Name in lights: MGM revels in the business of show

MGM’s boomtown benefits, Penn’s NY license, DDI and GiG earnings, Catena reaction +More

MGM enjoys F1 and Super Bowl Vegas success while Macau rebounds.

In +More: GAN votes ‘yes’, Super Bowl reaction.

Penn buys out Wynn Interactive in New York.

Earnings in brief: DoubleDown Interactive and GiG.

Catena Media tries to explain itself after a disastrous Q4 revenue decline.

Let's go on with the show, let's go on with the show.

MGM’s stellar Vegas performance

That’s entertainment: CEO Bill Hornbuckle’s long-standing claim that Las Vegas is the entertainment capital of the world was proven by the Super Bowl on Sunday, he suggested. The Super Bowl weekend is always big in Vegas, but Hornbuckle said having the game in town “amplified those results dramatically.”

Deluxe: CFO Jonathan Halkyard pointed out revenue for the luxury end of the property portfolio rose by mid-teens for the quarter and FY23 and represented ~90% of absolute top-line growth.

This “further highlights the prominence of the higher-end segments in our business here in Las Vegas,” he added.

Notably, the Bellagio had its best quarter and its best year in its 25-year history as a property on the Strip.

Rolling in it: As opposed to F1 where performance was patchy up and down the Strip, Hornbuckle said the performance of the properties for the Super Bowl was “across the board”. “Las Vegas showed up,” he said. “Every cash till was ringing,” added COO Corey Sanders.

Hornbuckle noted the Las Vegas revenue performance came despite the company being “on its heels” after the September cyber-attack.

He said the Marriott Bonvoy partnership would bring a new customer base, which would be achieved at a lower acquisition cost, higher rates and with more spend on property.

Last year was “an amazing stretch,” he added. But “replicating that won’t be easy.”

By the numbers: Las Vegas revenue of $2.37bn was up 3% both YoY and QoQ, while weather-affected regionals revenues were “stable,” down 12% to $873m.

Macau was the main driver of top-line growth, up over fourfold to $983m, and with managed and other bringing in $149m it saw total revenues up 22% to $4.38bn. Adj. EBITDA was up 25% for the group at $1.19bn.

FY23 revenues rose 23% to $16.2bn while adj. EBITDA hit $4.6bn.

With BetMGM, Hornbuckle noted the omnichannel opportunity would be more fully realized following the relaunch of the app in Nevada on the new Entain-provided platform. In the UK, he said the BetMGM launch KPIs had exceeded initial expectations, adding that further territories were being actively considered.

He said the goal had always been to get into the top 3 and that had been achieved.

“Obviously, you’ve seen we have lost share,” he admitted. “We want and need to get our product into better shape.”

Asked about potential M&A to gain ownership of BetMGM, Hornbuckle demurred.

But when asked later about other M&A in the digital space, he said MGM was “on the heels of buying sports technology.”

“We want to obviously be in our own sports-betting business with our own technology,” he added, before suggesting the company was also “on the heels of a deal for live dealer.”

Enter the dragon: Hornbuckle said Macau produced exceptional results that carried over into the New Year. The ongoing Chinese New Year festivities were also “very strong.” “Our competitors are wondering what we are doing right,” he added.

