Portnoy raises prospect of Barstool departure

Barstool founder talks potential exit, The week that was, XLMedia shares tumble, Analyst takes, Sector watch – AI +More

Good morning. On the Weekender agenda:

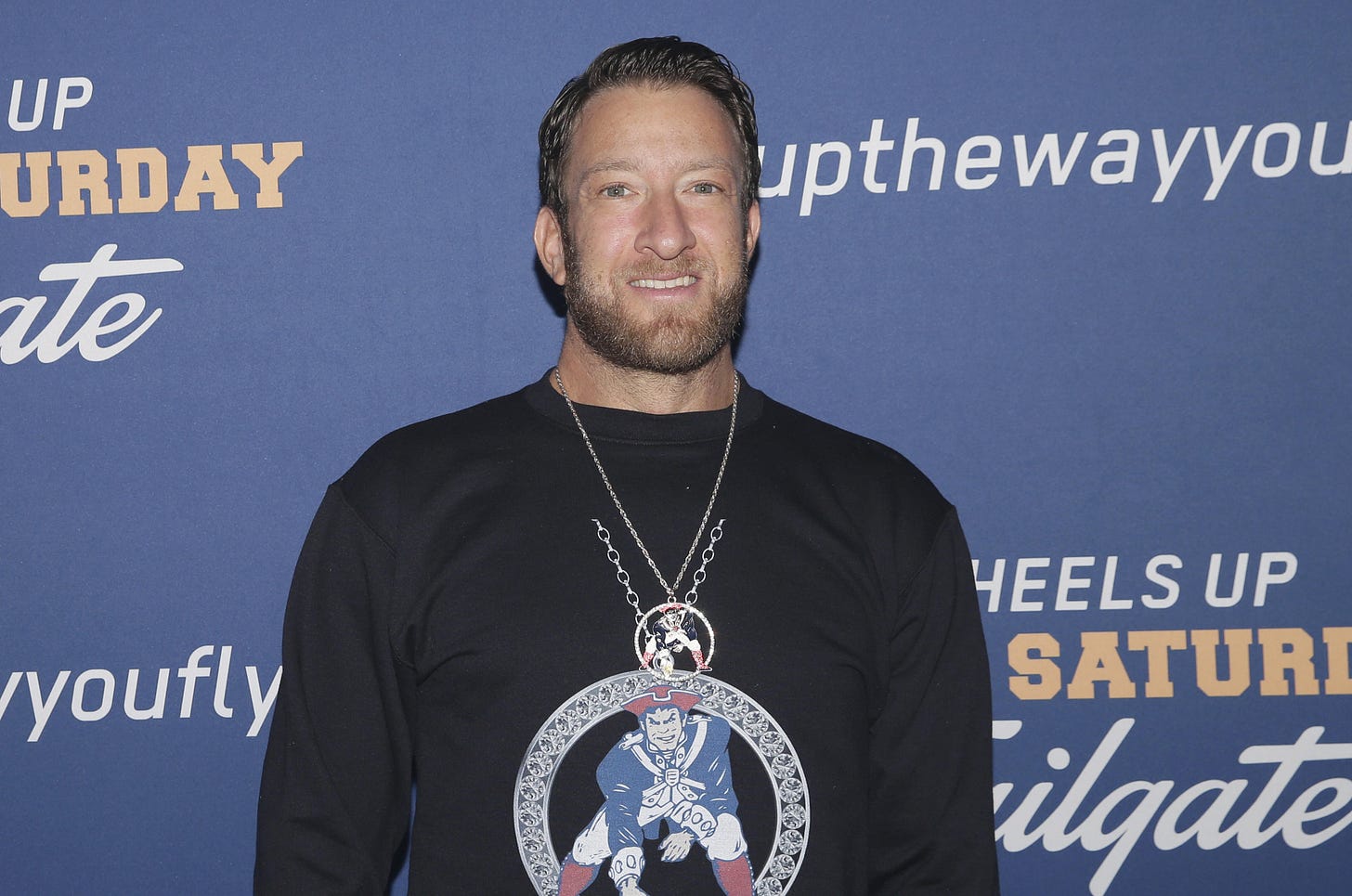

Dave Portnoy hints that he may depart Barstool when contract expires.

