Portnoy redux: DraftKings ’close’ to Barstool marketing deal

Barstool return, LVS booming, Betr’s Mass exit, Sportradar restructure, FDJ/Kindred reaction +More

Barstool reported to be in talks with DraftKings over betting link-up.

In +More: Sportradar restructure, Caesars’ new debt.

Las Vegas Sands‘ growth in Macau “just keeps coming.”

Exit ramp: Betr calls a halt in Massachusetts.

More reaction to Kindred/FDJ.

BettingJobs’ Jobsboard includes country and operations manager roles.

In the twist of separation you excelled at being free.

Barstool return

Barstool is reported to be getting back into betting via a marketing partnership with DraftKings.

Look who’s back? Barely six months after being sold by Penn Entertainment and seeing its name swapped out for ESPN Bet, Dave Portnoy’s Barstool Sports appears to be on the verge of a betting sector comeback via an exclusive marketing deal with DraftKings.

According to Sportico, the two are in advanced talks about an extensive deal that would involve a marketing plus affiliate relationship.

The multi-year agreement would involve a fee for Barstool in the low double-digit millions, Sportico reported.

It also noted that, according to the terms of the Penn separation lock-up, the deal cannot be finalized until after the Super Bowl.

On the rocks: Any deal would represent a return to the fray for Barstool, albeit without having its name emblazoned across a sportsbook, after a fractious period of ownership by Penn. On the face of it, an exclusive affiliate relationship would avoid many of the reputational issues that bedeviled the brief lifespan of Barstool Sportsbook.

Penn called a halt to the relationship in August when it announced the deal with ESPN and sold the Barstool Sports business back to Portnoy for $1.

Penn had originally laid out $551m for the business.

One season wonder: Penn said in August that, as part of the sale back, Portnoy had signed a non-compete alongside other restrictive covenants and had agreed to give Penn 50% of the proceeds from any subsequent Barstool sale.

Sportico reported insiders as saying the restrictions on getting involved in betting only applied for the current football season.

OhPenn verdict: Chris Grove from EKG said via LinkedIn that while both DraftKings and Barstool will be happy about the “high floor, moderate ceiling” nature of the deal, for Penn the optics are less than positive.

“Armchair quarterbacking someone else’s deals is always tricky business, but regardless of the particulars, this just reads really poorly for the company,” he wrote.

He followed up on X saying that while Penn likely didn’t have “much choice” with regard the length of the lock-up, the news of a Barstool/DraftKings tie-up “underscores just how bad the overall deal ended up for them.”

Further reading: Dustin Gouker’s The Closing Line was similarly caustic on the apparent strategic mis-step from Penn.

Smelling of roses: “[Portnoy has] come out of this extremely well despite the fact the company failed in creating a critical mass of sports bettors under the Penn umbrella. The whole thing was a bad idea, poor execution, or some combination of both.”

EveryMatrix delivers iGaming software, solutions, content and services for casino, sports betting, payments, and affiliate/agent management to 300+ global Tier-1 operators and newer brands. The platform is modular, scalable, and compliant, allowing operators to choose the optimal solution depending on their needs.

EveryMatrix empowers clients to unleash bold ideas and deliver outstanding player experiences in regulated markets.

+More

Streamlined: Sportradar has announced a reorganization and new executive team while reaffirming guidance for last year and the outlook for 2024. As part of the restructure, which sees Sportradar divided into six business functions, the company also announced the departure of CFO Gerard Griffin and chief strategy officer Ulrich Harmuth.

For 2023, the company reiterated its expected revenue to come in at €870m-€880m, representing growth of 19-21%. Adj. EBITDA is forecast at €162m-€167m, up 29-33% YoY.

It said growth in 2024 is expected at >20%.

Analysts at Jefferies said Griffin’s departure after a brief tenure of less than a year introduced a “notable uncertainty.” But their impression was there was a “growing appetite” from management to engage with the capital markets “more actively.”

Caesars Entertainment has launched a $1.5bn private placement offer of senior secured notes and has upsized the recently announced new senior secured term loan from $2bn to $2.9bn. The proceeds will go to repaying $4.4bn of existing debt.

In suspense: Flutter has suspended trading of its shares on the Euronext Dublin exchange ahead of the dual-listing in New York next week.

Evolution has been landed with a class-action lawsuit in the US alleging it misled investors over growth prospects and compliance issues. See Compliance+More next week for more.

Fanatics Betting & Gaming has launched in Pennsylvania. Meanwhile, PrizePicks has launched a P2P fantasy sports game, PrizePicks Arena, in Alabama, Tennessee, West Virginia and Wyoming and Underdog Fantasy will launch online sports betting in North Carolina through a partnership with McConnell Golf.

Bruin Capital-owned gaming affiliate Oddschecker Global Media has rebranded as FairPlay Sports Media.

IGT will provide its PeakDual VLTs to Loto-Québec under a new multi-year agreement.

Seventeen tracks and I've had it with this game: Las Vegas natives The Killers are set for a residency at Caesars Palace in August and September.

