Markets look beyond DraftKings’ short-term NFL results hiccup.

In +More: PointsBet denies Asian buyout rumors.

The week ahead: Flutter Entertainment and Better Collective Q3s.

+More markets: Sportradar enjoys a 27% bump.

Never gonna run around and desert you.

Hard Rock Bet is gearing up for 2025 with a focus on amplifying brand and product engagement. With a powerful, custom-built bonusing system and an ambition to redefine traditional CRM, we're seeking leaders who are driven to challenge the status quo:

And other amazing positions here

Together forever

Never gonna tell a lie: Despite cutting its 2024 adj. EBITDA guidance for the second quarter in a row, the markets largely accepted DraftKings’ explanation of a shocking run of adverse NFL results and rewarded the company with a near 3% bump on Friday.

On the call with analysts, CEO Jason Robins noted volatility in sports results over short periods can “swing either way.”

Indeed, the analysts at Truist pointed out the new 2024 estimates could be “conservative” with the amount of football yet to be played in Q4.

Moreover, as Robins said on the call, as the business scales such temporary impacts would become “rounding errors.”

We belong together: Still, the analysts at Deutsche Bank pointed to DraftKings’ luck with its shareholder base.

Back on August 1, when DraftKings was still saying it would generate $500m of adj. EBITDA this year, the share price was standing at ~$35.50.

As of Friday’s close, after two successive costs to the forecast meant adj. EBITDA at midpoint was now predicted at $260m, the shares were trading at ~$41.

✊ Keeping faith: DraftKings up 19.5% YTD despite two profit downgrades

A story to tell: As DB admitted, “poor hold is real” or, as their peers at Macquarie said, the adverse run of NFL results has been “unprecedented.” But it also helps mask improvements in the product offering, notably with parlays and in microbetting.

Of the latter, Robins said the acquisition of Simplebet earlier this year would “separate and differentiate” DraftKings’ in-play offering.

Four more years: What could yet be added to the offering is prediction markets. Last week’s presidential election was seen as heralding a new age of political betting under the auspices of the federal laws on futures trading.

Asked whether DraftKings might dip its toes, Robins indicated it was “definitely” something the company might look at in the next presidential election cycle.

“I think it’s a very interesting thing,” he said. “I do think there could be a place for it outside of elections.”

Of more immediate concern is the expansion of OSB and iCasino. Last week the voters in Missouri narrowly gave the go-ahead to an OSB measure that should see the market launch before next year’s NFL season.

Beyond that, Robins was understandably circumspect, saying that “looking at where we left off” in the last legislative cycle, the hopefuls were Texas, Georgia and Minnesota for OSB and New York and Illinois for iCasino.

Is your organization managing licensing submissions across several jurisdictions? Are redundant licensing tasks and scattered personal data slowing you down?

Now you can unlock new jurisdictional licensing within weeks, not months, with OneComply. By reducing application time from days to just minutes, OneComply improves efficiency by up to 99%.

Click here to connect with us and discover how much more you can get done with OneComply.

+More

PointsBet has denied a story published today in The Australian suggesting it is in negotiations over a A$300m ($198m) takeover by an unnamed entity in Asia. Shares rose more than 15% at one point early in the day before settling back to a 10% increase.

Recall, PointsBet sold its US-facing business to Fanatics in late 2023 for $225m.

Gaming affiliate Game Lounge has bought Netherlands-facing casino comparison site Meneer Casino for an undisclosed sum. The deal was brokered by advisor Corfai.

Earnings in brief: France’s Banijay Group, which owns Betclic, said its betting and gaming unit saw revenue rise 44% to €1.04bn in the nine months to the end of September.

The week ahead

Flutter Entertainment is the last of the big names to report when it releases its Q3s on Tuesday AMC. Of obvious concern will be the extent to which it too has been hurt by customer-friendly NFL results.

The team at Jefferies produced some analysis suggesting FanDuel has come off comparatively unscathed versus both DraftKings and BetMGM.

For October, FanDuel saw a 0.8% hold decline, according to Jefferies estimates, vs 0.8% for BetMGM and 1.8% for DraftKings.

