Leading gaming stocks still face recession risk, despite partial tariff U-turn.

In +More: Flutter gets regulatory and antitrust clearance on Snai acquisition.

The long take: Wynn Resorts gets Fertitta backing, but Deutsche Bank is wary.

Rank gives a positive view on UK trading in the first three months of 2025.

Hard Rock Bet is gearing up for 2025 with a focus on amplifying brand and product engagement. With a powerful, custom-built bonusing system and an ambition to redefine traditional CRM, we’re seeking leaders who are driven to challenge the status quo:

And other amazing positions here

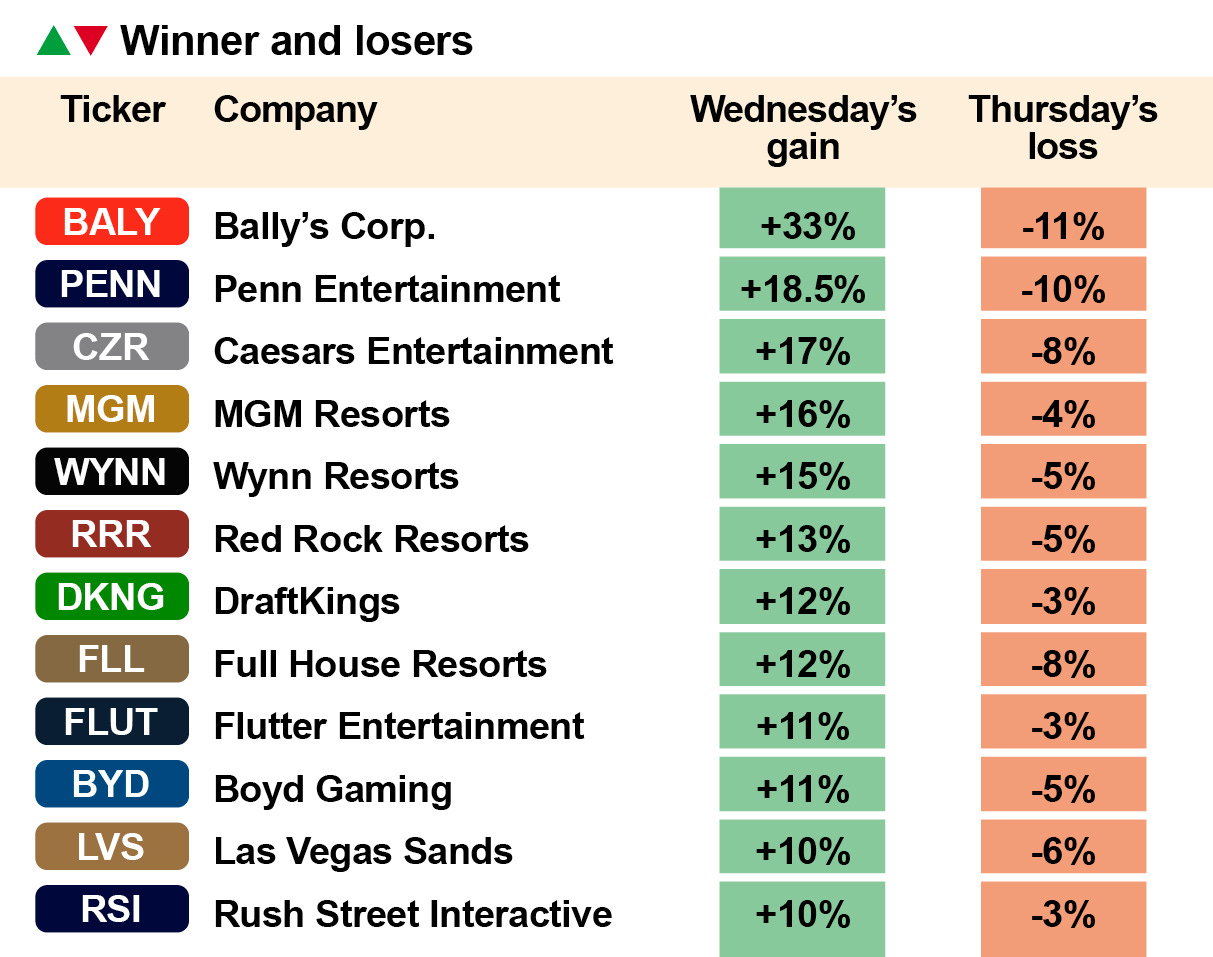

Ups and downs

The 73-minute recession: The US gaming sector enjoyed an epic across-the-board share price bounce after President Trump hit the pause button on reciprocal trade tariffs late on Wednesday, causing an immediate stock market resurgence.

