Promo addiction and GGR fiction

Debut Massachusetts data suggests DraftKings bought market share, a habit practiced widely in in Pennsylvania and Michigan +More

Good morning, welcome to the latest edition of the Data Month, which takes a deeper dive into the debut numbers from Massachusetts and makes some comparisons with the figures for promotional spend in Pennsylvania and Michigan.

The first sighting of data from the first 22 days of OSB operations in Massachusetts sees DraftKings just missing out on grabbing top spot by GGR in its home state. But DraftKings’ percentage of handle suggests it wasn’t for the want of trying.

Meanwhile, analysis of the promotional spend data from more mature states of Michigan and Pennsylvania indicates it isn’t just DraftKIngs that uses free bets as a crutch to prop up its market share, with BetMGM outspending DraftKings by this crucial metric.

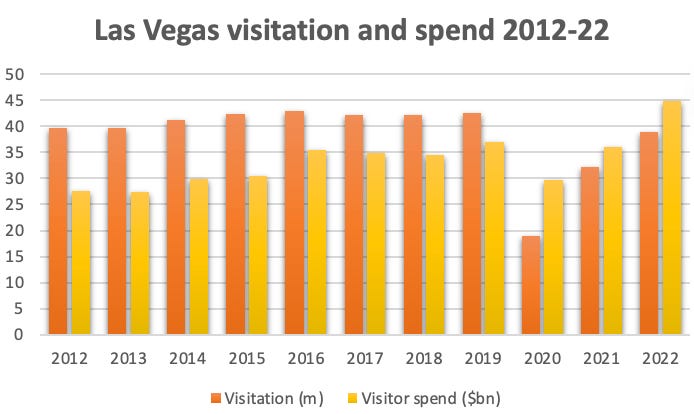

Lastly, as the Oakland A’s become the latest major league team to set out plans to make Las Vegas home, we take a look at the recent economic impact report from the Las Vegas Convention and Visitors Authority.

What’s your addiction? Is it money?

DraftKings’ Mass. gambit

Massachusetts saw DraftKings almost break the mold as it narrowly failed to eclipse FanDuel in the market’s first 22 days.

How to have a No.1 the easy way: The first data from Massachusetts since launch on March 10 displayed a familiar picture after FanDuel, DraftKings and BetMGM grabbed the podium positions and ~83% of total GGR. However, the race for top dog was the closest seen in any new state for a while, with FanDuel and DraftKings almost neck and neck.

Fine margins: In fact, there were just 40 bps between them as FanDuel grabbed 34.9% of GGR ($16.3m) versus DraftKings’ 34.5% ($16.1m).

BetMGM was third with $7.6m or 15.7% market share.

The handle picture was somewhat different, however, with DraftKings notching up a 47% share and $228m vs. the 33% share gained by FanDuel with $181m.

🍎‘s to 🍏’s: Massachusetts GGR and handle shares Mar23

On hold: The failure to translate the dominance in handle through to GGR is explained by the hold at each competitor. DraftKings achieved 6.3% hold while FanDuel managed 9%.

The difference could be explained first, by FanDuel’s evident advantage when it comes to same-game parlay.

The second factor is that DraftKings evidently handed out far more in terms of promotions than its major rival.

** SPONSOR’S MESSAGE ** Founded in 2013, Metric Gaming is based in Las Vegas and London and developed the industry’s first truly multi-tenant sportsbook platform, purpose-built to support operators across multiple territories, regions or States. Metric is proud to be partnered with both Racebook HQ and Lacerta Sports (powered by Starlizard) and will roll out innovative MTS solutions for both racing and sports in 2023, including soccer and four main US sports.

To find out more, please visit www.metricgaming.com

Home turf

Never gonna give you up: As the team at EKG put it in their analysis of the Massachusetts debut figures: “If you know anything about DraftKings, you know there was simply no way the company was going to play second fiddle to rival FanDuel on its home turf”.

The ‘easiest’ way to ensure the first weeks played out as DraftKings would have hoped was to juice promotions in order to ensure handle market share leadership.

EKG’s team said it was “reasonable to infer” from both the regulator’s and the Google trends data that DraftKings “likely” accounted for the majority of bonusing as part of its “win-at-all-costs home-field launch”.

FanDuel will doubtless have been aware of this dynamic – and adjusted its own offer accordingly.

Likewise – possibly – BetMGM, which like FanDuel markedly improved on its handle share in the GGR tally, moving from 8% to 16% in the translation after achieving a hold of 16%.

Give me strength: Meanwhile, players such as Caesars, Barstool and Wynn have collectively made it abundantly clear in a succession of earnings calls that they do not intend to carry on in the same vein with promotions as was the case previously.

Holds of over 11% for Caesars, 10.5% for Barstool and nearly 9% for WynnBet suggest they held on to the promo reins tightly in the opening weeks.

This abstemiousness compared with the promo incontinence displayed in New York at the start of 2022.

Regulus analysts point out that the ~30% of GGR left behind by the top two is on the face of it good news for the rest of the market.

“But it is deeply misleading,” they add. “In handle terms, FanDuel and DraftKings took 80% share of between them, which we believe is far more instructive for underlying momentum.

And the winner is: Regulus points out that FanDuel will – as has been the case in every other state launch in recent years – be the happiest. “FanDuel’s strategy is clearly working in Massachusetts just as it is nearly everywhere else,” the team suggests.

“Other operators cannot match FanDuel’s product or brand while competing on generosity or marketing is just to invite a campaign of attrition they clearly cannot win.”

For DraftKings, there is “clearly intangible (hope) value” in being number 2 in OSB.