But when including the first week of November, YoY hold decline was 0.9% for FanDuel but 2.6% for DraftKings and 3.1% for BetMGM.

It’s a long way back: The affiliate space has been in the news in recent weeks with Better Collective’s profit warning the cause of some consternation, particularly for its investors.

The share price plummeted 35% on the day and, as can be seen below, is yet to recover any ground.

The share price is currently 55% below its high water mark of SEK321 ($30) in February this year.

The company has embarked on a cost-cutting exercise including letting go over 200 of its 1,200 strong staff.

Isolation ward: Also reporting this week are fellow gaming affiliate providers Gambling.com and Gentoo Media, which will be pressing home their separate messages that Better Collective’s woes aren’t contagious.

🚧 Better Collective: down down deeper and down

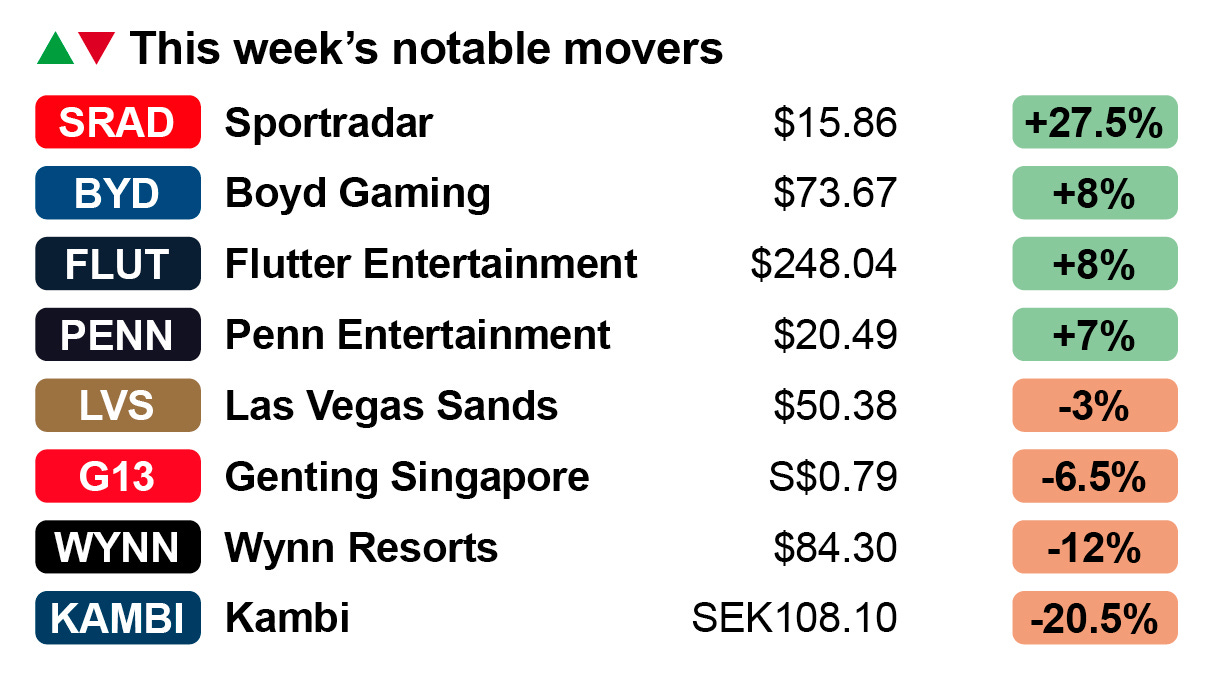

Shares watch

The old one-two: Sportradar will be well pleased with its week’s work after it managed to produce consensus-busting Q3 numbers, followed that up with a FY24 raise and then was rewarded with an above 27% share price rise.

The analysts at Deutsche Bank said it was a case of investors waking up to “one of the best gaming growth stories” heading into 2025.

The team at Jefferies noted the company was “more definitive” on how it would use its 50%+ cash conversion on investing in organic growth, seeking opportunistic tuck-in M&A deals and still repurchasing shares.

Meanwhile, JMP’s analysts noted the “under the radar” deal for XLMedia’s US-facing affiliate assets, suggesting the “largest sports data provider in the world” has a chance to capitalize on a vertical currently “facing headwinds.”

