McAfee to desert FanDuel for ESPN

Broadcast news, Lottomatica’s strong start, BC's 30% revenue rise, Catena’s hiccup, NE states data +More

Good morning. On today’s agenda:

Pat McAfee set to walk out on FanDuel, heading for ESPN.

All lights are green in Lottomatica’s debut earnings as a listed entity.

CEO “truly astonished” by Better Collective’s revenue growth.

Catena Media stumbles with US revenue drop.

Data from Massachusetts, Michigan and New Jersey.

Ex-Pat

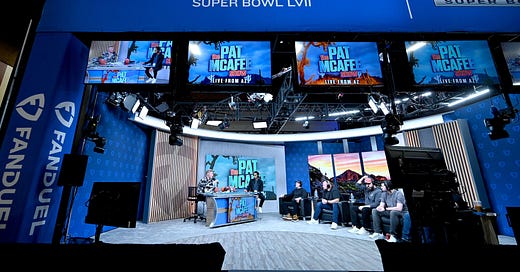

Pat McAfee is walking away from a $120m deal with FanDuel to join ESPN.

Big Mac fee: In only the second year of his four-year contract with FanDuel, the sports broadcaster will be joining ESPN in a multi-million dollar-a-year deal. From September, the show will air on ESPN, ESPN’s YouTube channel and ESPN+. The new deal is reported to be worth eight figures per annum.

The news comes a couple of months after McAfee expressed concern that FanDuel “[does] not have a network” that could accommodate the “issues” he was facing.

The Pat McAfee Show was highlighted as a key element of the OTT FanDuel TV when it was launched in September last year.

The former Colts player and ex-pro-Bowler McAfee first rose to prominence on Barstool Sports.

McAfee is already a regular on ESPN’s College GameDay and, in conjunction with Peyton Manning’s Omaha Productions, produces College football broadcasts for the channel.

Further reading: “Even as the network lays off employees, it’s handing out the richest talent contracts in its history, trusting that a handful of highly paid big names will help it win the streaming wars,” writes The Ringer.

Prime mover: Meanwhile, DraftKings co-founder Matt Kalish popped up on LinkedIn yesterday to promote its recently launched 24/7 streaming service in association with Samsung TV Plus.

“Why is this such a big deal? We’re the first US sportsbook to do it,” he boasted.

“DraftKings is more than a sports-betting operator,” he added. “We’re a digital sports entertainment company ready for primetime.”

** SPONSOR’S MESSAGE ** Tried, tested and proven over a decade in the highly-regulated US market, and continuing to expand across Europe, Latin America, Asia and Africa. GeoComply harnesses the power of its market-leading geolocation technology to protect against fraud, including fake account creations, bonus abuse, account takeovers, stolen identities, money laundering, and more. Visit geocomply.com.

Lottomatica’s debut quarter

The Italian group said all key indicators were up and maintained guidance.

Up, up and away: Having carried out its listing on Milan’s Euronext earlier this month and with online revenues growing 40% thanks to its Betflag acquisition, CEO Guglielmo Angelozzi said the Q1 performance was “not just about the financials”.

“Basically every performance indicator has risen,” he noted. “We are seeing strong demand for every indicator that we monitor.”

The group had already carried out synergies of €3m through renegotiations of contracts with content and payment providers, but “more interesting” will be the potential impact on the top line.

Value added: “These are just examples of the value creation opportunities” at the group’s disposal, Angelozzi said. “They don't require any type of integration and have been very effective in the past.”

Raising the flag: With group revenues up 20% to €422m in Q1 and adj. EBITDA increasing 25% to €156m, CFO Lawrence Lewis Van Lancker noted that the positive trend continued into a “terrific” April.

However, Van Lancker said the group would be maintaining FY23 revenue guidance of €1.5bn-€1.6bn and adj. EBITDA of €550m-€570m, noting that there were “another eight months” of the year to go.

Target practice: Strategically, Angelozzi said the group had delivered on distribution agreements for AWPs and “smaller online targets”. “We continue to work on potential [larger] targets and think we are in a better position than we were before,” he added.

He said the draft law introduced in April to standardize land-based regulations was welcome and any negative impact was “already reflected in the numbers”.

“Our expectation is that it will be positive by being a homogeneous set of rules throughout the country,” he added.

BC sees growth

Even running up against the comparison with New York last year, Better Collective posts strong Q1 earnings.

Take my breath away: CEO Jesper Søgaard said he was “truly astonished” by the strength in Q1 as revenues rose 30% with revenue share up 75% YoY. This came even against strong comps from last year in the US. Latin America is emerging as the newest growth region.

CFO Flemming Pedersen did not break out revenues from Latam, but said the group enjoyed “strong growth” there, alongside the US and “more mature”, but still growing, European markets.

Søgaard said the importance of soccer/football in Latam meant there were “definitely more similarities” with Europe than the US, along with the “mix of sportsbooks” working in the region.

OH perfect: In the US the group’s ongoing shift towards revenue share continued and Ohio had been “a perfect state launch” from a regulatory perspective.

Rev share bans: Asked about potential bans on revenue share affiliate models in New York and Massachusetts, Pedersen said this was “new territory” for all stakeholders as well as an “ongoing political process”.

EBITDA was up 44% to €33m and April trading was up 40% YoY to €27m.

Catena Media’s stumble

Catena Media profits suffer against strong comparative.