“But making this tangible is a struggle, in our view, without profitable scale in a US sector that actually works economically (casino, whether land-based or online), and/or without meaningful international expansion.”

Promo fomo

Buying market share with promo spend isn’t just a new market phenomenon.

Giving it all away: The pattern set for gaining market share by offering bonuses and free bets has been evident for some time. As can be seen in the table below, between Jan22 and Mar23 FanDuel gave out $168.8m of free bets and promos in Pennsylvania and Michigan alone; DraftKings was on $93m and BetMGM $113.8m.

💵💵💵 Top 3 largesse: promo spend from Jan22-Mar23 in PA and MI

It is notable that BetMGM outspends DraftKings in both states.

Its reward in 2022 was 25% market share by GGR in Michigan but a share in the low single digits in Pennsylvania.

Moreover, it consistently outspends both its competitors when it comes to promo spend as a percentage of GGR. See Pennsylvania below.

🧐 Promo pros: the top three in Pennsylvania

Spend, spend, spend: BetMGM’s average promo spend as a percentage of GGR is 77% over the 15 months in question vs. 29% for FanDuel and 37% for DraftKings. In Michigan the picture is similar: FanDuel expends 34% of its GGR on promos, DraftKings 64% and BetMGM 53%.

It seems clear that BetMGM’s overall OSB revenue figures should, therefore, be taken with a large pinch of salt.

Pennsylvania and Michigan are only two states but it is hard to believe the picture is any different in states where no promotional data is recorded.

While it is hard to be precise, it seems fair to suggest a large degree of GGR inflation for OSB.

The figures for March in Michigan give a picture of what happens to revenues when promos are taken into account. While market leader FanDuel spent the most on promos in absolute terms at $6.5m, it also made the most GGR ($30.4m), so its NGR only fell to $23.9m.

DraftKings, meanwhile, saw its GGR total of $15.1m chiseled down to $12.3m after $2.8m of promo spend is taken into account.

However, BetMGM drops from $6.3m of OSB GGR to $3m after $3.3m of promos is taken into account.

But what about iCasino? No figures from either Pennsylvania or Michigan are available but standard iCasino marketing practice also relies on bonusing, albeit to a lesser extent than sports.

Given BetMGM’s evident reliance on this tactic in OSB, it is fair to suggest something very similar goes on in iCasino.

BetMGM generated $589m of GGR in Michigan in 2022 or 37% market share, a trend that has continued into 2023.

But the NGR picture is likely to look very different depending on the levels of promo spend.

Vegas’s room to maneuver

The data for 2022 shows the number of visitors still lagging 2019 despite record spend.

Boomtown: Visitors to Las Vegas spent an all-time high of $44.9bn in 2022, an improvement of 21% on the pre-pandemic high of $36.9bn in 2019 and 24% ahead of 2021. Recall, in 2022 the Las Vegas Strip generated GGR of $8.3bn.

The data comes from the Las Vegas Convention and Visitors Authority.

Notably, the report shows that spending came from fewer visitors than in any of the previous 10 years.

At 38.8m, the number of visitors was up 21% on the still pandemic-affected 2021 but down 9% on the 42.5m in 2019.

🎉 Party like it's 2022

This ain’t over: Whether 2022 marks some kind of high-water mark for visitor spend lies in the lagging number of visitors. Though convention attendees were more than double that of 2021 at 5m.

Yet, this was still 24% down on the 6.6m convention attendees in 2019.

As the LVCVA said, a full recovery in the convention segment and international visitors will be central to whether the momentum from 2022 can be maintained.

** SPONSOR’S MESSAGE ** Venture capital firm Yolo Investments manages in excess of €600m in capital across 80 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

Data points

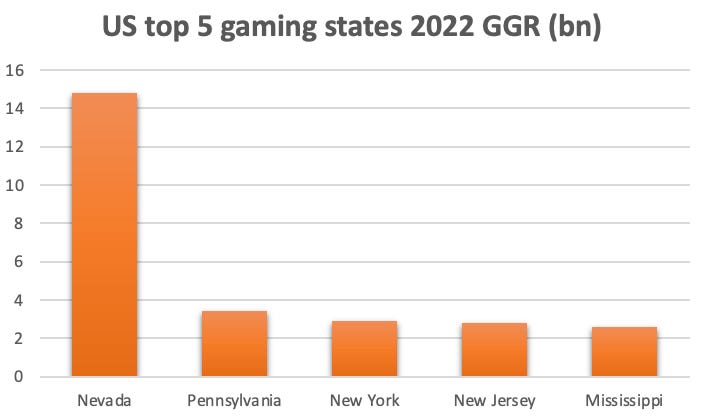

Start spreading the news: A recent note from the analysts Bank of America noted New York could hit $5bn GGR and $2bn+ in combined EBITDA.

As the note mentioned, New York is already the third-biggest commercial market in the US behind Nevada and Pennsylvania and just ahead of New Jersey.

🍎 New York is already a big gaming state

All-in: Truist took a look at how the rise of sports betting and iCasino impacts the overall gaming revenue picture. As can be seen, while both the newcomers are on the rise, up from $4bn to $6bn for sports betting and $4.7bn to $5bn for iCasino, the market is still dominated by land-based gaming.

🎰 Dwarfed: sports betting and iCasino in the shadow of land-based gaming

Calendar

Apr 25: Boyd Gaming

Apr 26: Kindred, Kambi, Rivalry, Churchill Downs earnings

Apr 27: Churchill Downs call, Evolution, Betsson, GLP earnings

Apr 28: GLP call

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.