A host of companies are likely to be lining up offerings in the year ahead.

Markets watch: Flutter and DraftKings wobble (then recover) on antitrust threat.

Entain’s new management gets a thumbs up from the analysts.

Fantasy app downloads have a story to tell.

I fly like paper, get high like planes.

Hard Rock Bet is gearing up for 2025 with a focus on amplifying brand and product engagement. With a powerful, custom-built bonusing system and an ambition to redefine traditional CRM, we're seeking leaders who are driven to challenge the status quo:

And other amazing positions here

Taking flight

Cashing in: This past 12 months has been dire for public offerings in the betting and gaming sector, but there are widespread hopes that 2025 will see a slew of floats as owners seek to cash in on public market buoyancy.

The only successful float in 2024 was the New York minor High Roller Technologies, which managed to get its IPO away in late October.

That aside, the nearest the sector got to a larger offering was Games Global, which pulled its offering in May.

But sources suggested there is greater optimism that, as Itai Pazner – former CEO at 888 (now Evoke) – said, “falling interest rates and the prospect of less regulation means that the animal spirits are back.”

“This year set a low bar for IPOs,” said Chris Grove, partner at EKG. “2025 should have little trouble clearing that.”

The combination of new markets, a pro-business administration in the US and the reduction in inflationary pressures and cost of capital “all point to a more hospitable environment” for gambling-related IPOs, Grove added.

Ripe: Data put together recently by Citizens Bank shows the extent to which the wider US IPO market has made a stuttering recovery since the nadir of 2021, when climbing interest rates put an end to the SPAC boom.

Only $28bn of share offerings were completed this year compared to $141bn three years ago.

SPAC for good: Sources concur that now even SPACs could be back on the agenda as founders and backers seek quick routes to take advantage of the new enthusiasm.

The sector has form with SPACs. DraftKings is perhaps the most successful example in any sector, while Genius Sports was another that managed to get a float away before rising interest rates crushed further hopes.

A safe European home: A wrinkle for the sector, however, is that some of the most obvious candidates for public offerings are European-based and European-focused entities.

The PE-owned Cirsa is one such company. Last week it was the subject of reports that Blackstone is seeking a float on the Madrid stock exchange.

Sources pointed to the CVC-owned Tipico as another candidate. But as one corporate advisor who opted for anonymity put it, “people hate buying from private equity.”

Go west: A more likely source for activity will be the US but, as ever, a North American angle to the underlying business will be imperative if enthusiasm among investors is to be whipped up.

“The US is the place to list, but without a US story it really won’t be easy,” said another corporate advisor who opted for anonymity.

“A US angle certainly improves the prospects for a US IPO,” said Grove. “But there are other and arguably more critical thresholds you need to clear.”

Sweeping statement: Among these, he suggested, are a “hook” for retail investors and a “clear and compelling growth story is still a table-stakes requirement.” One such obvious hook is the sweepstakes market.

“Once the dust from Light & Wonder’s anti-competitive crusade inevitably settles, it wouldn't surprise me to see the larger social sweeps operators, especially VGW, explore public listings,” Grove added.

“My guess is something will happen in sweeps,” said one of the corporate advisors.

“And if someone gets something away, and the markets are quite frothy, then you can see copycat deals taking place.”

Yellow river: Also in the sweeps space, Yellow Source Interactive, home of the Pulsz sweepstakes site, “has the potential for a direct listing or a reverse takeover,” added the corporate advisory source. Meanwhile, the DFS+ operators are also waiting in the wings.

DFS+ operators “may still be a year or so away from optimal positioning for an IPO, but that could change if there’s a sense that American retail investors are inclined to throw their enthusiasm behind the category,” said Grove.

South for the winter: Contrary to that US imperative, one of the advisors spoken to by E+M suggested VGW, which runs the phenomenally successful Chumba sweepstakes offering, could seek a float in Australia.

“If there is simply too much heat, Australian investors might be more oven-proof,” another corporate advisor source added.

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

+More

Resorts World Las Vegas: Jim Murren, the ex-CEO at MGM Resorts, has been appointed to head up a four-person board to oversee operations at Genting Malaysia’s troubled casino resort.

Murren will be joined on the part-time board by former Nevada Gaming Control Board chair A.G. Burnett, human resources exec Michelle DiTondo and Genting Berhad president Kong Han Tan.

Blame it on the sunshine: Just last week Genting blamed Nevada’s summer heatwave and economic uncertainty for a 46% revenue decline in Q3 at RWLV to $117m.

The Nevada Independent noted that Genting was the only company to mention the heat as a factor in operations in Q3.

DAZN has paid a reported $1bn for the global free-to-air broadcast rights to FIFA’s restyled Club World Cup taking place next summer.

Boyd Gaming’s board has authorized a further $500m share buyback, giving the company a maximum $843m of remaining authorization.