The U-turn came just over an hour after Goldman Sachs suggested the chances of a recession occurring in the US in the next 12 months were at ~65%.

Night follows day: But with the tariff situation far from settled, the markets took a bath once more yesterday, dragging down the leading gaming stocks, albeit – in some cases at least – less dramatically than in previous daily drops.

The downturn train: The uncertainty over direction of travel is reflected in Kalshi’s recession prediction market, which hit a high of 69% before the Trump announcement, fell back to ~54% after, and as of late Thursday was back up to 62%.

TFI Friday: The market chaos has done nothing for the stability of the leading gaming sector stocks. Fears over how some of the leading names in both Las Vegas and the regional markets might fare in an economic downturn have driven share price volatility.

Meanwhile, the leading online stocks have also been suffering, including DraftKings.

This despite a prevalent ‘buy the dip’ mentality among the stock’s followers, argued the analysts at Deutsche Bank.

Similarly, the team at Stifel this week said in a note picking out Flutter that iCasino and OSB had an “immaterial direct exposure” to tariffs.

In a note assessing the positioning of the sector given the current recession talk, the team at Macquarie said they favored online stocks “during trying times” given their more resilient characteristics and low leverage.

Moody blues: The current general mood is perhaps typified in a separate report from the DB team, who wrote in a note published on Wednesday that they didn’t expect the upcoming Q1 earnings season to “serve as a material upside catalyst” for the operators.

“For Las Vegas and Macau operators specifically the unclear outlook and current valuations provide a stable platform from which to reduce investor expectations,” they added.

“We expect some, though not all, to do so in the upcoming earnings season.”

GeoComply's international solutions are unlocking compliance and security for the global market, so players everywhere can enjoy seamless, worry-free gaming experiences.

GeoComply’s Brazilian solution is designed specifically for the local market, offering seamless geolocation compliance (without requiring a companion app), robust anti-fraud measures, and streamlined licensing support—all while minimizing customer friction.

Learn how our advanced geolocation, identity, and fraud solutions safeguard your platform from account takeovers, fraudulent chargebacks, promotion abuse, and more!

+More

Crossing the Ts: Flutter Entertainment’s €2.3bn acquisition of Snaitech from Playtech is set to complete later this month after it received all the necessary regulatory and antitrust approvals. Playtech confirmed it will now return much of the fee to shareholders via a special dividend.

Mohegan has announced the issuance of $1.2bn in new secured notes as a first step in the expected closing of significant refinancing transactions, including the notes offering, a private notes exchange and entry into a new credit agreement.

Bragg Gaming has announced it has taken an equity stake in Brazil-based iCasino studio RapidPlay for an undisclosed sum. Under the terms of the deal, it will now be the exclusive distributor of the studio’s portfolio of games in the country. Bragg said it also has the option to acquire a controlling stake in the business in the future.

What we’re reading: Having spoken to Kalshi, Prediction News writes that of the $504m traded on March Madness on the operator’s prediction markets, the estimate for in-play action stands at 50%.

Read across

Derailed: In Compliance+More this week, ahead of President Trump’s U-turn on reciprocal tariffs, the Thai government reached an agreement with parliament to delay discussing the potential opening up of the country’s gaming market, in order to prioritize its response to the threat posed by the imposition of a 36% levy on exports to the US.

+More careers

The big move: Gambling.com Group has seen a number of boardroom changes, with the departure of Gregg Michaelson, who will be stepping down in May, and the appointments of Jayme Mendel, currently CEO at EverQuote, and Fintan Costello, who was the CEO of the BonusFinder business Gambling.com acquired in 2022.

Accel Entertainment has appointed Scott Levin as chief legal officer and has also added Cheryl Kondra to its board. Marc Burroughes is joining EveryMatrix as CCO for casino operations. Mikael Marceau has announced he is starting a new position as director of product growth and strategy at FDJ United.

Chief Marketing Officer – North America / US

Director of Software Engineering – London, UK

Product Manager – MarTech – Ras Al Khaimah

The long take – Wynn Resorts

Fill yer boots: Taking advantage of the share price lows – and ahead of Wednesday’s sharp move upward – was Wynn Resorts’ largest shareholder Tilman Fertitta, who snapped up more than 400,000 shares to take his ownership stake to over 12%.

Fertitta, who has recently taken up the post of US ambassador to Italy, was already the owner of over 10% of Wynn and said previously the company was undervalued.

His buying spree occurred when the stock was valued at under $70 a share vs. the near-$76 a share at close on Wednesday.

Read the memo: While unlikely to be representing the US government's views to foreign states anytime soon, the team at Deutsche Bank appeared to be on the same wavelength as Fertitta.

In a note this week, the DB team argued that, “broadly speaking,” Wynn’s shares are currently cheap.