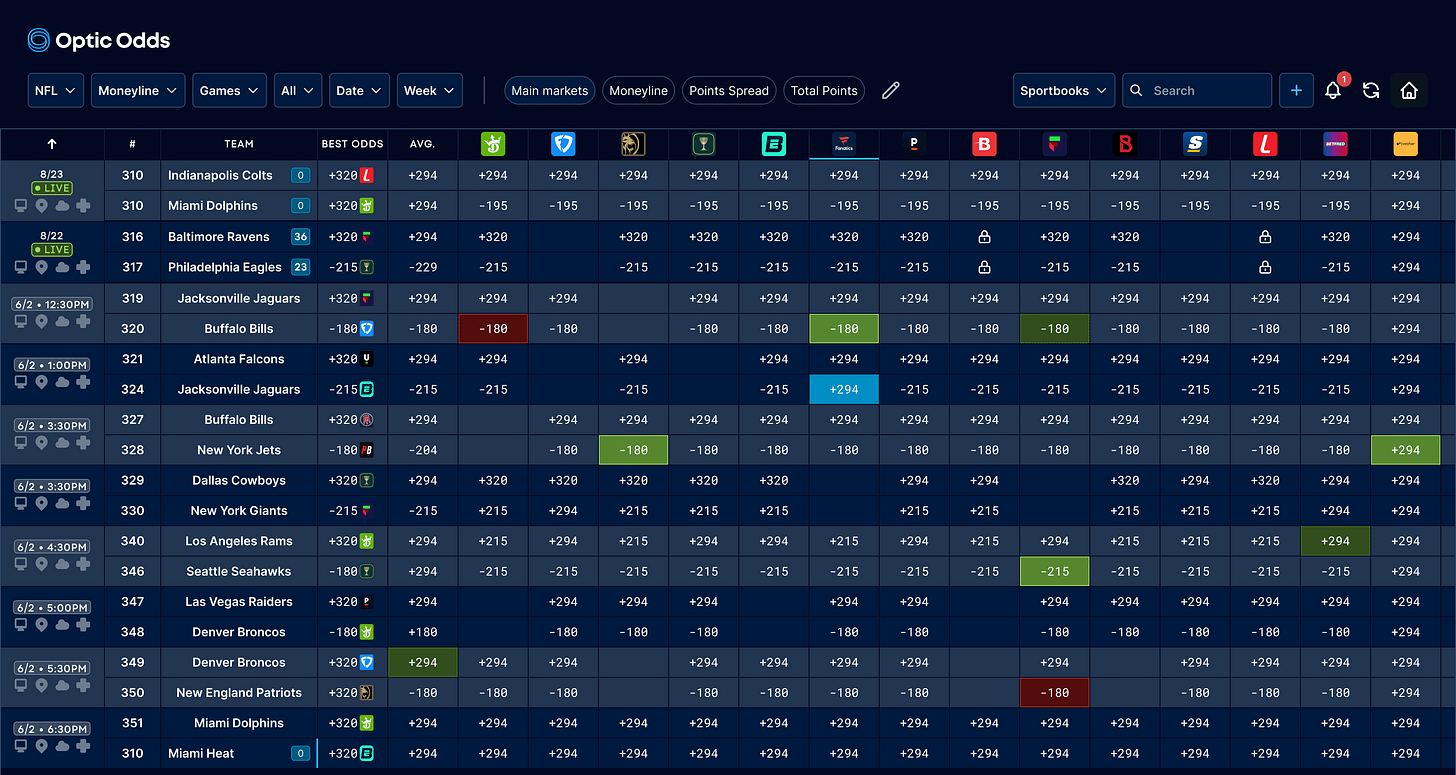

Operators, how's your risk management for NFL or March Madness? Utilize the trading screen used by top operators in the US, Europe, and Australia.

Optic Odds includes:

Main lines, alternative markets, player props for the Big 6, soccer, and more

Ultra-low latency: built with an emphasis on speed

Create bespoke custom weighted lines on the screen and receive live alerts for line movement via Slack or Teams

Also, our push format API offering real-time betting odds from 150+ sportsbooks: player props, alternate markets, injury data, historical odds, schedules, ranking, scores & more, is available upon request.

Get in touch at ryan@opticodds.com.

+More

GAN shareholders have overwhelmingly approved the sale of the company to Sega Sammy for $108m. The deal will complete either by the end of this year or in early 2025.

Flutter has announced an extension on its long-standing B2B sportsbook provision agreement with French operator PMU. As part of the deal. Flutter will now provide a full multi-channel platform alongside the odds and risk management that came as part of the original 2010 arrangement.

By the numbers – Bowl cuts

Wood for the trees: The margin on Sunday’s game might have been in negative territory at 14%, according to Macquarie estimates, but the analysts believed the strong results from January more than offset the poor outcome from the Chiefs beating the 49ers in overtime.

Macquarie suggested January’s hold of 10.8% is not being reflected in consensus forecasts.

The team at EKG noted the hold performance of individual books is likely to vary depending on the extent of SGP penetration among their customer base.

EKG also noted the shape of the download shares were very different this year compared to last with Hard Rock Bet, ESPN Bet and bet365 all capturing significant share.

Meanwhile, Nevada confirmed it was the biggest betting event in its history with $186m wagered across the state’s 182 sportsbooks.

By the numbers – Macau

The Chinese New Year has seen visitation break post-pandemic records with over 217k arrivals on day three of the celebrations, according to Inside Asia Gaming. This was followed by another 200k-plus tally on day 4.

What we’re watching

‘I’m not bored, I’m locked in’: The four-minute version of that Dunkin’ Donuts Super Bowl ad.

Penn buys WynnBet NY license

These streets will make you feel brand new: Penn Entertainment’s ESPN Bet will launch in New York later this year after the company reached an agreement with Wynn Interactive to acquire its license. As part of the deal, Penn will pay Wynn $25m, the same cost as the original licensing fee each operator paid the state authorities at launch.

The move has been anticipated ever since WynnBet announced it was all but shuttering its online operations last summer, but keeping the option of selling on its New York license.

You just say ‘go’ and that is that: The team at JMP noted that New York was the largest single US sports-betting state with GGR in 2023 of $1.7bn. However, this comes at a cost – the tax rate is an eye-watering 51%.