Rivalry has completed a private sale of shares for C$335k ($237k), its third such sale within the last month.

Earnings in brief: Allwyn said revenue rose 7% YoY in Q3 to €2.14bn while adj. EBITDA was up 12% to €411m. See Wednesday’s Midweek Memo for more.

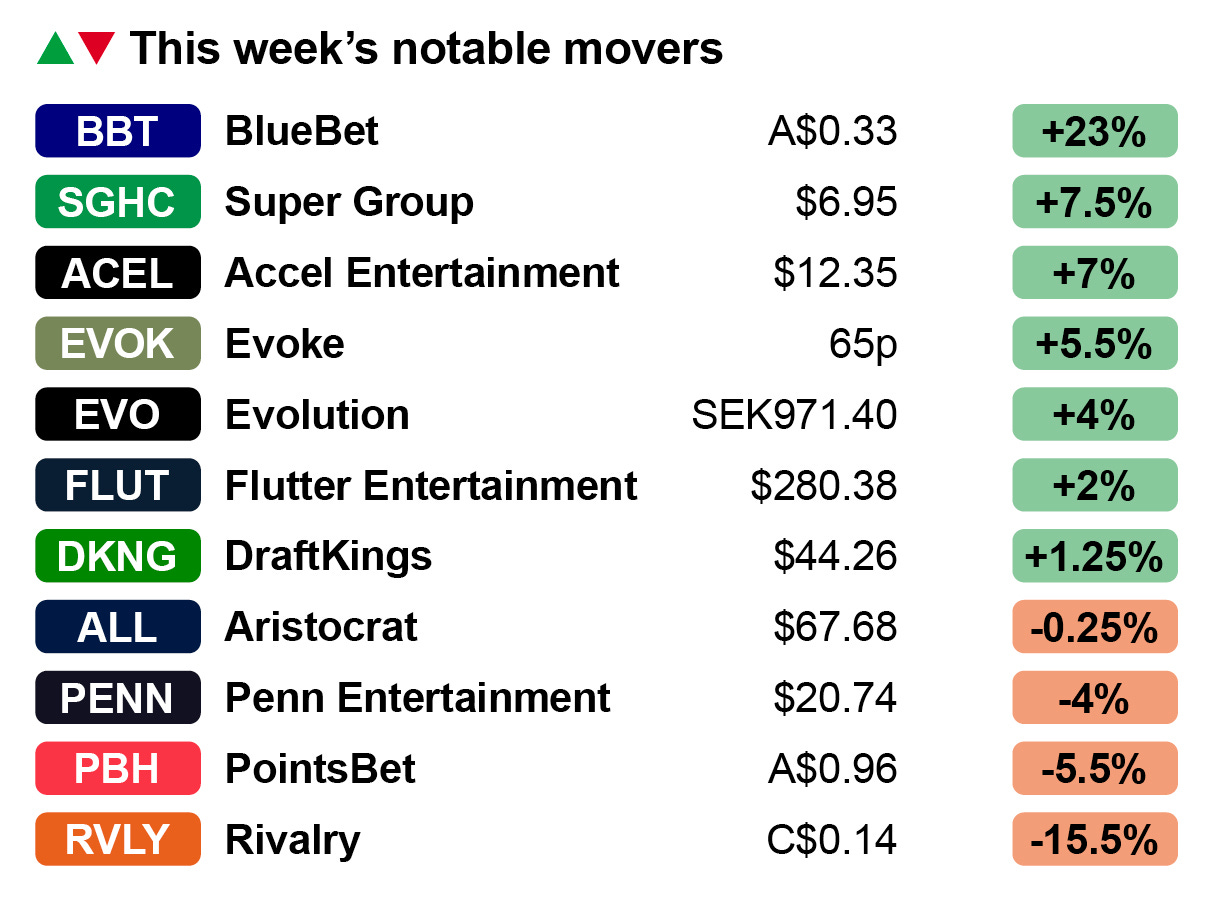

Markets watch

Coming up short: Flutter Entertainment was up 2% on the week but once again fell just short of the $50bn market cap level on Friday, despite staging a recovery after suffering a nasty 3.5% downward jolt on the day.

The cause of the early downward pressure was the news of a call from two US senators for an anti-trust investigation into the Flutter-owned FanDuel and rival DraftKings.

In a letter to the Federal Trade Commission and the Department of Justice (and posted on X), Senators Mike Lee and Peter Welch accused the pair of colluding to “obstruct or impair” competition.

The letter cited “public reports,” which the senators said “allege” the pair via the Sports Betting Alliance trade association have pressured business partners “not to do business” with rivals.

Note, the sole source mentioned in the letter is an article on law.com from March this year written by Salil Mehra, a Temple University law professor, arguing that antitrust regulators should “protect fantasy sports competitions.”

Accel-erating: Accel Entertainment enjoyed a positive week, leaving the shares at a 52-week high after it finalized the $35m acquisition this week of Fairmount Park and its associated FanDuel-branded sportsbook.

