now expected to be at the bottom end of the company’s previously communicated ranges of A$260-A$270m ($170m-$177m) and A$11-A$14m, respectively.

Virgin Hotels Las Vegas has launched Cherry Rewards, a modernized resort loyalty program developed in partnership with GMA Consulting, as part of its broader initiative to take full control of casino operations.

Data points

Ontario: The online market notched up a monthly record in May with total GGR rising 40% YoY to C$338m ($247.5m), with iCasino up a whopping 45% to C$260m and accounting for 77% of total GGR. OSB rose 21% to C$71.8m and poker GGR was up 19% to C$6.3m. The only downside was a 2% fall in monthly actives to 1.07 million.

Puts+takes

Penn Entertainment: In upgrading the company, Citizens said Penn’s interactive future was now a binary choice: either there is an improvement in market share or there is an exit/restructure of the ESPN Bet partnership. The latter would come with the benefit of shedding costly marketing obligations, “shining a light on the positive contribution from theScore, US iGaming and its online skins.”

Markets

Whistling past the graveyard: Defying numerous tail risks – war, tariffs and maybe one or two more of the four horsemen of the apocalypse – the S&P closed at a record high on Friday, so unsurprisingly all-things-trading operator Robinhood enjoyed a strong June, up 27.5%.

Everything’s a market: A note from Compass Point on Friday pointed out Robinhood had disclosed that users have traded 1.5bn of prediction market contracts, implying ~500m contracts since the end of April, which the analysts suggested translates to ~$30m in revenue.

“Following a seasonally light sports calendar, we expect prediction market revenue to accelerate during the NFL season,” the team added.

“Robinhood didn't start offering bets on individual games until late in the NBA/NHL seasons and we expect a wider selection of bets during the NFL season.”

The June brides: The drama surrounding Penn Entertainment’s AGM proxy fight, including the tit-for-tat exchanges between management and HG Vora, appears to have done little to dampen the appetite of investors who sent the shares up over 20% this month.

As noted above, the enthusiasm for the shares is perhaps pinned on hopes that the company can be persuaded to change course on ESPN Bet.

Also enjoying 20%+ gains in June were Super Group and GiG Software, the latter helped by the news early in the month of the sale of €5m of shares to an unnamed strategic investor.

Entain was also up 20%, boosted mid-month by the news from the BetMGM JV that it was upping its forecasts for the year.

Full House Resorts was boosted by analyst reports suggesting the turnaround of its new Chamonix property in Cripple Creek was now underway.

Can you feel the farce? Suffering a 29% loss this month was the Australian Betr Entertainment, which now looks set to lose the battle for rival firm PointsBet to the off-market all-cash bid from Mixi. This despite a farcical count last week, which – eventually – rejected a previous takeover scheme.

The worst performing stock, however, was gaming affiliate turned Ether treasury play SharpLink Gaming.

It fell 68% during the month despite going ahead with the first stage of its Ether buying spree.

What we’re watching: The gamblers edge on Wall Street, On Bloomberg. Gamified trading “creates an opportunity for us,” says former poker player and hedge fund manager Galen Hall.

Looking to break into the North American sports betting market? IGT PlaySports is your winning play. Trusted in over 30 jurisdictions, we deliver reliable retail, mobile, and platform technology to launch your sportsbook FAST. Our turnkey solution also includes an expert trading team with decades of experiences – right here in Las Vegas – to handle your primetime action. Whether you're starting fresh or scaling up, we’ve got the tools and expertise to put you ahead of the game. Ready to play? Contact us today!

https://www.igt.com/products-and-services/playdigital/sportsbetting

The teardown – UK bookies

Counter revolution: BoyleSports is preparing to buck the trend for UK high-street bookmakers and is ready to expand its number of outlets and just about quadruple its existing footprint, according to a report in The Times.

Do they mean us? One of the leading bookmakers in Ireland, BoyleSports currently runs around 70 shops across England, Scotland and Wales.

According to CEO Vlad Kaltenieks, the company plans to open a further 200 outlets in what he called “one of the most exciting” jurisdictions in the world. No timeline was given.

Against the tide: At least BoyleSports won’t struggle to locate empty premises. According to the latest data from the UK Gambling Commission, the number of betting shops in Great Britain fell to 5,931 in 2024, down over the past 10 years from 9,111.

The Covid years were particularly damaging for UK high-street bookies, with the number of shops in 2019, the year before lockdown, standing at 8,304 vs. 6,472 in 2021.

Shed a tear: All of the big firms have shed outlets in that period: Entain’s Ladbrokes and Coral chains are now down to ~2,400 outlets across the UK & Ireland, with Evoke’s William Hill and Betfred at 1,400 and 1,300 a piece. Flutter’s Paddy Power runs 563 shops across the UK and Ireland.

But it is among the independents where there has been the biggest change.

The Gambling Commission figures show the number of betting operator licensees – which would include all forms of betting, including trackside – dropped from 958 to 534.

The social dumpster

AI-created ads are so last month, hence it is maybe not surprising that Jake Paul’s Betr has gotten in on the act with an ad made by AI video creator Waymark Cinematic. Here’s the ad and, well, we don't think the ad agencies will be losing any sleep.

Omnigame is reshaping iGaming by offering a full-spectrum service—game studio, platform provider and operator in one. It creates unique, player-focused games with integrated mechanics that engage recreational players. This approach is proven with success on pip.dk.

Ready to partner with the innovators? Explore more at Omnigame.com.

Upcoming earnings

Jul 17: Evolution

Jul 18: Betsson

Jul 23: Kambi, Las Vegas Sands, Churchill Downs

Jul 29: BetMGM

Jul 31: Vici Properties (call)

Still swerving around the same platform potholes?

Are you one bump away from a blowout?

Legacy drag, fragile integrations, and internal delivery gaps don’t fix themselves.

Fincore brings three generations of iGaming platform expertise, a library of proven modules, and serious tech muscle to smooth the journey and accelerate what matters.

We don’t just patch. We rebuild momentum.

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.