Macanese unease: However, they have lowered their estimates for Wynn in Macau. The team was previously forecasting marketwide GGR growth of 4% for Q1 compared with consensus of +7%. But the actual number ended up coming in down 1%.

The forecast cut is a combination of this marketwide GGR shortfall plus what they believe will be Wynn’s lower market share and poor hold in January.

But the US business “remains compelling,” the team added. Despite the challenging Super Bowl comparison, they suggested Wynn Las Vegas has held up fairly well in Q125. But, they added, investors have become “jittery” around the impact of geopolitical tensions on international travel.

“At this stage, while we expect Strip operators to recognize the uncertainty, we do not expect to hear commentary on impacts to the business at present, from international demand or the potentially weakening domestic consumer,” they added.

“We do believe the cloudy outlook will be noted, however.”

Quick takes

Las Vegas: The latest room rate survey from Truist is “mostly stable/positive from prior weeks,” argued the analyst team, with none (as yet) “major signs of deceleration amidst an uncertain macro.” But the team added Q2 remains more mixed than Q1, with April up YoY, May slightly down and June “looking soft.”

EDGE Boost is a dedicated bank account for bettors with a daily debit limit of $250,000 and 100% approval for all gaming activity. Money movement in gaming has never been a payments problem, it's been a banking problem. With no integration (Runs on VISA rails) and no costs, EDGE can impact Operator margin by lowering processings costs and reducing chargebacks while growing revenue through increased cash access and a 1% rebate on all transactions.

To find out more, go to www.edgeboost.bet

Earnings update

Rank: The first sighting of how the UK gambling sector fared in the first three months of the year comes from Rank’s FYQ3 update, which showed its B&M casinos business and its digital arm both growing double digits.

The Grosvenor Casinos arm saw revenues rise 13% YoY to £90.4m while the iCasino business was up over 15% to £58.4m. Within the Grosvenor brand it was up 43%.

The Mecca Bingo business saw only 2% growth to £36.6m, however, with a 2% decline in customer visits countered by a 4% growth in spend per head.

The Enracha venues business in Spain, meanwhile, was up 4% to £10.2m.

Total revenues for the quarter came in up 11% at £196m while in the FY25 YTD total revenues were up 12% to £597m.

CEO John O’Reilly said the company holds out strong hopes for the government to publish the statutory instruments needed to unlock the planned land-based gaming reforms.

This should see Rank able to add additional gaming machines across its casino estate and add in sports betting to the B&M casino mix.

Quick takes: The analysts at Peel Hunt said they were “itching” to upgrade their forecasts on Rank given its continued progress, but are holding fire until the current turmoil abates.

Connections

The big deal: EveryMatrix iCasino content has gone live across five regulated jurisdictions with Caesars Entertainment’s brands, including New Jersey, West Virginia, Michigan, Pennsylvania and the Canadian province of Ontario. The deal involves content from its in-house studios, including Armadillo Studios and newly acquired Fantasma Games via integration with SlotMatrix.

Penn Entertainment has launched a standalone iCasino app in Ontario for its theScore brand. It will operate on the same backend that powers Penn’s US iCasino brand, Hollywood Casino.

Black Cat Games has announced plans to develop a new slot with Yggdrasil. Gaming Corps is to supply its online casino games to FDJ United’s 32Red brand. Malta-based iGaming developer Logifuture will provide its virtual soccer product to Aristocrat’s interactive platform in Mexico. Playson’s online games are now accessible in Latvia through a content partnership with Novomatic’s Fenikss brand. RubyPlay’s online slot games are now available on Betsson’s StarCasinò brand in Italy under a content partnership. Thunderkick will continue to provide its online slot content to Domusbet in Italy after signing a partnership extension.

Incentive Games is set to enter the UK market after receiving a license from the UK Gambling Commission. Playnetic has been awarded an Ontario license by the Alcohol and Gaming Commission of Ontario. Splash Tech has received a B2B supplier license from the Malta Gaming Authority to launch its real-money jackpot technology.

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

Upcoming earnings

Apr 23: Churchill Downs (earnings)

Apr 24: Churchill Downs (call), Boyd Gaming

April 25: Gaming & Leisure Properties

Apr 29: Caesars Entertainment

Apr 30: MGM Resorts, Rush Street

May 1: VICI Properties

EveryMatrix delivers iGaming software, solutions, content and services for casino, sports betting, payments, and affiliate/agent management to 300+ global Tier-1 operators and newer brands. The platform is modular, scalable, and compliant, allowing operators to choose the optimal solution depending on their needs.

EveryMatrix empowers clients to unleash bold ideas and deliver outstanding player experiences in regulated markets.

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.