May 25: Super Group shares crash on forecast warning

Super Group Q1, Scout Gaming cash call, Esports Entertainment earnings warning, Better Collective analyst update +More

Good afternoon. Here is today’s agenda.

Super Group says it will cut FY22 forecasts on European concerns.

Scout Gaming goes for a cash call; Esports Entertainment warns.

Better Collective gets an upgrade on 2022 revenues.

Warning. Click below:

Super Group Q1

Revenues up 7% YoY to €334.5m, adj. EBITDA up 14% to €61.5m.

Africa and Mid-east up 57% to €79.2m; Asia-Pac up 36% to €55.3m.

North America up 1% to €150.4m, Europe down 20% to €30.2m.

There may be trouble ahead: Super Group shares tanked by over 16% in early trading after the company effectively pre-announced a profit warning on its Q1 earnings call. Citing regulatory changes in Germany, Austria and the Netherlands, it said they had led to a €4m drop in Q1 revenues.

It said this would make it “tough to meet or exceed 2022 revenue guidance”.

The group said it was reassessing its FY22 forecasts and will update the markets when it presents its Q2 results in August.

Recall, in April Super Group said 2022 revenues would come to $1.4bn and adj. EBITDA of $354m.

High wire: COO Richard Hasson said the business is “made up of numerous different markets that are all at different stages, so it’s very much a balancing act between finding how best to invest for the long term and balancing that with short term profitability”.

It therefore “made sense” to look at the forecasts. “The key point is that the model has been tried and tested over many years, and is very much intact,” Hasson added.

“Our view is keep doing what we’ve been and striking the balance between short and long term outlooks.”

Different worlds: CEO Neal Menashe said “the world today is a very different world than it was 12 months ago”, but Super Group’s broad international reach also gave it many opportunities.

“We know how to adjust levers that are in our control and if we’re in certain markets where there are headwinds. By the time of the re-forecast in Q2 we will have adjusted those levers.”

Little miss earnings: Asked what had changed and if there would be ”a little miss on 2022 revenues or a big step down”, management said hold levels in March were hit by unfavorable results and “it can take a while to catch up”.

“For the rest of the year, if we carry on as we’ve seen in April and May the top line is not looking scary, the issue is catching up on EBITDA bottom line.”

“Six to eight weeks ago it was harder to make a call on where exactly it would go but now we’re in a better position to say.”

Waiting for launch: The group didn’t provide much insight into its Ontario activities other than to say it had been certified for sports betting and was waiting to shortly switch over to the regulated offering.

It expects to also be certified for online casino in the province and said it might launch later or at the same time as OSB.

**Sponsor's message: Spotlight Sports Group (owned by Exponent Private Equity) is a leading technology, content and media business specializing in sports betting. Join Spotlight Sports Group and The Parleh for a live webinar on Wednesday, May 25, as we take a deep dive into the launch of Ontario’s online sports betting market. Register for the event here.

Esports Entertainment profit warning

A new low: “A failure to monetize” esports assets has led Esports Entertainment to warn that revenues for the full year would be lower than forecast at between $55m-$60m.

The stock fell over 18% on the news as the company also said it would be taking a $38.6m impairment charge against Helix, ggCircuit and eSports Gaming League businesses.

CEO Grant Johnson said: “We do not see a path to attractive profitability in the Helix business given its significant overhead and ongoing capex and are currently working to divest our two existing centers.”

He added that the team was working to “properly forecast” the business opportunity for the other two assets “which will allow us to better establish their carrying value”.

Changes afoot: Johnson said Esports Entertainment would be “dramatically simplifying” its esports offering to focus on SAAS-based technology under the ggCircuit brand, in-person tournaments under the EGL brands, and our peer-to-peer wagering platform.

Second, iot is “aggressively cutting costs” across its seven brands including driving its iGaming team to be “more strategic in our sales and marketing initiatives in certain European markets”

Grant Johnson: “We have also identified further avenues to increase our cost savings and will pursue these in the coming months.”

Extinction rebellion: The company's FYQ3 earnings showed revenue up 8% sequentially to $15.7m. In March the company raised $13.6m from a sale of shares. Johnson said the Lucky Dino igaming brand had generated “record-breaking” quarterly revenue.

Post-quarter end the company launched its Vie.gg esports-betting operation in New Jersey.

Scout Gaming cash call

Scout Gaming says its working capital is below the level required by the Nasdaq First North Growth Market after its Q1 results showed EBITDA losses doubling to €30m.

With only SEK15m of cash left at quarter end, it said today it is “working (on) receiving new financing” which will initially be a bridging loan followed by a convertible loan and new share issue in the summer.

Blame the war: Q1 saw revenues dip 20% to SEK6.7m which the company ascribed to the effects of the war in Ukraine. B2B revenues rose 23% to SEK2.4m but B2C revenues declined by 34% to SEK4.3m.

The company has launched a cost-reduction effort but this won’t have an effect until H2. It signed an agreement with bet365 over the period.

Further reading: A Scout Gaming skeptic lets fly on Twitter.