Deal talk

Look sharp: SharpLink Gaming has sold its fantasy sports and F2P games business SportsHub to RSports Interactive for $22.5m in an all-cash transaction. Sharplink will use the proceeds to pay off $14.9m of loans and lines of credit and will use a further $4.9m to redeem an outstanding convertible debenture.

Seal of approval: Shareholders at Playmaker Capital have approved Better Collective’s €176m cash and shares offer, and the deal – Better Collective’s second-biggest transaction – is now set to close in early February.

What we’re reading

FanKings: The EKG Line points out the FanDuel/DraftKings duopoly hit a 14-month low in November.

Las Vegas Sands earnings

Gravy train: CEO Rob Goldstein said the growth in Macau “just keeps coming” after the company delivered $654m of EBITDA from the gambling enclave in Q4, up from a $51m loss this time last year. He also predicted the Londoner “juggernaut” would soon eclipse the Venetian in “earning power.”

“Our future growth in Macau is tethered to these powerful assets,” he told analysts on the call on Wednesday.

I’m a believer: Goldstein was also positive on prospects for the overall market, saying LVS was a “staunch believer.”

Chum Kwan Lock, Sands China COO, said that while mass gaming in Macau was “progressing nicely” it was premium mass that “had a great performance.”

He added that the “desirability” of Macau was clear even though transportation capacity was “still recovering.”

All guns blazing: Not to be eclipsed, the company’s Marina Bay Sands in Singapore delivered adj. EBITDA of $544m, up 99% YoY – the property’s best-ever result and despite the disruption caused by the ongoing $1.75bn renovation work. MBS was “hitting on all cylinders,” Goldstein said.

The CEO suggested the only “disappointment” with Singapore was capacity. “We just don’t have more space,” he added.

Back to the world: Goldstein said LVS was “enthused” about the potential to develop a resort casino in downstate New York. “Our bid is compelling,” he added. “If we receive the license, we’d be on the ground as quickly as possible.”

Giving it back: Asked about share buyback plans, COO Patrick Dumont said the company “fundamentally believes” in the long-term value of “benefit of share shrink.”

Market exit

Betr out than in: The Jake Paul-fronted Betr has announced it is exiting Massachusetts after failing to grab any kind of market share, saying this week it has elected not to renew its license.

Miserable: According to data from the Massachusetts Gaming Commission, Betr garnered just shy of $500k in handle in December and a mere $39k in GGR.

Since its launch in May last year, Betr has managed to accumulate a handle of just $2.4m and GGR of $178k.

Still thinking about the bad news? Spinning the news, Betr quietly announced the departure from Massachusetts in a press release that said it had secured market access in three more states, including Pennsylvania, which will be the company’s first iCasino state, Colorado and Kentucky.

According to the company, Betr is “trading a 7m population state for over 23m in the new states for collectively less economics than it would have required to renew in MA alone.”

Betr luck next time: Joey Levy, CEO, thanked the Massachusetts Gaming Commission for a “great partnership” during the temporary license period. “We hope to receive the honor and privilege of re-entering this market at a later date.”

Boult-on deal: The launch in Pennsylvania will come via a market access deal with the Cordish Companies. In Colorado, meanwhile, Betr has been granted market access via a deal with Boulter Developments, which has also taken an equity interest in the operator.

In Kentucky, access comes via a deal with the Eastern Band of Cherokee Indians.

The tribe has also increased its existing equity stake in Betr, previously acquired through a market access partnership for Indiana where the company is yet to launch.

Earnings in brief

IG Group: UK-listed financial trading outfit IG Group, soon to be headed by ex-Paddy Power Betfair CEO Breon Corcoran, kitchen-sinked the bad news before he officially takes up the post next week, saying revenue for H124 was down 9% to £473m while adj. pre-tax profit fell 21% to £206m.

NorthStar Gaming: The Ontario-focused operator has announced it expects to report revenue of C$6.5m ($4.8m) for Q4, a 103% YoY increase, while FY23 revenues will come in up 242% to C$19.5m. Total Q4 handle is estimated to be C$213m, up 90%. It expects to report full-year numbers in April.

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

M&A reaction – FDJ/Kindred

Big get bigger: The pace of consolidation within the European betting and gaming space took a “major step forward” with the $2.8bn acquisition of Kindred by Française des Jeux, according to the team at Deutsche Bank.

The team noted the headline valuation of just 7.1x FY25 EV/EBITDA was “particularly low” due to FDJ’s decision to exit all of Kindred’s gray markets bar Finland, where there is a clear path to regulation. This reduces Kindred’s estimated 2025 EBITDA by ~20%.

Rocky road: The sale to FDJ brings to an end a period of uncertainty surrounding Kindred, including the strategic review, problems over the delayed Netherlands re-entry, regulatory issues in Norway, the loss of a CEO and the exit from North America.

But despite the low multiple, the Deutsche Bank team said that, while not representing a “knock-out offer”, the exposure to unregulated markets means they see “little scope” for any competing offer.

