Penn CEO talks levers to pull, signals about 2026 break clause.

In +More: Star Entertainment’s shares suspended, seeking rescue funding.

Market watch: Genting Malaysia loses CEO, ships 20%.

The teardown: A look at January’s handle.

Hard Rock Bet is gearing up for 2025 with a focus on amplifying brand and product engagement. With a powerful, custom-built bonusing system and an ambition to redefine traditional CRM, we’re seeking leaders who are driven to challenge the status quo:

And other amazing positions here

The end of the affair

Breaking up is never easy: By Penn Entertainment CEO Jay Snowden’s own admission, the new market share target for ESPN Bet spoken about on last week's Q4 earnings call is unlikely to satisfy the sports channel owners and makes a termination of the partnership more likely.

Let’s call the whole thing off: On the call, Snowden said that if “for whatever reason” ESPN Bet was “not hitting the levels that we need to” then at the three-year break point (in 2026) “both sides will have to do what’s in their best interest.”

One investment executive who opted for anonymity told E+M “the call undeniably had a tone that the partnership was not going well.”

Pre-nup: When the deal was first announced in August 2023, amid much talk of achieving a podium position and 20% OSB market share, Snowden told the analysts the three-year break clause would become applicable “if certain market share thresholds aren’t met.”

The investment source suggested the current market share is “below the threshold to terminate the contract.”

“But they’ve been very tight lipped about what these thresholds actually are.”

What he said: Asked back in 2023, Snowden said Penn was “not doing this deal to be a 4% or 5% market share player.”

This is not what I signed up for: Such a percentage share was “not going to be acceptable” for either Penn or ESPN, Snowden said in 2023.

Yet, as of last week’s earnings call, the target is 4.7%, a level that Snowden previously dismissed as “not really exciting” and, moreover, not actually profitable.

“Trying to drive 20% margins at 5% market share is going to be impossible in online sports betting,” he said at the time.

To the lifeboats: It is no wonder then, as the analysts at Citizens noted, that a “potential pivot away from ESPN was on the table for the first time.”

The team suggested the options on the table include a restructuring and a partial or total shutdown of the sports-betting business in the next 20 months.

Hiding in plain sight: The Citizens team added that within the Penn interactive business there were elements that are already likely EBITDA positive, including theScore in Ontario, iCasino and the digital skins, which they estimated contribute ~$60m in EBITDA annually,

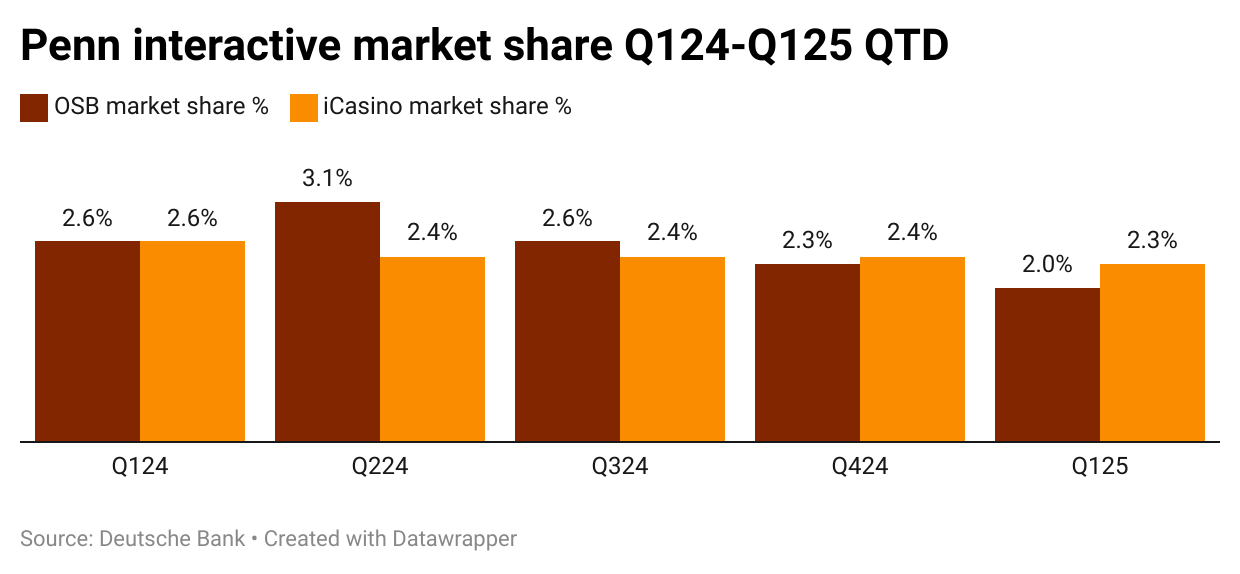

Hooray for Hollywood: Deutsche Bank analysts noted the “momentum continuing to build” in the more lucrative iCasino vertical, after Snowden said on the call that Penn was “encouraged” by the early data for the Hollywood-branded standalone app.