Better Collective analyst update

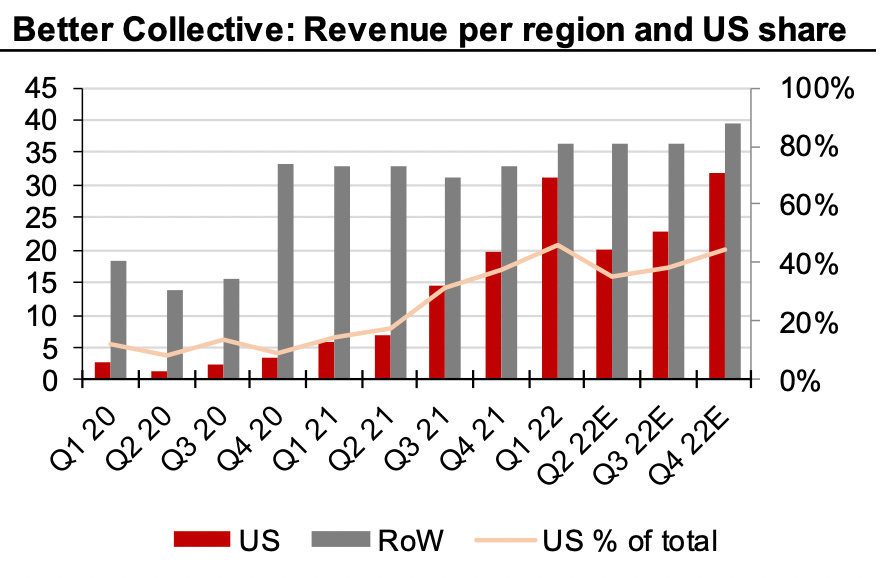

Buy the dip: The team at Redeye predict that the gaming affiliate will see a pronounced dip in US revenues for the gaming affiliate giant in Q2 and Q3 as the low season for sports takes effect before a strong bounceback in Q4.

“We expect a gradual increase from Q3 as the NFL season starts and a strong finish to the year where the FIFA World Cup should also impact positively,” they add.

They add that the acquisition of esports play Futbin “will also drive the seasonal uptick in Q4” due to its own Q4/Q1 seasonality.

Positive thoughts: Redeye say revenue growth will hit 44% in FY22, raising their target to €255m with organic growth amounting to 24%.

They forecast 19% revenue growth in 2024 to €304m and 16% the year after to €352m.

Earnings in brief

Zeal Q1 revenues were up 11% to €25.1m, billings were up 10.9% to €181m due to stronger jackpots and to a special promotion for the Freiheit+ charity lottery. Customer numbers were slightly down to 154K, acquisition costs were up 13.8% from €33.48 to €38.09.

Zeal has also renewed its seven-year license for its Lotto24 AG subsidiary in Germany. The permit allows Zeal to continue offering its lottery brokerage products in the country and is the first to be issued under the Germany new gambling treaty that came into force in July 2021.

Cirsa said Q1 EBITDA came in at €118.1m, €3.1m ahea do forecasts The company said a “good evolution” in revenues during the period (unstated) was the driver. Over 555 of EBITDA came from Spain with Colombia the next biggest market, worth 12.3% of the EBITDA total.

Newslines

Do you want a flake with that? Canadian-listed King’s Entertainment said it had entered into an “arm’s length business agreement” with SVH, the holding company behind Bet99, a gray market operator in Canada.

Demerger: The Tabcorp demerger has closed with the Lottery Corporation debuting on the Australian stock exchange.

Bet365 has been warned about its anti-money laundering policies by the Danish gambling regulator Spillemyndigheden after it failed to carry out any KYC or background checks on a young player who was able to deposit around €25.5K ($27.2K) into their account over a 12-month period.

Paysafe's affiliate network management division Income Access has expanded its agreement with the Ontario Lottery and Gaming Corporation (OLG). Paysafe has been processing payments for OLG since 2015 and managed its affiliate activities through Income Access since 2002.

Baltic in here: Gaming Innovation Group has launched William Hill’s new online casino in Latvia. The two groups collaborated to rebrand the 11.lv icasino site which William Hill acquired in 2019.

Meanwhile, William Hill has been fined €138K by the Swedish gambling regulator Spelinspektionen for breaching its reporting obligations. The group’s subsidiaries Mr Green and Evoke agreed to pay the penalty.

Wynn probe: The 2012 licensing process for Wynn Resorts’ Encore Boston Harbor is again facing investigation over alleged ties to organized crime relating to the purchase of land for the project.

US Integrity will provide its analysis and integrity monitoring services to the sports-betting solutions provider SB22. US Integrity will provide its full suite of betting analysis solutions to the Texas and Belgrade, Serbia-based SB22.

What we’re reading

Are consumers… just fine.

Luna eclipse: Dark side of the moon.

On social

Calendar

May 25: Lottomatica Q1

May 26: Rivalry Q1

May 31: Gambling.com Group Q1

Contact us

Scott Longley scott@clearconcisemedia.com

Jake Pollard jake@openmediaservices.com