The shares week – Inspired

Relief rally: Inspired Entertainment’s shares rose over 11% this week after the company said it would finally release its restated Q1, Q2 and Q3 numbers not later than Feb. 28. It will then file its Q4 and full-year earnings in March.

Recall, in November the company told the market its Q3 numbers would be delayed due to the need to restate figures provided by previous accountants Marcum.

🤔 Inspired up over 11% on the week

Calendar

Jan 30: PointsBet

Feb 1: Rank

Feb 6-8: ICE, London

Feb 7: Disney

Country Manager – Copenhagen

Commercial / Operations Manager – Sierra Leone

Marketing Director – London

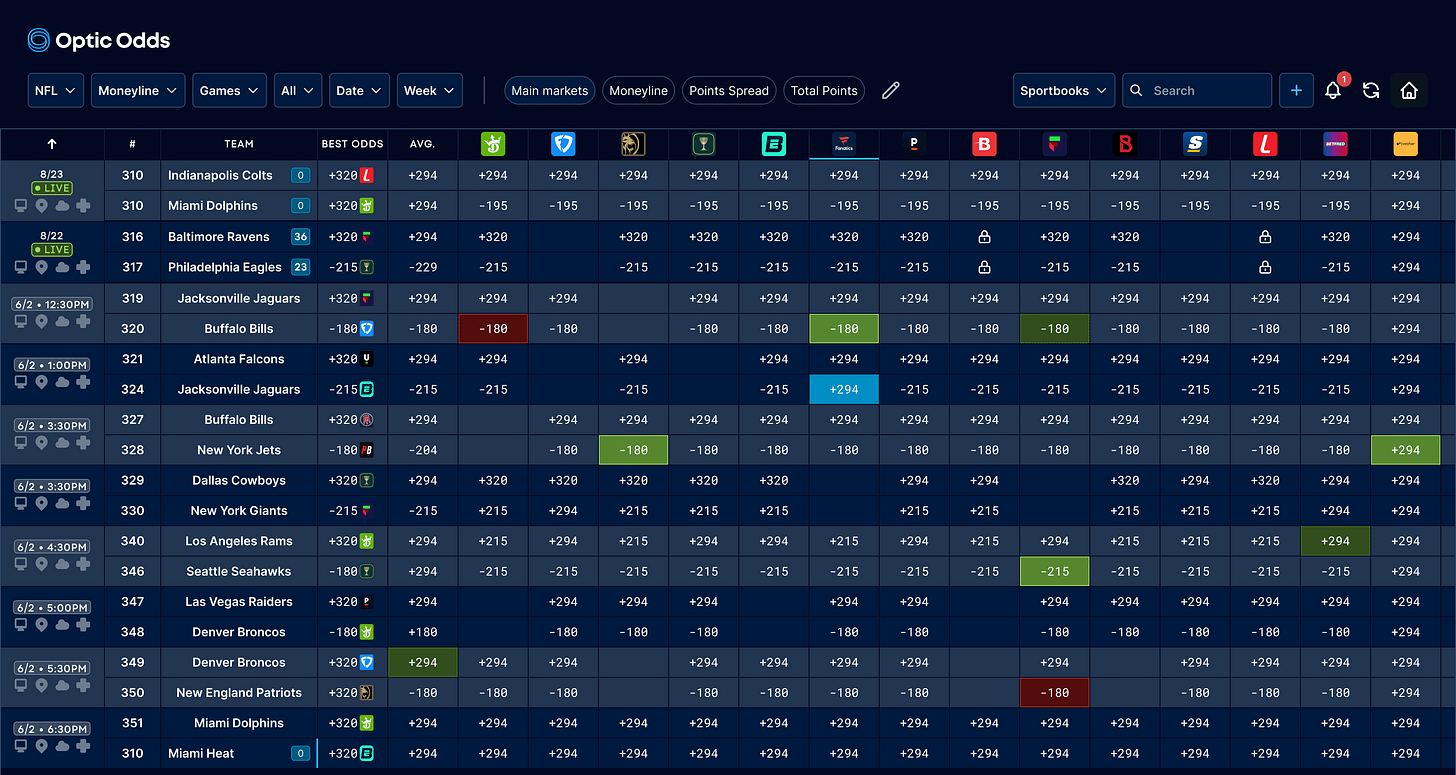

Operators, how's your risk management for NFL or March Madness? Utilize the trading screen used by top operators in the US, Europe, and Australia.

Book a meeting with Optic Odds at ICE and receive complimentary access to our trading screen for one month - no strings attached.

Includes:

Main lines, alternative markets, player props for the Big 6, soccer, and more

Ultra-low latency: built with an emphasis on speed

Create bespoke custom weighted lines on the screen and receive live alerts for line movement via Slack or Teams

Also, our push format API offering real-time betting odds from 150+ sportsbooks: player props, alternate markets, injury data, historical odds, schedules, ranking, scores & more, is available upon request.

Book a meeting here or get in touch at ryan@opticodds.com.

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.