A new CEO at Entain will have a full in-tray from day one and will be taking over a company where shareholders will be expecting a change of plan.

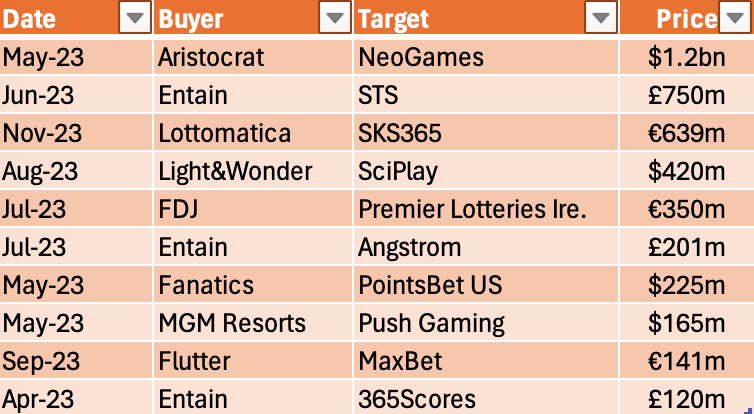

A look at the top 10 sector-specific M&A deals from the past 12 months.

It's been a long, a long time coming, but I know a change gon' come.

What next for Entain?

Leaderless and with activist investors demanding change both from within and without, Entain faces a tricky start to 2024.

First things first: The company needs a new CEO after Jette Nygaard-Andersen quit with immediate effect at the end of 2023. The board has shown a desire to break from the old regime by appointing non-executive director Stella David as interim CEO, rather than deputy CEO and CFO Rob Wood.

Former Sky Betting & Gaming CEO Richard Flint was immediately installed as the bookies’ favorite last week following the announcement he would step down from the board of Flutter after its AGM in May 2024.

Still, Flint’s return would be something of a surprise, coming six years after he left frontline executive action.

Others to have been given mentions in despatches include:

Ex-Gamesys and Bally’s CEO Lee Fenton.

Former Entain COO, now Restaurant group CEO Andy Hornby.

Previous Paddy Power MD and until recently Superbet CEO Johnny Hartnett.

Daniel Taylor, currently CEO of Flutter International.

Gustaf Hagman, CEO and former founder at LeoVegas.

Carl Leaver, formerly CEO at Gala Coral.

Irina Cornides, another ex-Gamesys exec, currently COO at Pragmatic Play.

Andreas Meinrad, currently CEO at BV Group.

Joachim Baca, currently CEO at Tipico, formerly COO at bwin.

Hospital pass: The board might consider some to be too untested – at FTSE 100 level at least – while all might well have questions about the attractiveness of the role given the current backdrop.

Still, analysts believe investors – including Eminence – might well crave a return to old-fashioned gambling industry experience, citing a need to get the business back to what it is good at.

Ricky Sandler, founder and CEO/CIO of Eminence, is now on the board and will directly influence the appointment, while the other hedge funds on the shareholder register, including Corvex, are also sure to be keen to voice an opinion.

Hot mess: The alternative view, as expressed by one advisor, is the job is an “organizational challenge.” “There are people who know big businesses and have the clarity of thought to bring all of Entain’s acquired businesses together. Gambling sector knowledge is not a must-have.”

Given this, interim CEO Stella David might even fit the bill.

Flutter CEO Peter Jackson stepped from the board into the interim role before taking the job permanently.

As did, of course, Nygaard-Andersen, who was parachuted in from a NED position following Kenny Alexander’s fall from grace.

That fact, however, might count against David.

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

Jette propelled

How did we get here? Nygaard-Andersen resigned after pressure from activist investors and an FT report that revealed her internal nickname as ‘Private Jette’ because of the frequency of her private flights.

One advisor commented: “You can argue whether it’s fair or unfair – and I would argue it’s unfair – but UK public company CEOs are not allowed to take private jets.”

Another said: “The flights themselves weren’t that outrageous – taken due to lockdowns. But it was the straw that broke the camel’s back.”

That camel’s back was already loaded down with seven acquisitions Entain made during 2022 and 2023:

Latvian operator Klondaika for an undisclosed amount

Polish operator Totolotek for €6.1m.

Netherlands operator BetCity for an initial €300m.

Croat operator SuperSport for €600m.

Another Polish operator STS for £750m.

Data analytics firm Angstrom for an initial £81m.

Sports media business 365Scores for £120m.

Strategic rights and wrongs: The bolt-on spending spree followed a change in the European gambling market as a new breed of national champions rose to challenge Entain and peers such as bet365 and Flutter.

All were in danger in key markets of bleeding market share to the upstart operators, who were arguably more focused and in tune with their customers.

But a separate pressure was the HMRC investigation that would eventually lead late last year to Entain reaching a deferred prosecution agreement (DPA).

