B2B will continue to be the likely focus for PE involvement in gambling.

In +More: Caesars and MGM Resorts in the week ahead.

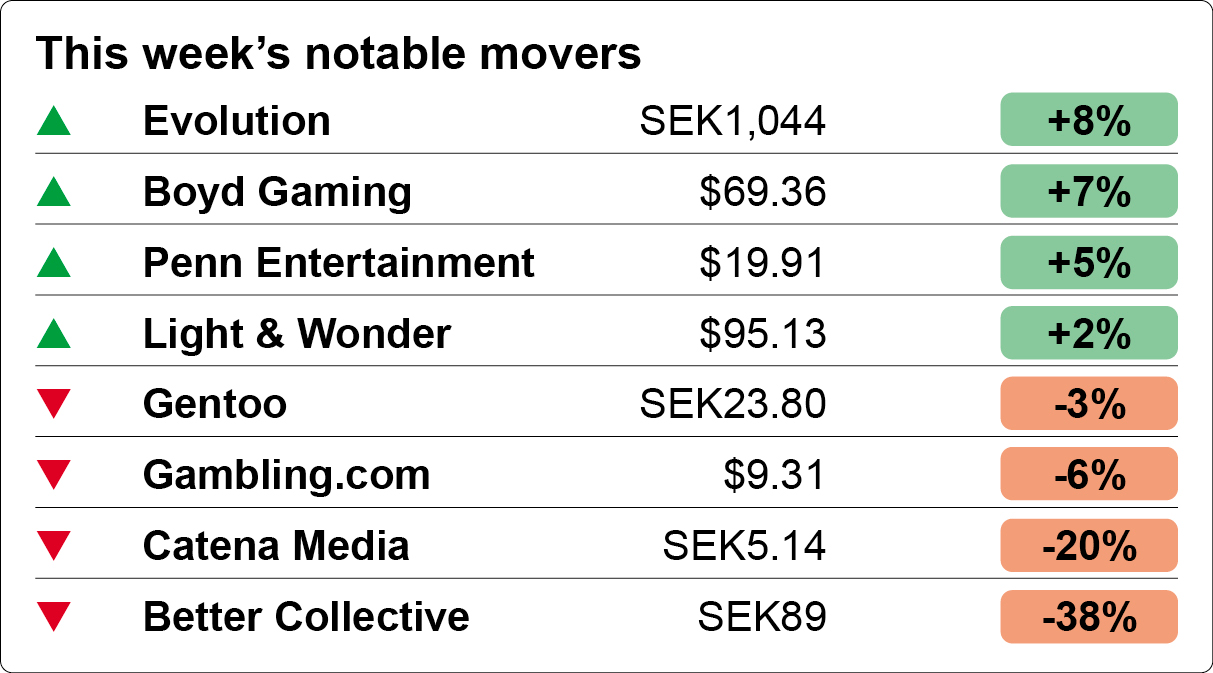

Affiliates suffer concussion from Better Collective’s share price crash.

Doth protest too much: Goldstein makes a meal of iCasino cannibalization.

Still gotta keep makin’ the loot.

Hard Rock Bet is all about fun and innovation. With a top ranked sportsbook & casino product, unique access to US states, and a globally recognized brand, join our team to help shape the online experiences that millions love. We’re currently seeking:

And other amazing positions here.

Getting involved

Never tell anyone outside the family what you’re thinking again: The news that Swedish gaming group Cherry is looking to offload its iCasino entity ComeOn is a reminder that private equity has a long history of being involved with investment in the gaming sector.

Cherry has been owned since 2018 by PE group Bridgepoint, which paid $1bn for the business.

According to Reuters, it is now hoping to cash in part of that investment via a sale, which Bridgepoint hopes will raise ~€500m.

It’s not personal, it’s strictly business: The fact that news of a potential sale has now been leaked is an indication that Cherry might struggle to offload ComeOn, suggested sources. But regardless, the gaming sector is expected to see more private equity involvement in the near future rather than less.

In part this is due to the falling cost of capital: the Fed funds rate means the cost of debt – central to leveraged buyouts – is now lower than it has been for two or more years.

Dirty cash I want you: The likeliest sources of cash will not be the banks but rather through bonds or private credit, suggested one banking contact, who said institutional squeamishness over gambling still hangs heavy. The PE names that are willing to get their hands dirty in gambling are likewise limited.

Apollo is involved in the sector via its ownership of the Venetian in Las Vegas and its soon-to-be-completed bid for IGT/Everi.

Blackstone until recently owned the Cosmopolitan in Las Vegas and since 2022 owns Australia’s Crown Resorts, Cirsa, bought in 2018, and has a stake in Superbet.