The company’s seemingly more modest aims on the iCasino side were reflected in its aim to move its market share up to 3.5% from ~2% at the end of 2024.

Notably, Penn’s Hollywood iCasino plans are independent of ESPN Bet. “Penn was late to the party due to its misguided focus on sports betting,” said the investment executive.

Betting the farm: Snowden said in August 2023 that the deal with ESPN was not a “bet-the-company type of transaction.” This remains the case: Penn is a much larger and more profitable entity, producing $1.4bn of adj. EBITDAR in 2024.

But after the mis-steps on interactive – and with a proxy battle looming, where the complaints have centered on his stewardship of the company – it is possible to argue the ESPN Bet deal was a bet-the-career move that hasn’t paid off.

Earnings Extra

Disnae care: See the Earnings Extra – mining the 10-Ks edition later today for more on why, for all the talk of a sub-standard market share, the Disney organization can console itself by counting the cash rolling in.

Also in the 10-Ks edition, gaining a fuller picture of Caesars Entertainment’s sports-betting and iCasino splits.

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

+More

Star Entertainment shares were suspended on the Australian stock exchange today, March 3, due to a failure to produce Q4 earnings. Meanwhile, the Australian Financial Review reported CEO Steve McCann is trying to secure more than A$100m ($62m) in short-term funding to allow the casino group to give it time to land a long-term rescue deal.

February in Macau: The Chinese New Year celebrations turned out to be backend loaded, at least as far as gaming activity in the gambling enclave was concerned. Revenue for the month, which included the latter half of the eight-day holiday, rose 6.8% YoY and 8.2% sequentially. However, the team at Deutsche Bank suggested the combined 0.5% YoY improvement for January and February was below consensus estimates.

The Bally’s Chicago $250m ‘minority investor’ IPO has been timed out after the SEC failed to declare the registration effective before the end of February, despite generating interest from eligible investors, according to the Chicago Tribune. Recall, the IPO was the subject of a civil suit alleging it racially discriminated against white male investors.

What we’re reading

Pontificating: Polymarket has seen $420k of wagers betting on whether there will be a new Pope this year. “Betting on the Pope’s health sends you directly to Hell,” Bloomberg reported one Polymarket user as writing on Tuesday last week.

On social

😓 Failure is an orphan: Patrick Jay, previously head of sportsbook at Penn and now at Evoke, reposted on LinkedIn a Front Office Sports article suggesting the ESPN Bet deal was “in trouble” with a sad face emoji and the words “so sad.”

The week ahead

Flutter Entertainment report on Tuesday AMC in New York. Recall, in January the company said the customer-friendly results in October and December meant US revenue would be ~$370m lower than previously guided at midpoint at ~$5.78bn, while US adj. EBITDA would be ~$205m lower than at midpoint at ~$505m.

On Thursday, Entain will report its FY24 numbers a month after the shock departure of now ex-CEO Gavin Isaacs. As yet there is no word of a permanent replacement, though the suspicion is that Stella David, who once again stepped up as a temporary replacement, might be persuaded/forced to take on the job full time.

On Tuesday Italian online market leader Lottomatica will publish its FY24 numbers, while later that day Genius Sports also reports. Thursday will see the FY24 figures from FDJ and later that day Full House Resorts.

Market watch

Bad news: Seeing the CEO resign with immediate effect while the Resorts World Las Vegas unit posted an adj. EBITDA for Q4 of just $1m were plenty enough reasons for Genting Malaysia investors to dump the stock on Friday, sending it down 20%.

The news of Lim Kok Thay’s departure as CEO of both Genting and Genting Malaysia came as a shock late Thursday after nearly two decades in charge. Tan Kong Han, COO, is to step up to the CEO role effective immediately.

The troubled RWLV property saw revenue rise 7% to $190m but EBITDA plunged to just $1m from $52.8m in the prior-year period.