ICYMI features yesterday’s Compliance+More story on France iCasino.

Earnings in brief includes a warning from XLMedia.

Sector watch looks at how Artificial Intelligence has gone mainstream.

Jobsboard by BettingJobs features Casino Operations Manager and Legal Counsel roles.

Portnoy saga

Barstool founder’s latest comments follow Ben Mintz sacking storm.

Exit interview: Talking on the Kirk Minihane Show earlier this week, Barstool’s Dave Portnoy suggested he might not take up a contract extension with owner Penn Entertainment. The comments come weeks after Portnoy made plain his frustrations at having to toe the corporate line on the sacking of Barstool influencer Ben Mintz.

Asked directly about whether he might himself leave the company, Portnoy said “My contract’s done in 20 months, so.”

“Who knows what they’re thinking at this point.”

Controversialist: Portnoy has effectively become the lightning rod for Barstool, at the center of various scandals and seemingly willing to use social media to air his grievances. The most recent furore saw him cite regulatory concerns for Penn as the reason behind the sacking of Mintz for using a racial epithet on air.

Asked what he might do post-Barstool, Portnoy said the idea of a no-holds-barred podcast would appeal.

“Would I just do a podcast a week that’s totally unfiltered? Would I enjoy doing that? Maybe,” he said.

“There’s part of me that thinks I’d be like, OK I’m done.”

** SPONSOR’S MESSAGE** BettingJobs is the global leading recruitment solutions provider to the iGaming, Sports Betting and Lotteries sectors. Boasting a 20-year track record supporting the iGaming industry, and with a team of experts and world class knowledge, it’s no surprise BettingJobs is experiencing rapid growth with outstanding results. Does your company have plans to expand teams to cope with strong growth and demand?

Contact BettingJobs.com today where their dedicated team members will help you find exactly what you are looking for.

ICYMI

In Compliance+More this week, developments with iCasino in France was the top story yesterday where the ruling party has set out plans for a five-year moratorium that would exclude all but ‘national actors’.

In Earnings+More on Wednesday, reports suggested Kindred’s strategic review process has come to the conclusion that a sale of the business is the best option.

Meanwhile, in the latest Data Month, we featured analysis from USAbility, which looked at in-play suspension times across the major books.

In Sharpr this week, Australian authorities have rolled back the years to have a pop at skin gambling via the banning of the CSGORoll site.

And on the Gambling Files podcast, in the week that the latest attempt at getting OSB legalized in Texas came to nothing, Jon talks to The Texas Tribune journo Patrick Svitek.

Coming up: Next week will see the release of the debut issue of Los Ingresos+Mas, the new Spanish-language, Latin America-facing newsletter from the +More Media stable. Sign up here.

Earnings in brief

Bet-at-home: The operator continued to struggle in Germany with revenue falling 5% YoY to €13.3m. However, it returned to EBITDA profitability of €1.8m after a loss of €1.4m last year, helped by restructuring programmes that have cut staff costs by over 40%. Marketing activity was also curtailed, down 22% YoY.

The FY23 outlook was maintained with revenues at €50m-€60m and EBITDA of between a €3m loss and €1m profit.

Opap: Revenue for the quarter came in at €527m, up 15%, while EBITDA rose 16% to €196m. Over the period, Opap released a revamped online sportsbook proposition as well as a new iLottery platform, which it said strengthened its online footprint.

NorthStar Gaming: The Ontario-based operator saw sequential growth of 8% as GGR came in at C$4m. Earlier this month, the company completed its acquisition of Slapshot Media, the iGaming marketing and managed services provider, with the aim of opening up the rest of the Canadian market to NorthStar.

XLMedia: The gaming affiliate provider has warned that revenues in H1 will “inevitably” come in below H122 levels, which had benefited from last year’s OSB launch in New York. The company noted that levels of operator acquisition spend in H1 was “not comparable” to last year, with less generous promotions available to attract new customers.