Also hitting a 52-week high was Super Group, now up over 130% over the year, and Evoke, up 27% in the past fortnight.

Better off: Australian minnow BlueBet was up 23% for the week helped by a well-received but brief Q1 FY25 trading update, which said the company had achieved the rebrand and customer migration associated with the recent merger with the Australian Betr.

The company said it achieved cash-flow profitability in Q1 and was on track to achieve EBITDA profitability in H1.

Meritocratic: In the loser column this week was Aristocrat. The shares were down only 0.25% on the week, but this included a 3% fall on Friday after it was revealed the company had lost its gaming division CEO Hector Fernandez, who has left to head up the soon-to-be merged IGT/Everi combination.

Fernandez departed with immediate effect and has been replaced by current Aristocrat Gaming CFO and EVP of gaming operations Craig Toner.

Analyst takes – Entain

Fruits of labor: After meeting with CEO Gavin Isaacs, now three months into his stint at the company, the team at CBRE have come away encouraged about progress being made towards the turnaround, identifying key areas of focus.

The first is product, where CBRE suggested the "lowest hanging fruit” is upgrades to the legacy Bwin system, which powers the UK brands among others.

Culture club: The analysts believe Isaacs is overseeing an injection of new “human capital” and improving the company culture, suggesting the recent appointment of Dafne Guisard as COO was “notable.”

The CBRE team pointed out that one of Guisard’s focuses will be the integration of businesses from Entain’s long line of previous M&A.

Seamless Onboarding, Happy Players. It's That Simple.

Experience the perfect balance between stringent identity verification and effortless onboarding with IDComply, a groundbreaking solution from GeoComply. Optimized to deliver pass rates up to 95% while fighting fraud at registration.

Connect with us to learn more.

By the numbers

Broken links: If the linking of accounts between ESPN Bet and the mothership site was meant to be a gamer-changer then it will have to be a slow burner going by the data from Iowa.

While it is only one state, ESPN Bet’s GGR of $0.6m means its market share is stationary at 2.4% from handle of 3%.

This does represent an improvement on the 1% share from a hold-hit October but is the same as the 2% share from September.

Total sports-betting GGR soared 113% to $30.1m on handle up 9% to $315m and hold at 9.5%, with DraftKings on 44.5% and FanDuel behind it with 32% share.

New York: Total GGR for November came in up 53% to $232m with FanDuel retaining top spot with 44% market share followed by DraftKings on 33%.

Fantasy apps

Plus points: The fantasy sports app download data for the NFL season to date showed DFS+ operators in a clear position of dominance, with PrizePicks at 33% market share, Underdog at 20%, and Dabble and Sleeper on 11% and 10% respectively.

Still fighting for ground in the fantasy space is DraftKings, which holds a 12% share. The team at JMP suggested this is largely down to the success of its Pick6 app, which alone accounted for 7% share in the season-to-date within the fantasy category.

But rival FanDuel appeared to have all but completely given up the hunt in the fantasy space with a mere 3% share season to date.

Indeed, in week 13 its share was down to 1% and, as JMP noted, the DFS app’s download total for the season to date is 179k, down 52% YoY.

Flight of fantasy: It feels like a curious oversight from the OSB market leader given the continuing enthusiasm for fantasy sports among consumers. As the JMP team noted, as a group, fantasy operators increased downloads by 64% in the season to date.

At 6.8 million it represents 37% market share across total OSB, iCasino and fantasy apps.

Does your Bet Builder supplier or in-house Same Game Multiple solution support 13 sports, including all of the main global betting sports, plus local variants and even eSports? Does your product allow your end-users to place both pre-match and In-Play Bet Builders across multiple sports? Can you offer cashout across all Bet Builder transactions? Does your solution use your own odds to generate Same Game Multiple calculations rather than another opinion of the market? If the answer to any of these is ‘no’ then come and find out why over 170 operators are using the Algosport Bet Builder solution today.

To understand how we could help create more revenue get in touch at www.algosport.co.uk

Earnings and events

Dec 9: Allwyn

Jan 20-23: iGB Affiliate, Barcelona

Jan 20-22: ICE, Barcelona

Feb 23-25: SIGMA, Eurasia Summit, Dubai

Feb 25-27: SBC Summit, Rio de Janeiro

Mar 12-13: Next: NYC 25, New York

We simplify game development by doing the heavy lifting, so you can focus on creativity.

Whether you’re an emerging studio or an established one looking to relieve development pressure, we ’ve got you covered.

Flexible Build Support: We bring your math sheets to life and handle rollout across RGS instances.

Rapid Deployment: Get your content live in as little as 2 months.

Wide Distribution: Access key US & European markets via an extensive network of distributors and integration with chosen operators.

Future-Proof Growth: Secure a path to owning your own platform with our source code license option.

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.