Moreover, New York is dominated by the FanDuel/DraftKings duopoly, which along with BetMGM between them control 80% of the market.

“The market has proven lopsided since launch as operators have generally taken a conservative approach toward spending on promotions and marketing in the state, with contribution profit margin well below other US gaming markets,” said the JMP team yesterday.

Give me your poor: The team at Jefferies noted the opportunity to gain market share opens up questions about cost magnitude. They noted that Penn’s existing marketing plans will push the online segment to an expected ~$290m loss in FY24.

With a New York launch, Jefferies said any increased promotional spend would “ultimately affect the timeline of long-term profit and value creation for the business.”

Tri-harder state: They noted Penn has no competitive advantage, with no B&M assets in the state or neighboring New Jersey or Connecticut.

Unsurprisingly, they added that Penn will be relying on the ESPN media assets.

On social: Some are not so sure about the economics of a New York entry.

Diary note; Penn reports its Q4 earnings BMO on Thursday with an analyst call taking place at 9am ET.

US OSB handle share analysis

Nothing ever lasts forever: Using early January data from Indiana, Maryland and Iowa as a proxy for the total market, the team at JMP suggested the data “paints a picture” for ESPN Bet of declining promo activity leading directly to lower market share as measured by handle.

The analysts pointed out that ESPN Bet’s promos in Maryland as a percentage of handle fell back to 2.4% in January versus expectations of 5-6%. This compares with 14% in the prior month.

“The company was slightly more promotional in Maryland during December, which leads us to believe the lack of free money across the platform was the driver of the 200 bps of market share loss,” the team wrote.

The data shows FanDuel increasing its share despite the advent of ESPN Bet, while DraftKings recovered most of the ground lost in Nov/Dec with a revival in January.

🤨 Early January evidence suggests ESPN Bet falling back already

Earnings in brief

Doubledown Interactive: The recently acquired SuprNation business made its debut contribution to earnings, adding $4.3m in revenue in the 61 days of ownership in the quarter and helping to push total revenues up 9% to $76.2m.

Ex-SuprNation, revenues were up 3% for the social casino business, which, as analysts at Macquarie noted, was the first time it had seen the business growth for 12 consecutive quarters. Adj. EBITDA was up 47% to $36.2m.

FY23 revenue rose 4% to $321m while adj. EBITDA rose 17% to $119m.

CEO In Keuk Kim said the company was progressing with its growth initiatives, with SuprNation in its core UK and Swedish markets.

Macquarie said the return to growth in social was a “nice surprise,” pointing out they were forecasting a 3% decline in FY24. They suggested SuprNation would be breakeven by Q4.

GiG: The gaming affiliate arm achieved all-time high revenues in Q4, up 49% to €26.5m and helping total revenues to rise 37% to €35.6m. The platform and sportsbook provision business saw an 11% uplift to €9.1m. Adj. EBITDA rose 32% to €14.2m.

Hello, I must be going: The company said it had made progress on the intended split, with the platform and sportsbook business set to go its own way in Q2 this year.

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

Catena earnings reaction

Sh*t show: Catena media’s share price suffered a near 10% fall yesterday after its Q4 earnings statement showed a dramatic decline in revenues and EBITDA profits. The shares are down over 77% in the past 12 months.

On the call with analysts management blamed, variously, stiffer competition in North America, a move to rev-share over CPA arrangements with operators, “challenging comparables” and decreased activity around sweepstake casino influencers.

Lower for longer: CEO Michael Daly noted the comparative lack of new state launches in 2023, saying it was a year of “fewer and smaller launches of states in North America versus prior years.”

He noted the prospects for North Carolina in March but added Catena was “not relying on state launches to move the needle for us this year.”

Instead, he promised “sustainable growth” driven by “advancing” its tech.

Playing with fire: Part of this is about utilizing AI within the content set. Asked whether this risked the wrath of the Google algorithm, Daly said Catena was “very cognizant of Google and its search engine requirements and its search engine understanding of AI.”

He added that it was “still a moving target with Google” and the testing of the AI content was about making sure Catena was “doing things in a positive way from our Google rankings perspective.”

Calendar

Feb 15: Betsson, Penn Entertainment, DraftKings (earnings)

Feb 16: DraftKings (call)

Feb 20: Caesars Entertainment

Feb 21: Raketech, Kambi, Churchill Downs (e)

Feb 22: Acroud, Better Collective, Churchill Downs call, VICI (e)

Feb 23: VICI (call)

EveryMatrix delivers iGaming software, solutions, content and services for casino, sports betting, payments, and affiliate/agent management to 300+ global Tier-1 operators and newer brands. The platform is modular, scalable, and compliant, allowing operators to choose the optimal solution depending on their needs.

EveryMatrix empowers clients to unleash bold ideas and deliver outstanding player experiences in regulated markets.

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.