Trump trade-offs: As noted by E+M, the US-listed gaming operators rode on the coattails of the market enthusiasm that greeted Donald Trump’s victory last week.

But, by the end of the week, a more nuanced reaction took hold as those with a Macau focus saw substantial falls, presumably on fears of what the incoming administration might mean for trade links with China.

Worst hit was Wynn Resorts, which saw its share price fall 12%, while Las Vegas Sands was off 3%.

Who killed Kambi? It wasn’t all champagne and flowers for the gaming suppliers that reported this week. While Sportrdar was flying high, sportsbook backend supplier Kambi saw its value tumble 20%+.

The fall meant the company gave up most of the ground gained in the past nine months, ever since its collapse in February after its disappointing Q423 numbers.

What caused the rush to exit isn’t clear, although comments from CEO Werner Becher that “not everything is going in our favor” may have unnerved investors.

Jazz odyssey: Spinning the departures of Kindred and LeoVegas, Becher said Kambi “won't be overly reliant on a small number of operators anymore.”

Algosport are regarded as one of the ‘best-kept secrets’ in the gambling industry, currently supporting hundreds of Tier 1 and challenger operators with our proprietary Algosport Blackbox – a powerful engine capable of supercharging your sportsbook.

We are best known for our next generation Bet Builder/Same Game Multiples product that offers the widest range of sports with unrivalled coverage, markets and features, both pre-match and in-play.

To understand how we could help create more revenue get in touch at www.algosport.co.uk

Inspirational

Hybrid engine: Inspired Entertainment has gone down the bespoke route with its recently announced partnership with FanDuel for the provision of a hybrid dealer product, and CEO Brooks Pierce was keen to stress the cooperative nature of the deal.

He said that with a customer of the “cache and size” as FanDuel, and with its creative input, the pair had managed to “come up with a pretty amazing concept.”

But in this sense, FanDuel might be unique. “We have tons of customers that, quite frankly, want to have the capability of a hybrid dealer, [but] don't want to spend the upfront money to do the advanced work.”

By the numbers: The interactive segment was the standout performer in Q3 with revenues up 40% to $10.2m, helping to drive a 4% total revenue increase to $78m. Adj. EBITDA was up 13% to $30.1m.

Pedaling backwards: Less positively, the virtual sports business saw revenue falling 16% to $11.2m, which chair Lorne Weil somewhat bafflingly described as “treading water.” Without naming names, Pierce said the fall was due to declines with the company’s largest client.

He added that he hoped new geographies such as Brazil would spur the unit back to growth alongside new licensed content from the major leagues.

But he admitted the unit was “beset by delays due to customer resource issues, technical integrations and regulatory approvals.”

By the numbers – DraftKings’ ARPMUP

Law of averages: The analysts at Deutsche Bank suggested the average revenue per monthly unique players number – more snappily called ARPMUP – are displaying some surprising dynamics in recent quarters.

The team noted that in Q3, MUPs excluding the additional players from Jackpocket rose 27% (vs. true total 56%).

But ARPMUP, ex-Jackpocket, was up just 8% (whereas it was down 10% when Jackpocket’s less free-spending customers are included).

DB pointed out that given the general OSB and iCasino growth in Q3 of +39% and +26% YoY as reported by the states, it suggested either the mix of newer customers or “perhaps greater scrutiny of higher-spend sharper customers” was influencing ARPMUP’s downward trajectory.

We simplify game development by doing the heavy lifting, so you can focus on creativity.

Whether you’re an emerging studio or an established one looking to relieve development pressure, we ’ve got you covered.

Flexible Build Support: We bring your math sheets to life and handle rollout across RGS instances.

Rapid Deployment: Get your content live in as little as 2 months.

Wide Distribution: Access key US & European markets via an extensive network of distributors and integration with chosen operators.

Future-Proof Growth: Secure a path to owning your own platform with our source code license option.

Calendar

Nov 11: DoubleDown Interactive

Nov 12: Flutter Entertainment, Genius, IGT, Light & Wonder

Nov 13: Better Collective

Nov 14: Gambling.com

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.