Hiccup: Despite saying the recent launch in Ohio was one of the company’’s “best ever”, Catena said the 5% drop in group revenues was caused by “challenging comparatives” in New York.

The group also saw a “successful” launch in Massachusetts during the period but the new launches didn’t stop revenues from North America falling 2% to €29m.

Total revenues fell to €35m while adj. EBITDA was down 7% to €20.5m.

Organic growth for its continuing operations in the rest of the world was also down 5%, though it claimed a “strong rebound” in profitability in the UK and Italy.

Michael Daly, CEO, reiterated the US remained a “key strategic objective”. The company is targeting North American revenues of €125m by 2025.

Bally’s A’s deal

Bally’s has teamed up with GLPI to furnish the Oakland A’s with a new Las Vegas stadium.

Ballpark figure: The new stadium is being planned on the site of the Tropicana, to be replaced in part by a 30,000-seat state-of-the-art ballpark. The deal is subject to legislation for public financing and relocation approval from MLB.

As part of the agreement, Bally's retains the ability to assign the rights to all aspects of this development and has received material interest from development partners.

GLPI has agreed to fund up to $175m towards "certain shared improvements within the future development in exchange for a commensurate rent increase”.

Trop prop: Bally’s acquired the Tropicana from GLPI in Sep22 for $148m. As part of that deal, it entered into a 50-year ground lease agreement with the real estate investment trust.

Bally’s said it intends to continue the operations of the Tropicana Las Vegas for the foreseeable future “while evaluating all available options for a broader redevelopment of the remainder of the site that will be adjacent to the new ballpark”.

Datalines

Massachusetts: DraftKings grabbed leadership by GGR in the first full month of operations with 48% share of the $60m market total. FanDuel was a distant second with 31%, followed by BetMGM (8%), Barstool (4%), WynnBet (4%) and Caesars (3%). This was on a handle of $579m.

Recall, DraftKings was in second spot in the partial month of March with 34.5%, slightly behind FanDuel on 34.9%.

In other news, the Massachusetts Gaming Commission has confirmed Fanatics license application, with the company indicating it will launch by the end of the month.

Michigan: iCasino GGR rose 20% YoY to $159m while OSB was up 11% to $36m. Combined, MGM claimed top spot with 30%, FanDuel was second (24%) and DraftKings third (19%). MGM’s iCasino share was 32%; FanDuel’s OSB lead stood at 43%.

New Jersey: The standout figure was the 44% rise on sports-betting GGR in April, up to $72m, helped by markedly better hold, up ~370bps to 8.7%. It meant GGR rose despite handle being down 10% YoY to $834m.

Sequentially, GGR was down 22% while handle was down 19%.

A bad year: DB noted this was the 12th month of YoY handle declines.

iCasino was up 16% YoY to $159m, but down 4% MoM.

Land-based gaming was down 1.6% YoY to $232m.

AGA: Commercial gaming revenue reached a quarterly record of $16.6bn in Q1, the eighth consecutive record-breaking quarter, according to the American Gaming Association’s tracker.

March was the highest grossing month ever for commercial gaming, coming in at $5.9bn.

Earnings in brief

Playmaker Capital: Further leveraging of the company’s media and affiliates operations, including the most recent pure affiliate acquisition Wedge, is among the priorities as Playmaker looks to build on its pro forma Q1 revenue of $15.7m.

The figure represented a 69% leap YoY while adj. EBITDA rose 78% to $5.9m. LTM revenues rose 9% to $53m.

The popularity of Playmaker’s sports media sites continues to place the company among the top 10 media groups in the Americas by total visits.

FansUnite: The now largely affiliate provider has achieved a significant reorganization of the business with the offloading of the BetPrep domain to Stram in Q1 and, post-quarter, the closing of the sale of the McBookie operation for C$5m , as well as a deal that sees micro-betting specialist Betr take on its Chameleon gaming platform for C$10m.

Due to the repositioning of the business towards being affiliate led, via the Betting Hero brand, revenues were down 11% YoY to C$8.7m but net losses were trimmed to just over $6m.

SharpLink Gaming: The affiliate marketing-to-sports-services provider saw revenues rise 79% to $3.4m, with CEO Rob Phythian suggesting the company was now well-positioned to take advantage of US OSB and iCasino opportunities.

He added that the multi-channel revenue strands and industry relationships left it “uniquely positioned”.

Acroud: Revenues rose 33% to €9.3m helped by an all-time high in NDCs to just under 100k, nearly three times the figure from last year. However, organic growth was down over 20% and QoQ revenues were down 7%. The company blamed the revenue shortfall on unfavorable sports results.

** SPONSOR’S MESSAGE ** Existing sports-betting technology and services can be built better for operators. At Metric we’re changing the game by doing things differently, so our customers can too. Inspired to solve the problems and surpass the limitations of existing systems, we’ve employed modern technology and processes to build a ground-breaking sportsbook solution that can handle the needs of any modern operator – whatever they are.

Contact us to find out more.

Email: info@metricgaming.com

Web: www.metricgaming.com

Newslines

LeoVegas has relaunched its sports-betting brand Expekt in Denmark after a 10-year hiatus.

Gaming Innovation Group has launched 888’s Willam Hill and Mr Green online sportsbooks in Latvia, as well as local brand FeniBet.

Calendar

May 18: Aristocrat

May 19: E+M Weekender

May 23: E+M The Data Month

May 24: Super Group (call); Rivalry (call)

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.