In line with the provisions of the DPA, it led to the company accelerating its efforts to exit markets where it saw no prospect of regulation.

Peel Hunt analyst Ivor Jones told E+M: "Different shareholders want different things at different times. The board took the decision to seek higher levels of sustainability and less risk. “If this is the priority then the strategy makes perfect sense. If you are a shareholder that wants as much money as possible in the short term then that position is difficult."

Some still argue that Entain spent too much on its acquisitions, but another analyst who spoke to E+M on condition of anonymity contends whether they paid too much for those businesses is “slightly irrelevant.”

“They are using debt and paying down that debt,” the analyst argued. “They are good businesses and without the M&A the business would be nowhere near as strong as it is today.”

“There was nothing wrong with the strategy,” said another analyst, “it had to be done.”

In the in-tray: The new CEO will need to focus on getting the most out of the acquired businesses. With no M&A on the horizon, group director of M&A Nick Batram left the company shortly after Nygaard-Andersen. The dabbling with diversifying away from gambling (see Unikrn) is also dead in the water.

“Compare and contrast the Entain operational MO with Flutter, which runs very autonomous units,” said one advisor.

“They call it a federal strategy. Entain talked like that but has often interfered with calamitous consequences.”

“There have been so many changes of organization and restructurings over the past couple of years,” said an analyst source. “They need to decide who is responsible for what. What is local and what is central? You need that to be very, very clear.”

And then there is the small business of BetMGM and the relationship with MGM Resorts.

Jones said: "For MGM, they have a number of big land-based projects such as Japan and New York, which might be strategically more important than Entain.

“Digital might be considered a sideshow next to the core business of bricks and mortar casinos.”

It means the new Entain CEO might just get the chance to draw breath. But not much more than that.

Sportsbook operators & providers - Are you looking to up your risk management & trading game in 2024?

Set a meeting with Matchbook at ICE 2024 February 6th-8th to discuss any of the following:

The fastest moving pricing & tightest overrounds in class across all major markets for Football, US Sports, Golf, Racing & Greyhounds

A dedicated high limit brokerage service to offset risk for requests like:

$1m on Trump to win the US election in 2024

$200k on the 49ers to win the Super Bowl

$2m on France to win the Fifa World Cup Final

$100k for it to snow on Christmas day in London… we can take it all!

Direct API connection for low latency pricing with historical pricing available on request.

Matchbook B2B - Because the best price is for everyone.

Visit http://www.matchbook.com/promo/b2b or get in touch at b2b@matchbook.com

+More deals

Golden Entertainment has announced the completion of the previously disclosed sale of its distributed gaming operations in Nevada to an affiliate of J&J Ventures Gaming for $214m in cash.

Australian minnow BlueBet is in discussions regarding “strategic initiatives” with the Australian Betr and other potential partners. Recall, the Matt Tripp-led Betr has long been rumored to be a potential bidder for PointsBet’s Australian business.

Table talk: Another rumor given an airing late last year – and providing a question which is yet to be answered – is whether Playtech was considering jettisoning its B2B arm in order to effect a merger with William Hill.

M&A in 2023

Poetic license: The remnants of Entain’s prior bolt-on strategy litter the chart of M&A deals in 2023 like archaeological remains in the desert. But it was the second deal in the list of top buys – the £750m splashed out on STS – that ultimately led to the defenestration of Nygaard-Andersen and the parallel ending of the company’s erstwhile bolt-on strategy.

🎯 The top 10 M&A deals in the gambling space in 2023

The biggest deal, however, was Aristocrat's bid in May for online lottery, iCasino and OSB provider NeoGames.

The deal is expected to close in Q1 of this year and will see Aristocrat substantially increase its online footprint.

The Italian front: The purchase of SKS365 in November became something of a bunfight, with Playtech going public on its desire to be considered a bidder and rumor circulating that Flutter was also in the market to augment its existing Italian market positioning.

In the end, however, it was the newly floated Lottomatica that won the race with a knockout €639m valuation.

The way forward: Of significance further down the list are the $225m Fanatics laid out for PointsBet US and the $165m MGM Resorts stumped up for Push Gaming.

As per yesterday’s edition of E+M, expectations are high that there will be some significant M&A in the year ahead.

JMP suggested iCasino-centric companies “will be the focus of M&A.”

Meanwhile, the team at EKG predicted DraftKings will once again enter the M&A arena this year.

Calendar

Jan 17: 888

Jan 18: Flutter Entertainment

Feb 1: Rank

Feb 6-8: ICE

Feb 7: Disney

BettingJobs is the global leading recruitment solution provider for the iGaming, Sports Betting, and Lottery sectors. Backed by a 20-year track record of successfully supporting the iGaming industry, it's no surprise BettingJobs is experiencing rapid growth and outstanding results. Does your company plan to expand its teams to cope with strong demand and growth?

Contact BettingJobs today where their dedicated team members will help you find exactly what you are looking for.

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.