CVC previously owned Sky Bet and is currently the owner of Germany’s Tipico.

Then there is Brightstar, which is hoping to complete the buyout of AGS early next year.

Appetite for construction: Regulation remains the single biggest issue for PE firms, reasoned one investment source, who argued that while most would like the opportunity for “upside surprise,” such as iCasino legislation in any given state, they simply don’t have the appetite for “downside risk.”

“This could make some of the suppliers attractive given you are backing the picks and shovels as opposed to the gold mines,” the investment source added.

Recent activity – the aforementioned IGT/Everi and AGS deals – supports this argument and it was confirmed by the banking source, who suggested that everything from iCasino providers to slot manufacturers, sportsbook suppliers and data providers would be of interest.

Obvious opportunities right now include OpenBet, on the market since Endeavor said it was surplus to requirements in August.

There is also talk surrounding Play’n Go, which sources suggested has been shopping itself for a while.

And then there is the much speculated upon Kambi – but E+M will shy away from getting into further trouble.

Moonshot: Lastly, the investment source suggested that in B2C one example stands out as a candidate for a take-private bid and that is Entain.

Apollo “could pull off an Entain scenario,” said the investment source.

“But it would need to have an appetite to acquire Entain, sell BetMGM to MGM and dispose of non-core non-integrated assets.”

Is your organization managing licensing submissions across several jurisdictions? Are redundant licensing tasks and scattered personal data slowing you down?

Now you can unlock new jurisdictional licensing within weeks, not months, with OneComply. By reducing application time from days to just minutes, OneComply improves efficiency by up to 99%.

Click here to connect with us and discover how much more you can get done with OneComply.

+More

Do it clean: BlueBet said the shuttering of its US-facing ClutchBet business in Iowa, Colorado and Louisiana cost it less than had been provisioned, meaning the A$11.2m ($7.4m) that had previously been set aside can now be released.

Easy does it: The company behind easyJet, the easyGroup, has launched an online betting venture in conjunction with Matchbook called, naturally, easyBet.

The week ahead

Small town, big man, fresh lipstick glistening: The big beasts of the Las Vegas Strip report this week, with Caesars Entertainment up on Tuesday AMC followed by MGM Resorts the day after.

Recent analyst commentary for Caesars has focused on the company’s improving cash position and the impact of lower interest rates on its debt payments.

Post-G2E, the team at Bain noted Caesars was hoping for additional cash contributions from the sale of non-core assets, as well as growth in Las Vegas and in its digital operation.

Look out for further commentary about the latter, with Truist making the point that at G2E the company was dangling the prospect of upgrades to its 2025 adj. EBITDA forecast of $500m.

The most recent analyst commentary on MGM Resorts was not quite so positive, with the JP Morgan team cutting their forecasts on what they said was likely to be an “uneven performance” in Q3 and tricky YoY comps.

Shares watch

Bad ’n’ ruin with my tail between my legs: It has been an ill-starred week for the listed gaming affiliates, as first Catena Media announced a €40m writedown and further job losses and then Better Collective followed up with a profit warning and the announcement of €50m of cost cuts.

This came despite the news earlier in the week that Sportradar is close to entering the sector via the buyout of XLMedia’s North America assets.

What a drag: But even that deal could be spun as merely completing the XL fire sale. Meanwhile, the bad news from BC and Catena dragged down the remaining listed affiliate constituents.

Gentoo (ex-GiG) was down 3% for the week despite issuing a positive update.

Gambling.com also suffered a 6% glancing blow while being a bystander to events.

Research does not support the old stock market adage that warnings tend to come in threes, but the same research suggested it will likely be a long road back for Better Collective if it is to regain previous heights.

As one investment source put it to E+M: “To understand where the bottom for a share price might be, consider that a stock that has fallen 90% first fell 80% and then halved again.”

The source added: “Your shares only go up if there are more buyers than sellers.”

It is worth noting here the extent to which almost all of Better Collective’s 35 acquisitions since 2017 have been funded in part through the issuing of shares.

X times marks the spot: Boyd Gaming leads the positive column after it produced well-received earnings last week, with the team at CBRE saying the company had managed to “change the narrative” around its development pipeline.

Specifically, the team said the recent “impressive” opening of the Treasure Chest in Louisiana provided for re-rating of the ROI benchmark for the remaining capex plans across Boyd’s portfolio.

That portfolio includes a new project in Las Vegas and four other properties.

GLP’s tribal funding first

New model: Gaming & Leisure Properties announced a gaming REIT first during its Q3 earnings call on Friday when it said it had completed a $110m sale-and-leaseback deal with Sacramento’s Ione Band of Miwok Indians, the first such funding agreement with a tribal player.