“This reflects our previous acknowledgement that growth in the US market will not be linear,” the company said.

The statement added that “continued softness” was expected for the rest of the summer.

👀 XLMedia shares down nearly 17% in early trading

Analyst takes

Regional gaming outlook: The team at JMP have suggested that with GGR growth decelerating every month in 2023 so far, the likelihood is that growth will “remain muted” for the rest of this year.

The team noted that earnings for the regional operators “surprised on the upside: in Q1”.

But it is macro headline worries that are influencing the share prices, which are down as a group 10% in the last three months.

Better Collective: Analysts at Redeye said the growth outlook remains positive for the affiliate giant, following its solid Q1. Despite the seasonally slower Q2, the period started strongly, with April up 40% YoY with revenues of €27m, the analysts noted.

However, they maintained Q2 revenue forecasts of €66m as they expect May and June to be “slower” than April.

Sequential growth is expected in Q3 and Q4, helped by a potential sports-betting launch in Kentucky, but Europe and RoW regions face tougher comps from the strong Q422 and limited total growth in Q423.

South America will continue to emerge as an affiliate market in the next two years and will grow alongside a “more mature” European business, the team added.

Sector watch – AI

Artificial Intelligence has gone mainstream – and the gaming sector is playing catch up.

Boss of me: The International Gaming Standards Association (IGSA) isn’t waiting to find out who will set the rules on AI, and believes that self-regulation is healthier than legislation. The lobby group recently formed a non-technical committee to monitor ethical use of AI across the industry and ensure players are treated fairly by algorithms.

Aristocrat Gaming, AXES.ai, Light & Wonder and Playtech are founder members of the board, and will help to shape the industry guidelines, policies and standards that will be shared with gambling regulators.

Chat me up: The measure comes as AI moves up the news agenda, with the developers warning that the technology needs guardrails. OpenAI CEO Sam Altman recently told Congress it’s “time to start setting limits on powerful AI systems”.

AI governance is being discussed in multiple international forums, including the US-EU Trade and Technology Council (TTC), the Global Partnership on AI (GPAI) and the Organisation for Economic Co-operation and Development (OECD).

A recent G-7 leaders communiqué also highlighted the need for cooperation on AI, stating that top nations are effectively stumped as to how they will proceed.

The US is making some progress on standards, but experts say the fragmented domestic approach will hinder the nation’s desire to take the lead internationally.

Everyone’s a winner: There appear few boundaries in what generative AI can achieve, particularly in gaming where every facet of the industry stands to benefit from LLM breakthroughs. Customer service chatbots, player behavior analytics, casino surveillance, to intelligent tools themselves used by punters to gain an edge, everyone stands to gain something.

But the growing accessibility of the tools, privacy worries, and the inherent risk of discrimination and bias within the training models has fuelled concerns of increased toxicity and misinformation.

Using AI to speed up decision-making could have consequences for account onboarding, KYC and AML checking, if the models aren’t accurate.

Bureaucratic quandaries and regulatory boundary disputes are also growing in number.

** SPONSOR’S MESSAGE ** Tried, tested and proven over a decade in the highly-regulated US market, and continuing to expand across Europe, Latin America, Asia and Africa. GeoComply harnesses the power of its market-leading geolocation technology to protect against fraud, including fake account creations, bonus abuse, account takeovers, stolen identities, money laundering, and more. Visit geocomply.com.

What we’re reading

Circa has a new sportsbook director but the same sharp model.

Newslines

Fanatics has launched an invitation-only, beta-testing mobile sportsbook app in Massachusetts.

Conifer Management has emerged as a near-10% shareholder in Catena Media. Recall, rival Better Collective also owns a near-10% stake.

The Dutch government says it is reviewing its options with regard to a potential sale of the state-owned Holland National Lottery.

Calendar

Jun 8: Gaming in Holland

Casino Operations Manager – Malta

Legal Counsel – Malta

Manager of Risk – Europe

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.