The property has been caught up in the controversy surrounding Scott Sibella, the ex-RWLV chief currently being investigated by the Nevada Gaming Control Board.

In worse trouble this week was Playtika, down nearly 25% after a poorly received earnings statement on Friday. Q4 EBITDA plunged 36% to $104m on revenues that rose an anemic 2% to $650m.

The social casino side saw a mixed year, with the rise in revenue at Bingo Blitz to $159m being offset by a 13.5% fall in Slotomania to $118m while Solitaire Grand Harvest’s revenue of $72.5m was off by 4% YoY.

Gambling.com was down 3% for the week despite a positive note from Jefferies, who following meetings with management reported back that the acquisition of Odds Holdings was “progressing smoothly.”

Moreover, the team suggested there was “significant runway for international expansion” as the B2B product is “not well established among international operators.”

EveryMatrix delivers iGaming software, solutions, content and services for casino, sports betting, payments, and affiliate/agent management to 300+ global Tier-1 operators and newer brands. The platform is modular, scalable, and compliant, allowing operators to choose the optimal solution depending on their needs.

EveryMatrix empowers clients to unleash bold ideas and deliver outstanding player experiences in regulated markets.

Earnings TL;DR

Golden Entertainment

Home advantage: Last year was a transformative one as Golden Entertainment completed the divestitures of the distributed gaming businesses and the Rocky Gap Casino in Maryland, leaving itself as wholly Nevada-focused.

The divestitures generated over $600m in proceeds, allowing the company to reduce its leverage and return capital to shareholders through dividends and buybacks.

In terms of M&A, CEO Blake Sartini said the company remained “proactive” but that no purchase of any single asset would be sub-$40m-$50m in annualized EBITDA.

Charles Protell, CFO, said that since selling the non-core assets Golden has repaid over $500m of debt and returned nearly $190m to shareholders, including $113m last year alone.

See today’s Earnings Extra. E+M PRO subscribers only.

In brief

Scout Gaming: Q4 revenue rose 55% to SEK13.5m ($1.3m), with B2B revenue of SEK9.4m up 25% while B2C revenue of SEK2.7m was more than double the prior-year period. FY24 revenue rose 43% to SEK44.4m. The company now has 11 B2B partners.

The teardown – January handle

Hot topic: The team at Deutsche Bank noted handle growth in Q4 and into January this year “remains topical,” with the percentage YoY increase tracking at just 4.2% across the DB team’s focal subset of nine states.

The subset includes New York, New Jersey, Pennsylvania, Michigan, West Virginia, Indiana, Iowa, Tennessee and Maryland.

The data showed the damage in January was done by New Jersey, where handle fell nearly 27% YoY. In Michigan, handle was down less dramatically by nearly 4%.

Lap dancing: The DB team suggested the comps “remain challenging” for the subset through until August. They also noted that, looking beyond the subset, the wider market saw the lapping of the launch in Vermont in January while the lapping of the North Carolina launch is coming up in March.

“We note that North Carolina accounts for ~5% of our tracked industry handle,” the team added.

The handle figures are particularly relevant due to the rise in promos tracked by the DB team in four of the six states that publish the data – Pennsylvania, Michigan, Connecticut and Kansas – to have reported January numbers.

Here the team noted promos as a percentage of handle rose by 20bps to 4.2% in January after promos in the four states rose 9% YoY.

GeoComply's international solutions are unlocking compliance and security for the global market, so players everywhere can enjoy seamless, worry-free gaming experiences.

GeoComply’s Brazilian solution is designed specifically for the local market, offering seamless geolocation compliance (without requiring a companion app), robust anti-fraud measures, and streamlined licensing support—all while minimizing customer friction.

Learn how our advanced geolocation, identity, and fraud solutions safeguard your platform from account takeovers, fraudulent chargebacks, promotion abuse, and more!

Learn more

Earnings

Mar 4: Flutter Entertainment, Lottomatica, Genius Sports

Mar 5: Bally’s

Mar 6: Entain, FDJ, Full House Resorts

Mar 10: Playstudios

Mar 20: Gambling.com

Are payments getting in the way of your progress? A poor payments experience can lead to many operational problems, including higher fraud, increased player churn, low conversion rates and more.

PayNearMe is a payments experience management platform that enables you to streamline deposits and withdrawals, increase acceptance rates and radically drive down your total cost of acceptance—all with a single, modern platform.

Take the first step toward progress: www.paynearme.com

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.