COO Brandon Moore said the agreement was “probably just the first step.”

He added that GLP hoped the structure of the deal, as agreed with the NIGC, was one that could be utilized as an “alternative form of funding” for tribes that have land held in trust.

He noted GLP had met with many tribes over the last several years and was “in the process of going back to many of those tribes now that we have the [NIGC] letter in hand.”

Outside the box: The team at Deutsche Bank congratulated GLP on being “creative” with its deal-making, opening up a “new and healthy pipeline, should tribal entities engage going forward.”

Algosport are regarded as one of the ‘best-kept secrets’ in the gambling industry, currently supporting hundreds of Tier 1 and challenger operators with our proprietary Algosport Blackbox – a powerful engine capable of supercharging your sportsbook.

We are best known for our next generation Bet Builder/Same Game Multiples product that offers the widest range of sports with unrivalled coverage, markets and features, both pre-match and in-play.

To understand how we could help create more revenue get in touch at www.algosport.co.uk

Analyst takes

Mohegan Sun: Having attended the company’s investor day, the credit team at CBRE said the “story” of next year would be the company’s continued efforts to reduce its debt load via refinancing of the $1.7bn due in 2026.

Business-wide, the ramp at the Inspire resort in South Korea continued but the company said EBITDA positivity won’t be reached for at least “a few more quarters.”

The digital operation, meanwhile, was experiencing “impressive growth” and would be a meaningful contributor to the company’s cash flow.

The analysts noted management remained committed to focusing on EBITDA, which in the last 12 months to June stood at $72m, over chasing GGR.

By the numbers – New Jersey

Crosstown traffic: On his company’s earnings call last week, Las Vegas Sands CEO Robert Goldstein made the point that iCasino cannibalization was a very real consideration when it comes to the prospective bid for one of the three downstate licenses on offer in New York.

LVS is involved with a bid for a casino to be constructed in Nassau County, Long Island, but Goldstein last week chose to pour cold water over the plans for a $6bn casino and resort.

While suggesting the company was “still interested” in pursuing its bid, he said his “only concern” was the ongoing strength of iCasino in neighboring New Jersey and Pennsylvania.

He noted that building a B&M casino resort was capital intensive and required a long-term perspective.

But the rise of iCasino – and the albeit somewhat distant prospect of the form being licensed in New York – was a “concern.”

He added that the rise of iCasino “makes you stop and scratch your head,” adding that “you can’t ignore the impact on land-based revenue.”

So, what is that impact? Goldstein suggested that “sometime in the next year or two” there would be a crossover in New Jersey with iCasino overtaking B&M GGR. YTD iCasino has grown 23% YoY to $1.73bn vs. a 1% decline in B&M GGR to $2.15bn.

It is not hard to see, given the differing growth rates, how on a month-by-month basis crossover could indeed occur within Goldstein’s timeline.

As can be seen in the chart below, the data from September showed the two forms of casino gambling closer than ever, with B&M gaming on $231m and iCasino on $208m.

🔀 B&M and iCasino approaching a crosswalk

But is this really the reason for Goldstein’s comments? iCasino’s trajectory has been apparent for a long time, while the specificities of New Jersey count against using its example in the wider debate around cannibalization.

Perhaps more relevant to Goldstein’s comments is the vocal opposition to the company’s bid in Nassau County.

Notable, also, is Las Vegas Sands’ absence of any online presence.

More numbers

Ontario: Handle rose $18.7bn in Q2, up 32% YoY, while GGR was up 35% to $738m, with iCasino representing 75% of GGR, sports betting 23% and P2P poker 2%. This was generated by a total of 51 operators with 83 websites.

Greece: Total handle in Greece increased 14% YoY in the first eight months of 2024, with the amount bet by players generating €28.3bn, according to local media. Online betting produced €20.1bn while €1.3bn came from B&M casino gaming, up 7% YoY.

Your Fast Track to Platform Ownership

At Fincore, we believe ambitious operators should control their own platforms and customer data.

Meet TRI, our modular software suite including Sportsbook, RGS, PAM, Payments and Bonus.

Each service works brilliantly alone, integrates seamlessly with your tech stack, or functions as a complete solution.

Join us on a 3-step journey to owning your own platform:

1. Choose a module and we’ll customise it to your needs.

2. We’ll run it with you, acting as an extension of your team.

3. When ready, you can take full ownership and control.

Find out more here

Earnings calendar

Oct 25: GLP (call)

Oct 29: Caesars Entertainment

Oct 30: MGM Resorts

Oct 31: VICI (earnings)

Nov 1: VICI (call)

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.